Answered step by step

Verified Expert Solution

Question

1 Approved Answer

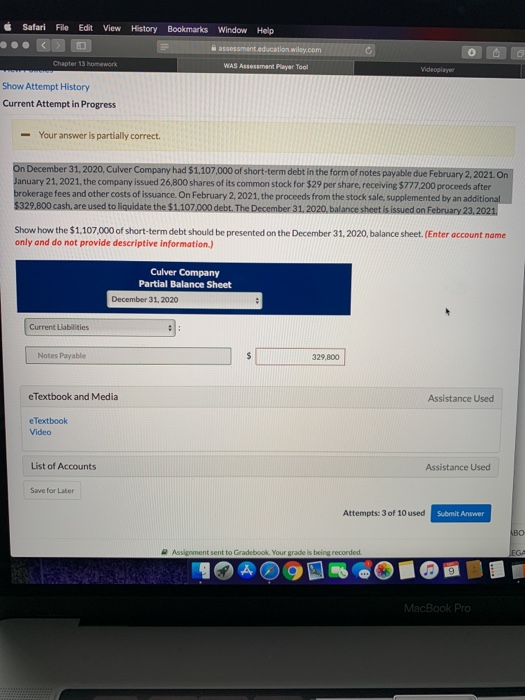

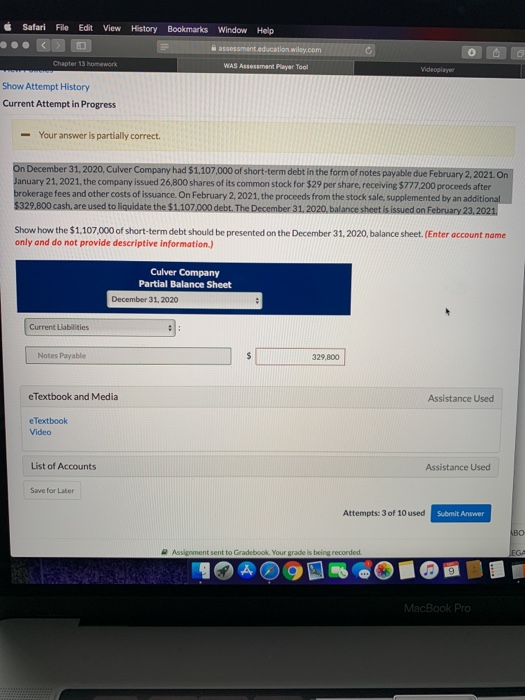

can someone help me with this please? the answer is not $329,800 Safari File Edit View History Bookmarks Window Help assessment.education wiley.com WAS Assessment Player

can someone help me with this please? the answer is not $329,800

Safari File Edit View History Bookmarks Window Help assessment.education wiley.com WAS Assessment Player Tool Chapter 13 homework Show Attempt History Current Attempt in Progress - Your answer is partially correct. On December 31, 2020, Culver Company had $1.107.000 of short-term debt in the form of notes payable due February 2, 2021. On January 21, 2021, the company issued 26,800 shares of its common stock for $29 per share receiving $777.200 proceeds after brokerage fees and other costs of issuance. On February 2, 2021, the proceeds from the stock sale, supplemented by an additional $329,800 cash, are used to liquidate the $1.107.000 debt. The December 31, 2020. balance sheet is issued on February 23, 2021 Show how the $1,107,000 of short-term debt should be presented on the December 31, 2020, balance sheet. (Enter account name only and do not provide descriptive information.) Culver Company Partial Balance Sheet December 31, 2020 Current abilities Notes Payable 329,800 e Textbook and Media Assistance Used e Textbook Video List of Accounts Assistance Used Save for Later Attempts: 3 of 10 used Submit Answer Assignment sent to Gradebook. Your grade is being recorded

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started