can someone help me with what I am missing....

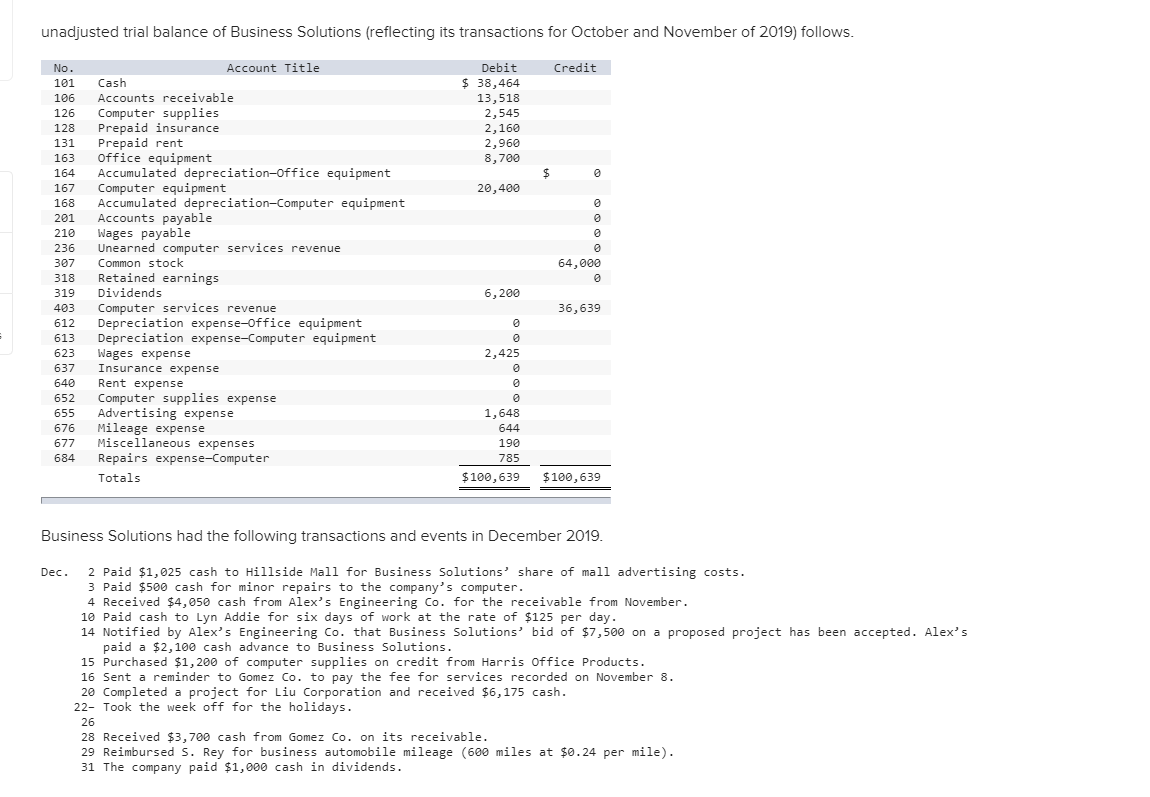

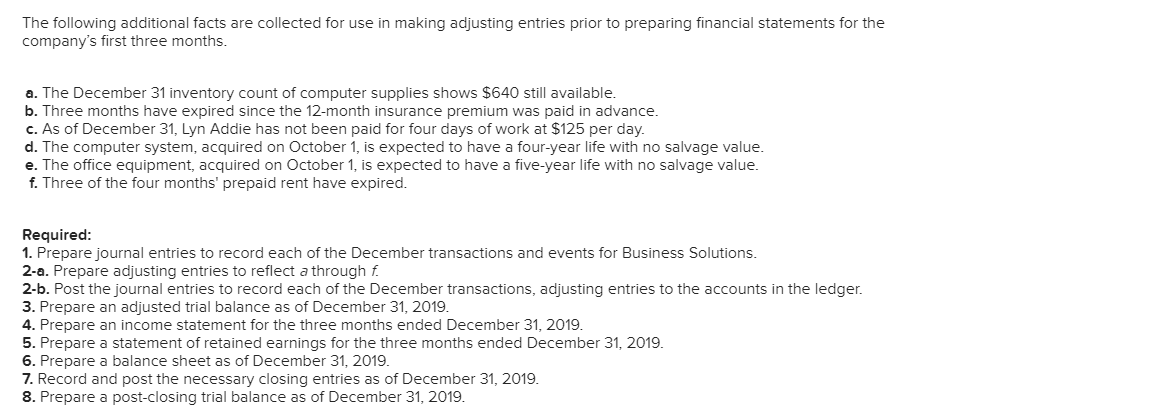

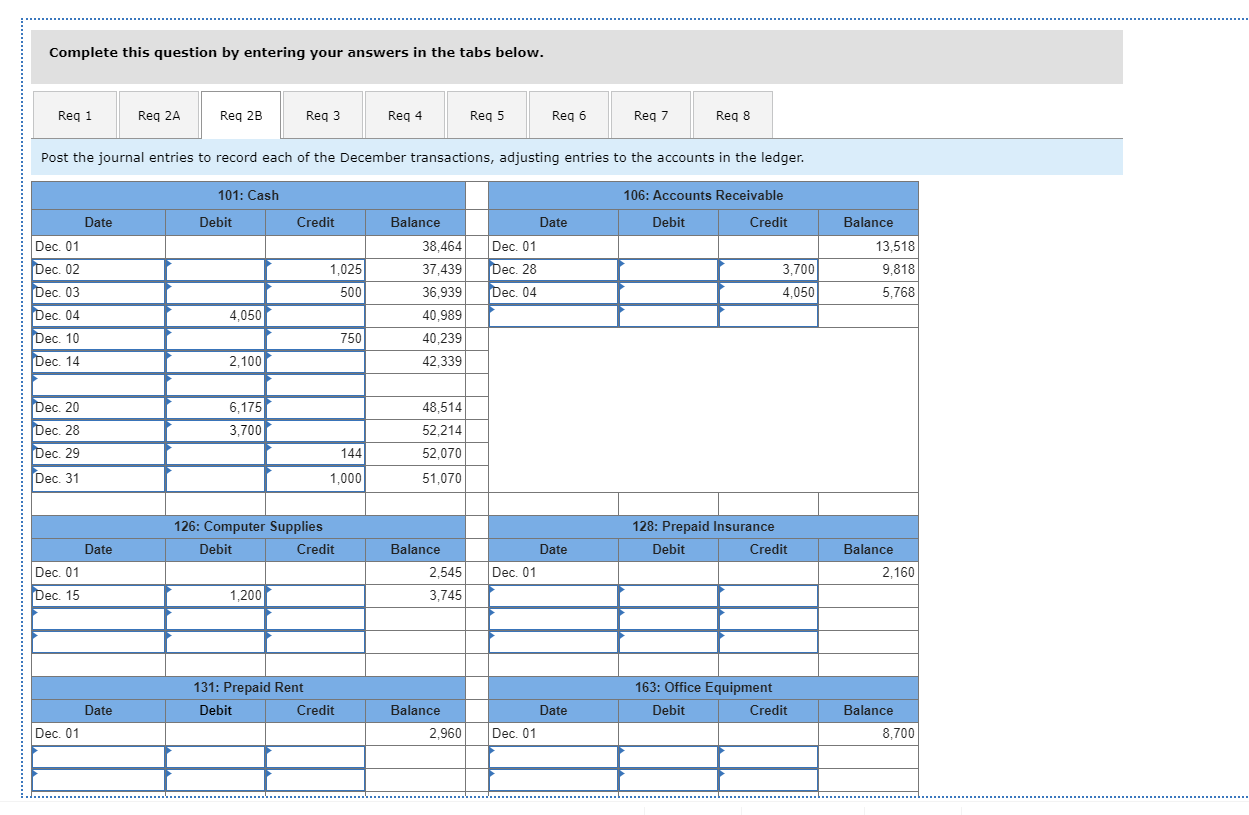

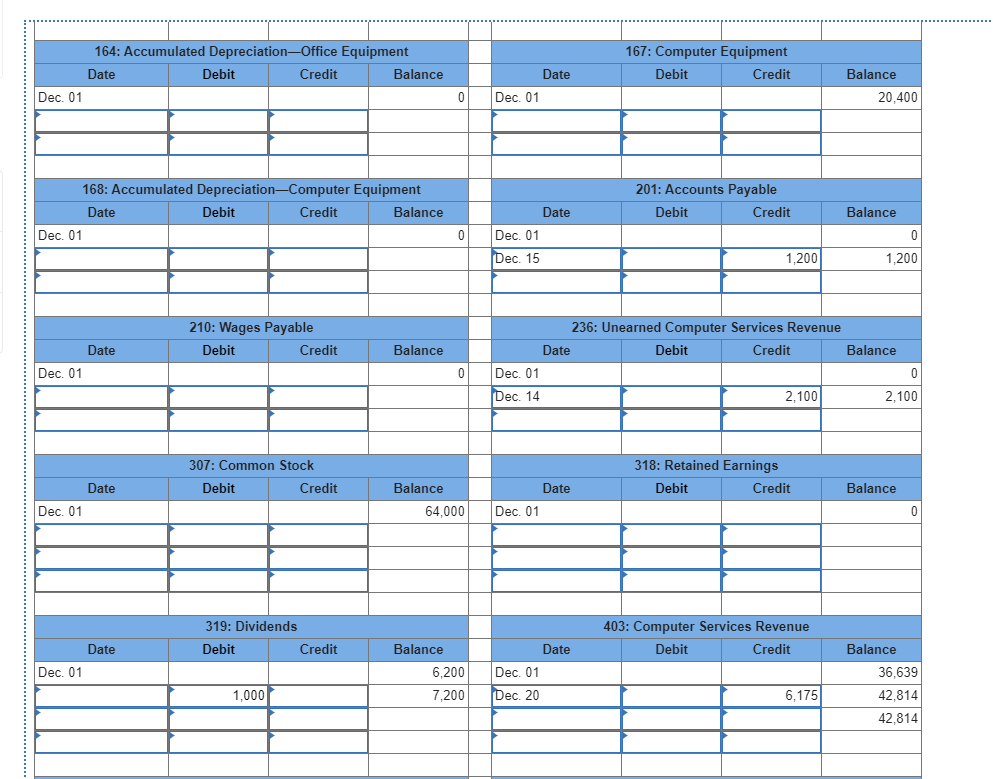

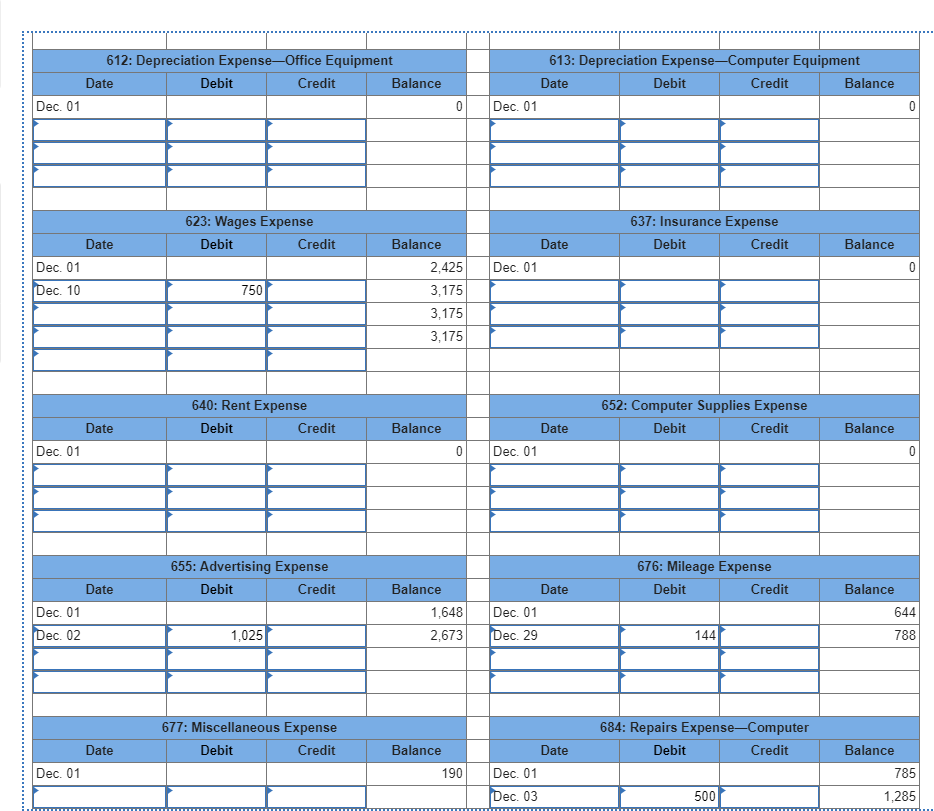

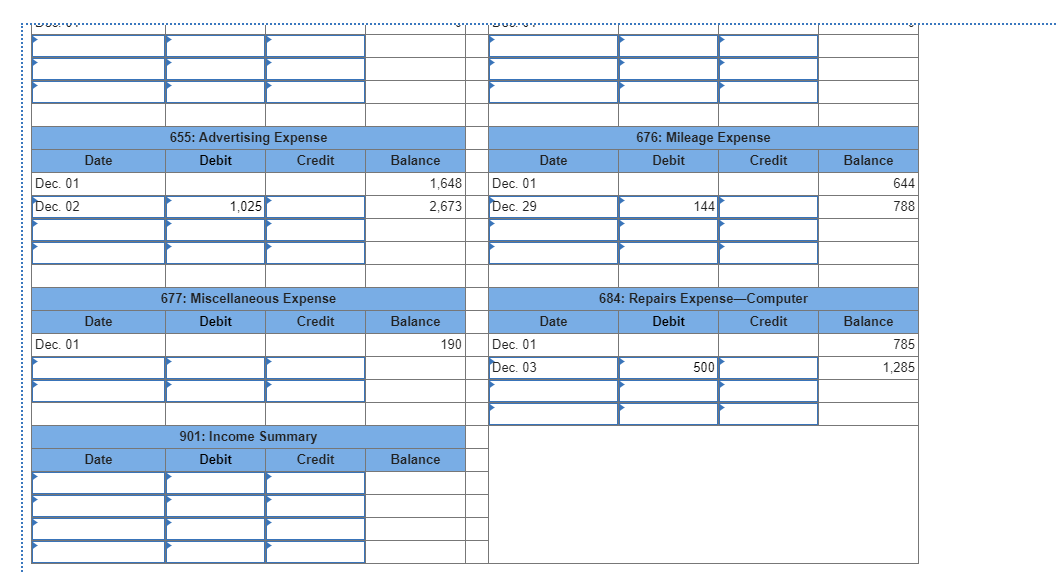

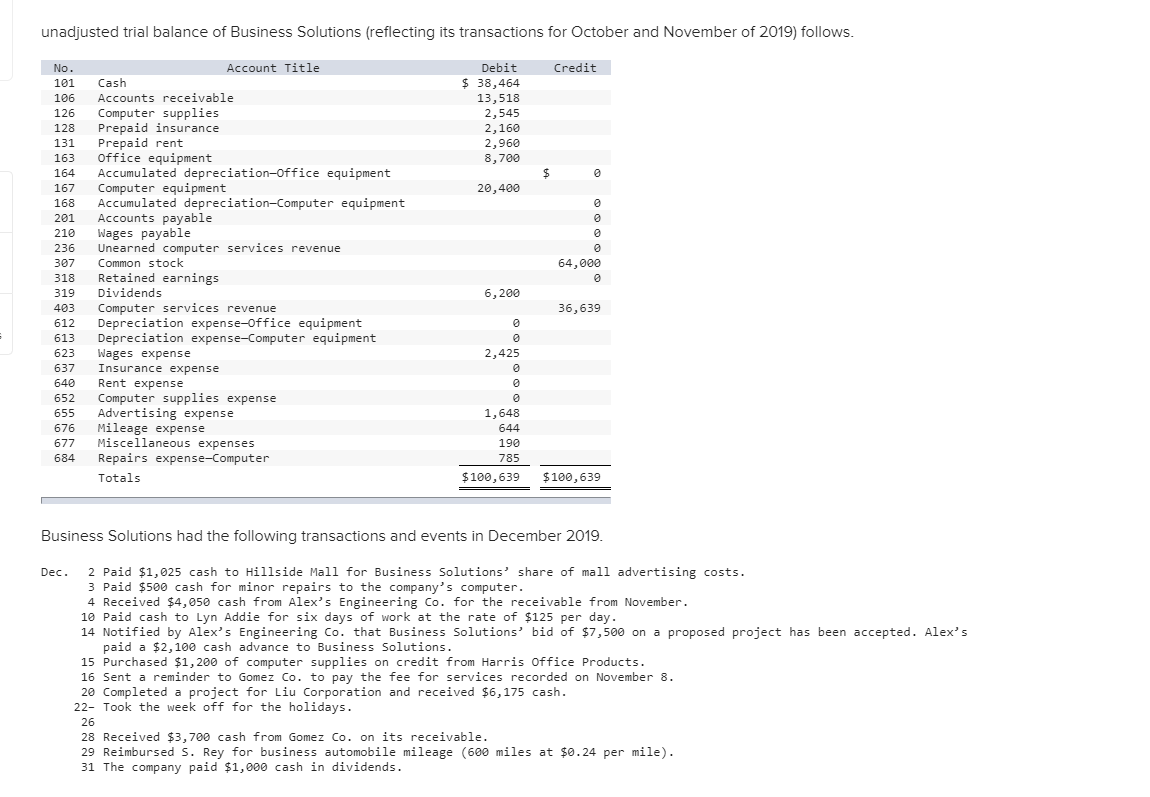

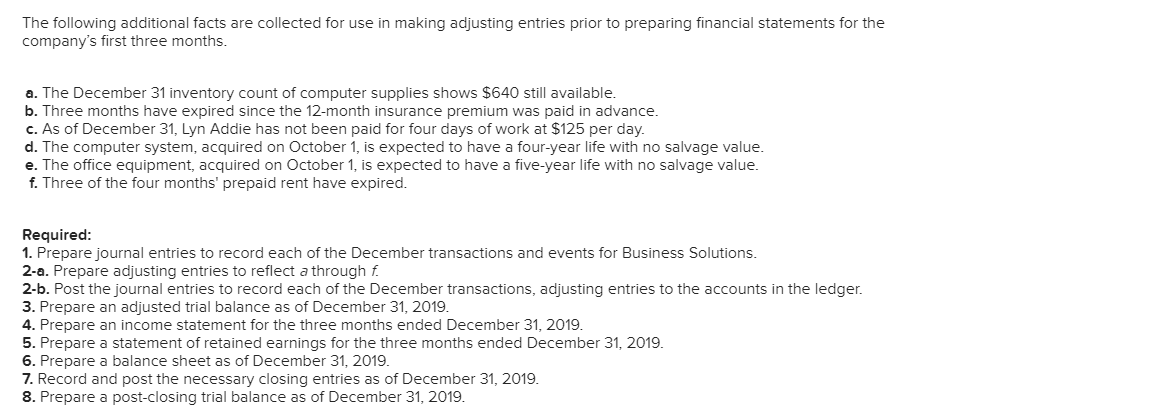

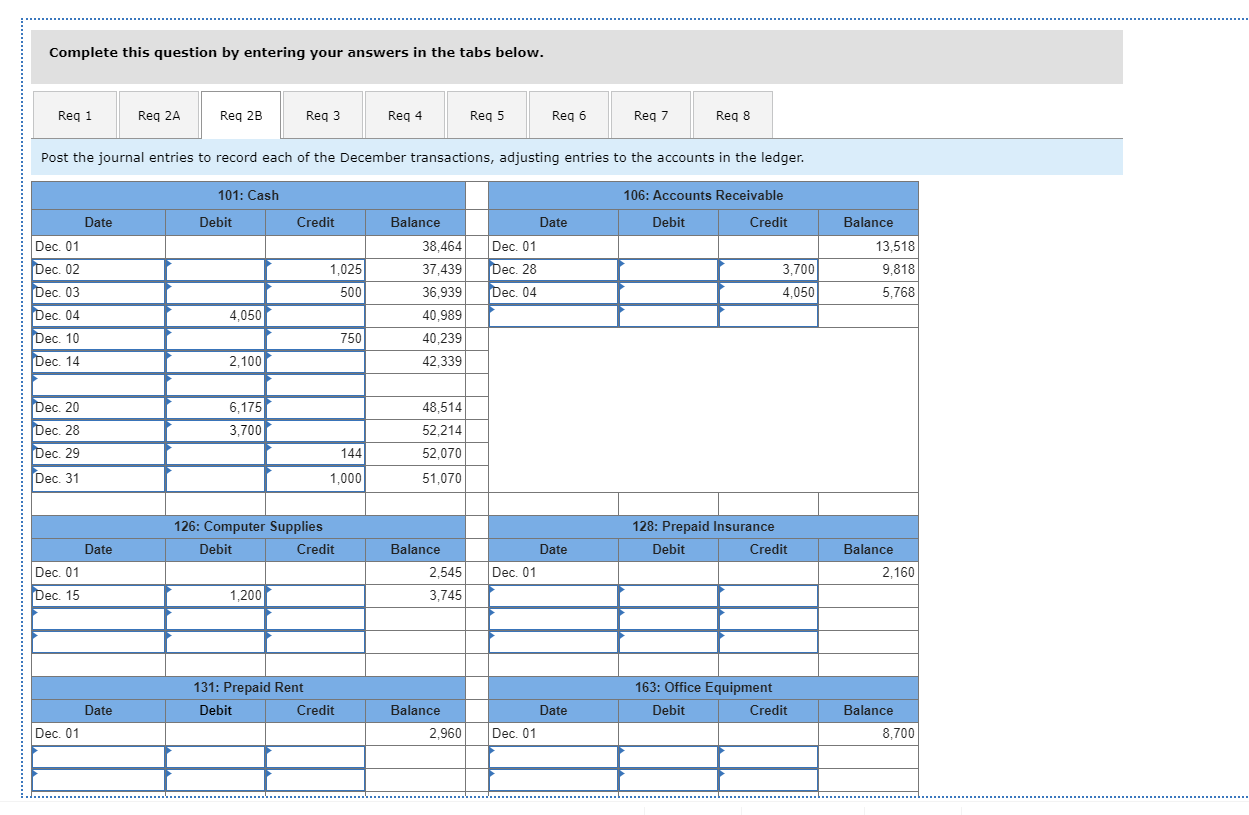

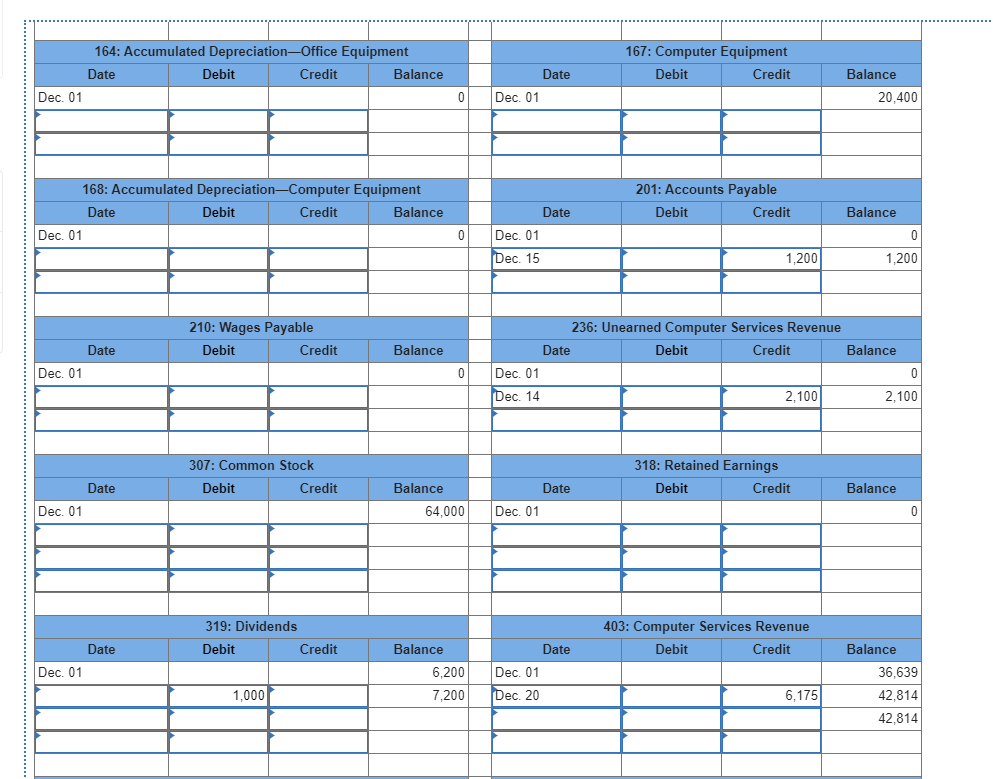

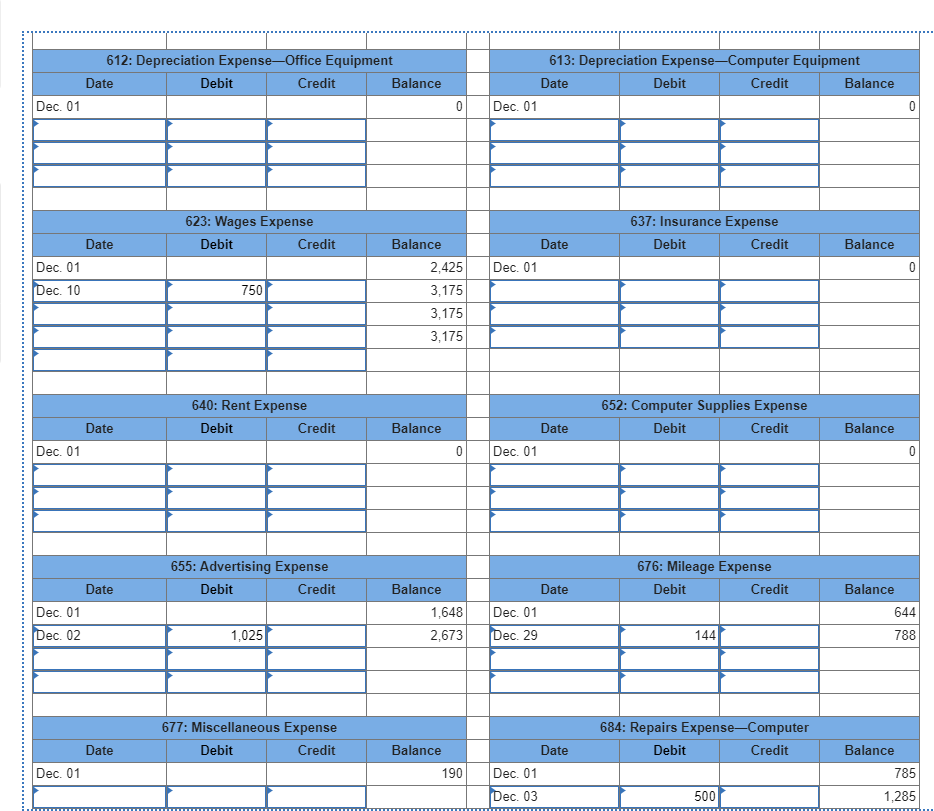

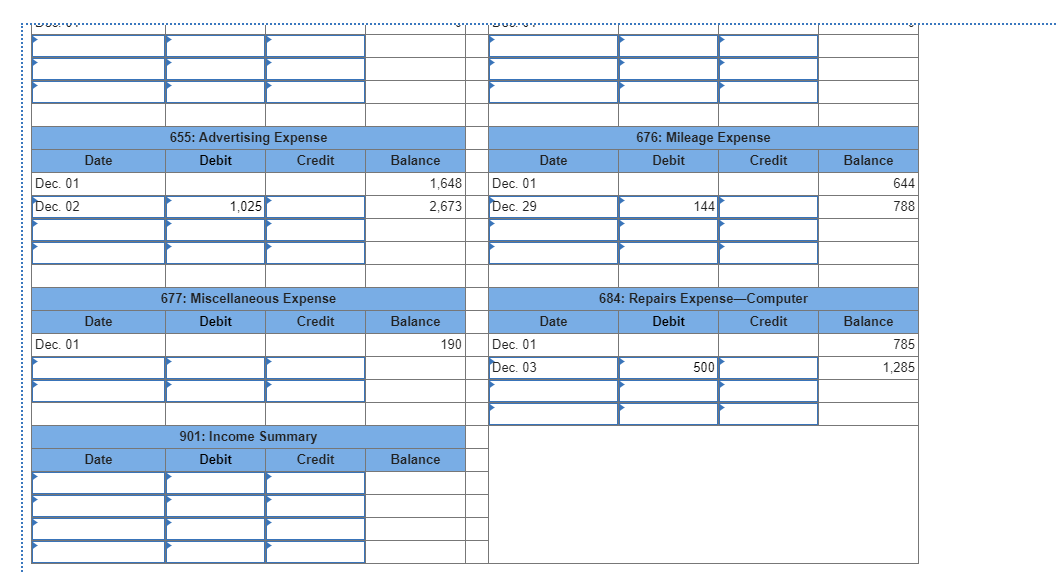

