Can someone please answer based on instructions and proper steps to calculations, please?

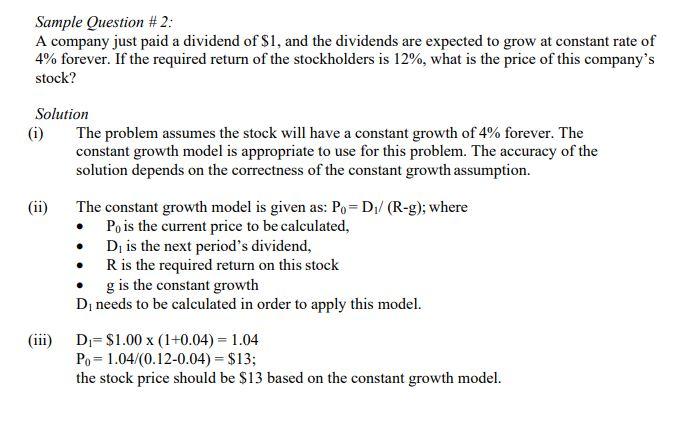

ASSIGNMENT #2 The purpose of this assignment is to solidify your understanding on the applications of the risk and return concepts and their role in valuing financial assets. The scores of this assignment will help in assessing the following learning goal of the course: students successfully completing this course will be able to Analyze risk return characteristics to assess valuation of financial assets". Instructions: You are required to use a financial calculator or spreadsheet (Excel) to solve 10 problems (provided on page 4) related to the risk and return, stocks and bonds valuation. You are required to show the following 3 steps for each problem (sample questions and solutions are provided for guidance): (i) Describe and interpret the assumptions related to the problem. (ii) Apply the appropriate mathematical model to solve the problem. (iii) Calculate the correct solution to the problem. Sample Questions and Solutions Sample Question #1: A company has an issue of 12-year bonds that pay 5% interest, annually. Further assume that today's required rate of return on these bonds is 7%. How much would these bonds sell for today? Round off to the nearest $1. Solution (1) The problem assumes that the face value of the bond is $1000. The bond will pay an annual coupon of 5% i.e., coupon or interest amount of $50 is assumed to paid every year. It also assumes that investors currently required a return of 7% on investments with similar risk characteristics. The use of bond valuation concept is appropriate to calculate the true value of these bonds. The accuracy of the solution depends on the correctness of the assumptions on face value, coupon payments and required rate of return assumption. The use of bond valuation concept which suggests that the true value of a bond is the present value of its future coupon and face value discounted at investors required rate of return is appropriate to calculate the true value of these bonds. We are required to compute the present value (PV) which represents the true value of the bond. (iii) FV= $1000; PMT=$50; Rate = 7%; N=12 years; Compute PV = ? = $841.15 Value of the Bond = $841.15 Sample Question #2: A company just paid a dividend of $1, and the dividends are expected to grow at constant rate of 4% forever. If the required return of the stockholders is 12%, what is the price of this company's stock? Solution (1) The problem assumes the stock will have a constant growth of 4% forever. The constant growth model is appropriate to use for this problem. The accuracy of the solution depends on the correctness of the constant growth assumption. (ii) The constant growth model is given as: Po=D1/ (R-g); where . Po is the current price to be calculated, Di is the next period's dividend, R is the required return on this stock g is the constant growth Di needs to be calculated in order to apply this model. (iii) D=$1.00 X (1+0.04) = 1.04 Po= 1.04/(0.12-0.04) = $13; the stock price should be $13 based on the constant growth model