can someone please help me anser this question. i am checking my work. this is my third time posting. someone please help

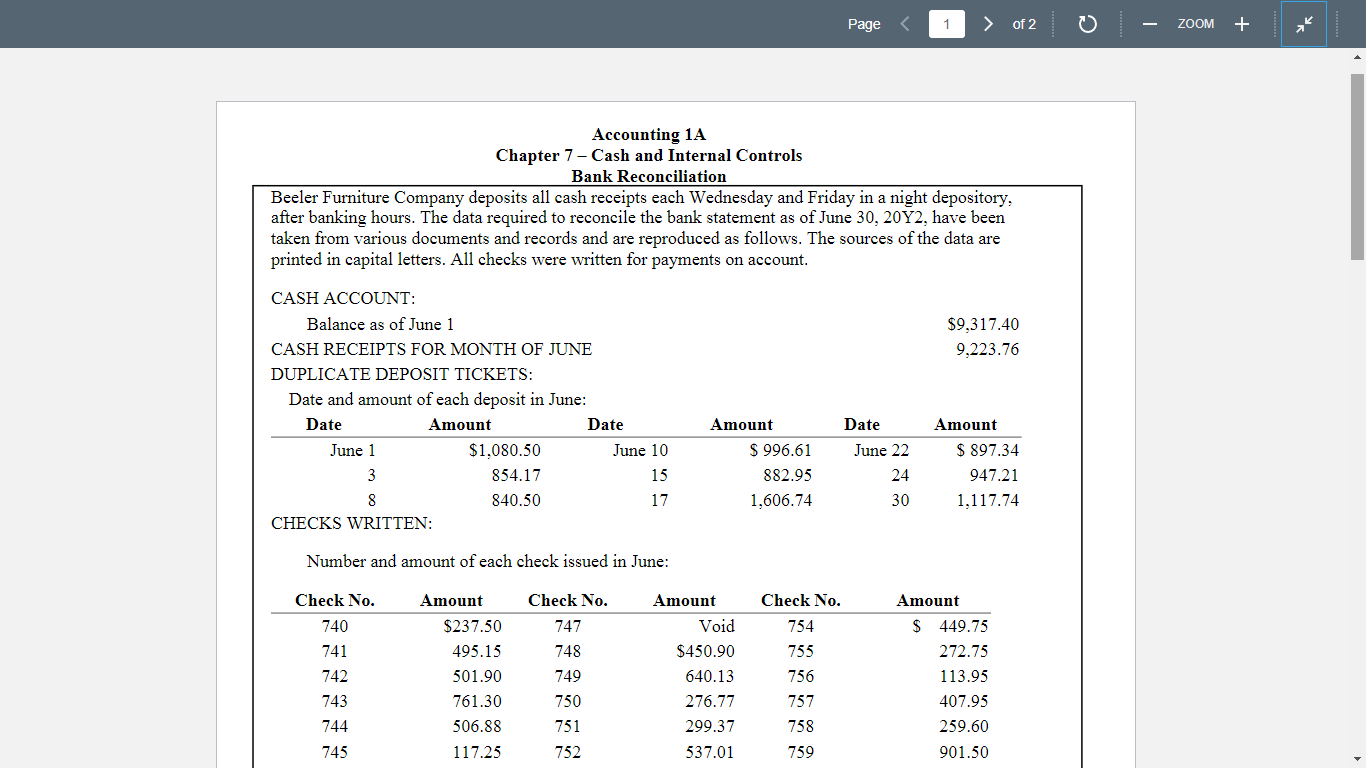

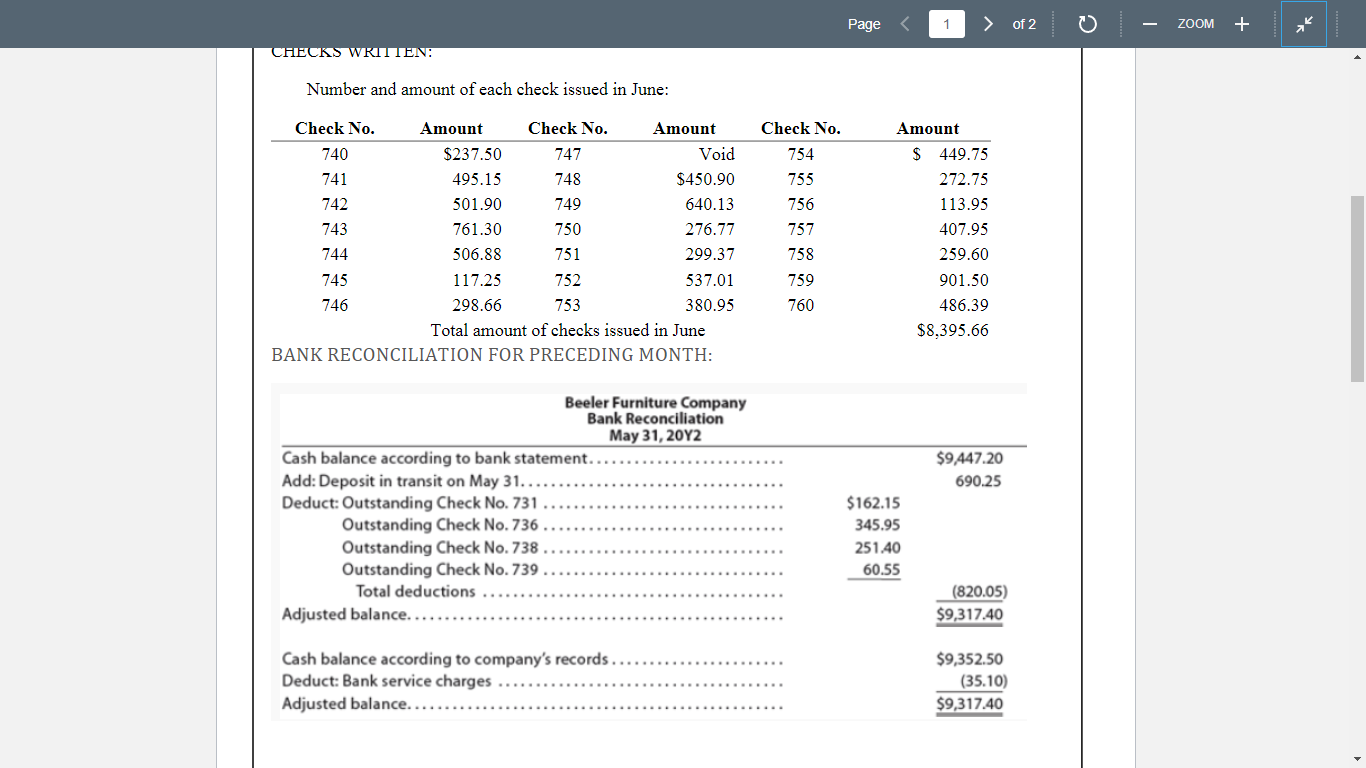

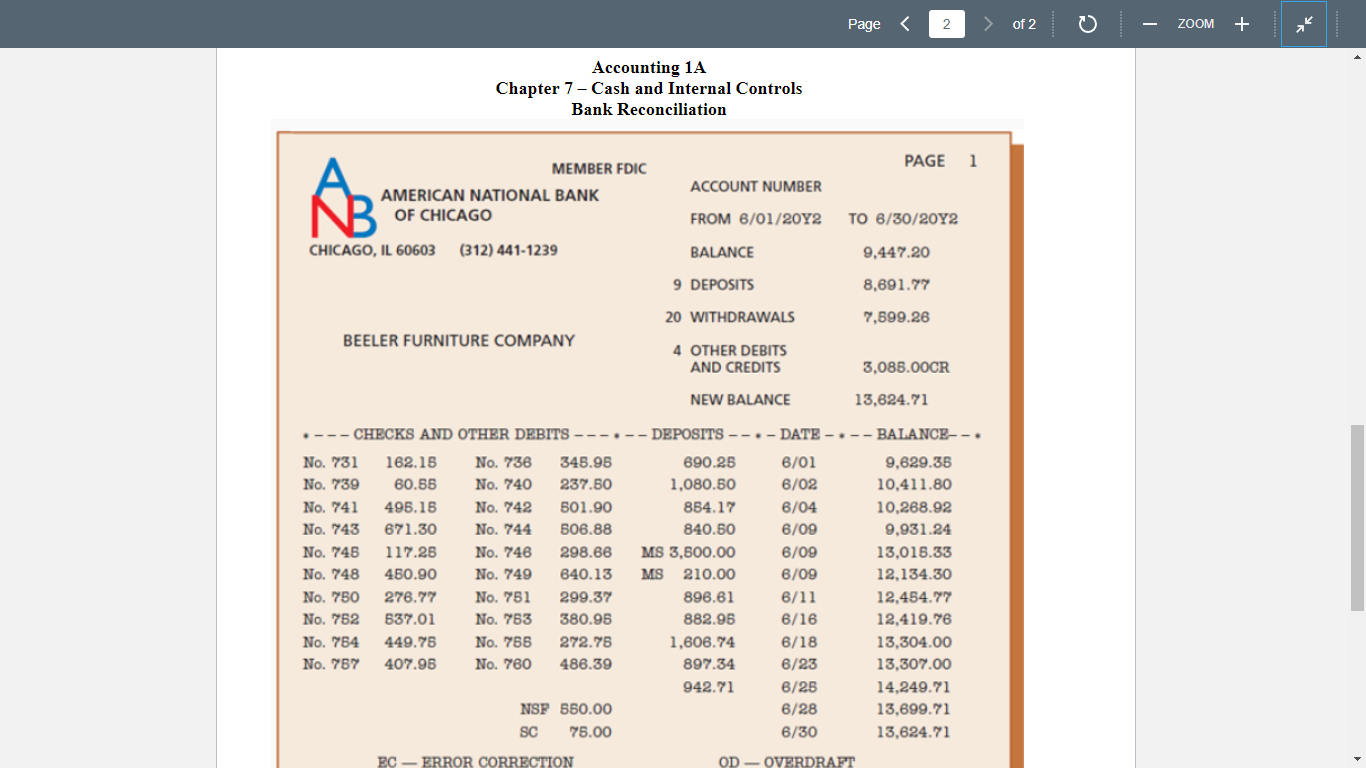

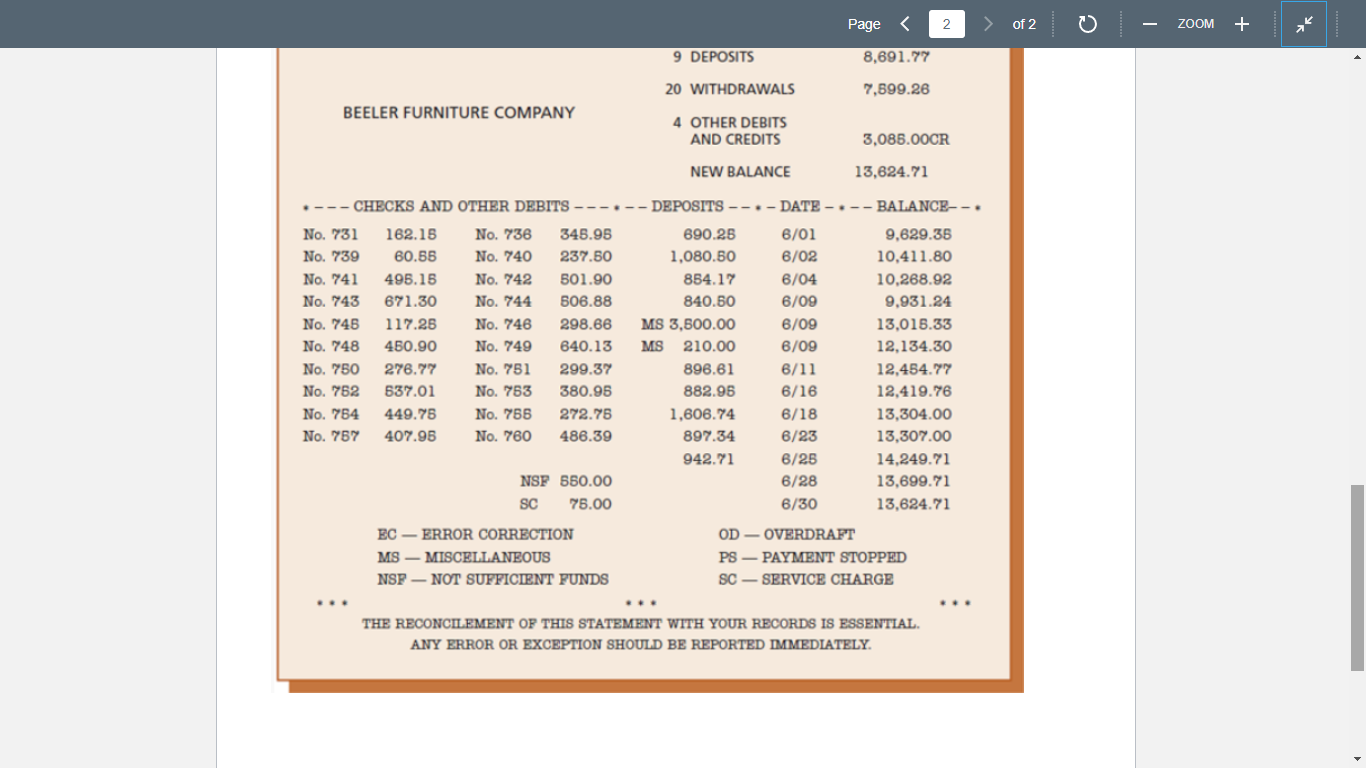

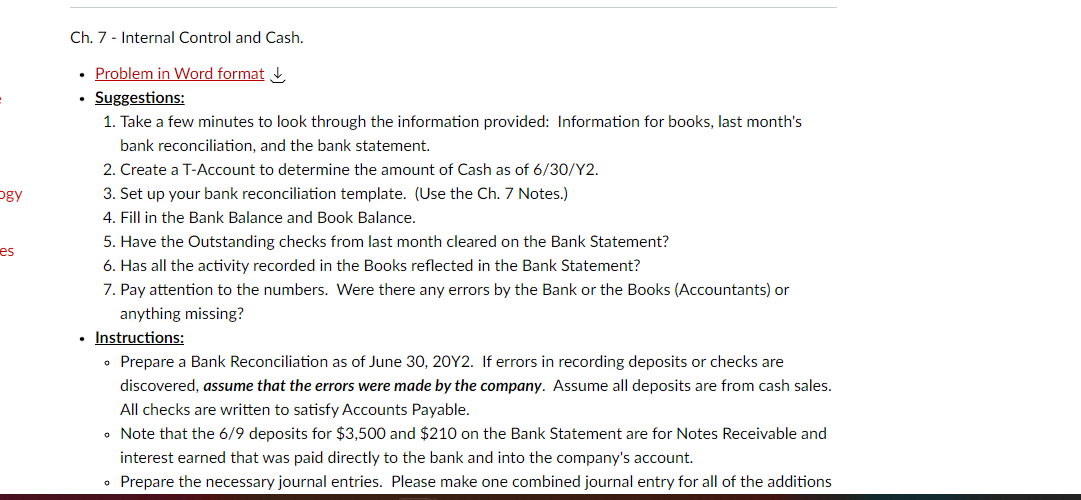

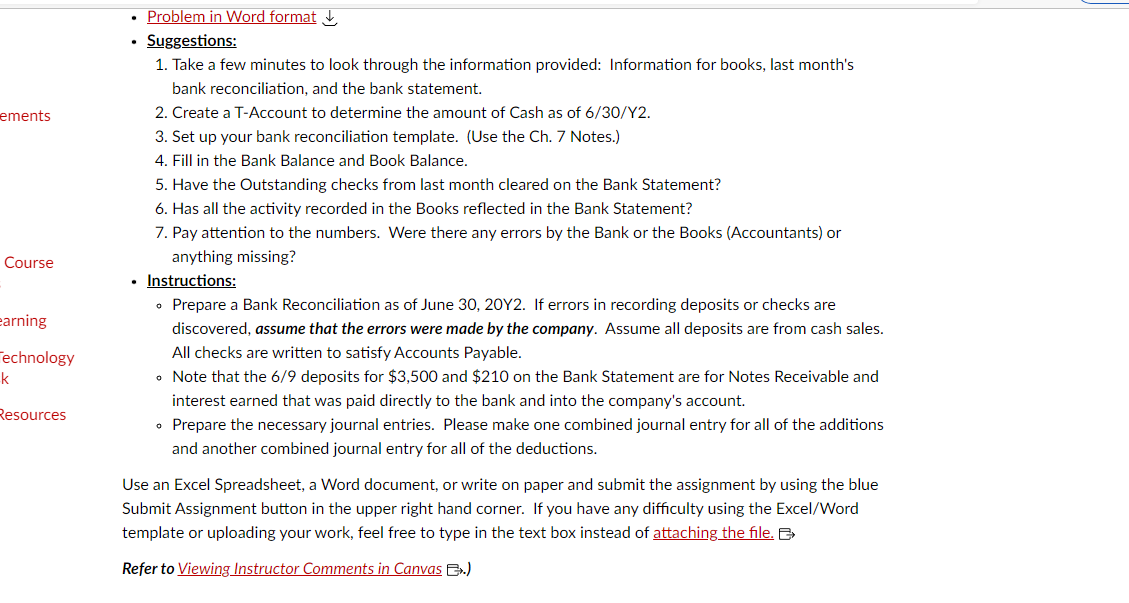

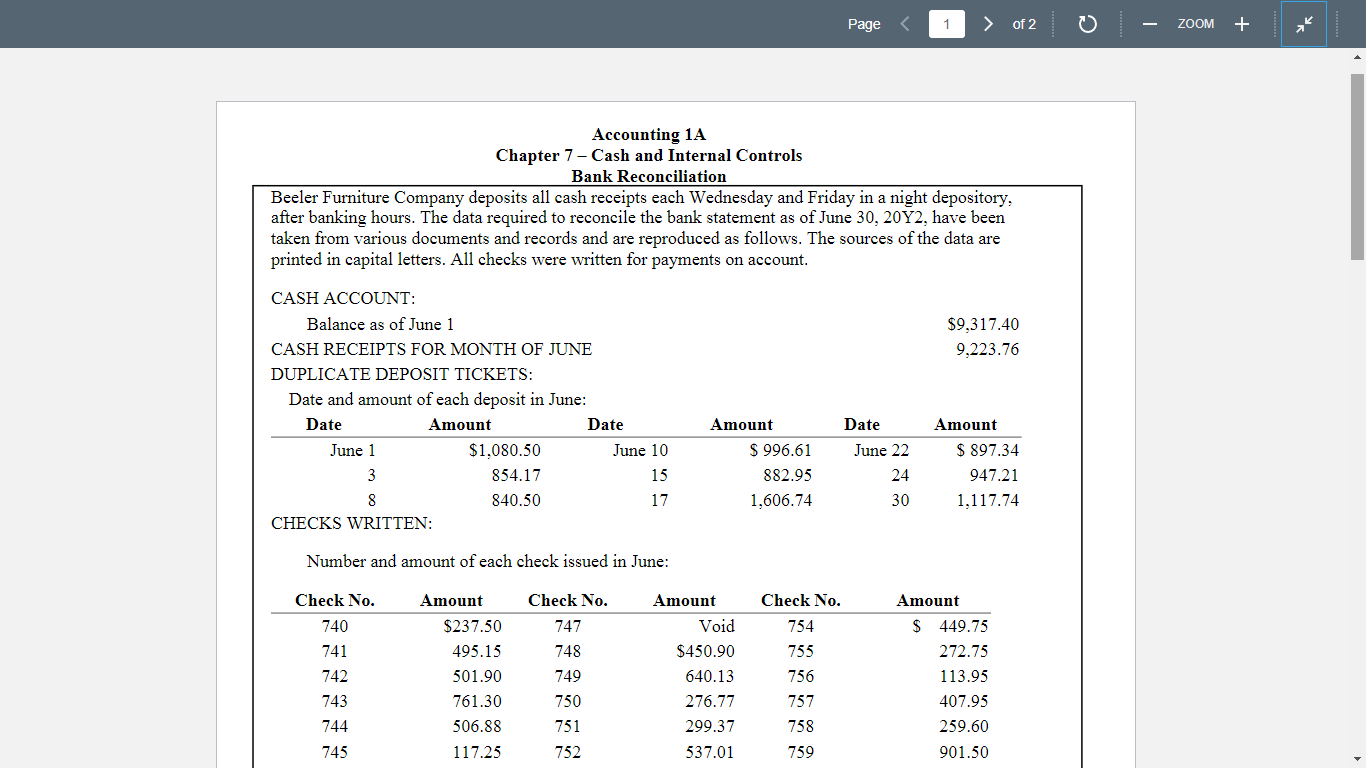

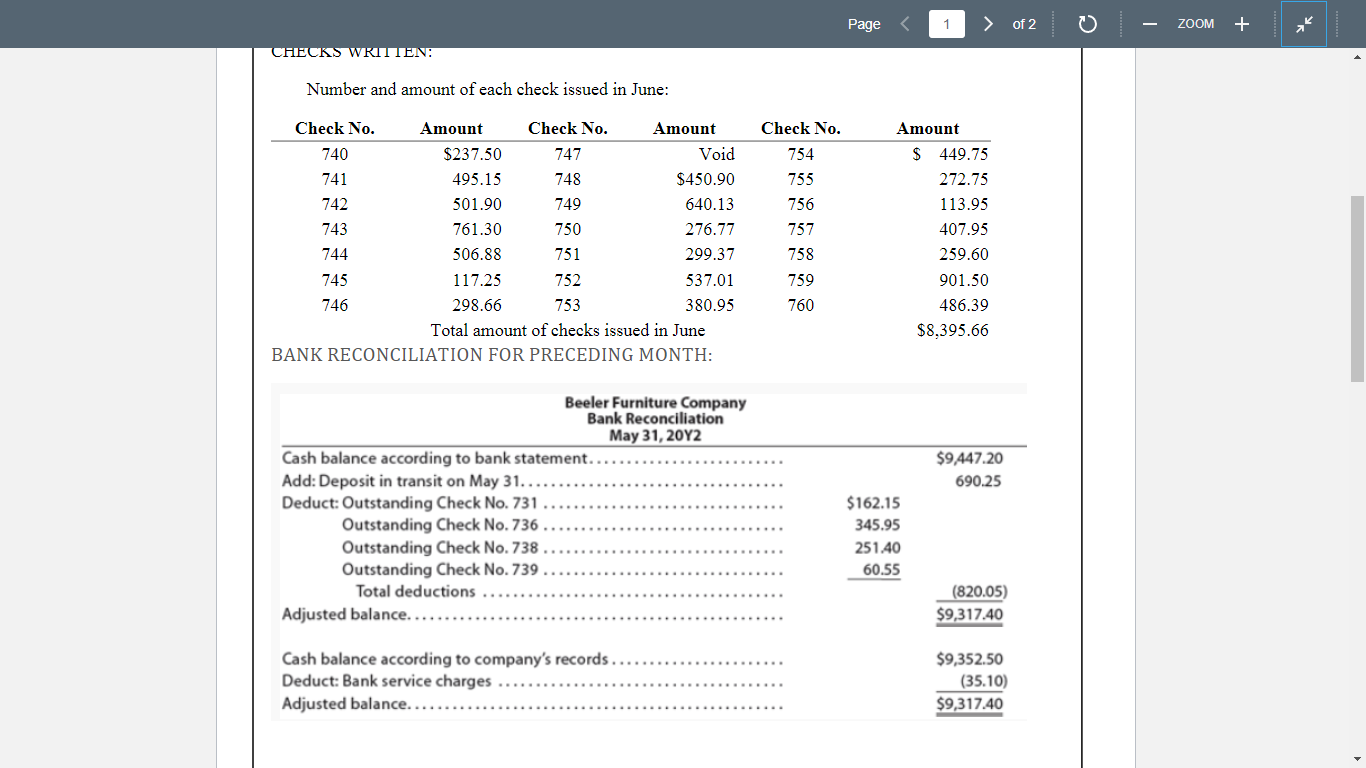

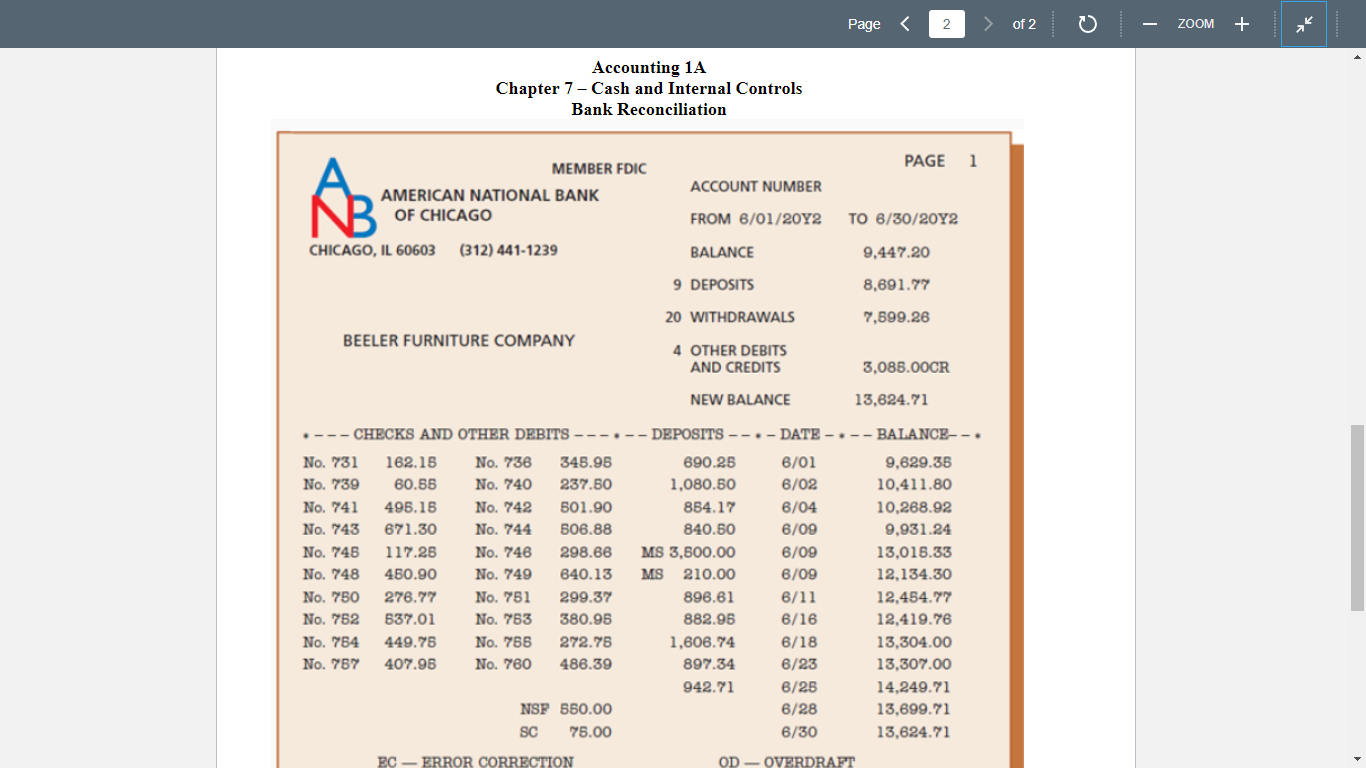

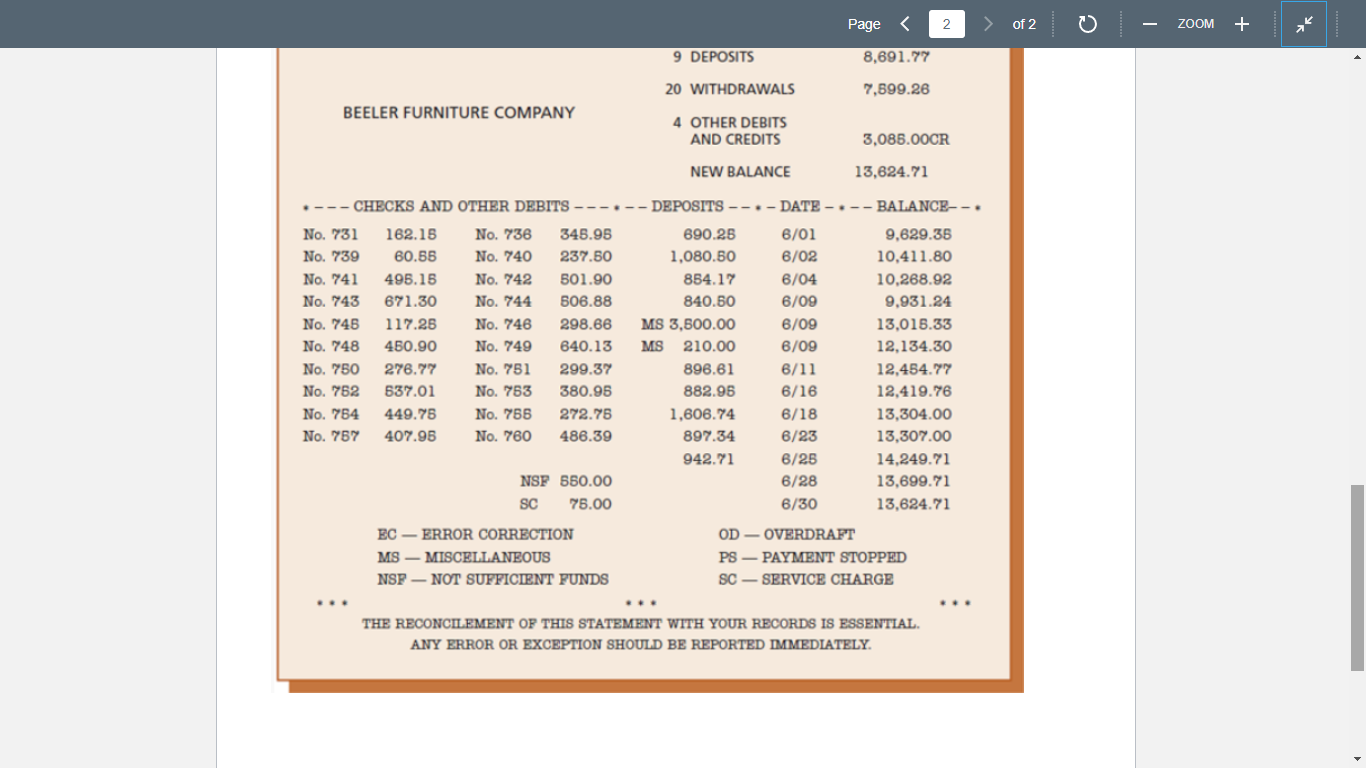

Ch. 7 - Internal Control and Cash. - Problem in Word format - Suggestions: 1. Take a few minutes to look through the information provided: Information for books, last month's bank reconciliation, and the bank statement. 2. Create a T-Account to determine the amount of Cash as of 6/30/Y2. 