unadjusted trial balance of Business Solutions (reflecting its transactions for October and November of 2019) follows. Credit No. 101 106 126 128 131 Debit $ 38,464 13,518 2,545 2,160 2,960 8,700 164 Accu 20,400 64,000 Account Title Cash Accounts receivable Computer supplies Prepaid insurance Prepaid rent Office equipment Accumulated depreciation-office equipment Computer equipment Accumulated depreciation-Computer equipment Accounts payable Wages payable Unearned computer services revenue Common stock Retained earnings Dividends Computer services revenue Depreciation expense-Office equipment Depreciation expense-Computer equipment Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense-Computer Totals 167 168 201 210 236 307 318 319 403 612 613 623 637 640 652 655 676 677 6,200 36,639 2,425 1,648 644 190 785 $100,639 $100,639 Business Solutions had the following transactions and events in December 2019. Dec. 2 Paid $1,025 cash to Hillside Mall for Business Solutions' share of mall advertising costs. 3 Paid $500 cash for minor repairs to the company's computer. 4 Received $4,050 cash from Alex's Engineering Co. for the receivable from November. 10 Paid cash to Lyn Addie for six days of work at the rate of $125 per day. 14 Notified by Alex's Engineering Co. that Business Solutions' bid of $7,500 on a proposed project has been accepted. Alex's paid a $2,100 cash advance to Business Solutions. 15 Purchased $1,200 of computer supplies on credit from Harris Office Products. 16 Sent a reminder to Gomez Co. to pay the fee for services recorded on November 8. 