Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please explain where they got the $20,300 from? What is the calculation with the given information so I can solve future claims? One

Can someone please explain where they got the $20,300 from? What is the calculation with the given information so I can solve future claims?

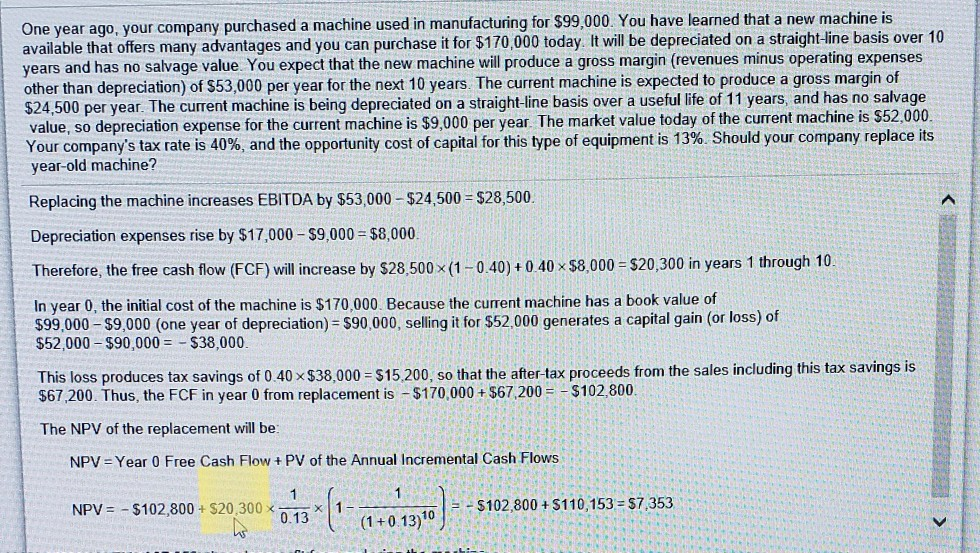

One year ago, your company purchased a machine used in manufacturing for $99,000. You have learned that a new machine is available that offers many advantages and you can purchase it for $170,000 today. It will be depreciated on a straight-line basis over 10 years and has no salvage value. You expect that the new machine will produce a gross margin (revenues minus operating expenses other than depreciation) of $53,000 per year for the next 10 years. The current machine is expected to produce a gross margin of $24,500 per year. The current machine is being depreciated on a straight-line basis over a useful life of 11 years, and has no salvage value, so depreciation expense for the current machine is $9,000 per year. The market value today of the current machine is $52,000 Your company's tax rate is 40%, and the opportunity cost of capital for this type of equipment is 13%. Should your company replace its year-old machine? Replacing the machine increases EBITDA by $53,000-$24,500 $28,500, Depreciation expenses rise by $17,000 $9,000 $8,000 Therefore, the free cash flow (F CF) will increase by $28,500x(1 0.40)+040 8 000-$20,300 in years 1 through 10 In year 0, the initial cost of the machine is $170,000. Because the current machine has a book value of $99,000-S9,000 (one year of depreciation) $90,000, selling it for $52,000 generates a capital gain (or loss) of $52,000 -$90,000$38,000 This loss produces tax savings of 0.40 x$38,000 $15.200, so that the after -tax proceeds from the sales including this tax savings is $67 200. Thus, the FCF in year 0 from replacement is $170,000 S67,200 $102,800 The NPV of the replacement will be: NPV Year 0 Free Cash Flow + PV of the Annual Incremental Cash Flows NPV $102,800 $20,3000,13 $102,800+$110,153 $7,353 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started