Can someone please help me how to enter these information on a income tax form?

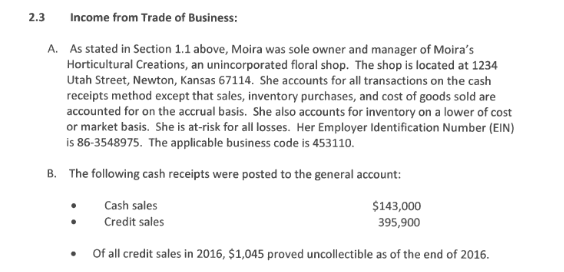

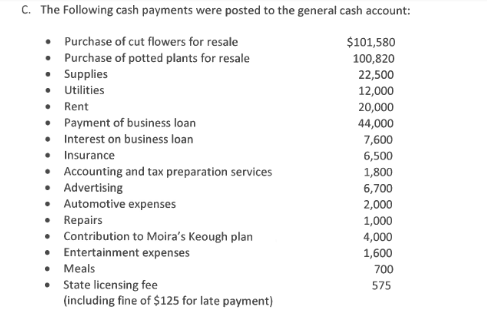

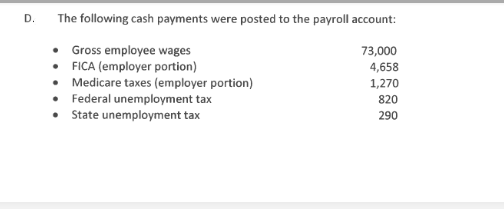

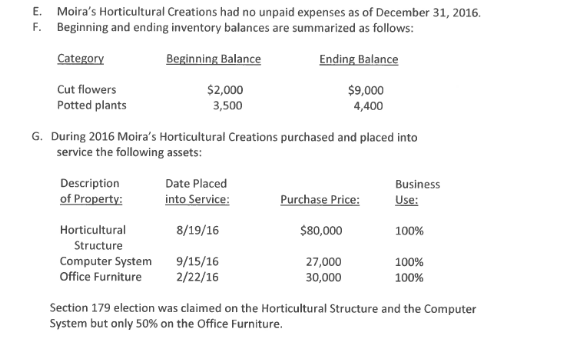

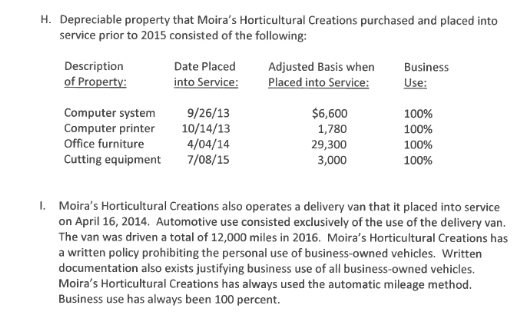

2.3 Income From Trade of Business: A. As stated in Section 1.1 above, Moira was sole owner and manager of Molra's Horticultural Creations. an unincorporated oral shop. The shop is located at 1234 Utah 5treet. Hes-uteri. Kansas E0114- She accounts for all transactions on the cash receipts method except that sales. inventory purchases, and cost of goods sold are accounted for on the eccrlual basis. She also accounts for Inventory on a lower of east or market basis. She is at-n'slt for all losses. Her Em ployer Identicatlon Number IEIH} is Eli-SHEETS. The applicable business node is 453 11a. B. The following cash receipts were posted to the general acceunt: I Eash sales 5143,0l3' I Eredlt sales 395.9111 I Dl' all credit sales in Mid. SLIJIIS proved uncolleetible as of the end of 2015. E. The Fellnwing cash payments were posted tn the general cash aeceunt: a Purchase el tut flewers for resale 5101;550 1 Purchase at patted plants for resale WELSH] 1 5n pplies 22.5 I Utilities 12mm :- Rent Inll} e Payment ef business lean 41m 1' Interest en business lea n 16m - Insurance Ej I Ate-taunting and tax preparation services LED-:1 I Advertising arm I Autprnptiwt expenses Lam I Repairs LDIII - Enntributien ta Melra's Keenan plan 4pm I Entertainment expenses 1.5m Ir Meals 'a' Ir State licensing fee 5?5 [including l'lne af 5125 fer rate payment} I]. The fallnung cash payments ware pasted tn the paymll accuunt: I Grass em pluvee wages 13M - FICA lempluyer partlunl 4,553 I- Mail-tare taxes lemplmra partinn] 1,2?[1 - Fedemi unamplcwmant ta: 52D 1- State unempluwnint tax 19:! E. Muira's Herticultural Creations had nu unpaid expenses as ef December 31. mm. F. Beginning and ending ins-renters hale nces are sum merited as fellows: REESE! Beglnnlng Balance Ending Halang Cut crwers Same $9300 Futted plants 3.5M 41.400 6. During sate heha's Horticultural Ereatiuns purchased and placed intc seMee the fcrllnwing assets: Descriptien Date Placed Business cf Fulani: intu Sgnrice: W 1.13; Hmimural E! 15%|r IE SEDJ'JEIJ 1% Structure Computer Eysterrr 51'153'15 ILIJDD mesa Dlce Furniture ERNIE 541000 1% Sectllcn 1T9 eiectien was claimed an the Hertimltural Structure and the Computer Stretch-r but anhr 5015 an the afce Furn rture. H. Depreciaole property that Moira's Horticultural Creations purchased and placed into service prior to H115 consisted efthe foliowing: Description Date Placed Adjusted Basis when Businesa of Pmi into Seruice: Placed mtg 55mg; E Computer system Brill-ii" 13 55,501: twill; Computer printer l'i'l Li's-El 100% Flite furniture who! 14 25,3]: lli': Cuttlng equipment TIDE! 15 3,i:i l'i I. Moira's Horticuituml Creations also operates a d-Ell'liI'El'y' van that it pieced into sen-ice on April 16. ID\". Automothre use oonsisted uirtlusirrelirr ofthe use of the itiell'ireryr van. The van was driven a total of 113:!) miles in 2015. Moira's Horticultural Creations has a liirrltten policy prohibiting the personal use of business-owned uehioles. Written documentation also exists justlfuing business use of all businEssvowned vehicles. Moira's Horticultural Creations has ah-rays usecl the automatic mileage method. BttslneSs use has always been 1m percent