Answered step by step

Verified Expert Solution

Question

1 Approved Answer

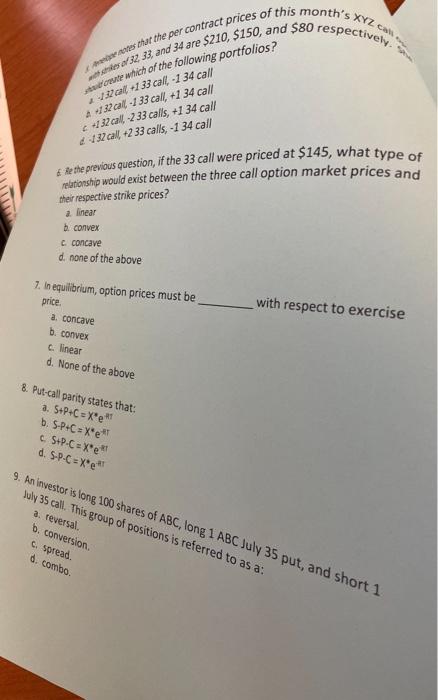

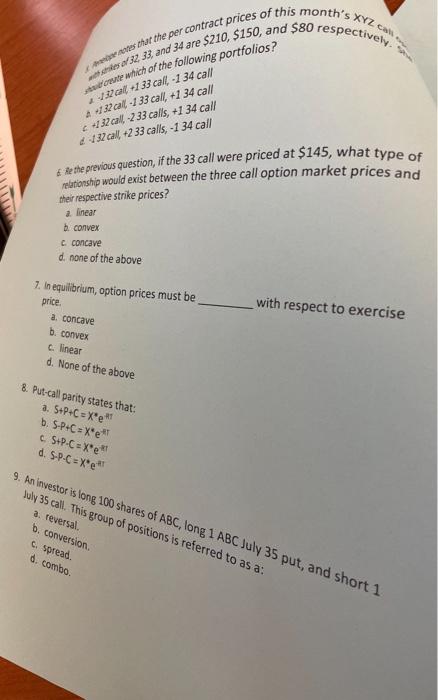

help me with all please C Xar the per contract prices of this month's XYZ 32 33 and 34 are $210, $150, and $80 respectively.

help me with all please

C Xar the per contract prices of this month's XYZ 32 33 and 34 are $210, $150, and $80 respectively. aderente which of the following portfolios? 32ca133 call -1 34 call a 32 cal 133 call, +1 34 call 32 al 233 calls, +1 34 call 132 call +2 33 calls. -1 34 call & Reshe previous question, if the 33 call were priced at $145, what type of relationship would exist between the three call option market prices and their respective strike prices? linear convex concave d. none of the above 7. In equilibrium, option prices must be price with respect to exercise a concave b. convex clinear d. None of the above 8. Put-call parity states that: a. S+P+C=X'e b. S-P+C=X*e c. S+P-C=X*e d. S.P-C=X*** RT 9. An investor is long 100 shares of ABC, long 1 ABC July 35 put, and short 1 July 35 call. This group of positions is referred to as a: a. reversal b. conversion C. Spread. d. combo C Xar the per contract prices of this month's XYZ 32 33 and 34 are $210, $150, and $80 respectively. aderente which of the following portfolios? 32ca133 call -1 34 call a 32 cal 133 call, +1 34 call 32 al 233 calls, +1 34 call 132 call +2 33 calls. -1 34 call & Reshe previous question, if the 33 call were priced at $145, what type of relationship would exist between the three call option market prices and their respective strike prices? linear convex concave d. none of the above 7. In equilibrium, option prices must be price with respect to exercise a concave b. convex clinear d. None of the above 8. Put-call parity states that: a. S+P+C=X'e b. S-P+C=X*e c. S+P-C=X*e d. S.P-C=X*** RT 9. An investor is long 100 shares of ABC, long 1 ABC July 35 put, and short 1 July 35 call. This group of positions is referred to as a: a. reversal b. conversion C. Spread. d. combo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started