Can someone please check my journal enteries and my t accounts. Why do my assets not equal my liabilties +equity??

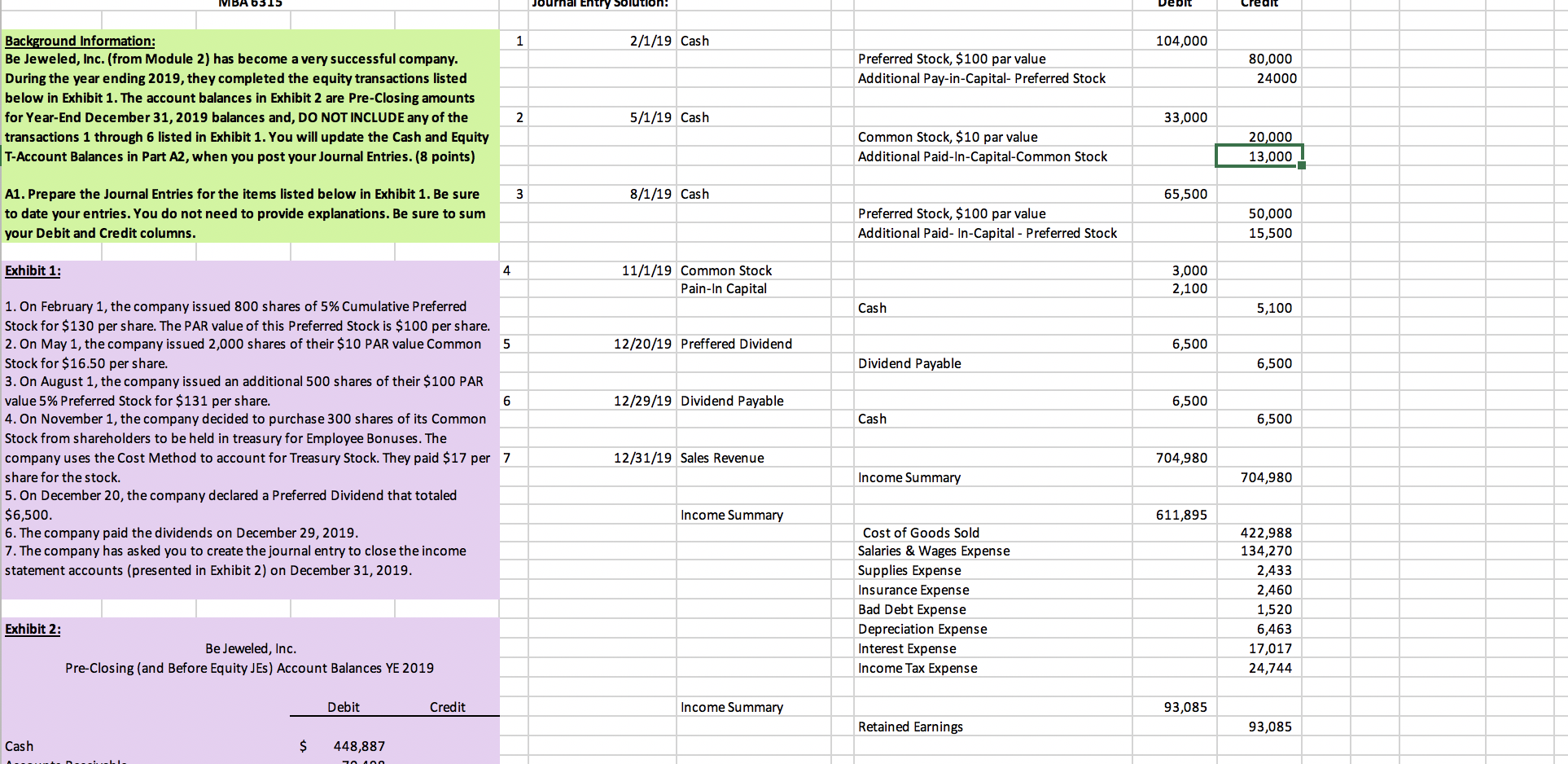

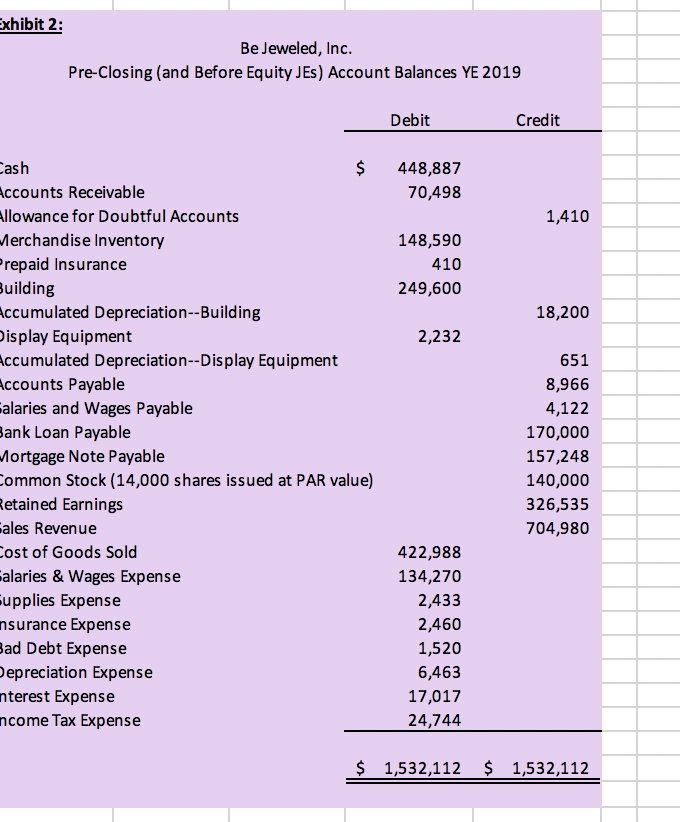

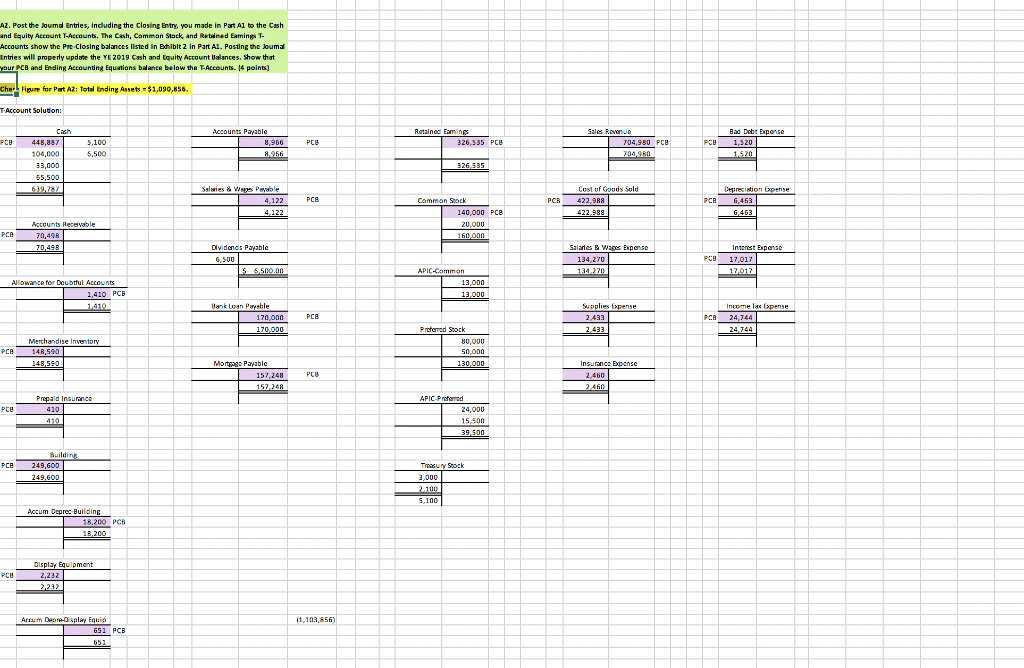

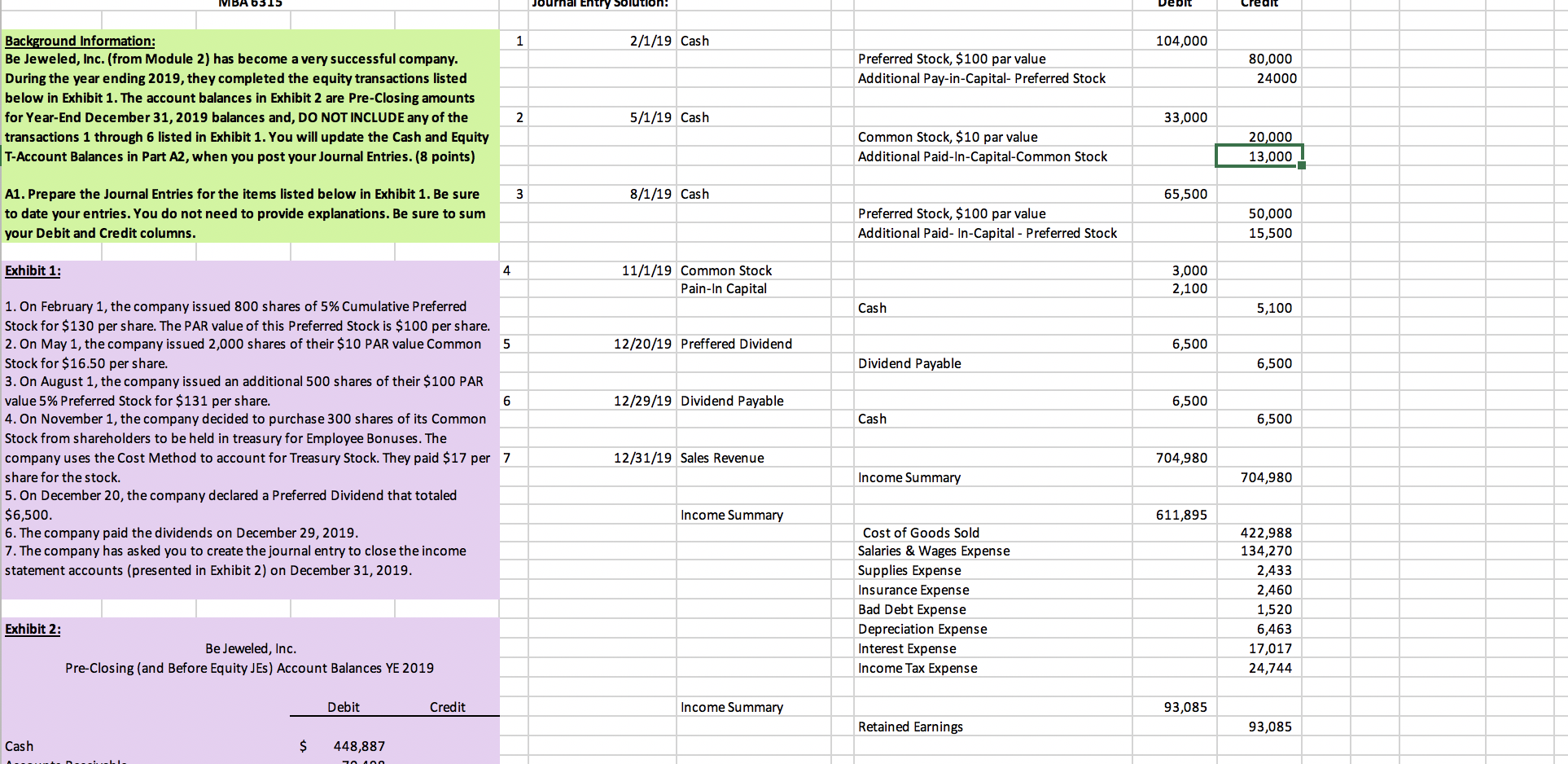

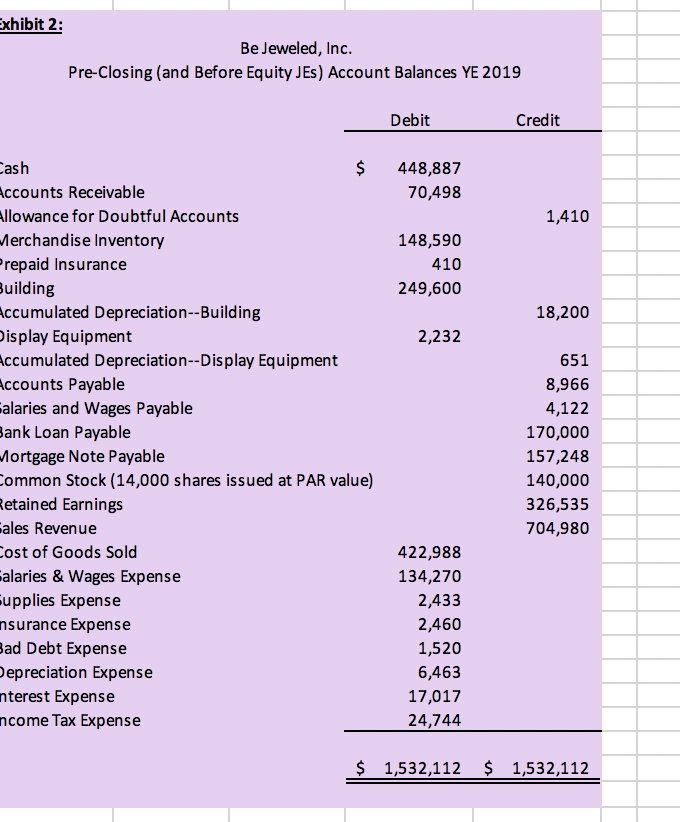

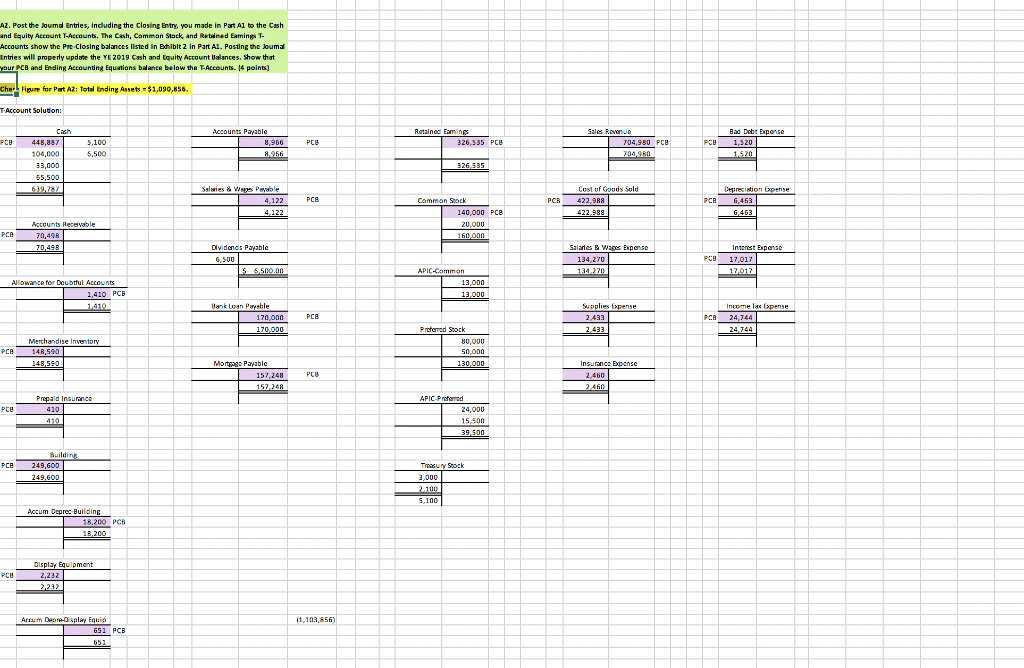

IIIBA315 Journal Entry Solution! Deblt Crealt 2/1/19 Cash 104,000 Preferred Stock, $100 par value Additional Pay-in-Capital- Preferred Stock 80,000 24000 Background Information: Be Jeweled, Inc. (from Module 2) has become a very successful company. During the year ending 2019, they completed the equity transactions listed below in Exhibit 1. The account balances in Exhibit 2 are Pre-Closing amounts for Year-End December 31, 2019 balances and, DO NOT INCLUDE any of the transactions 1 through 6 listed in Exhibit 1. You will update the Cash and Equity T-Account Balances in Part A2, when you post your Journal Entries. (8 points) 