Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone make reconciliation to operating cash flow? Rona Ltd requires a Statement of Cash Flows to be prepared for the year ended 31 March

can someone make reconciliation to operating cash flow?

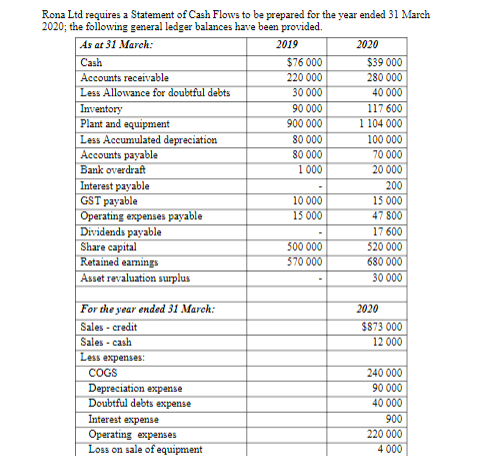

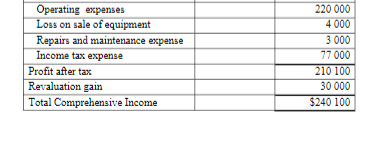

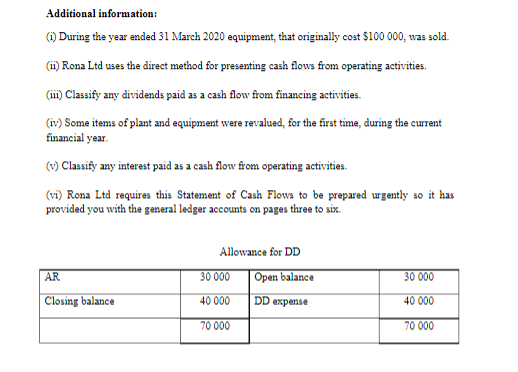

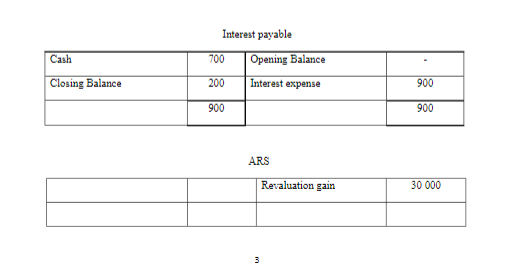

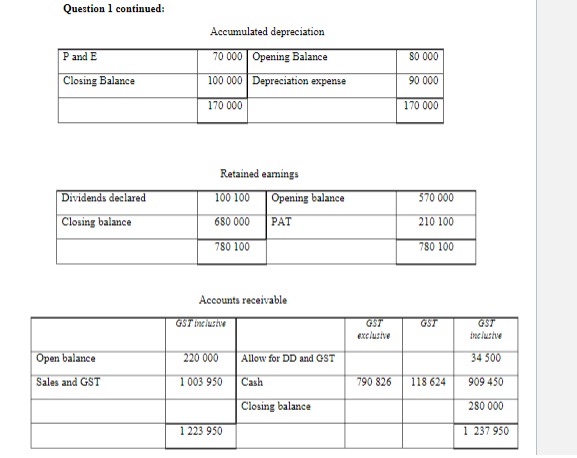

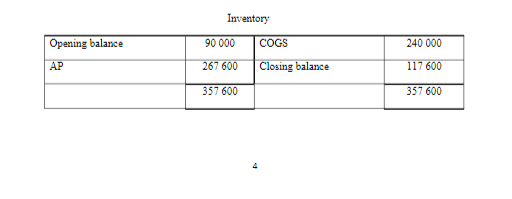

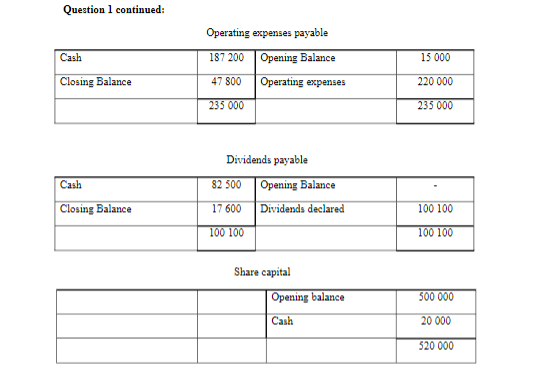

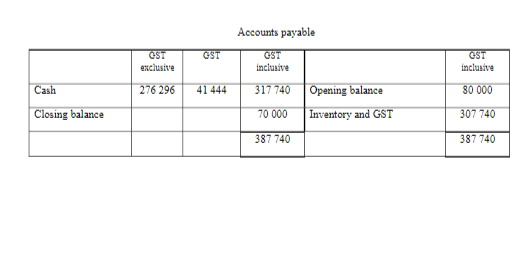

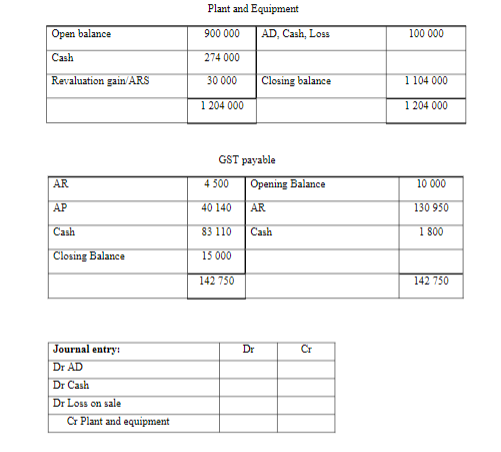

Rona Ltd requires a Statement of Cash Flows to be prepared for the year ended 31 March 2020; the following general ledger balances have been provided. As ar 31 March: 2019 2020 Cash $76 000 $39 000 Accounts receivable 220 000 280 000 Less Allowance for doubtful debts 30 000 40 000 Inventory 90 000 117 600 Plant and equipment 900 000 1 104 000 Less Accumulated depreciation 80 000 100 000 Accounts payable 80 000 70 000 Bank overdraft 1000 20 000 Interest payable 200 GST payable 10 000 15 000 Operating expenses payable 15 000 47 800 Dividends payable 17 600 Share capital 500 000 520 000 Retained eamings 570 000 680 000 Asset revaluation surplus 30 000 2020 $873 000 12 000 For the year ended 31 March: Sales - credit Sales - cash Less expenses: COGS Depreciation expense Doubtful debts expense Interest expense Operating expenses Loss on sale of equipment 240 000 90 000 40 000 900 220 000 4 000 Operating expenses Loss on sale of equipment Repairs and maintenance expense Income tax expense Profit after tax Revaluation gain Total Comprehensive Income 220 000 4 000 3 000 77 000 210 100 30 000 $240 100 Additional information: (1) During the year ended 31 March 2020 equipment that originally cost $100 000, was sold (11) Rona Ltd uses the direct method for presenting cash flows from operating activities. (iii) Classify any dividends paid as a cash flow from financing