can someone please answer my question. thank you so much!!!!!

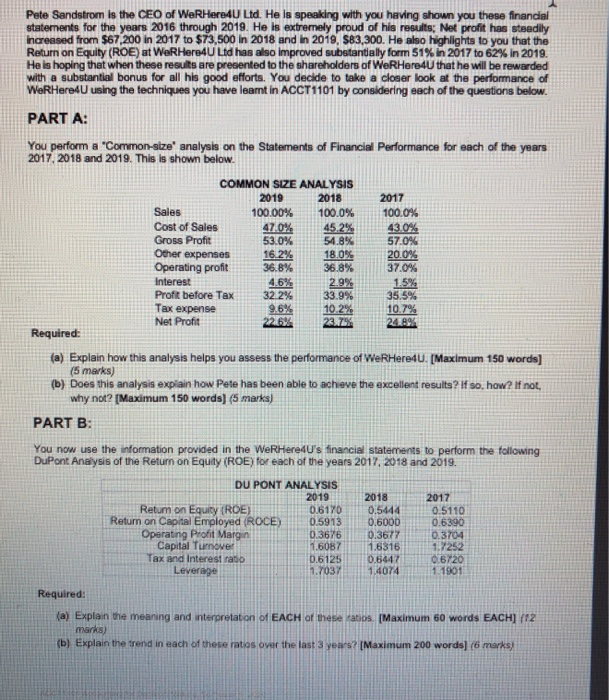

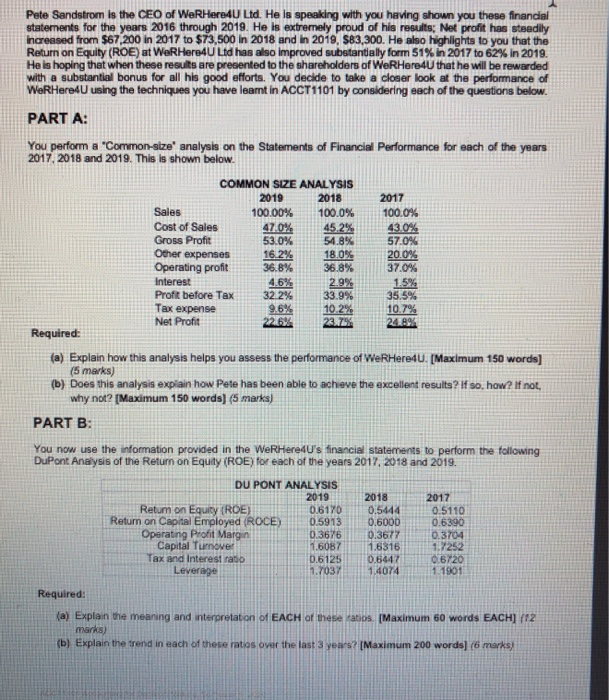

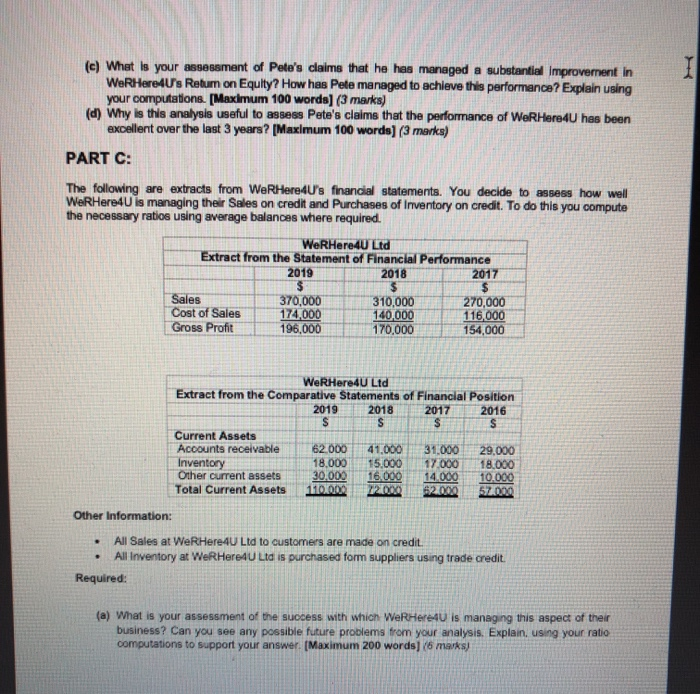

Pete Sandstrom is the CEO of WerHered Ltd. He is speaking with you having shown you these financial statements for the years 2016 through 2019. He is extremely proud of his results: Net profit has steadily increased from $67,200 in 2017 to $73,500 in 2018 and in 2019, 583,300. He also highlights to you that the Return on Equity (ROE) at WeHere4U Ltd has also improved substantially form 51% in 2017 to 62% in 2019. He is hoping that when these results are presented to the shareholders of WeRHere4U that he will be rewarded with a substantial bonus for all his good efforts. You decide to take a closer look at the performance of WerHered using the techniques you have learnt in ACCT1101 by considering each of the questions below. PART A: You perform a "Common-size' analysis on the Statements of Financial Performance for each of the years 2017 2018 and 2019. This is shown below. COMMON SIZE ANALYSIS 2019 2018 2017 Sales 100.00% 100.0% 100.0% Cost of Sales 47.0% 45.2% 43.0% Gross Profit 53.0% 54.8% 57.0% Other expenses 16.29 18.0% 20.0% Operating profit 36.8% 36.8% 37.0% Interest 4.6% 2.9% 1.5% Profit before Tax 32.2% 33.9% 35.5% Tax expense 9.6% 10.2% 10.7% Net Profit 22.62 23.7% 2014 Required: (a) Explain how this analysis helps you assess the performance of WerHeredu. [Maximum 150 words] (5 marks) (b) Does this analysis explain how Pete has been able to achieve the excellent results? If so, how? If not, why not? [Maximum 150 words) (5 marks) PART B: You now use the information provided in the WeHeredU's financial statements to perform the following DuPont Analysis of the Return on Equity (ROE) for each of the years 2017, 2018 and 2019. DU PONT ANALYSIS 2019 2018 2017 Retum on Equity (ROE) 0.6170 0.5444 0.5110 Return on Capital Employed (ROCE) 0.5913 