Can someone help me with this study guide?

1st part is a True or False, 2nd part is Multiple Choice, 3rd is exercises

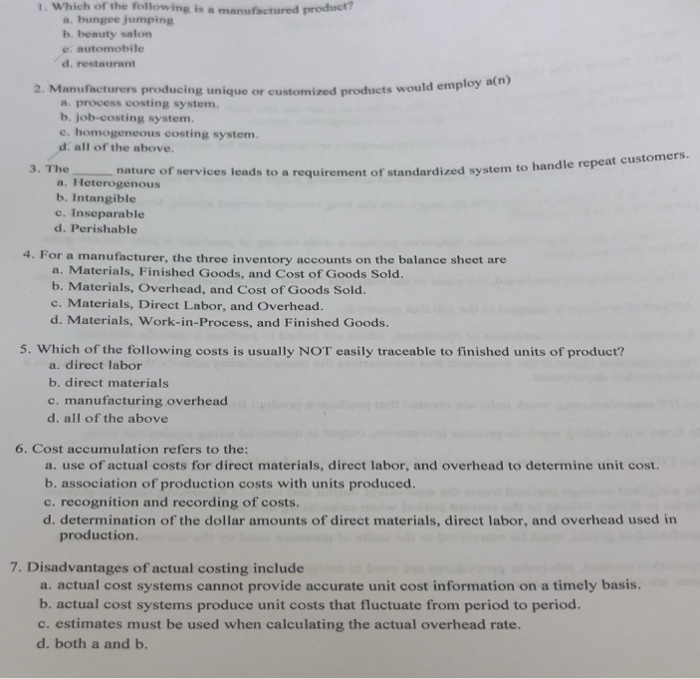

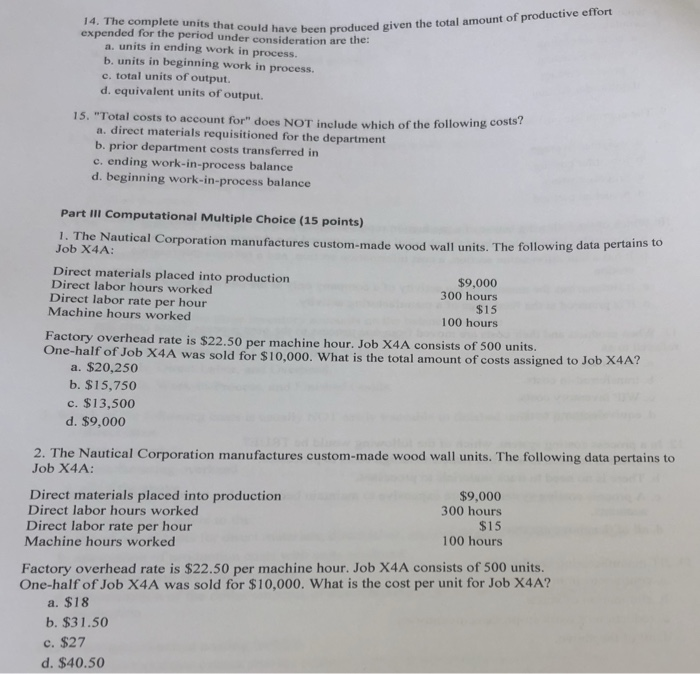

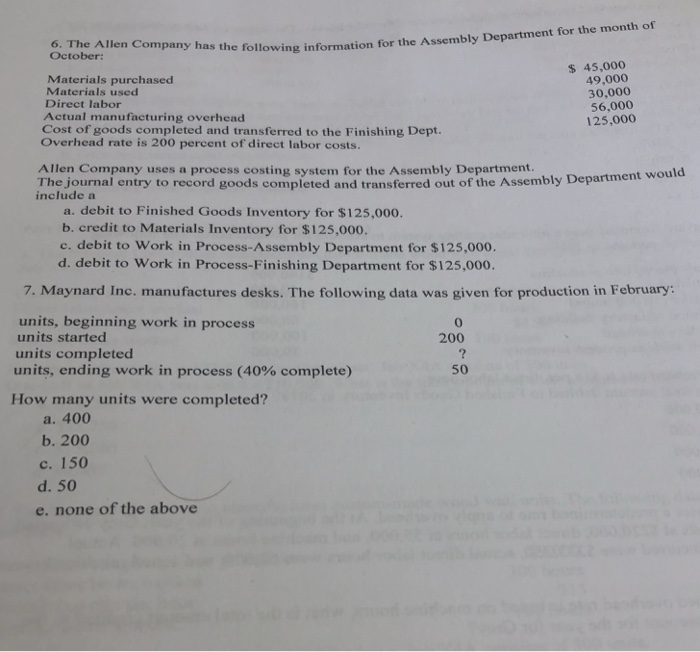

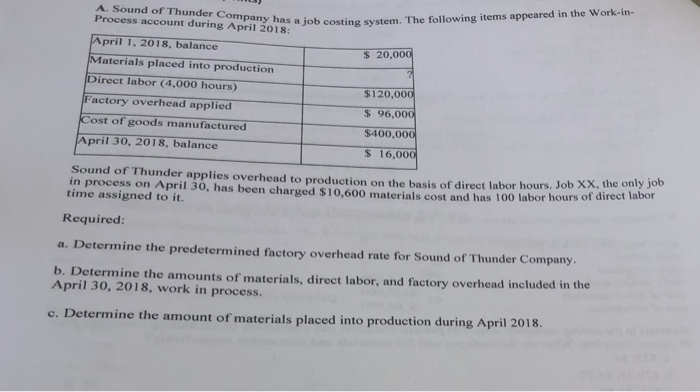

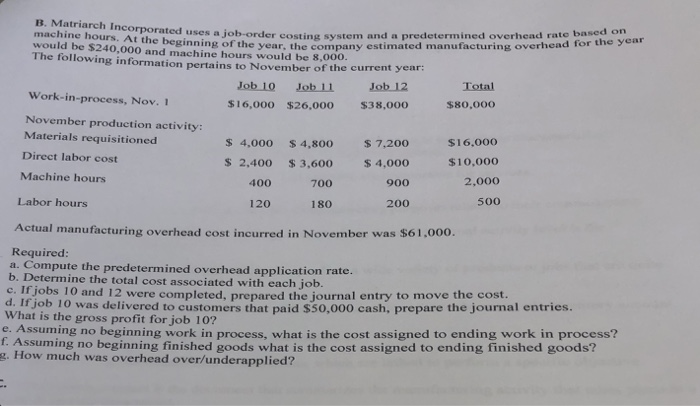

1. A production process may yield a tangible product or a service and their unique characteristics determine the best approach for developing a cost management system 2. Inseparability means that production and consumption are inseparable for services. 3. The uniqueness of the products or units for cost accounting purposes relates to their com 4. Activity level is the average activity usage over mon costs. the long term and normal activity level is the production level for one year. 5. Companies operating in job-order industries produce a wide variety of products or jobs that are quite 6. When materials are purchased, the costs of the materials "nlows" into the materials inventory account. 7. Abnormal spoilage is charged to the job that caused it. 8. A process is a series of activities or operations, which are linked to perform a specific objective. 9. The production report is the document that summarizes the manufacturing activity that takes place in a different from each other. work-in-process department. 10. In JIT manufacturing, work cells are created that produce a product from start to finish. 11. In firms with ending work-in-process inventories, output is measured using equivalent units. 12. The FIFO method unit costs are used to value output that is related to future periods. 13. The weighted average method treats the equivalent output and costs in beginning work-in-process inventories as if they belong to the current period when calculating unit cost. 14. Transferred-in goods, must be converted to the units of measure used by the current department. 15. In operation costing, job-order procedures are used to assign direct materials costs and process procedures are used to assign conversion costs. 1. Which of the following is a manufactured a. bungee jumping b. beauty salon e automobile d. restaurant 2. Manufacturers producing unique or customized products wou a. process costing system. b. job-costing system. e. homogeneous costing system. d. all of the above 3. Thenature of services leads to a requirement of standardized system to han a. Heterogenous b. Intangible c. Inseparable d. Perishable 4. For a manufacturer, the three inventory accounts on the balance sheet are a. Materials, Finished Goods, and Cost of Goods Sold. b. Materials, Overhead, and Cost of Goods Sold c. Materials, Direct Labor, and Overhead. d. Materials, Work-in-Process, and Finished Goods. 5. Which of the following costs is usually NOT easily traceable to finished units of product? a. direct labor b. direct materials c. manufacturing overhead d. all of the above 6. Cost accumulation refers to the: a. use of actual costs for direct materials, direct labor, and overhead to determine unit cost. b. association of production costs with units produced c. recognition and recording of costs. d. determination of the dollar amounts of direct materials, direct labor, and overhead used in production. 