20 Completed a project for Liu Corporation and received $6,175 cash. 22- Took the week off for the holidays. 26 28 Received $3,700 cash from Gomez Co. on its receivable. 29 Reimbursed s. Rey for business automobile mileage (600 miles at $0.24 per mile). 31 The company paid $1,000 cash in dividends. 164: Accumulated Depreciation Office Equipment Date Debit Credit Balance 167: Computer Equipment Debit Credit Date Dec. 01 Balance 20,400 Dec. 01 0 168: Accumulated Depreciation-Computer Equipment Date Debit Credit Balance Dec. 01 201: Accounts Payable Debit Credit Balance Date Dec. 01 Dec. 15 1,200 1,200 210: Wages Payable Debit Credit Balance Date Dec. 01 236: Unearned Computer Services Revenue Date Debit Credit Balance Dec. 01 Dec. 14 2,100 2,100 307: Common Stock Debit Credit 318: Retained Earnings Debit Credit Balance Date Dec. 01 Balance 64,000 Date Dec. 01 319: Dividends Debit Credit 403: Computer Services Revenue Debit Credit Date Dec. 01 Balance 6,200 7,200 Date Dec. 01 Dec. 20 Balance 36,639 42,814 42,814 1,000 6,175 612: Depreciation Expense-Office