Answered step by step

Verified Expert Solution

Question

1 Approved Answer

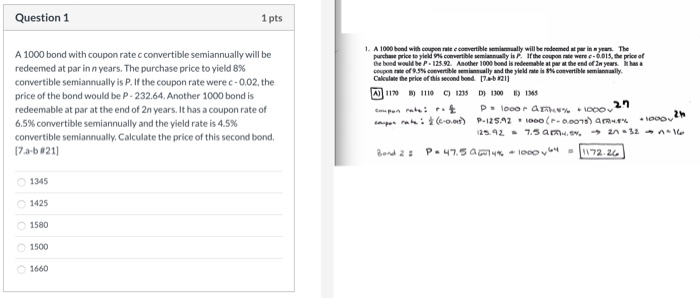

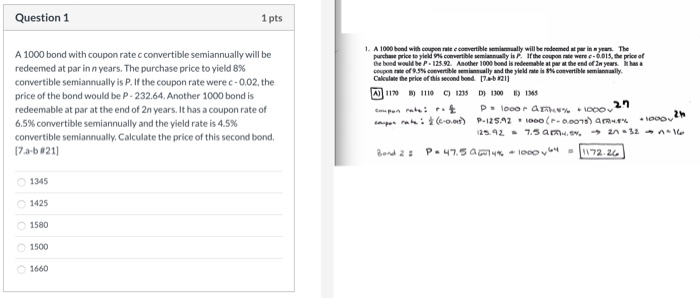

Can someone help me with this problem? I attached an example to help. Question 1 1 pts 1. A 1000 bond with coupon rate e

Can someone help me with this problem? I attached an example to help.

Question 1 1 pts 1. A 1000 bond with coupon rate e convertible semiannually will be redeemed at par in a yean. The purchane price to yield 9 comvertible semiannually is P. If the coupon rate were e-6.015, the price of the bond would be P. 125.92. Aaother 1000 bond is redeemable at par at the end of 2n years. ik has a coupon rate of 9.3N convertible semiannually and the yield rate is convertible semiannally. Caleulate the price of this second bond (7ab21) A 1000 bond with coupon rate c covertible semiannually will be redeemed at par inn years. The purchase price to yield 8% convertible semiannually is P. If the coupon rate were c-0.02, the A 1170 ) 1110 ) 1235 D) 1100 ) 136s price of the bond would be P- 232.64. Another 1000 bond is .t redeemable at par at the end of 2n years. It has a coupon rate of 6.5% convertible semiannually and the yield rate is 4.5% Cpan rate: npan rat: (e-o.os) P-12SA2 oeo (-0.00s) amu% o0ovN 125.92 - 7.samu.ov, 2n32 - nle convertible semiannually. Calculate the price of this second bond. (7.a-b#21) Bond 2s P.47.5 a4 - lo0ov 72.24 O 1345 1425 1580 1500 1660 Question 1 1 pts 1. A 1000 bond with coupon rate e convertible semiannually will be redeemed at par in a yean. The purchane price to yield 9 comvertible semiannually is P. If the coupon rate were e-6.015, the price of the bond would be P. 125.92. Aaother 1000 bond is redeemable at par at the end of 2n years. ik has a coupon rate of 9.3N convertible semiannually and the yield rate is convertible semiannally. Caleulate the price of this second bond (7ab21) A 1000 bond with coupon rate c covertible semiannually will be redeemed at par inn years. The purchase price to yield 8% convertible semiannually is P. If the coupon rate were c-0.02, the A 1170 ) 1110 ) 1235 D) 1100 ) 136s price of the bond would be P- 232.64. Another 1000 bond is .t redeemable at par at the end of 2n years. It has a coupon rate of 6.5% convertible semiannually and the yield rate is 4.5% Cpan rate: npan rat: (e-o.os) P-12SA2 oeo (-0.00s) amu% o0ovN 125.92 - 7.samu.ov, 2n32 - nle convertible semiannually. Calculate the price of this second bond. (7.a-b#21) Bond 2s P.47.5 a4 - lo0ov 72.24 O 1345 1425 1580 1500 1660

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started