Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me with this problem? I attached an example to help. Question 2 1 pts 1.75 2. Seith purchases a 1000 par value,

Can someone help me with this problem? I attached an example to help.

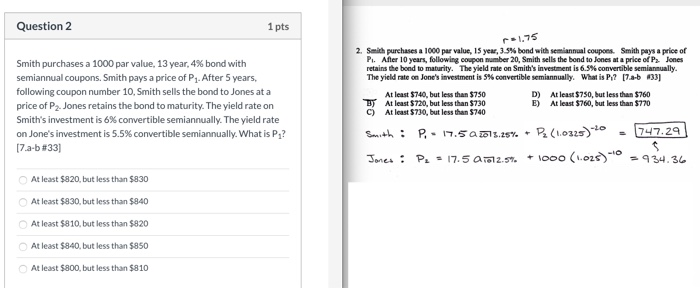

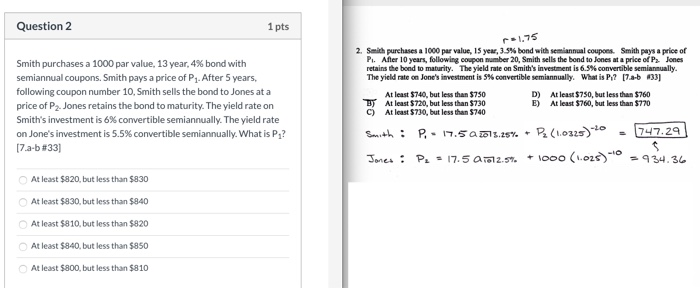

Question 2 1 pts 1.75 2. Seith purchases a 1000 par value, 15 yen, 35% bond with semiannual coupons. Smith pays a price of P. After 10 years, following coupon number 20, Smith sells the bond to Jones at a price of P, Jones retains the bond to maturity. The yield rate on Smith's investment is 6.5% convertible semiannually. The yield rate on Jone's investment is 5% convertible semiannually. What is P.? 17a- b 4331 Smith purchases a 1000 par value, 13 year, 4% bond with semiannual coupons. Smith pays a price of P1. After 5 years, following coupon number 10, Smith sells the bond to Jones at a price of P2. Jones retains the bond to maturity. The yield rate on Smith's investment is 6% convertible semiannually. The yield rate on Jone's investment is 5.5% convertible semiannually. What is P,? [7.a-b#33] At least $740, but less than $750 At least $720, but less than $730 At least $ 730, but less than 5740 D) E) By c) At least $750, but less than 5760 At least 5760, but less than 5770 - 747.29 Smith : P - 17.5 2015.25%. + P(1.0225)-20 Jones : PL 17.5 12.5%. + 1000 (1.02) 934.36 At least $820, but less than $830 At least $830, but less than $840 At least $810, but less than $820 At least $840, but less than $850 At least $800, but less than $810

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started