Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please help me! I think I did #5 correctly, I got 2.79%. But I am struggling to get problem 6 conepleted. please show

Can someone please help me! I think I did #5 correctly, I got 2.79%. But I am struggling to get problem 6 conepleted. please show work so I can learn and understand!

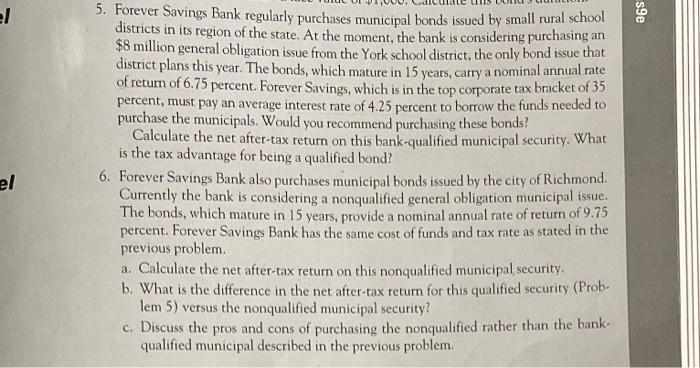

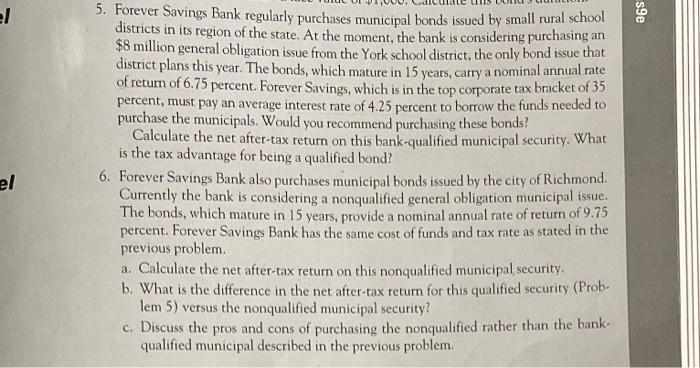

5. Forever Savings Bank regularly purchases municipal bonds issued by small rural school districts in its region of the state. At the moment, the bank is considering purchasing an $8 million general obligation issue from the York school district, the only bond issue that district plans this year. The bonds, which mature in 15 years, carry a nominal annual rate of return of 6.75 percent. Forever Savings, which is in the top corporate tax bracket of 35 percent, must pay an average interest rate of 4.25 percent to borrow the funds needed to purchase the municipals. Would you recommend purchasing these bonds? Calculate the net after-tax return on this bank-qualified municipal security. What is the tax advantage for being a qualified bond? 6. Forever Savings Bank also purchases municipal bonds issued by the city of Richmond. Currently the bank is considering a nonqualified general obligation municipal issue. The bonds, which mature in 15 years, provide a nominal annual rate of return of 9.75 percent. Forever Savings Bank has the same cost of funds and tax rate as stated in the previous problem. a. Calculate the net after-tax return on this nonqualified municipal security. b. What is the difference in the net after-tax return for this qualified security (Problem 5) versus the nonqualified municipal security? c. Discuss the pros and cons of purchasing the nonqualified rather than the bankqualified municipal described in the previous

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started