3. Set up your bank reconciliation template. (Use the Ch. 7 Notes.) 4. Fill in the Bank Balance and Book Balance. 5. Have the Outstanding checks from last month cleared on the Bank Statement? 6. Has all the activity recorded in the Books reflected in the Bank Statement? 7. Pay attention to the numbers. Were there any errors by the Bank or the Books (Accountants) or anything missing? - Instructions: - Prepare a Bank Reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume all deposits are from cash sales. All checks are written to satisfy Accounts Payable. - Note that the 6/9 deposits for $3,500 and $210 on the Bank Statement are for Notes Receivable and interest earned that was paid directly to the bank and into the company's account. - Prepare the necessary journal entries. Please make one combined journal entry for all of the additions - Problem in Word format - Suggestions: 1. Take a few minutes to look through the information provided: Information for books, last month's bank reconciliation, and the bank statement. 2. Create a T-Account to determine the amount of Cash as of 6/30/Y2. 3. Set up your bank reconciliation template. (Use the Ch. 7 Notes.) 4. Fill in the Bank Balance and Book Balance. 5. Have the Outstanding checks from last month cleared on the Bank Statement? 6. Has all the activity recorded in the Books reflected in the Bank Statement? 7. Pay attention to the numbers. Were there any errors by the Bank or the Books (Accountants) or anything missing? - Instructions: - Prepare a Bank Reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume all deposits are from cash sales. All checks are written to satisfy Accounts Payable. - Note that the 6/9 deposits for $3,500 and $210 on the Bank Statement are for