Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please help me fill this out? Thanks! Boise Corp is an all-equity firm with EBIT equal to $700,000. Its cost of equity is

Can someone please help me fill this out? Thanks!

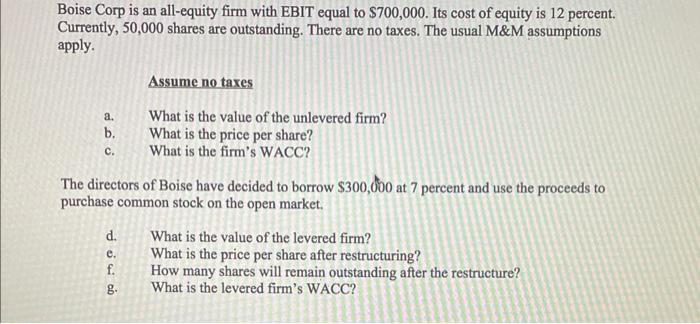

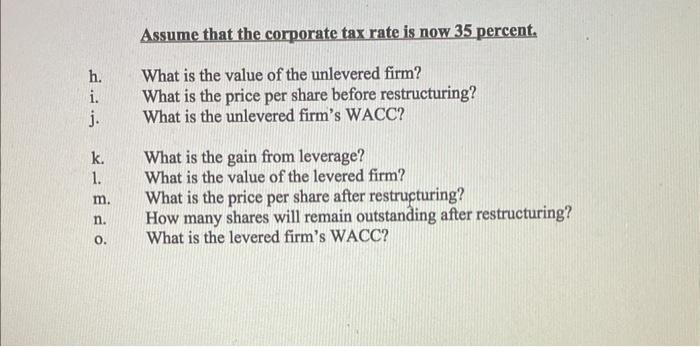

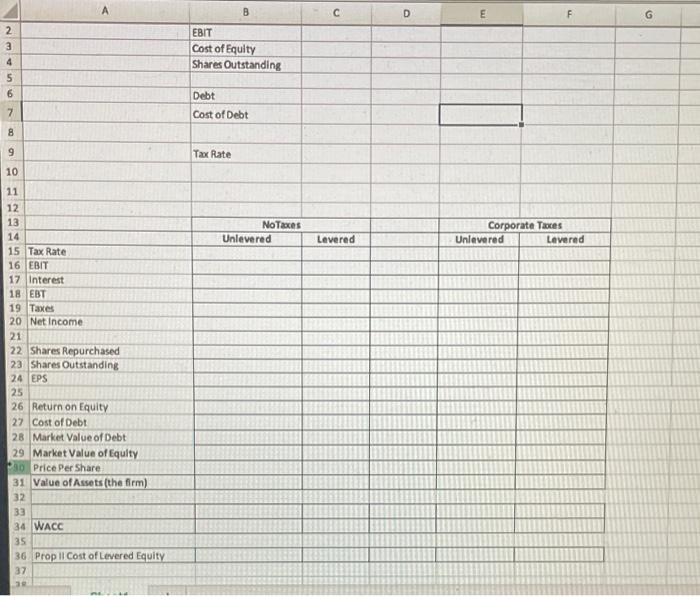

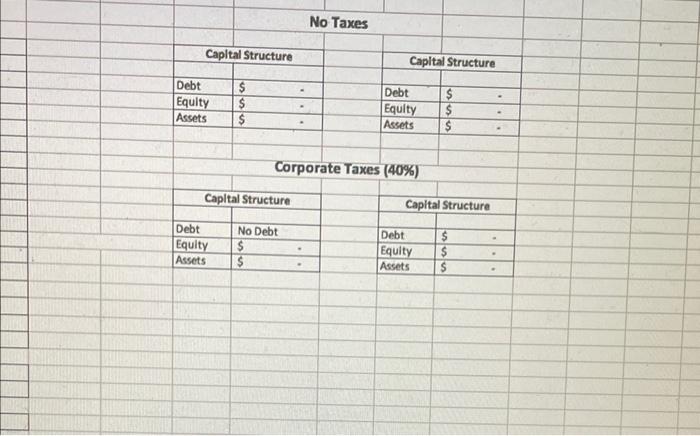

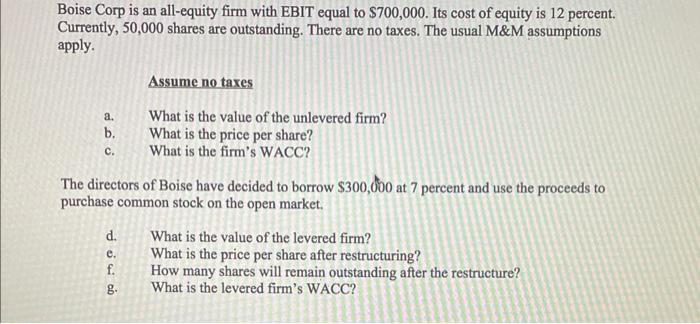

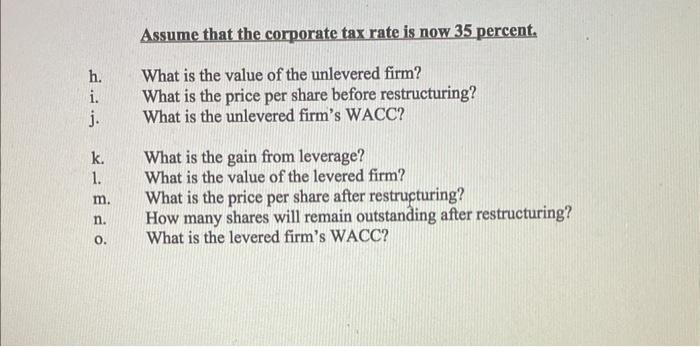

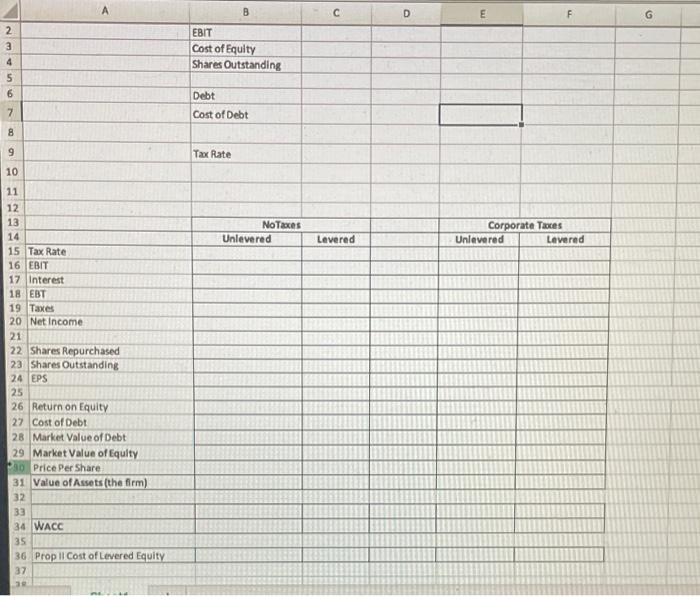

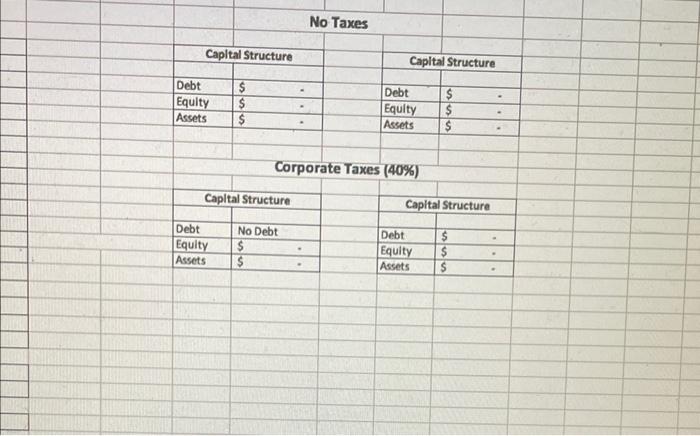

Boise Corp is an all-equity firm with EBIT equal to $700,000. Its cost of equity is 12 percent. Currently, 50,000 shares are outstanding. There are no taxes. The usual M\&M assumptions apply. Assume no taxes a. What is the value of the unlevered firm? b. What is the price per share? c. What is the firm's WACC? The directors of Boise have decided to borrow $300,000 at 7 percent and use the proceeds to purchase common stock on the open market. d. What is the value of the levered firm? e. What is the price per share after restructuring? f. How many shares will remain outstanding after the restructure? g. What is the levered firm's WACC? Assume that the corporate tax rate is now 35 percent. h. What is the value of the unlevered firm? i. What is the price per share before restructuring? j. What is the unlevered firm's WACC? k. What is the gain from leverage? 1. What is the value of the levered firm? m. What is the price per share after restructuring? n. How many shares will remain outstanding after restructuring? o. What is the levered firm's WACC? \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Capital