Can someone help me with this problem and show explanations? Especially how you get the "Proposed"

data on the Income Sheet.

data on the Income Sheet.

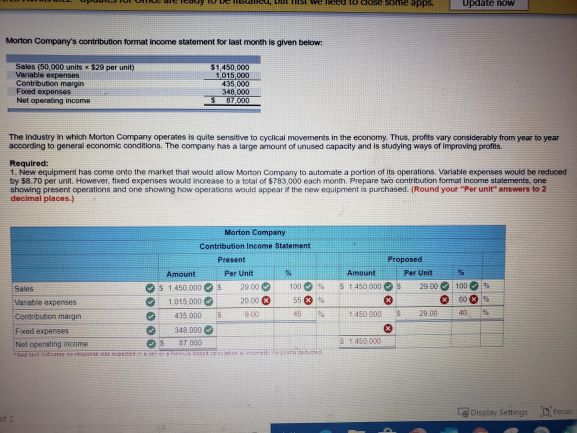

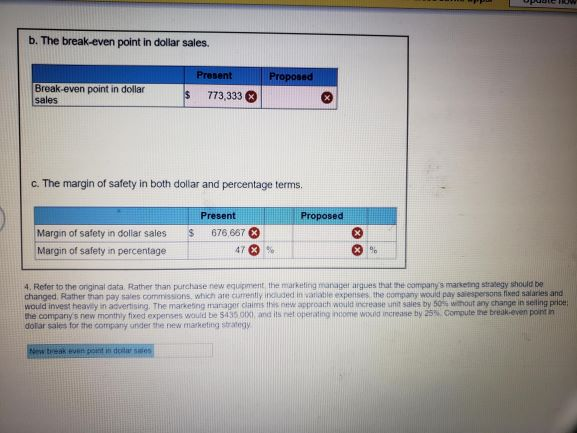

SW 10 cose some apps Update now Morton Company's contribution format income statement for last month is given below: Sales (50,000 units x 529 per unit) Variable expenses Contribution margin Fored expenses Net operating income $1,450,000 1015000 435,000 348 000 87.000 The Industry in which Morton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studying ways of improving profits. Required: 1. New equipment has come onto the market that would allow Morton Company to automate a portion of its operations, Variable expenses would be reduced by 58.70 per unit. However, fixed expenses would increase to a total of 8783,000 each month. Prepare two contribution format income statements, one showing present operations and one showing how operations would appear it the new equipment is purchased. (Round your "Per unit answers to 2 decimal places.) Morton Company Contribution Income Statement Present Amount Per Unit % $ 1450.000 2900 100 1 015 000 200G X 55 X 435.000 5 200 45 348.000 S 87 000 100 Proposed Amount Per Unit S 1 450 000 $ 29.00 X 450 000 $ 29.00 3 3 450.000 Sales Vanable expenses Contribution margin Fixed expenses Net operating income 00X9 40 Display Settings Fon b. The break-even point in dollar sales. Present Proposed Break-even point in dollar sales $ 773,333 c. The margin of safety in both dollar and percentage terms. Proposed Present 676 667 X $ Margin of safety in dollar sales Margin of safety in percentage 47 % %% 4. Refer to the original data Rather than purchase new equipment the marketing manager argues that the companys marketing strategy should be changed. Rather than pay sales commissions, which are currently ruded in variable expenses the company would pay salesperson fixed salaries and would invest heavily in advertising. The marketing manager claims new approach would increase in sales by 50% without any change in selling price the company's new monthly fixed expenses would be 5435 XI, and is net operating income werd increase by 25 Compute the break even point dofar sales for the company under the new marketing strategy New takve point in das

data on the Income Sheet.

data on the Income Sheet.