Notes Receivable and interest earned that was paid directly to the bank and into the company's account. - Prepare the necessary journal entries. Please make one combined journal entry for all of the additions and another combined journal entry for all of the deductions. Use an Excel Spreadsheet, a Word document, or write on paper and submit the assignment by using the blue Submit Assignment button in the upper right hand corner. If you have any difficulty using the Excel/Word template or uploading your work, feel free to type in the text box instead of attaching the file. G Refer to Viewing Instructor Comments in Canvas .) Beeler Furniture Company deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to reconcile the bank statement as of June 30,20Y2, have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account. CASH ACCOUNT: Balance as of June 1 $9,317.40 CASH RECEIPTS FOR MONTH OF JUNE 9,223.76 DUPLICATE DEPOSIT TICKETS: Date and amount of each deposit in June: Number and amount of each check issued in June: Number and amount of each check issued in June: Accounting 1A Chantap 7 - Cach and Internal Controls Ch. 7 - Internal Control and Cash. - Problem in Word format - Suggestions: 1. Take a few minutes to look through the information provided: Information for books, last month's bank reconciliation, and the bank statement. 2. Create a T-Account to determine the amount of Cash as of 6/30/Y2. 3. Set up your bank reconciliation template. (Use the Ch. 7 Notes.) 4. Fill in the Bank Balance and Book Balance. 5. Have the Outstanding checks from last month cleared on the Bank Statement? 6. Has all the activity recorded in the Books reflected in the Bank Statement? 