0.6000 0.6390 Operating profit Margin 0.3676 0.3677 0.3704 Capital Turnover 1.6087 1.6316 1.7252 Tax and Interest ratio 0.6125 0.6447 0.6720 Leverage 1.7037 1.4074 11901 Required: (a) Explain the meaning and interpretaton of EACH of these patios, [Maximum 60 words EACH) (12 marks) (b) Explain the trend in each of these ratios over the last 3 years? [Maximum 200 words) (6 marks) I (c) What is your assessment of Pete's claims that he has managed a substantial Improvement in WeRHero4U's Retum on Equity? How has Pete managed to achieve this performance? Explain using your computations. [Maximum 100 words) (3 marks) (d) Why is this analysis useful to assess Pete's claims that the performance of WeRHere4U has been excellent over the last 3 years? [Maximum 100 words) (3 marks) PART C: The following are extracts from WerHere4U's financial statements. You decide to assess how well WeRHere4U is managing their Sales on credit and Purchases of Inventory on credit. To do this you compute the necessary ratios using average balances where required. WeRHere4U Ltd Extract from the Statement of Financial Performance 2019 2018 2017 $ Sales 370,000 310,000 270,000 Cost of Sales 174,000 140,000 116.000 Gross Profit 196,000 170,000 154,000 WeRHere4U Ltd Extract from the Comparative Statements of Financial Position 2019 2018 2017 2016 $ S S S Current Assets Accounts receivable 62.000 41.000 31.000 29,000 Inventory 18.000 15.000 17.000 18,000 Other current assets 30.000 16.000 14.000 10.000 Total Current Assets 1110 001 2009 62000 57.000 . Other Information: All Sales at WeRHere4U Ltd to customers are made on credit. All Inventory at We Here4U Ltd is purchased form suppliers using trade credit. Required: (a) What is your assessment of the success with which WerHere is managing this aspect of their business? Can you see any possible future problems from your analysis. Explain, using your ratio computations to support your answer. [Maximum 200 words] (6 marks)