Equipment Date Debit Credit Balance Dec. 01 6 13: Depreciation Expense-Computer Equipment Date Debit Credit Balance Dec. 01 623: Wages Expense Debit Credit 637: Insurance Expense Debit Credit Balance Date Dec. 01 Dec. 10 Balance 2,425 Date Dec 01 750 3,175 3,175 3,175 640: Rent Expense Debit Credit 652: Computer Supplies Expense Debit Credit Balance Balance Date Dec. 01 Date Dec. 01 655: Advertising Expense Debit Credit 676: Mileage Expense Debit Credit Date Dec. 01 Dec. 02 Balance 1,648 2,673 Date Dec. 01 Dec. 29 Balance 644 788 1,0251 1 44 677: Miscellaneous Expense Debit Credit 684: Repairs Expense-Computer Debit Credit Date Dec. 01 Balance 190 Date Dec. 01 Dec. 03 Balance 785 500 500 1,285 655: Advertising Expense Debit Credit 676: Mileage Expense Debit Credit Balance Date Dec. 01 Dec. 02 1,648 Date Dec. 01 Dec. 29 Balance 644 788 1,025 2,673 144 677: Miscellaneous Expense Debit 684: Repairs Expense-Computer Debit Credit Date Credit Balance 190 Dec. 01 Date Dec. 01 Dec. 03 Balance 785 1,285 500 901: Income Summary Debit Credit Date Balance