7. Disadvantages of actual costing include a. actual cost systems cannot provide accurate unit cost information on a timely basis. b. actual cost systems produce unit costs that fluctuate from period to period c. estimates must be used when calculating the actual overhead rate d. both a and b. most likely use to 8. Wh accumulate costs? at system would a manufact a. contract costing b. variable costing e. process costing d. job-order costing urer of unique special orders or batch processes appropriate cost accounting system to use when inventory items are produced on an assembly line a. weighted average. b. job-order costing. c. process costing d. perpetual method. 9. The is 10. Which of the following is true of a production report prepared under a process-costing system? department. information about the physical units processed in a a. It provides b. It has a unit information section, a cost information section, and a revenue information section. e. It summarizes the d. It is prepared at the final stage of a manufacturing activity. manufacturing activity of a company only at the end of a reporting period 11. When products and their costs are moved from one process to the next process, these costs referred to as are a. unit costs. b. transferred-in costs. c. WIP inventory costs. d. equivalent unit costs. 12. In a process costing system, which of the following would be TRUE? a. There is no need to use time tickets to assign costs to processes. b. There is no need to track materials to processes. c. A process costing system is more expensive to maintain because it has more work-in-process accounts. d. all of the above are true. 3. JIT manufacturing emphasizes a. continuous improvement. b. elimination of waste. c. reduction of work-in-process inventories. d. all of the above. expended for the period uold have been produced given the total amount of productive effort under consideration are the: a. units in ending work in process. b. units in beginning work in process. c. total units of output. d. equivalent units of output. 15. "Total I costs to account for" does NOT include which of the following costs? a. direct materials requisitioned for the department b. prior department costs transferred in c. ending work-in-process balance d. beginning work-in-process balance Part III Computational Multiple Choice (15 points) 1. The Nautical Corpora Job X4A: tion manufactures custom-made wood wall units. The following data pertains to Direct materials placed into production Direct labor hours worked $9,000 300 hours $15 100 hours Direct labor rate per hour Machine hours worked Factory One-half of Job X4A was sold for $10,000. What is the total amount of costs assigned to Job X4A? overhead rate is $22.50 per machine hour. Job X4A consists of 500 units. a. $20,250 b. $15,750 c. $13,500 d. $9,000 2. The Nautical Corporation