Answered step by step

Verified Expert Solution

Question

1 Approved Answer

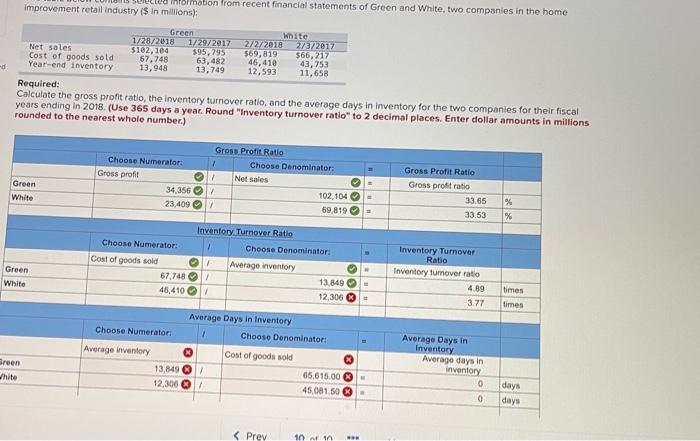

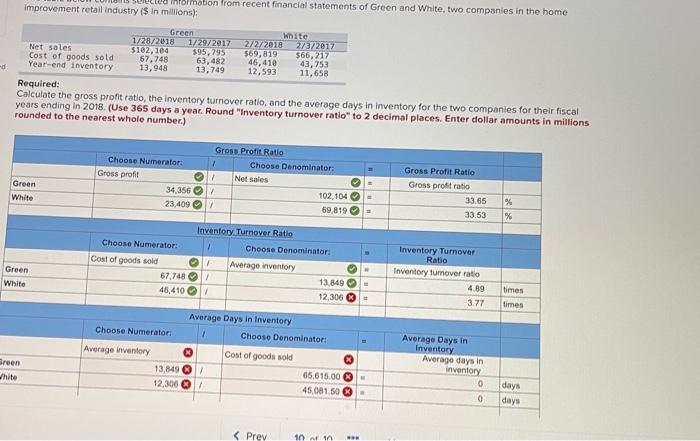

can someone please explain what in doing wrong? Information from recent financial statements of Green and White, two companies in the home Improvement retail industry

can someone please explain what in doing wrong?

Information from recent financial statements of Green and White, two companies in the home Improvement retail industry ($ in millions): Green White 1/28/2018 1/29/2017 2727 2018 2/3/2017 Net sales $102, 104 $95,795 569,819 $66,217 Cost of goods sold 67,748 63,482 46,410 43,753 Year-end Inventory 13,948 13,749 12,593 11,658 Required: Calculate the gross profit ratio, the inventory turnover ratio, and the average days in inventory for the two companies for their fiscal years ending in 2018. (Use 365 days a year. Round "inventory turnover ratio* to 2 decimal places. Enter dollar amounts in millions rounded to the nearest whole number.) Gross Profit Ratio Choose Numerator: Choose Denominator: Gross profit 1 Net sales BE 34 356 102,104 23,409 V 69,819 Green White Gross Profit Ratio Gross profit ratio 33.65 33.53 % % Inventory. Turnover Ratio 1 Choose Denominator Average inventory 13,849 12,306 Choose Numerator: Cost of goods sold 67,748 46,410 Green Inventory Turnover Ratio Inventory turnover ratio 4,89 3.77 White times times Choose Numerator: Average Days In Inventory Choose Denominator: Average Inventory Cost of goods sold x Green White 13,849 12,306 / Average Days in Inventory Average days in Inventory 0 0 65.615.00 45,081,50 days days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started