Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please answer this question using the following format. Thank u QUESTION 2 30 marks At 30 June 2018, Hawaii Limited had the following

Can someone please answer this question using the following format. Thank u

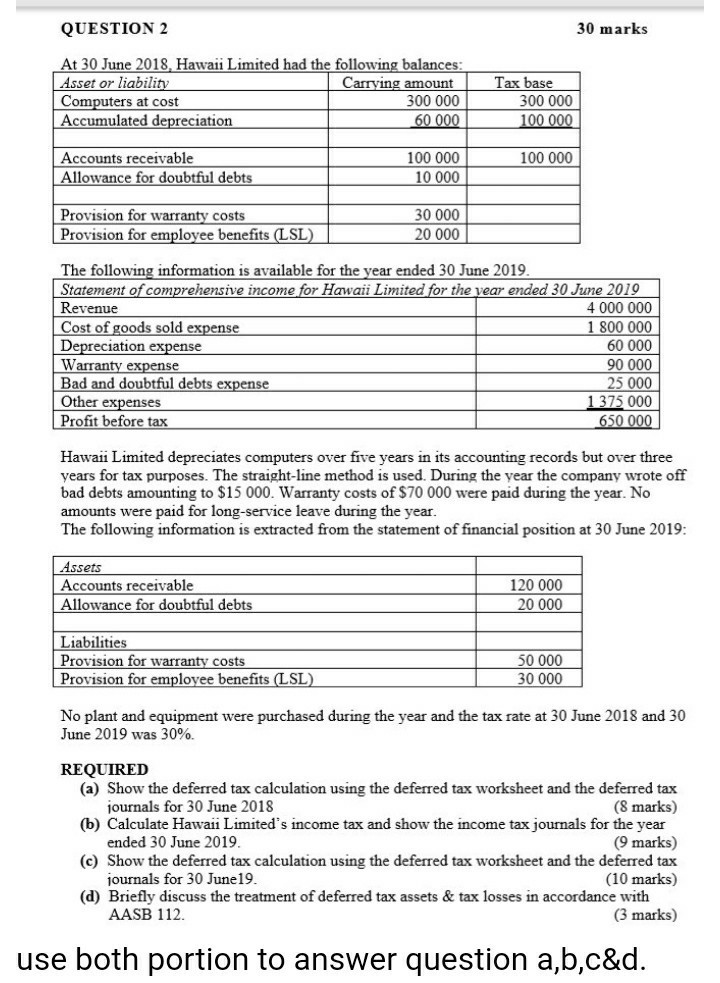

QUESTION 2 30 marks At 30 June 2018, Hawaii Limited had the following balances: Asset or liability Carrying amount Computers at cost 300 000 Accumulated depreciation 60 000 Tax base 300 000 100 000 100 000 Accounts receivable Allowance for doubtful debts 100 000 10 000 Provision for warranty costs Provision for employee benefits (LSL) 30 000 20 000 The following information is available for the year ended 30 June 2019. Statement of comprehensive income for Hawaii Limited for the vear ended 30 June 2019 Revenue 4 000 000 Cost of goods sold expense 1 800 000 Depreciation expense 60 000 Warranty expense 90 000 Bad and doubtful debts expense 25 000 Other expenses 1 375 000 Profit before tax 650 000 Hawaii Limited depreciates computers over five years in its accounting records but over three years for tax purposes. The straight-line method is used. During the year the company wrote off bad debts amounting to $15 000. Warranty costs of $70 000 were paid during the year. No amounts were paid for long-service leave during the year. The following information is extracted from the statement of financial position at 30 June 2019: Assets Accounts receivable Allowance for doubtful debts 120 000 20 000 Liabilities Provision for warranty costs | Provision for employee benefits (LSL) 50 000 30 000 No plant and equipment were purchased during the year and the tax rate at 30 June 2018 and 30 June 2019 was 30%. REQUIRED (a) Show the deferred tax calculation using the deferred tax worksheet and the deferred tax journals for 30 June 2018 (8 marks) (b) Calculate Hawaii Limited's income tax and show the income tax journals for the year ended 30 June 2019. (9 marks) (c) Show the deferred tax calculation using the deferred tax worksheet and the deferred tax journals for 30 June 19. (10 marks) (d) Briefly discuss the treatment of deferred tax assets & tax losses in accordance with AASB 112 (3 marks) use both portion to answer question a,b,c&d. Suggested Assignment Format T8 2019 Q1 General Journal 2019 Jul 15 Aug 31 Sep 10 Oct 31 2020 Jan 31 Feb 5 Feb 5 Feb 18 Feb 26 Apr 15 QUESTION 2 30 marks At 30 June 2018, Hawaii Limited had the following balances: Asset or liability Carrying amount Computers at cost 300 000 Accumulated depreciation 60 000 Tax base 300 000 100 000 100 000 Accounts receivable Allowance for doubtful debts 100 000 10 000 Provision for warranty costs Provision for employee benefits (LSL) 30 000 20 000 The following information is available for the year ended 30 June 2019. Statement of comprehensive income for Hawaii Limited for the vear ended 30 June 2019 Revenue 4 000 000 Cost of goods sold expense 1 800 000 Depreciation expense 60 000 Warranty expense 90 000 Bad and doubtful debts expense 25 000 Other expenses 1 375 000 Profit before tax 650 000 Hawaii Limited depreciates computers over five years in its accounting records but over three years for tax purposes. The straight-line method is used. During the year the company wrote off bad debts amounting to $15 000. Warranty costs of $70 000 were paid during the year. No amounts were paid for long-service leave during the year. The following information is extracted from the statement of financial position at 30 June 2019: Assets Accounts receivable Allowance for doubtful debts 120 000 20 000 Liabilities Provision for warranty costs | Provision for employee benefits (LSL) 50 000 30 000 No plant and equipment were purchased during the year and the tax rate at 30 June 2018 and 30 June 2019 was 30%. REQUIRED (a) Show the deferred tax calculation using the deferred tax worksheet and the deferred tax journals for 30 June 2018 (8 marks) (b) Calculate Hawaii Limited's income tax and show the income tax journals for the year ended 30 June 2019. (9 marks) (c) Show the deferred tax calculation using the deferred tax worksheet and the deferred tax journals for 30 June 19. (10 marks) (d) Briefly discuss the treatment of deferred tax assets & tax losses in accordance with AASB 112 (3 marks) use both portion to answer question a,b,c&d. Suggested Assignment Format T8 2019 Q1 General Journal 2019 Jul 15 Aug 31 Sep 10 Oct 31 2020 Jan 31 Feb 5 Feb 5 Feb 18 Feb 26 Apr 15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started