Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone please explain how to get question B) C) D) ? the answers for b) is borrow 101,05 c) 44,44 d) 34,54 I have

can someone please explain how to get question B) C) D) ?

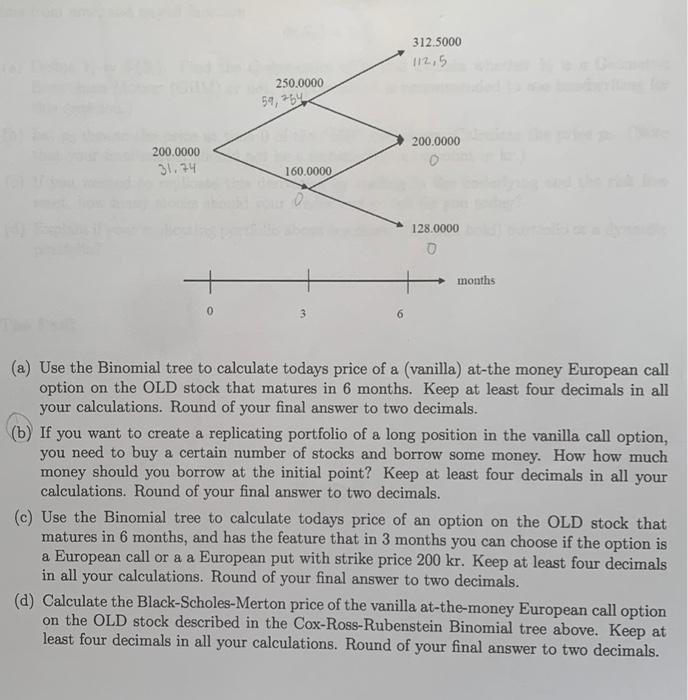

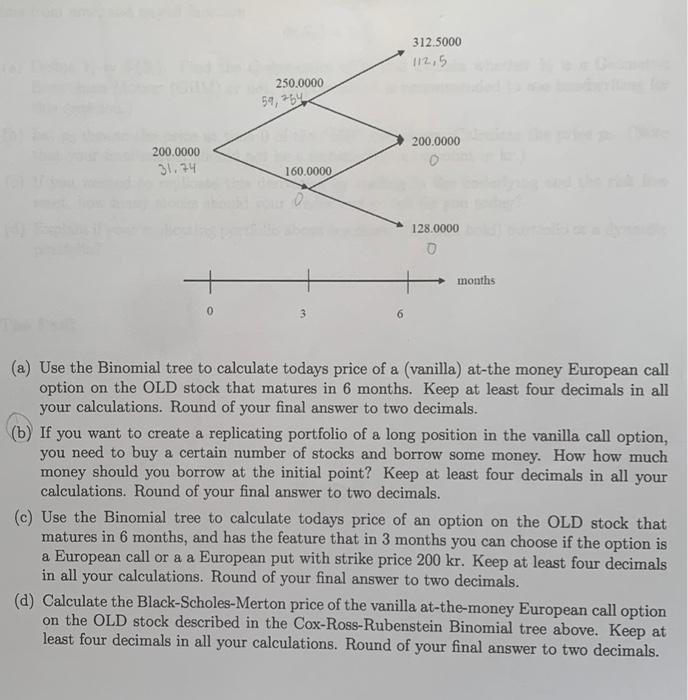

312.5000 112,5 250.0000 59,264 200.0000 31.74 200.0000 0 160.0000 o 128.0000 o months (a) Use the Binomial tree to calculate todays price of a (vanilla) at-the money European call option on the OLD stock that matures in 6 months. Keep at least four decimals in all your calculations. Round of your final answer to two decimals. If you want to create a replicating portfolio of a long position in the vanilla call option, you need to buy a certain number of stocks and borrow some money. How how much money should you borrow at the initial point? Keep at least four decimals in all your calculations. Round of your final answer to two decimals. (c) Use the Binomial tree to calculate todays price of an option on the OLD stock that matures in 6 months, and has the feature that in 3 months you can choose if the option is a European call or a a European put with strike price 200 kr. Keep at least four decimals in all your calculations. Round of your final answer to two decimals. (d) Calculate the Black-Scholes Merton price of the vanilla at-the-money European call option on the OLD stock described in the Cox-Ross-Rubenstein Binomial tree above. Keep at least four decimals in all your calculations. Round of your final answer to two decimals. 312.5000 112,5 250.0000 59,264 200.0000 31.74 200.0000 0 160.0000 o 128.0000 o months (a) Use the Binomial tree to calculate todays price of a (vanilla) at-the money European call option on the OLD stock that matures in 6 months. Keep at least four decimals in all your calculations. Round of your final answer to two decimals. If you want to create a replicating portfolio of a long position in the vanilla call option, you need to buy a certain number of stocks and borrow some money. How how much money should you borrow at the initial point? Keep at least four decimals in all your calculations. Round of your final answer to two decimals. (c) Use the Binomial tree to calculate todays price of an option on the OLD stock that matures in 6 months, and has the feature that in 3 months you can choose if the option is a European call or a a European put with strike price 200 kr. Keep at least four decimals in all your calculations. Round of your final answer to two decimals. (d) Calculate the Black-Scholes Merton price of the vanilla at-the-money European call option on the OLD stock described in the Cox-Ross-Rubenstein Binomial tree above. Keep at least four decimals in all your calculations. Round of your final answer to two decimals the answers for

b) is borrow 101,05

c) 44,44

d) 34,54

I have already answered question a) where i got option price : 31,74

stock price: 200

strike price: 200

risk free rate : 20%

t : 0,25

up: 1.25

down: 0.8

probability up: 0.55838

highly appreciated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started