Can someone please double-check my answers and help me out with cost- plus percentage? (I put a ? where I am stuck). Thanks!

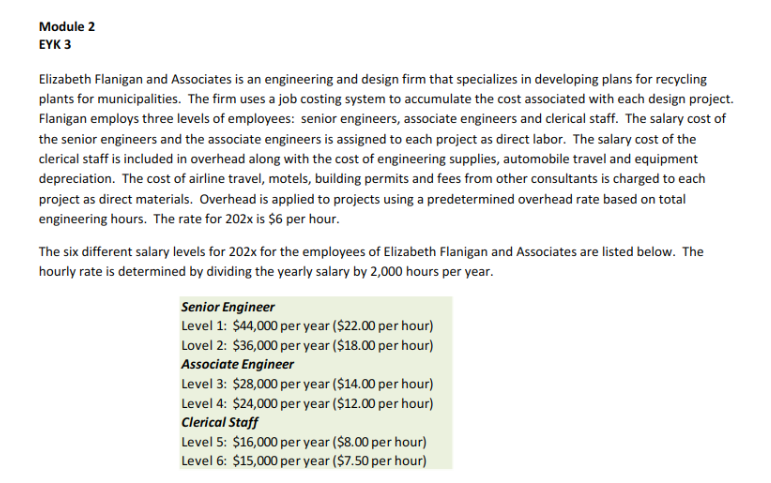

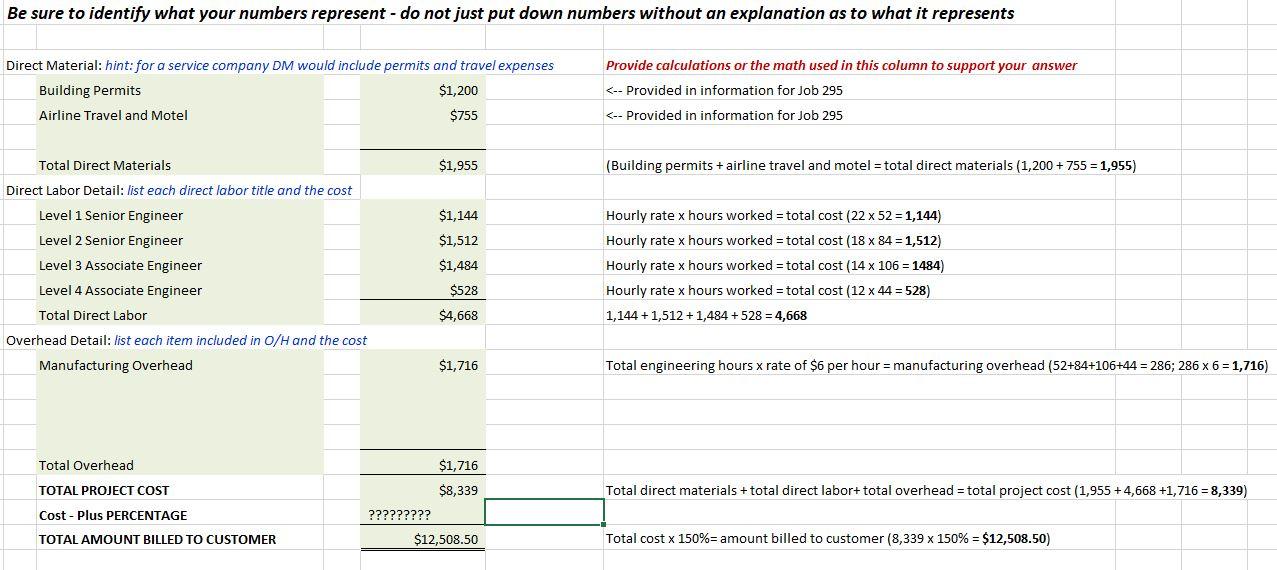

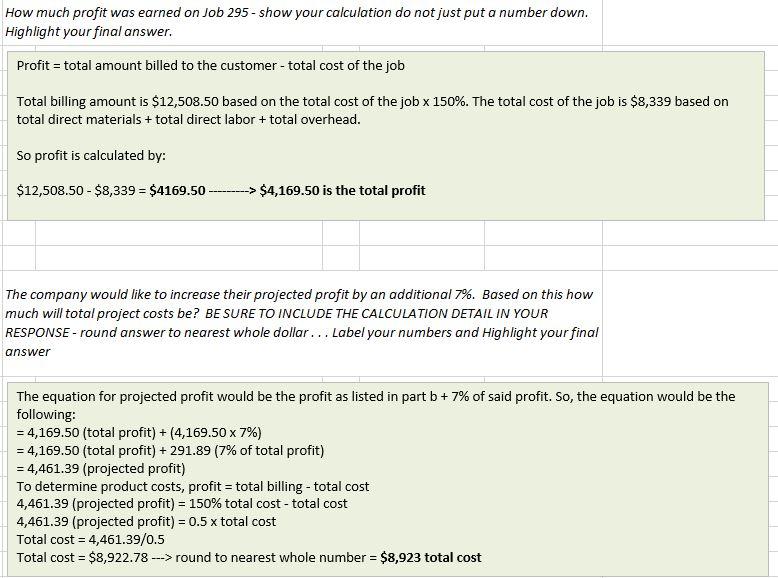

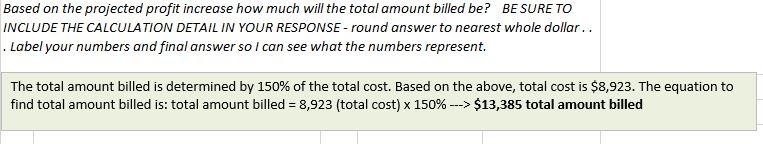

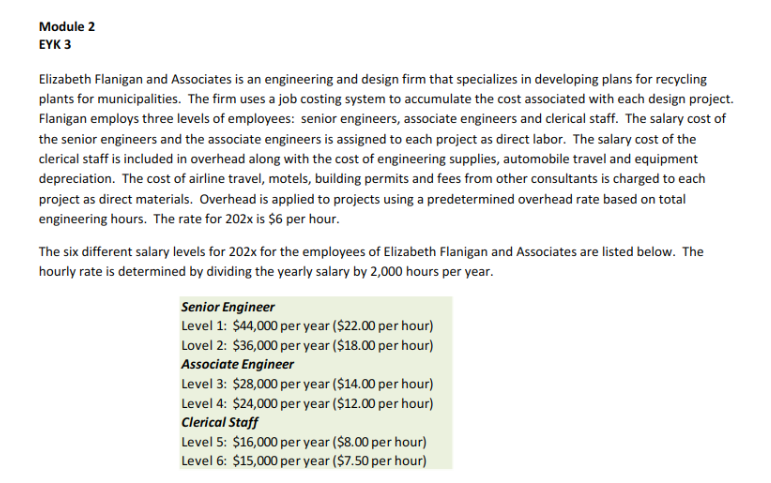

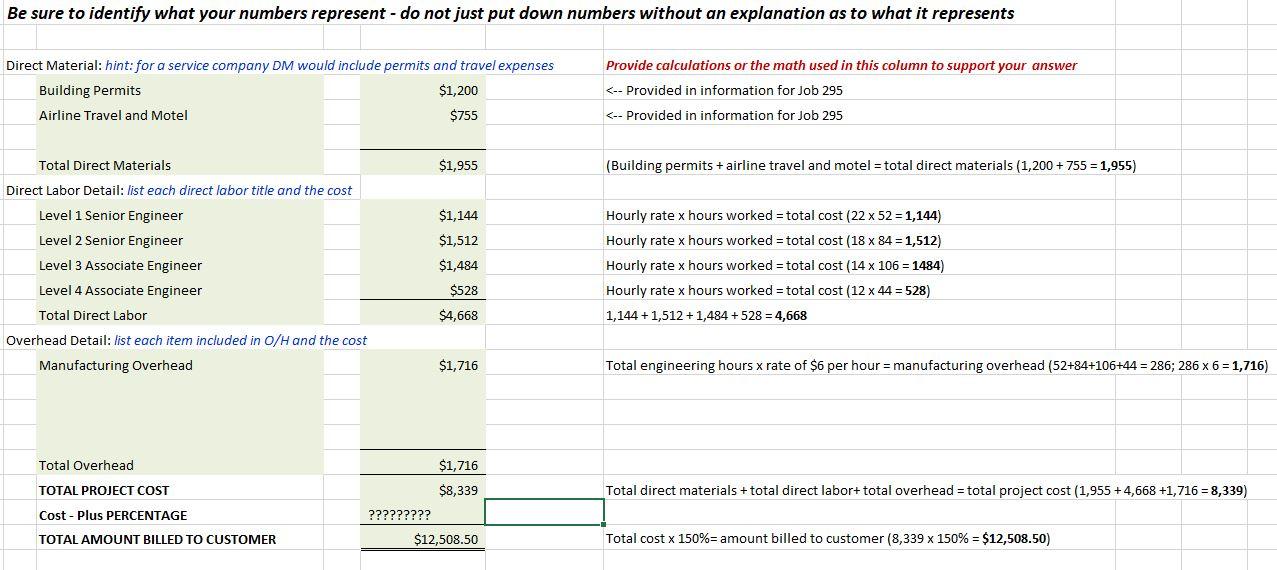

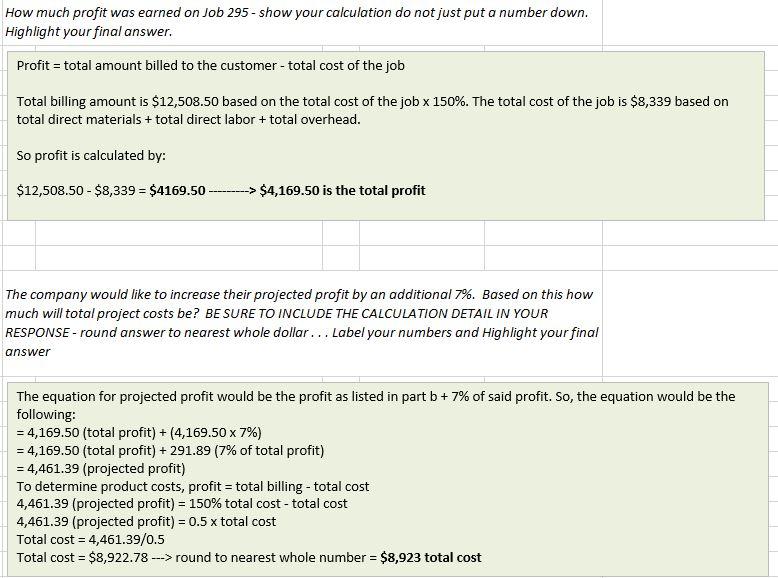

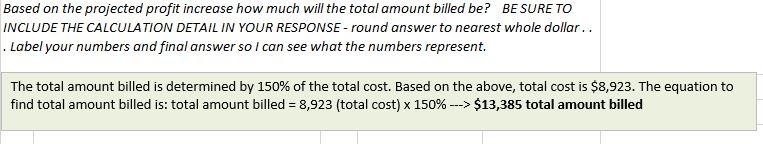

Module 2 EYK 3 Elizabeth Flanigan and Associates is an engineering and design firm that specializes in developing plans for recycling plants for municipalities. The firm uses a job costing system to accumulate the cost associated with each design project. Flanigan employs three levels of employees: senior engineers, associate engineers and clerical staff. The salary cost of the senior engineers and the associate engineers is assigned to each project as direct labor. The salary cost of the clerical staff is included in overhead along with the cost of engineering supplies, automobile travel and equipment depreciation. The cost of airline travel, motels, building permits and fees from other consultants