manufactures custom-made wood wall units. The following data pertains to Job X4A Direct materials placed into production Direct labor hours worked Direct labor rate per hour Machine hours worked $9,000 300 hours $15 100 hours Factory overhead rate is $22.50 per machine hour. Job X4A consists of 500 units. One-half of Job X4A was sold for $10,000. What is the cost per unit for Job X4A? a. $18 b. $31.50 c. $27 d. $40.50 3. T'he d'ameron Corporation custom-made porses. The following data pertains to Job XYS: Direct materials placed into production Direct labor hours sworked Direct labor rate per hour Machine hours worked s4,000 50 urs S1S so 100 hour budgeted of 50 units ar S Ko oc applied using a plant-wide rate based on direct labor hours. Factory overhead was nt 580,000 for the year and the direct labor hours were est imated to be 20,006. Job XYS consists What is the materials cost per unit for Job XY57 $267 580 c. $40 d. $4 information Company uses a job-order costing system to account for product costs. The following information pertains to 2o1s: $140,000 40.000 160,000 60,000 100,000 30,000 Materials placed into production Indirect labor Direct labor (10,000 hours) Depreciation of factory building Other factory overhead Increase in work-in-process inventory Factory overhead rate is $18 per direct labor hour. What is the total amount debited to Finished Goods Inventory in 20182 a. $490,000 b. $510,000 c. $450,000 d. $550,000 5. Grey, Ine, uses a predetermined rate to apply overhead. At the beg its overhead costs at $220,000, direct labor hours at 55,000, and machine ho overhead costs incurred were $233,250, actual direct labor hours were 62,000, and actual machine hours inning of the year. Grey estimated urs at 20,000. Actual were 15,000. f the predetermin factory overhead account for the year for Grey? ed overhead rate is based on machine hours, what is the total amount credited to the a. $240,000 b. $135,000 c. $215,000 d. $165,000 C Tte g information for the Assembly Department for the month of October: $ 45,000 Materials purchased Materials used Direct labor Actual manufacturing overhead Cost of goods completed and transferred to the Finishing Dept. 49,000 30,000 56,000 125,000 Overhead rate is 200 percent of direct labor costs. The journal entry to record goods completed and transferred out of the Assembly Departu include a The journal entyry to record goods onn pietedland than fered ot ohnssembly Department would a. debit to Finished Goods Inventory for $125,000. b. credit to Materials Inventory for $125,000. c. debit to Work in Process-Assembly Department for $125,000. d. debit to Work in Process-Finishing Department for $125,000. 