Answered step by step

Verified Expert Solution

Question

1 Approved Answer

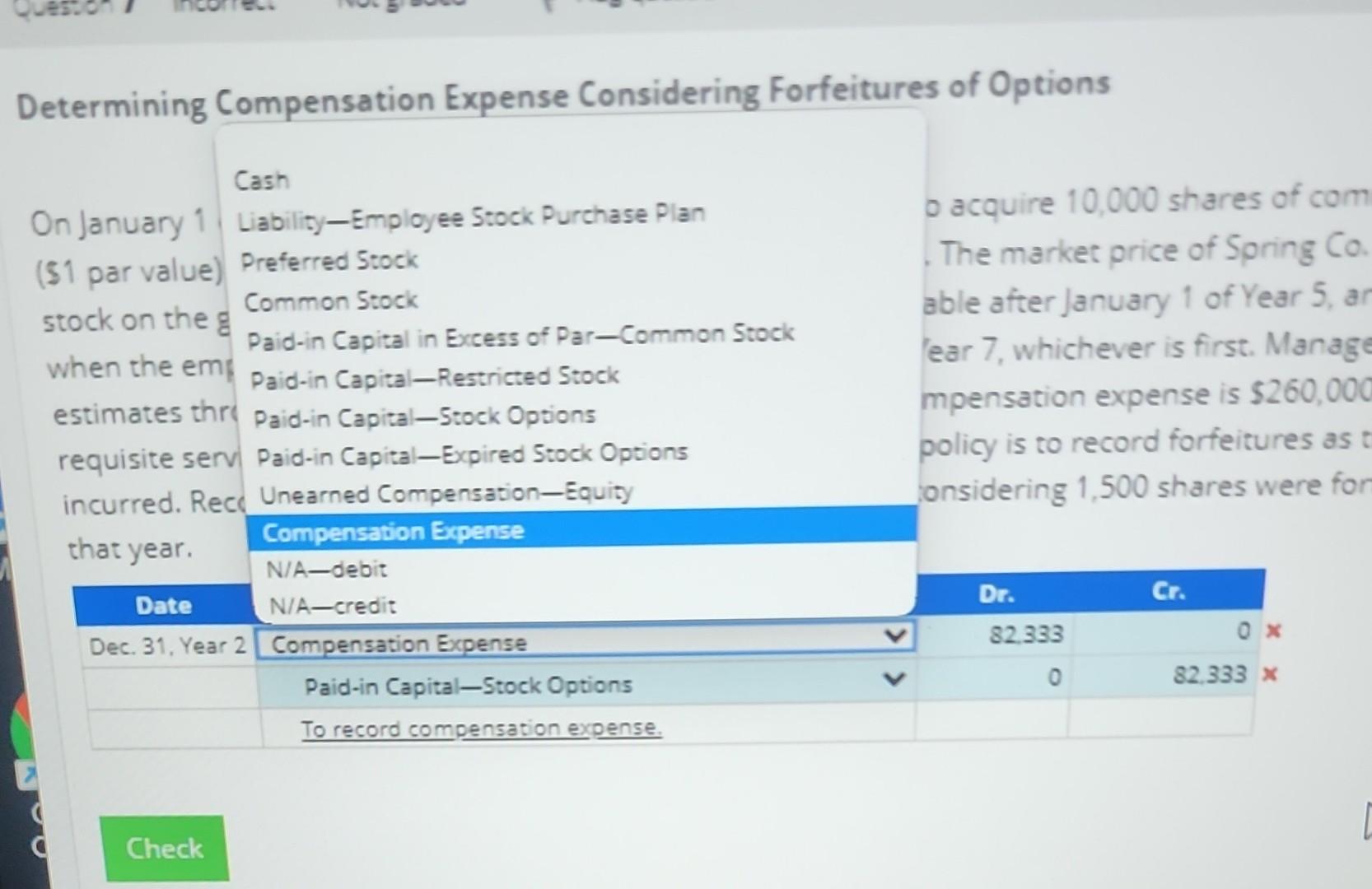

can someone help solve? the below are my option not sure if my amounts are wrong or just the entries Det stl W e! i

can someone help solve? the below are my option not sure if my amounts are wrong or just the entries