is charged to each project as direct materials. Overhead is applied to projects using a predetermined overhead rate based on total engineering hours. The rate for 202x is $6 per hour. The six different salary levels for 202x for the employees of Elizabeth Flanigan and Associates are listed below. The hourly rate is determined by dividing the yearly salary by 2,000 hours per year. Senior Engineer Level 1: $44,000 per year ($22.00 per hour) Lovel 2: $36,000 per year ($18.00 per hour) Associate Engineer Level 3: $28,000 per year ($14.00 per hour) Level 4: $24,000 per year ($12.00 per hour) Clerical Staff Level 5: $16,000 per year ($8.00 per hour) Level 6: $15,000 per year ($7.50 per hour) Be sure to identify what your numbers represent - do not just put down numbers without an explanation as to what it represents Direct Material: hint: for a service company DM would include permits and travel expenses Provide calculations or the math used in this column to support your answer $4,169.50 is the total profit The company would like to increase their projected profit by an additional 7%. Based on this how much will total project costs be? BE SURE TO INCLUDE THE CALCULATION DETAIL IN YOUR RESPONSE - round answer to nearest whole dollar... Label your numbers and Highlight your final answer The equation for projected profit would be the profit as listed in part b + 7% of said profit. So, the equation would be the following: = 4,169.50 (total profit) + (4,169.50 x 7%) = 4,169.50 (total profit) + 291.89 (7% of total profit) = 4,461.39 (projected profit) To determine product costs, profit = total billing - total cost 4,461.39 (projected profit) = 150% total cost - total cost 4,461.39 (projected profit) = 0.5 x total cost Total cost = 4,461.39/0.5 Total cost = $8,922.78 ---> round to nearest whole number = $8,923 total cost Based on the projected profit increase how much will the total amount billed be? BE SURE TO INCLUDE THE CALCULATION DETAIL IN YOUR RESPONSE - round answer to nearest whole dollar.. . Label your numbers and final answer so I can see what the numbers represent. The total amount billed is determined by 150% of the total cost. Based on the above, total cost is $8,923. The equation to find total amount billed is: total amount billed= 8,923 (total cost) x 150% ---> $13,385 total amount billed