7. Maynard Inc. manufactures desks. The following data was given for production in February: units, beginning work in process units started units completed units, ending work in process (40% complete) 0 200 2 50 How many units were completed? a. 400 b. 200 c. 150 d. 50 e. none of the above S. Mannassass Company manufactures chairs. The following informat was given for the company: units, beginning work in process units started units completed 20,000 units, ending work in process cost of direct materials cost of conversion 5,000 $440,000 S 64,000 Materials in the ending inventory were 100 percent complete a and conversion in the ending inventory was 20 percent complete What are the units started and completed? a. 20,000 b. 10,000 c. 15,000 d. 40,000 e. none of the above 9. Manassas Company manufactures chairs. The following informatio 0 units, beginning work in process units started 20,000 units completed units, ending work in process cost of direct materials 5,000 $440,000 20 perche ending inventory were 100 percent complete and conversion in the ending inventory was 20 percent cost of conversion 64.000 complete. What are the costs per unit for materials and conversion respectively? a. $22; $4 b$29.33; $4.27 c. SI1; $1.60 d. $88; $64 e. none of the above A. Sound of Thunder Company has Process account during April 2018 costing t during April 2oi8s a job costing system. The following items appeared in the Work-in- April 1. 2018, balance $ 20,000 Materials placed into production Direct labor (4,000 hours) $120,000 $ 96,000 $400,000 S 16,000 Factory overhead applied Cost of goods manufactured April 30, 2018, balance Sound of Thunder applies overhead to production on the basis of direct labor hours Job x irect labor in process on April 30, has been charged $10,600 materials cost and has 100 labor hours time assigned to it. nd has loo labor hours of hours. Job XX, the only job la direct labor Required a. Determine the predetermined factory overhead rate for Sound of Thunder Company b. Determine the amounts of materials, direct labor, and factory overhead included in the April 30, 2018, work in process. c. De termine the amount of materials placed into production during April 2018. B. Matriarch 1 Incorpora ted uses a job-order costing system and a predetermined overhead rate based on nebeginning of the year, the company estimated manufacturing overhead for the e would be $240,000 and machine hours would be 8,000 The following information pertains to November of the current year: Job 10 Job 11 Job 12 $16,000 $26,000 $38,000 Total Work-in-process, Nov. 1 $80,00o November production activity: Materials requisitioned $ 4,000 4,80o 7,200 s 2,400 $ 3,600 4,000 900 200 $16.000 $10,000 2,000 500 Direct labor cost Machine hours 100 700 Labor hours 120 180 Actual manufacturing overhead cost incurred in November was $61,000. Required: a. Compute the predetermined overhead application rate. b. Determine the total cost associated with each job c. If jobs 10 and 12 were completed, prepared the journal entry to move the cost. job 10 was delivered to customers that paid $50,000 cash, prepare the journal entries. What is the gross profit for job 10? e. Assuming no beginning work in process, what is the cost assigned to ending work in process? r. Assuming no beginning finished goods what is the cost assigned to ending finished goods? g. How much was overhead over/underapplied