5/1/19 Cash 33,000 Common Stock, $10 par value Additional Paid-In-Capital-Common Stock 20,000 13,000 8/1/19 Cash 65,500 A1. Prepare the Journal Entries for the items listed below in Exhibit 1. Be sure to date your entries. You do not need to provide explanations. Be sure to sum your Debit and Credit columns. Preferred Stock, $100 par value Additional Paid-In-Capital - Preferred Stock 50,000 15,500 Exhibit 1: 11/1/19 Common Stock Pain-In Capital 3,000 2,100 Cash 5,100 12/20/19 Preffered Dividend 6,500 Dividend Payable 6,500 12/29/19 Dividend Payable 6,500 Cash 6,500 1. On February 1, the company issued 800 shares of 5% Cumulative Preferred Stock for $130 per share. The PAR value of this preferred Stock is $100 per share. 2. On May 1, the company issued 2,000 shares of their $10 PAR value Common Stock for $16.50 per share. 3. On August 1, the company issued an additional 500 shares of their $100 PAR value 5% Preferred Stock for $131 per share. 4. On November 1, the company decided to purchase 300 shares of its Common Stock from shareholders to be held in treasury for Employee Bonuses. The company uses the Cost Method to account for Treasury Stock. They paid $17 per 7 share for the stock. 5. On December 20, the company declared a Preferred Dividend that totaled $6,500. 6. The company paid the dividends on December 29, 2019. 7. The company has asked you to create the journal entry to close the income statement accounts (presented in Exhibit 2) on December 31, 2019. 12/31/19 Sales Revenue 704,980 Income Summary 704,980 Income Summary 611.895 Cost of Goods Sold Salaries & Wages Expense Supplies Expense Insurance Expense Bad Debt Expense Depreciation Expense Interest Expense Income Tax Expense 422,988 134,270 2,433 2,460 1,520 6,463 17,017 24,744 Exhibit 2: Be Jeweled, Inc. Pre-Closing (and Before Equity JEs) Account Balances YE 2019 Debit Credit Income Summary 93,085 Retained Earnings 93,085 Cash $ 448,887 Exhibit 2: Be Jeweled, Inc. Pre-Closing (and Before Equity