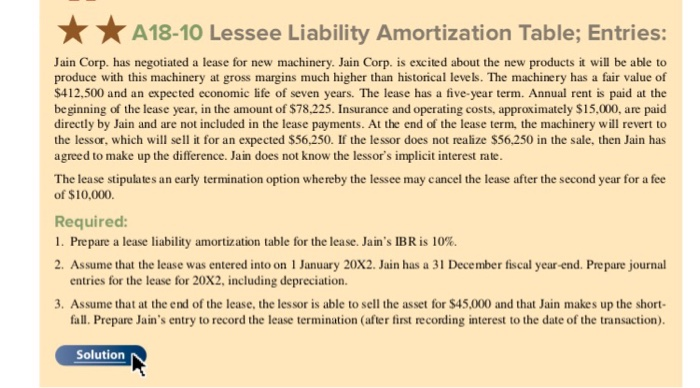

can someone please explain this solution in detail

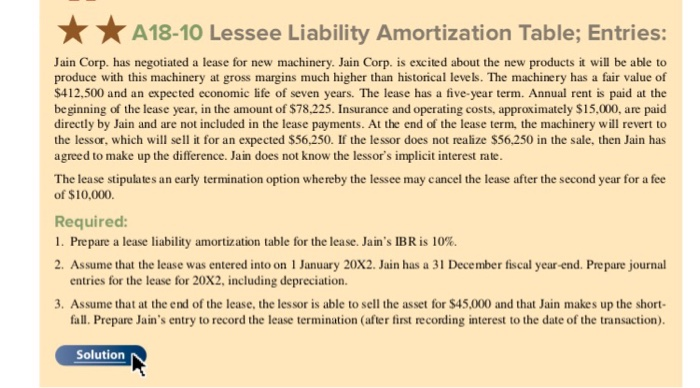

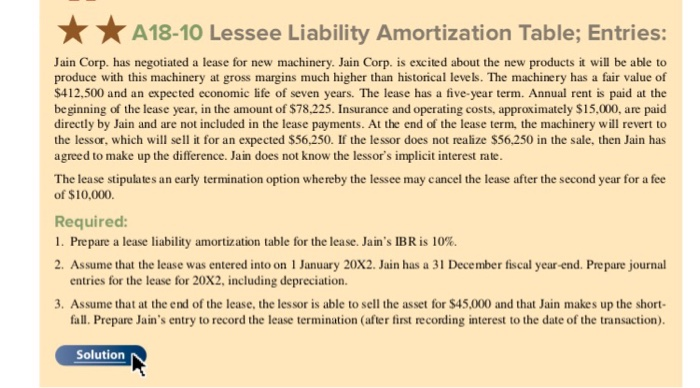

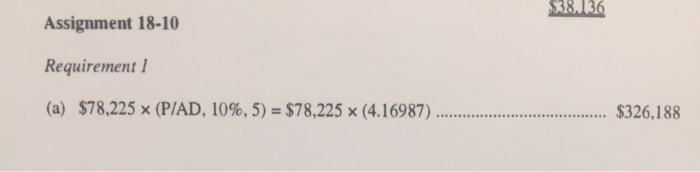

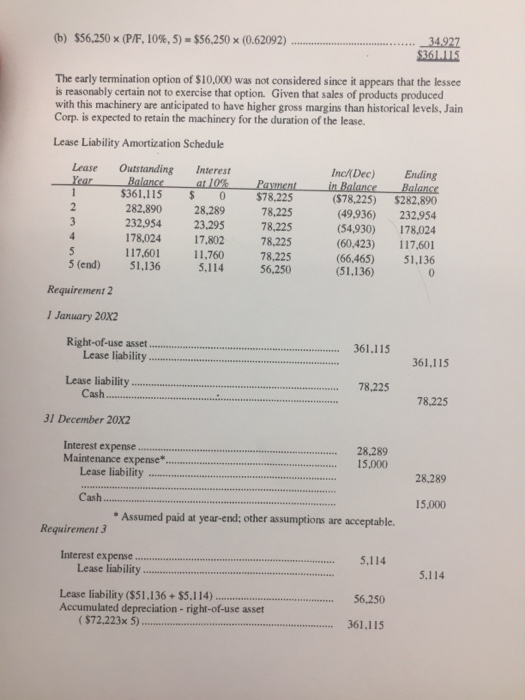

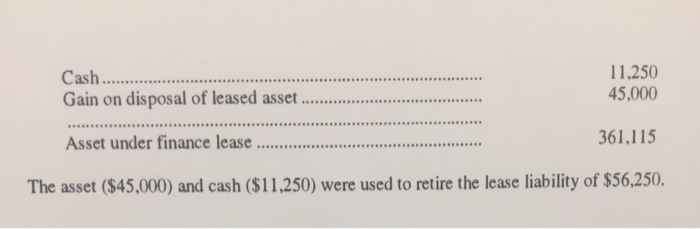

* * A18-10 Lessee Liability Amortization Table; Entries: Jain Corp. has negotiated a lease for new machinery. Jain Corp. is excited about the new products it will be able to produce with this machinery at gross margins much higher than historical levels. The machinery has a fair value of $412,500 and an expected economic life of seven years. The lease has a five-year term. Annual rent is paid at the beginning of the lease year, in the amount of $78,225. Insurance and operating costs, approximately $15,000, are paid directly by Jain and are not included in the lease payments. At the end of the lease term, the machinery will revert to pected $56,250. If the lessor does not realize $56,250 in the sale, then Jain has agreed to make up the difference. Jain does not know the lessor's implicit interest rate. The lease stipulates an early termination option whereby the lessee may cancel the lease after the second year for a fee of $10,000 Required: 1. Prepare a lease liability amortization table for the lease. Jain's IBR is 10% 2. Assume that the lease was entered into on 1 January 20X2. Jain has a 31 December fiscal year-end. Prepare journal entries for the lease for 20X2, including depreciation. 