Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please explain how to do a, b and c please? Question 1 On April 2013, Telephone Company purchased land for $700,000 and on

Can someone please explain how to do a, b and c please?

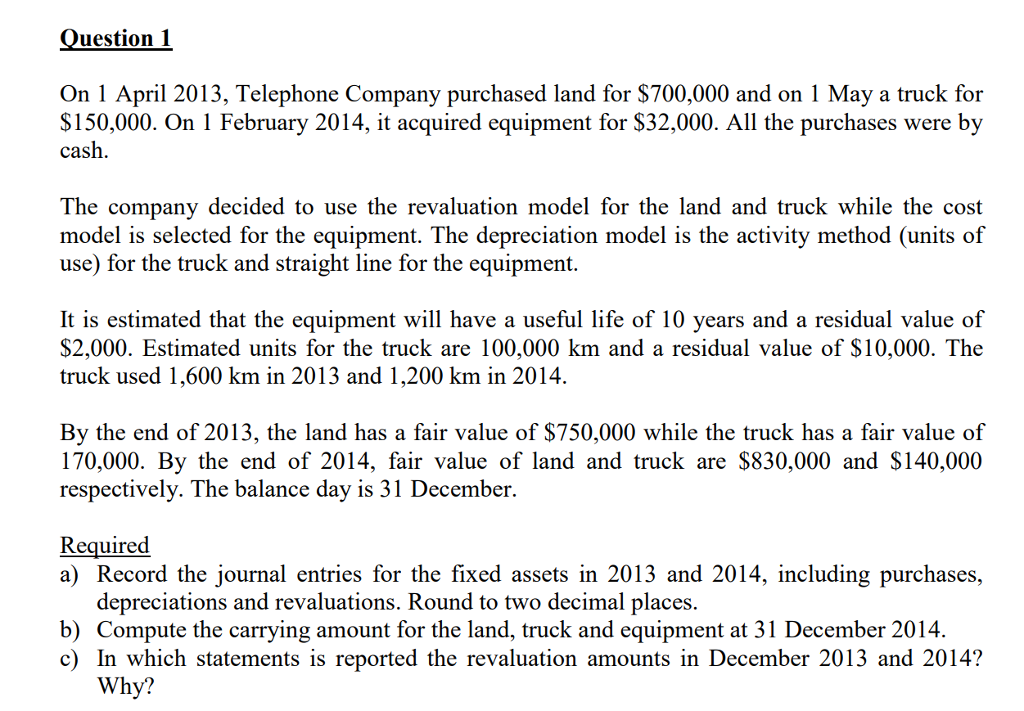

Question 1 On April 2013, Telephone Company purchased land for $700,000 and on 1 May a truck for $150,000. On 1 February 2014, it acquired equipment for $32,000. All the purchases were by cash The company decided to use the revaluation model for the land and truck while the cost model is selected for the equipment. The depreciation model is the activity method (units of use) for the truck and straight line for the equipment. It is estimated that the equipment will have a useful life of 10 years and a residual value of S2,000. Estimated units for the truck are 100,000 km and a residual value of $10,000. The truck used 1,600 km in 2013 and 1,200 km in 2014. By the end of 2013, the land has a fair value of $750,000 while the truck has a fair value of 170,000. By the end of 2014, fair value of land and truck are $830,000 and S140,000 respectively. The balance day is 31 December. Required a) Record the journal entries for the fixed assets in 2013 and 2014, including purchases, depreciations and revaluations. Round to two decimal places. b) Compute the carrying amount for the land, truck and equipment at 31 December 2014. c) In which statements is reported the revaluation amounts in December 2013 and 2014? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started