Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me with this problem please. The truck was driven 80,000 miles in 2015, 120,000 miles in 2016, and 160,000 miles in 2017.

can someone help me with this problem please.

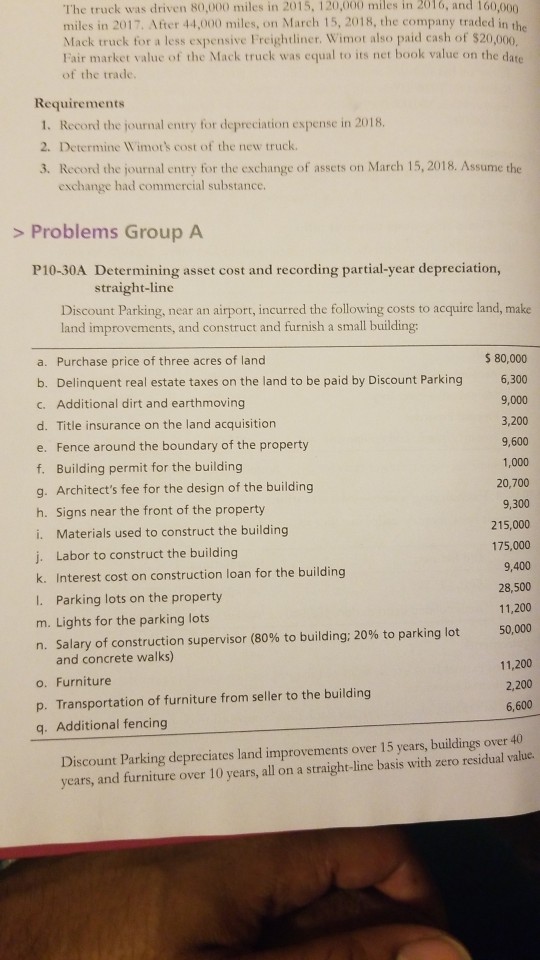

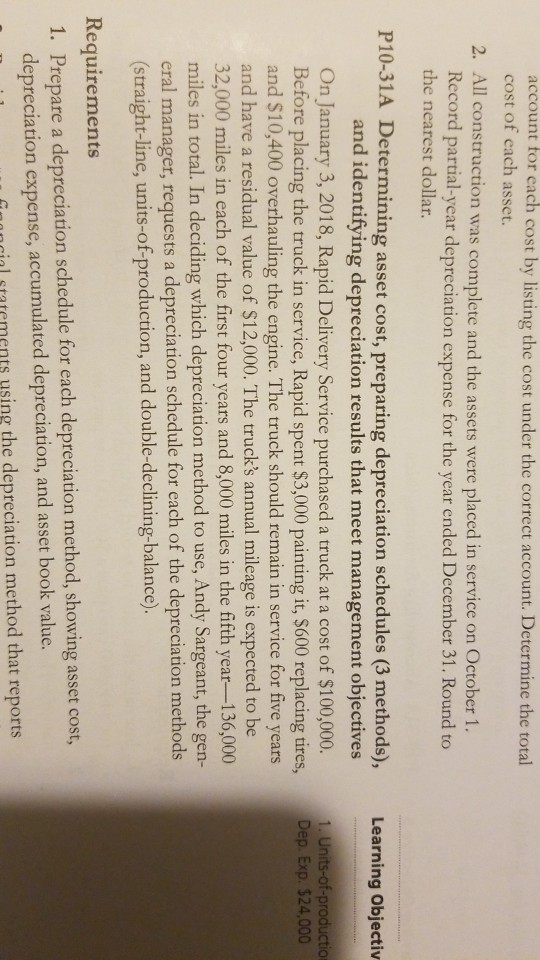

The truck was driven 80,000 miles in 2015, 120,000 miles in 2016, and 160,000 miles in 2017. After 44,000 miles, on March 15, 2018, the company traded in the Mack truck for a less expensive Freightliner. Wimot also paid cash of $20,000 Fair market value of the Mack truck was equal to its net book value on the date of the trade. Requirements 1. Record the journal entry for depreciation expense in 2018. 2. Determine Wimot's cost of the new truck. 3. Record the journal entry for the exchange of assets on March 15, 2018. Assume the exchange had commercial substance. > Problems Group A P10-30A Determining asset cost and recording partial-year depreciation, straight-line Discount Parking, near an airport, incurred the following costs to acquire land, make land improvements, and construct and furnish a small building: a. Purchase price of three acres of land b. Delinquent real estate taxes on the land to be paid by Discount Parking c. Additional dirt and earthmoving d. Title insurance on the land acquisition e. Fence around the boundary of the property f. Building permit for the building g. Architect's fee for the design of the building h. Signs near the front of the property i. Materials used to construct the building j. Labor to construct the building k. Interest cost on construction loan for the building I. Parking lots on the property m. Lights for the parking lots n. Salary of construction supervisor (80% to building: $ 80,000 6,300 9,000 3,200 9,600 1,000 20,700 9,300 215,000 175,000 9,400 11,200 50,000 11,200 2,200 20% to parking lot and concrete walks) o. Furniture p. Transportation of furniture from seller to the building q. Additional fencing Discount Parking depreciates land improvements over 15 years, buildings over 40 years, and furniture over 10 years, all on a straight-line basis with zero residual valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started