Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me with this question, please? As you can see the solution is already provided but my question is why are we debiting

Can someone help me with this question, please? As you can see the solution is already provided but my question is why are we debiting Accounts receiveable for 100,000 instead of debiting cash for 100,000? wouldn't Finn record/recognize 100,000 cash on March 1, 2017, because it transferred product B? please help and thanks in advance!

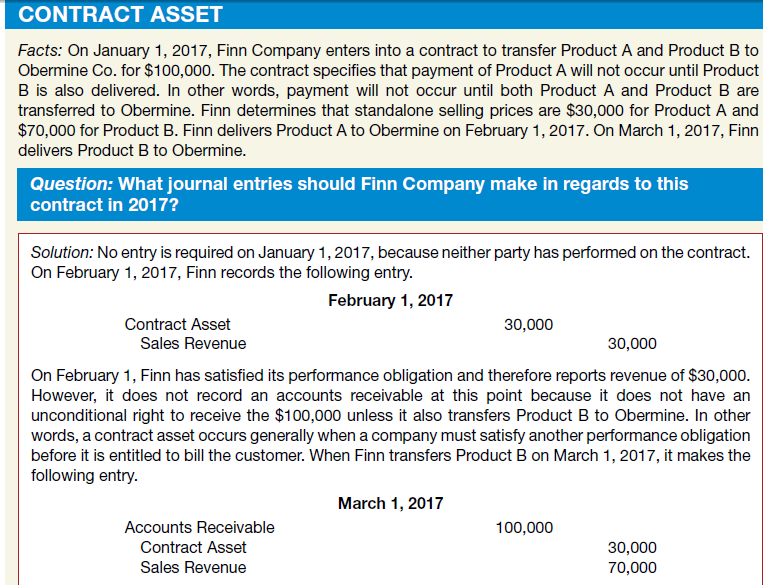

CONTRACT ASSET Facts: On January 1, 2017, Finn Company enters into a contract to transfer Product A and Product B to Obermine Co. for $100,000. The contract specifies that payment of Product A will not occur until Product B is also delivered. In other words, payment will not occur until both Product A and Product B are transferred to Obermine. Finn determines that standalone selling prices are $30,000 for Product A and $70,000 for Product B. Finn delivers Product A to Obermine on February 1, 2017. On March 1, 2017, Finn delivers Product B to Obermine. Question: What journal entries should Finn Company make in regards to this contract in 2017? Solution: No entry is required on January 1, 2017, because neither party has performed on the contract. On February 1, 2017, Finn records the following entry. February 1, 2017 Contract Asset 30,000 Sales Revenue 30,000 On February 1, Finn has satisfied its performance obligation and therefore reports revenue of $30,000. However, it does not record an accounts receivable at this point because it does not have an unconditional right to receive the $100,000 unless it also transfers Product B to Obermine. In other words, a contract asset occurs generally when a company must satisfy another performance obligation before it is entitled to bill the customer. When Finn transfers Product B on March 1, 2017, it makes the following entry. March 1, 2017 Accounts Receivable 100,000 Contract Asset 30,000 Sales Revenue 70,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started