can someone help me with this problem, i am self-teaching at financial acc

can someone help me with this problem, i am self-teaching at financial acc

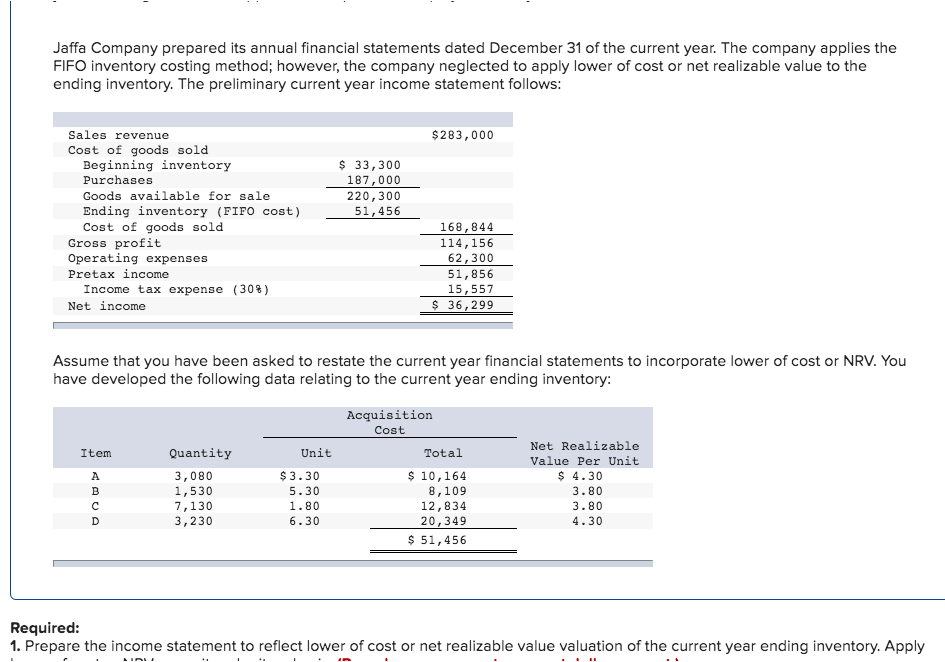

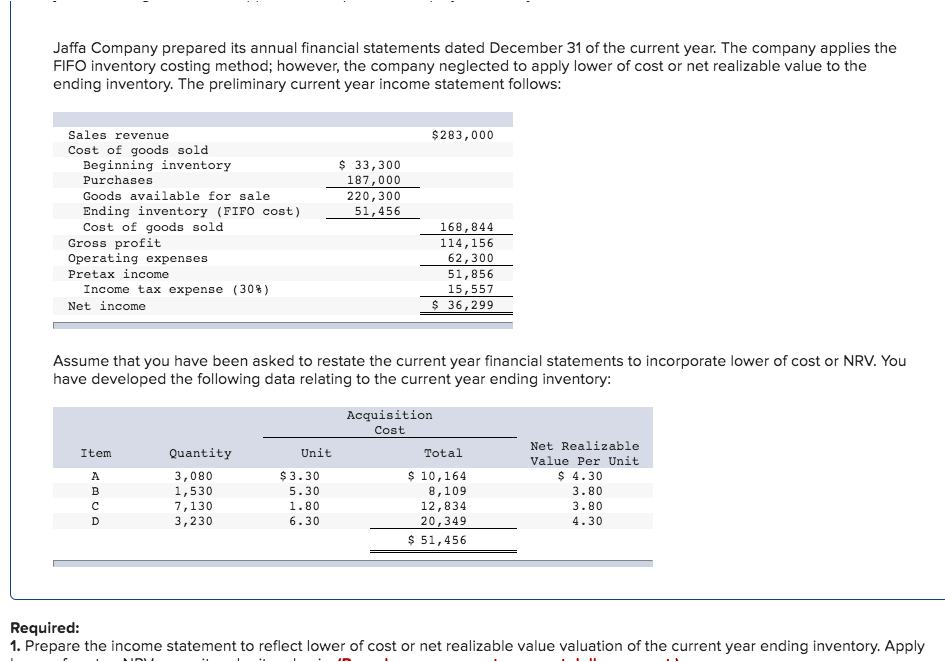

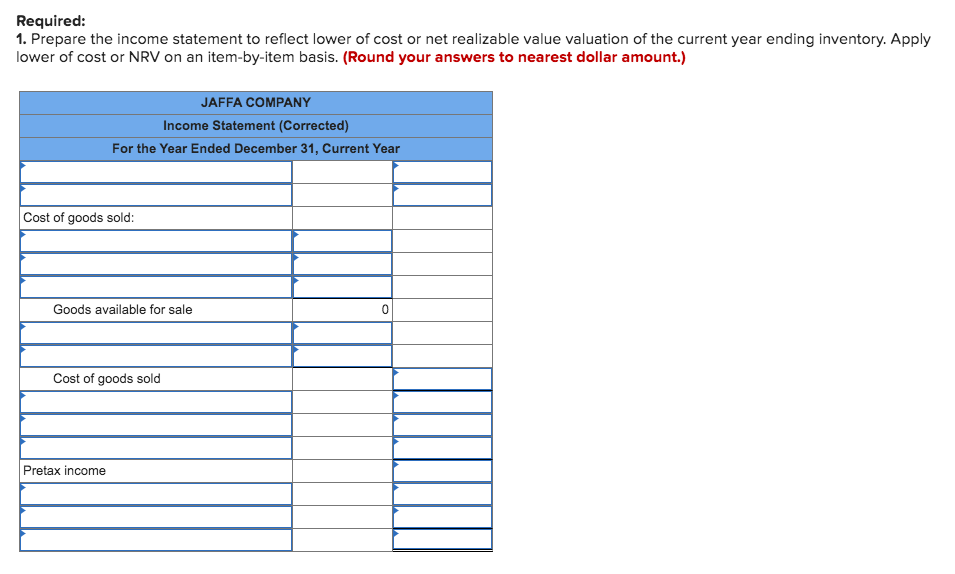

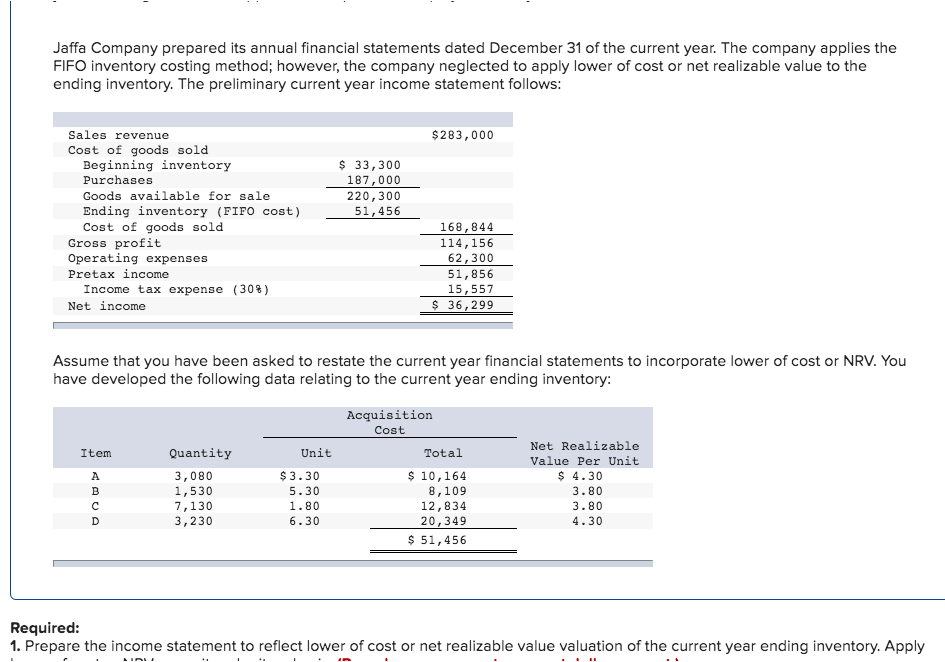

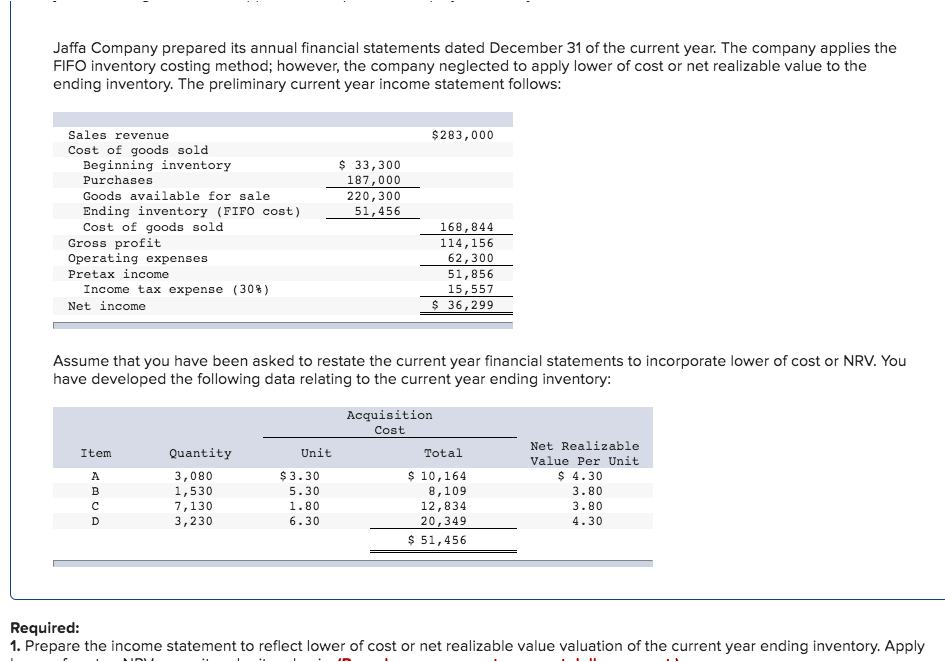

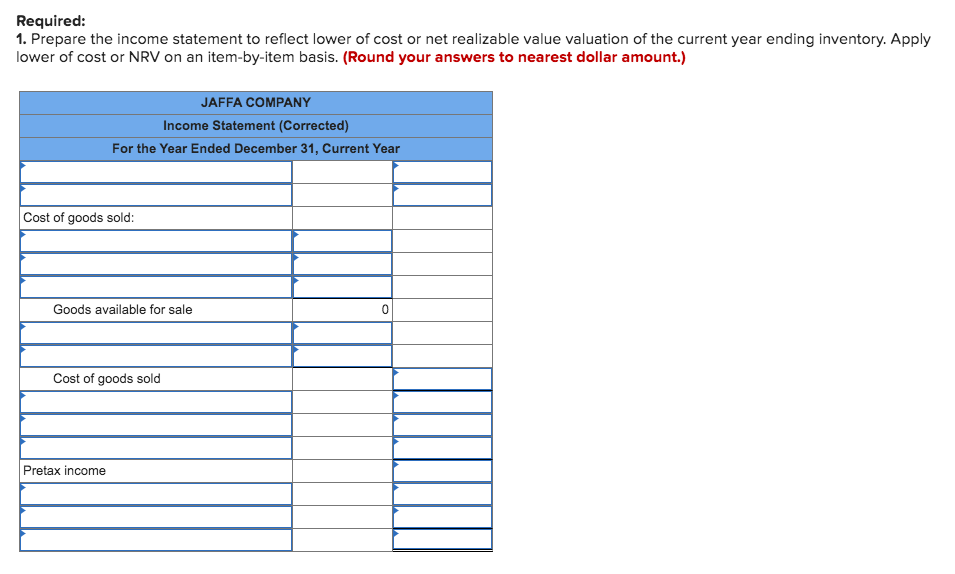

Jaffa Company prepared its annual financial statements dated December 31 of the current year. The company applies the FIFO inventory costing method; however, the company neglected to apply lower of cost or net realizable value to the ending inventory. The preliminary current year income statement follows: $ 283,000 $ 33,300 187,000 220,300 51,456 Sales revenue Cost of goods sold Beginning inventory Purchases Goods available for sale Ending inventory (FIFO cost) Cost of goods sold Gross profit Operating expenses Pretax income Income tax expense (30%) Net income 168,844 114,156 62,300 51,856 15,557 $ 36,299 Assume that you have been asked to restate the current year financial