Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please help? In this business, Julie purchases various fabrics from suppliers and retailers, and uses them to make dresses, which she then sells

Can someone please help?

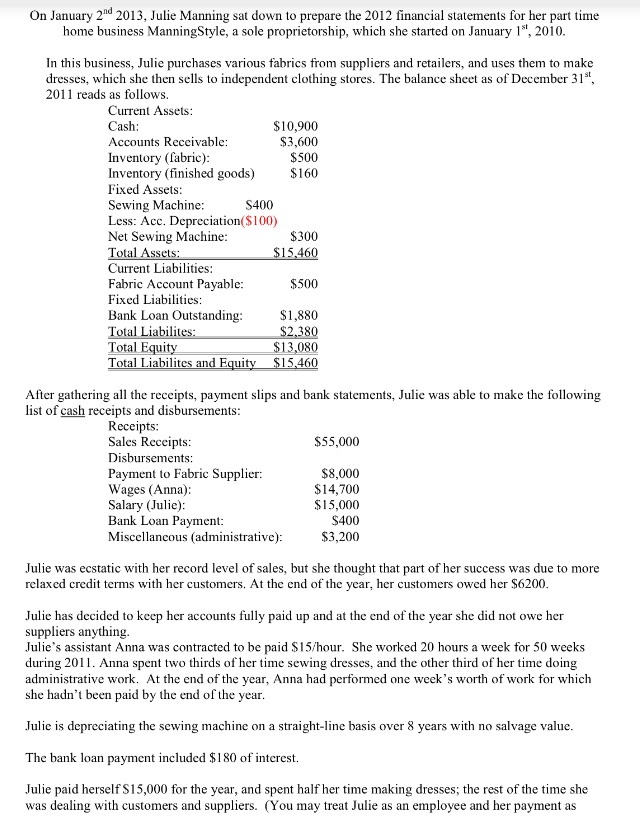

In this business, Julie purchases various fabrics from suppliers and retailers, and uses them to make dresses, which she then sells to independent clothing stores. The balance sheet as of December 31st, 2011 reads as follows. After gathering all the receipts, payment slips and bank statements, Julie was able to make the following list of cash receipts and disbursements: Receipts: Sales Receipts: $55,000 Disbursements: Payment to Fabric Supplier: $8,000 Wages (Anna): $14,700 Salary (Julie): $15,000 Bank Loan Payment: S400 Miscellaneous (administrative): $3,200 Julie was ecstatic with her record level of sales, but she thought that part of her success was due to more relaxed credit terms with her customers. At the end of the year, her customers owed her $6200. Julie has decided to keep her accounts fully paid up and at the end of the year she did not owe her suppliers anything. Julie's assistant Anna was contracted to be paid $15/hour. She worked 20 hours a week for 50 weeks during 2011. Anna spent two thirds of her time sewing dresses, and the other third of her time doing administrative work. At the end of the year, Anna had performed one week's worth of work for which she hadn't been paid by the end of the year. Julie is depreciating the sewing machine on a straight-line basis over 8 years with no salvage value. The bank loan payment included $180 of interest. Julie paid herself SI 5,000 for the year, and spent half her time making dresses; the rest of the time she was dealing with customers and suppliers. (You may treat Julie as an employee and her payment as On the same January 2nd, Julie did a quick inventory count, and counted S300 worth of fabric. She also had one finished dress that took Anna 4 hours to make and had $85 worth of fabric in it. She thought she could sell the dress for $250. What does the ManningStyle cash T-account look like for 2012? What is the total cost of goods sold (COGS) expense for ManningStyle in the year 2012? Show the entries in all three inventory T-accounts that are relevant to the calculation. Prepare the 2012 Income Statement for ManningStyle. Prepare the Balance Sheet for ManningStyle for the end of the year 2012Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started