3. Assume that at the end of the lease, the lessor is able to sell the asset for $45,000 and that Jain makes up the short fall. Prepare Jain's entry to record the lease termination (after first recording interest to the date of the transaction). Solution $38.136 Assignment 18-10 Requirement 1 (a) $78,225 x (P/AD, 10%, 5) = $78,225 x (4.16987). $326,188 (b) $56,250 (P/F, 10%, 5) - $56,250 x (0.62092) 34.927 $361.15 The early termination option of $10,000 was not considered since it appears that the lessee is reasonably certain not to exercise that option. Given that sales of products produced with this machinery are anticipated to have higher gross margins than historical levels, Jain Corp. is expected to retain the machinery for the duration of the lease. Lease Liability Amortization Schedule Lease Year Outstanding Balance $361,115 282,890 232.954 178,024 117,601 51,136 interest ar 10% $ 0 28.289 23.295 17.802 11,760 5.114 Payment $78.225 78,225 78,225 78.225 78.225 56,250 Inc/Dec) in Balance ($78,225) (49.936) (54.930) (60.423) (66.465) (51.136) Ending Balance $282.890 232.954 178,024 117,601 51,136 5 (end) Requirement 2 1 January 20X2 Right-of-use asset................. Lease liability ............. 361.115 361,115 Lease liability.... Cash 78,225 78.225 31 December 20X2 Interest expense ..... Maintenance expense*....... Lease liability ........... 28.289 15.000 28,289 Cash... 15,000 Assumed paid at year-end; other assumptions are acceptable. Requirement 3 Interest expense.......... Lease liability ............. ................. 5,114 5.114 56.250 Lease liability ($51.136 + $5.114) ....... ..... Accumulated depreciation - right-of-use asset ($72.223x 5).... 361,115 Cash Gain on disposal of leased asset ..... 11,250 45,000 Asset under finance lease ...... 361,115 The asset ($45,000) and cash ($11,250) were used to retire the lease liability of $56,250