statements to incorporate lower of cost or NRV. You have developed the following data relating to the current year ending inventory: Item Unit A B D Quantity 3,080 1,530 7,130 3,230 $ 3.30 5.30 1.80 6.30 Acquisition Cost Total $ 10,164 8,109 12,834 20,349 $ 51,456 Net Realizable Value Per Unit $ 4.30 3.80 3.80 4.30 Required: 1. Prepare the income statement to reflect lower of cost or net realizable value valuation of the current year ending inventory. Apply Jaffa Company prepared its annual financial statements dated December 31 of the current year. The company applies the FIFO inventory costing method; however, the company neglected to apply lower of cost or net realizable value to the ending inventory. The preliminary current year income statement follows: $ 283,000 $ 33,300 187,000 220,300 51,456 Sales revenue Cost of goods sold Beginning inventory Purchases Goods available for sale Ending inventory (FIFO cost) Cost of goods sold Gross profit Operating expenses Pretax income Income tax expense (30%) Net income 168,844 114,156 62,300 51,856 15,557 $ 36,299 Assume that you have been asked to restate the current year financial statements to incorporate lower of cost or NRV. You have developed the following data relating to the current year ending inventory: Item Unit A B D Quantity 3,080 1,530 7,130 3,230 $ 3.30 5.30 1.80 6.30 Acquisition Cost Total $ 10,164 8,109 12,834 20,349 $ 51,456 Net Realizable Value Per Unit $ 4.30 3.80 3.80 4.30 Required: 1. Prepare the income statement to reflect lower of cost or net realizable value valuation of the current year ending inventory. Apply Required: 1. Prepare the income statement to reflect lower of cost or net realizable value valuation of the current year ending inventory. Apply lower of cost or NRV on an item-by-item basis. (Round your answers to nearest dollar amount.) JAFFA COMPANY Income Statement (Corrected) For the Year Ended December 31, Current Year Cost of goods sold: Goods available for sale 0 Cost of goods sold Pretax income

can someone help me with this problem, i am self-teaching at financial acc

can someone help me with this problem, i am self-teaching at financial acc