7. Pay attention to the numbers. Were there any errors by the Bank or the Books (Accountants) or anything missing? - Instructions: - Prepare a Bank Reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume all deposits are from cash sales. All checks are written to satisfy Accounts Payable. - Note that the 6/9 deposits for $3,500 and $210 on the Bank Statement are for Notes Receivable and interest earned that was paid directly to the bank and into the company's account. - Prepare the necessary journal entries. Please make one combined journal entry for all of the additions - Problem in Word format - Suggestions: 1. Take a few minutes to look through the information provided: Information for books, last month's bank reconciliation, and the bank statement. 2. Create a T-Account to determine the amount of Cash as of 6/30/Y2. 3. Set up your bank reconciliation template. (Use the Ch. 7 Notes.) 4. Fill in the Bank Balance and Book Balance. 5. Have the Outstanding checks from last month cleared on the Bank Statement? 6. Has all the activity recorded in the Books reflected in the Bank Statement? 7. Pay attention to the numbers. Were there any errors by the Bank or the Books (Accountants) or anything missing? - Instructions: - Prepare a Bank Reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume all deposits are from cash sales. All checks are written to satisfy Accounts Payable. - Note that the 6/9 deposits for $3,500 and $210 on the Bank Statement are for Notes Receivable and interest earned that was paid directly to the bank and into the company's account. - Prepare the necessary journal entries. Please make one combined journal entry for all of the additions and another combined journal entry for all of the deductions. Use an Excel Spreadsheet, a Word document, or write on paper and submit the assignment by using the blue Submit Assignment button in the upper right hand corner. If you have any difficulty using the Excel/Word template or uploading your work, feel free to type in the text box instead of attaching the file. G Refer to Viewing Instructor Comments in Canvas .) Beeler Furniture Company deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to reconcile the bank statement as of June 30,20Y2, have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account. CASH ACCOUNT: Balance as of June 1 $9,317.40 CASH RECEIPTS FOR MONTH OF JUNE 9,223.76 DUPLICATE DEPOSIT TICKETS: Date and amount of each deposit in June: Number and amount of each check issued in June: Number and amount of each check issued in June: Accounting 1A Chantap 7 - Cach and Internal Controls