JES) Account Balances YE 2019 Debit Credit 448,887 70,498 1,410 148,590 410 249,600 18,200 2,232 Cash $ Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Prepaid Insurance Building Accumulated Depreciation--Building Display Equipment Accumulated Depreciation--Display Equipment Accounts Payable Salaries and Wages Payable Bank Loan Payable Mortgage Note Payable Common Stock (14,000 shares issued at PAR value) Retained Earnings Sales Revenue Cost of Goods Sold Salaries & Wages Expense Supplies Expense nsurance Expense Bad Debt Expense Depreciation Expense nterest Expense ncome Tax Expense 651 8,966 4,122 170,000 157,248 140,000 326,535 704,980 422,988 134,270 2,433 2,460 1,520 6,463 17,017 24,744 $ 1,532,112 $ 1,532,112 A2. Post the loumal Entries, including the Closing Entry, you made in Part Al to the Cash and Equity Account T-Accounts. The Cash, Camman Stock, and Retained Earnings T- Accounts show the Pre Closing balances listed in Ethibit 2 in Part Al. Pasting the Joumal Entries will properly update the YE 2019 Cash and Equity Account Valances. Show that your PCB and Ending Accounting Equations balance below the T-Accounts. 4 points) Cher Figure for Put A Total Ending Assets = $1,090,856. T-Account Solution: Bad Debt Expense Retaines Caming 326,535 PCB 5,100 9,966 PCB 704,980 PCB 448,887 104,000 33.000 326 535 639,287 Salies & Wa Pwle pense 4,122 Cost of Goods Sold 422,988 422.988 PCB Deinesition 6,453 6.453 4122 Accounts Receivable 70,4981 70.498 140,000 PCB 20,000 160,000 Dividends Payable 6.500 $ 6,500.00 Salades Wapes Expense 134.270 134 270 PCU 17,017 17.017 APICCamman Allowance for Doubtful Accounts 1,410 PCB 13,000 13,000 Bank Loan Purable 170,000 170,000 PCB Supplies Expense 2.433 PCB 24.744 Prstered Sock Merchandise Inventory 140.590 PCB 0.000 50,000 130,000 Mortgage Payable 157.248 PCB Insurance Expense 2.460 Prepaid Insurance 410 24,000 15.500 PCB Building 249,600 249,600 Treasury Stock 31.000 2.100 5,100 Accum Deprec-Building 18,200 PCB PCU 2,232