Structure } & & \multicolumn{2}{|c|}{} \\ \hline \multicolumn{2}{|c|}{} & & \multicolumn{2}{|c|}{ Capital Structure } \\ \hline Debt & No Debt & & \multicolumn{2}{|c|}{} \\ \hline Equity & $ & & Debt & $ \\ \hline Assets & $ & & Equity & $ \\ \hline \end{tabular} Boise Corp is an all-equity firm with EBIT equal to $700,000. Its cost of equity is 12 percent. Currently, 50,000 shares are outstanding. There are no taxes. The usual M\&M assumptions apply. Assume no taxes a. What is the value of the unlevered firm? b. What is the price per share? c. What is the firm's WACC? The directors of Boise have decided to borrow $300,000 at 7 percent and use the proceeds to purchase common stock on the open market. d. What is the value of the levered firm? e. What is the price per share after restructuring? f. How many shares will remain outstanding after the restructure? g. What is the levered firm's WACC? Assume that the corporate tax rate is now 35 percent. h. What is the value of the unlevered firm? i. What is the price per share before restructuring? j. What is the unlevered firm's WACC? k. What is the gain from leverage? 1. What is the value of the levered firm? m. What is the price per share after restructuring? n. How many shares will remain outstanding after restructuring? o. What is the levered firm's WACC? \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Capital Structure } & & \multicolumn{2}{|c|}{} \\ \hline \multicolumn{2}{|c|}{} & & \multicolumn{2}{|c|}{ Capital Structure } \\ \hline Debt & No Debt & & \multicolumn{2}{|c|}{} \\ \hline Equity & $ & & Debt & $ \\ \hline Assets & $ & & Equity & $ \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started