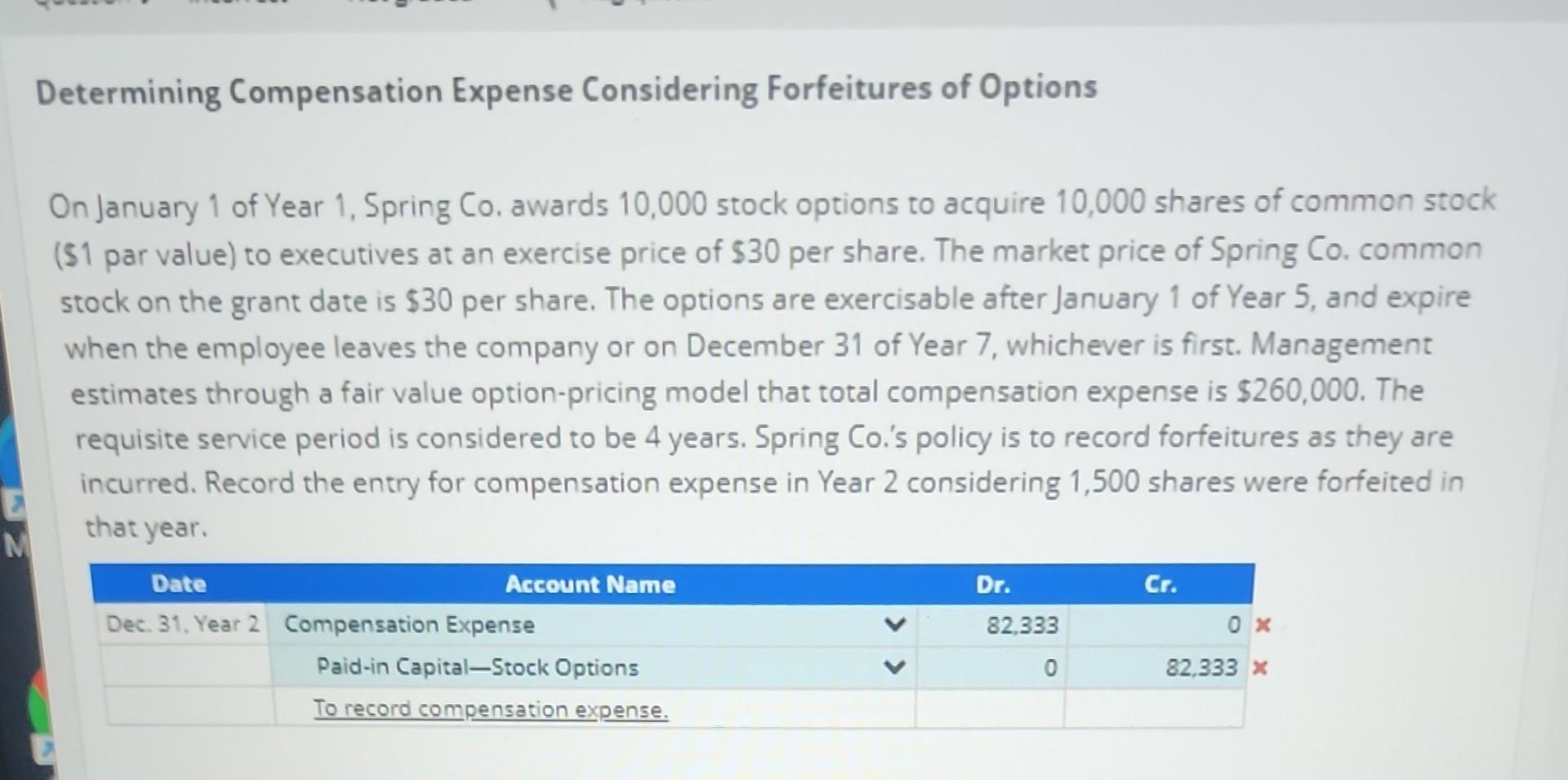

Det stl W e! i Determining Compensation Expense Considering Forfeitures of Options On January 1 of Year 1, Spring Co. awards 10,000 stock options to acquire 10,000 shares of common stock (\$1 par value) to executives at an exercise price of $30 per share. The market price of Spring Co. common stock on the grant date is $30 per share. The options are exercisable after January 1 of Year 5 , and expire when the employee leaves the company or on December 31 of Year 7, whichever is first. Management estimates through a fair value option-pricing model that total compensation expense is $260,000. The requisite service period is considered to be 4 years. Spring Co.'s policy is to record forfeitures as they are incurred. Record the entry for compensation expense in Year 2 considering 1,500 shares were forfeited in that year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started