activities. (iv) Some items of plant and equipment were revalued, for the first time, during the current financial year (v) Classify any interest paid as a cash flow from operating activities (vi) Rona Ltd requires this Statement of Cash Flows to be prepared urgently so it has provided you with the general ledger accounts on pages three to six. AR Allowance for DD 30 000 Open balance 40 000 DD expense 70 000 30 000 40 000 Closing balance 70 000 Interest payable Cash 700 200 Opening Balance Interest expense Closing Balance 900 900 ARS Revaluation gain 30 000 Question 1 continued P and E Accumulated depreciation 70 000 Opening Balance 100 000 Depreciation expense 170 000 Closing Balance 80 000 90 000 170 000 Dividends declared 570 000 Retained eamings 100 100 Opening balance 680 000 PAT 780 100 Closing balance 210 100 780 100 Accounts receivable GST Inclusive cluste 34 500 Open balance Sales and GST 220 000 1 003 950 Allow for DD and GST Cash Closing balance 790 826 118 624 909 450 280 000 1 223 950 1 237 950 Opening balance Inventory 90 000 COGS 267 600 Closing balance 357 600 240 000 117600 AP 357 600 Question 1 continued Operating expenses payable Cash 187 200 47 800 Opening Balance Operating expenses 15 000 220 000 Closing Balance 235 000 235 000 Dividends payable 82 500 17 600 Opening Balance Dividends declared Closing Balance 100 100 100 100 100 100 Share capital Opening balance 500 000 20 000 Cash 520 000 Accounts payable GSTGST exclusive 276 296 41 444 GST inclusive OST inclusive Cash 317 740 80 000 Opening balance Inventory and GST Closing balance 70 000 307 740 387 740 387 740 100 000 Open balance Cash Revaluation gain ARS Plant and Equipment 900 000 AD, Cash, Loss 274 000 30 000 Closing balance 1 104 000 1 204 000 1 204 000 GST payable 4 300 Opening Balance 40 140 AR 83 110 Cash 15 000 142 750 10 000 130 950 1 800 Closing Balance 142 750 Journal entry: Dr AD Dr Cash Dr Loss on sale Cr Plant and equipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started