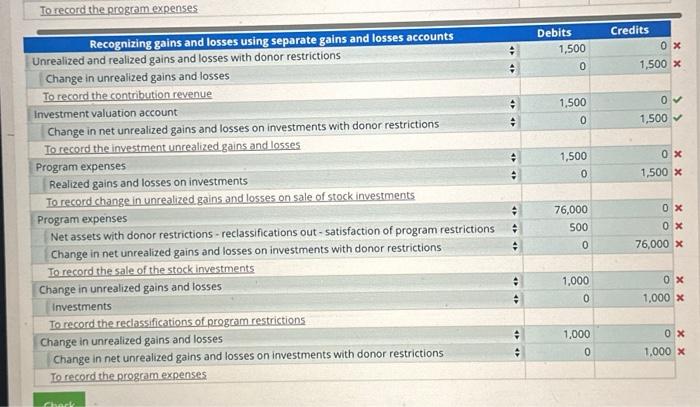

can someone please find the right answers to the second event/ journal entry

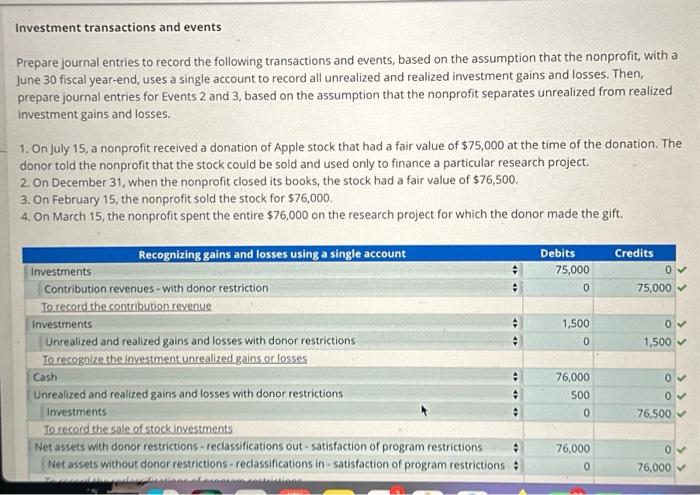

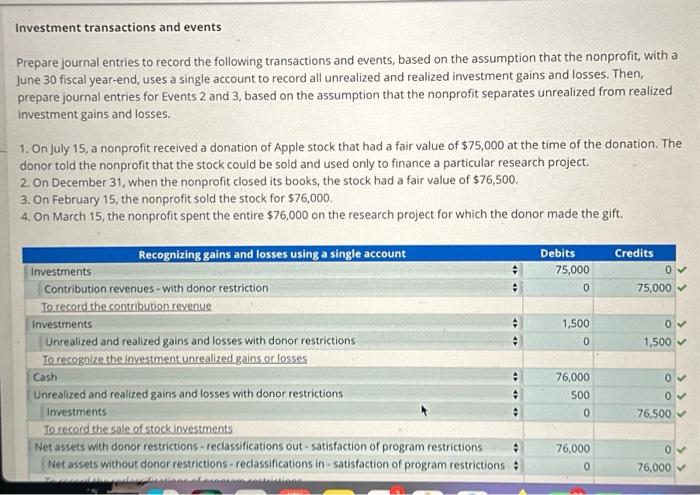

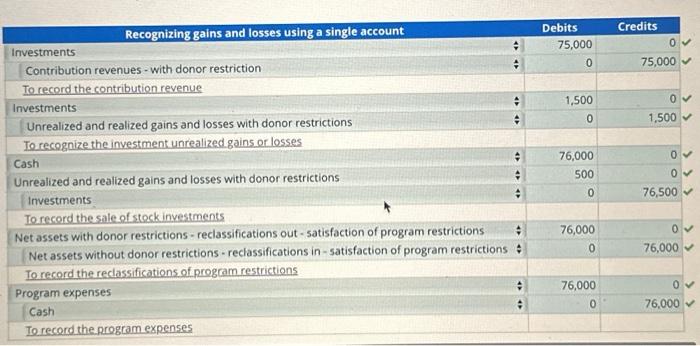

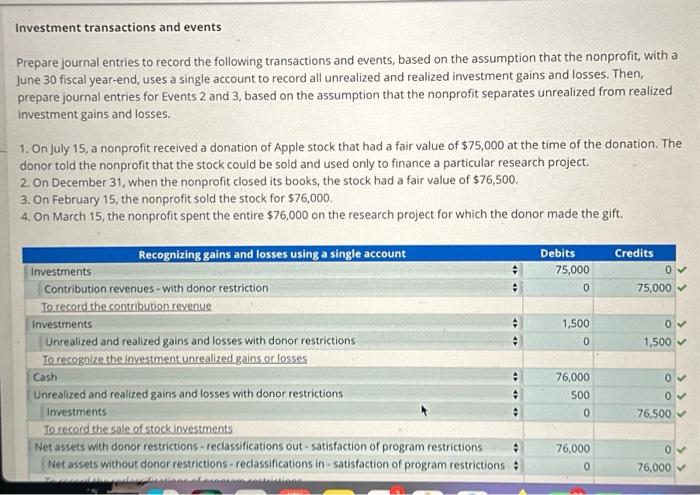

Prepare journal entries to record the following transactions and events, based on the assumption that the nonprofit, with a June 30 fiscal year-end, uses a single account to record all unrealized and realized investment gains and losses. Then, prepare journal entries for Events 2 and 3 , based on the assumption that the nonprofit separates unrealized from realized investment gains and losses. 1. On July 15 , a nonprofit received a donation of Apple stock that had a fair value of $75,000 at the time of the donation. The donor told the nonprofit that the stock could be sold and used only to finance a particular research project. 2 On December 31, when the nonprofit closed its books, the stock had a fair value of $76,500. 3. On February 15, the nonprofit sold the stock for $76,000. 4. On March 15, the nonprofit spent the entire $76,000 on the research project for which the donor made the gift. \begin{tabular}{|c|c|c|c|} \hline Recognizing gains and losses using a single account & & Debits & Credits \\ \hline Investments & ^ & 75,000 & 0 \\ \hline Contribution revenues - with donor restriction & & 0 & 75,000 \\ \hline To record the contribution revenue & & & \\ \hline Investments & & 1,500 & 0 \\ \hline Unrealized and realized gains and losses with donor restrictions & & 0 & 1.500 \\ \hline To recognize the investment unrealized gains or losses & & & \\ \hline Cash & & 76,000 & 0 \\ \hline Unrealized and realized gains and losses with donor restrictions & & 500 & 0 \\ \hline Investments & & 0 & 76,500 \\ \hline To record the sale of stock investments & & & \\ \hline Net assets with donor restrictions - reclassifications out - satisfaction of program restrictions & & 76,000 & 0 \\ \hline Net assets without donor restrictions - reclassifications in - satisfaction of program restrictions & & 0 & 76,000 \\ \hline To record the reclassifications of program restrictions & & & \\ \hline Program expenses & = & 76,000 & 0 \\ \hline Cash & = & 0 & 76,000 \\ \hline Te record the program expenses & & & \\ \hline \end{tabular} To record the program expenses \begin{tabular}{|c|c|c|} \hline Recognizing gains and losses using separate gains and losses accounts & Debits & Credits \\ \hline Unrealized and realized gains and losses with donor restrictions & 1,500 & 0 \\ \hline Change in unrealized gains and losses & 0 & 1,500 \\ \hline To record the contribution revenue & & \\ \hline Investment valuation account & 1,500 & 0 \\ \hline Change in net unrealized gains and losses on investments with donor restrictions & 0 & 1,500 \\ \hline To record the investment unrealized gains and losses & &. \\ \hline Program expenses & 1,500 & 0 \\ \hline Realized gains and losses on investments & 0 & 1,500 \\ \hline To record change in unrealized gains and losses on sale of stock investments & & \\ \hline Program expenses & 76,000 & 0 \\ \hline Net assets with donor restrictions - reclassifications out - satisfaction of program restrictions & 500 & 0 \\ \hline Change in net unrealized gains and losses on investments with donor restrictions & 0 & 76,000 \\ \hline To record the sale of the stock investments & & \\ \hline Change in unrealized gains and losses & 1,000 & 0 \\ \hline Investments & 0 & 1.000 \\ \hline To record the reclassifications of program restrictions & & \\ \hline Change in unrealized gains and losses & 1.000 & 0 \\ \hline Change in net unrealized gains and losses on investments with donor restrictions & 0 & 1.000 \\ \hline To record the program expenses & & \\ \hline \end{tabular}