Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone please help me solve this? thank you. Statement of revenues expenditures, and Unassigned fund balance, 35 activities, 27 Codiflcation of Govermensal Accownting Governmental

can someone please help me solve this? thank you.

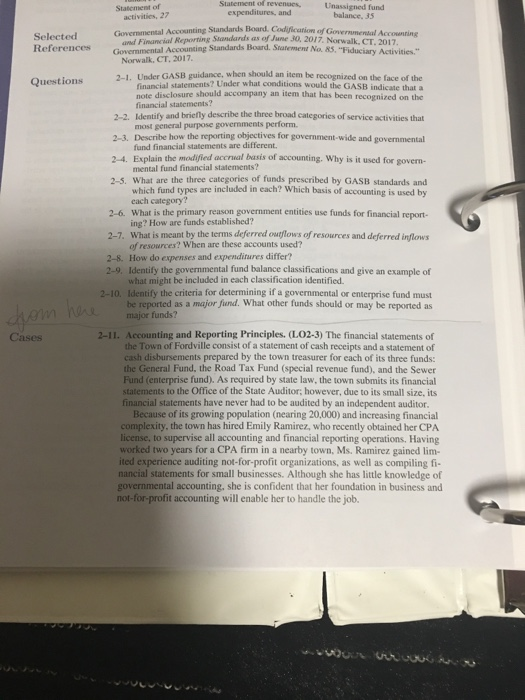

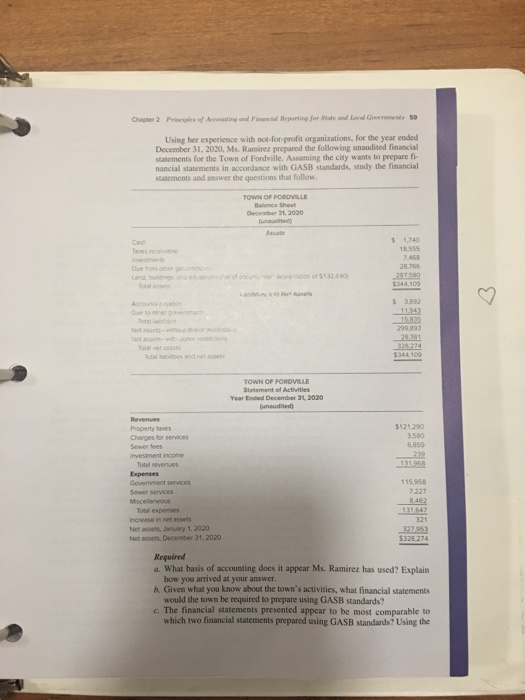

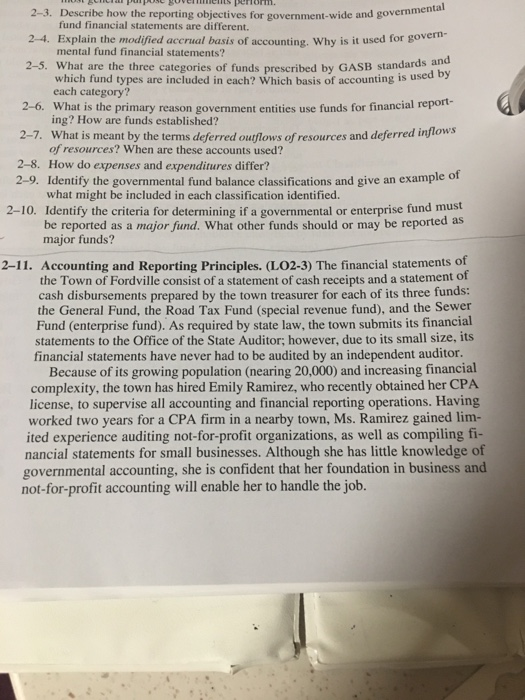

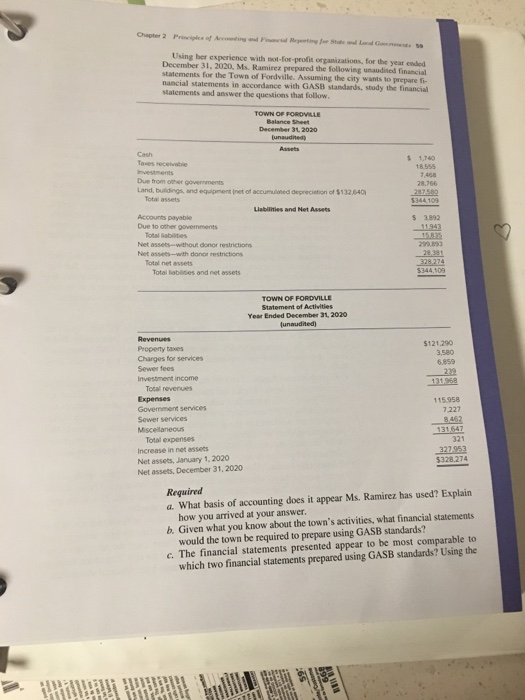

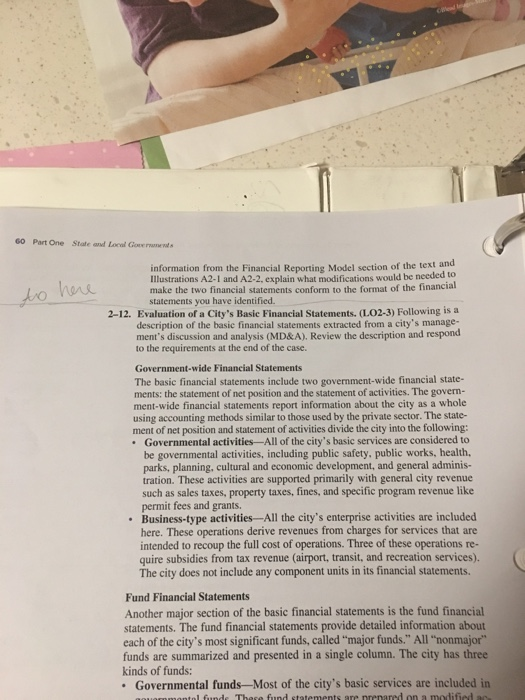

Statement of revenues expenditures, and Unassigned fund balance, 35 activities, 27 Codiflcation of Govermensal Accownting Governmental Accounting Standards Board Selected ReferenceGovemental Accounsting and Financial Reporting Standards as of Jume 30, 2017. Nowal Standards Board. Statement No. 85, "Fiduciary Activities." Norwalk, CT. 2017 Under GASB gu financial statements? Under what note disclosure should accompany an item that has been financial statements? idance, when should an item be recognized on the face of the conditions would the GASB indicate that a recognized on the 2-1. Questions Identify and briefly describe the three broad categories of service activities that Describe how the reporting objectives for govermment-wide and governmental 2-2. 2-3. 2-4. Explain the modifled accrual basis of accounting. Why is it used for 2-5. What are the three categories of funds prescribed by GASB standards and 2-6 What is the primary reason government entities use funds for financial report 2-7. What is meant by the terms deferred ougflows of resources and deferred inflows 2-8. How do expenses and expenditares differ? most general purpose governments perform. fund financial statements are different. mental fund financial statements? which fund types are included in each? Which basis of accounting is used by each category? ing? How are funds established? of resources? When are these accounts used? what might be included in each classification identified. major funds? 2-9, Identify the governmental fund balance classifications and give an example of Identify the criteria for determining if a governmental or enterprise fund must be reported as a major fund. What other funds should or may be reported as 2-10. Cases 2-11. Accounting and Reporting Principles. (L02-3) The financial statements of the Town of Fordville consist of a statement of cash receipts and a statement of cash disbursements prepared by the town treasurer for each of its three funds: the General Fund, the Road Tax Fund (special revenue fund), and the Sewer Fund (enterprise fund). As required by state law, the town submits its financial statements to the Office of the State Auditor; however, due to its small size, its financial statements have never had to be audited by an independent auditor. Because of its growing population (nearing 20,000) and increasing financial complexity, the town has hired Emily Ramirez, who recently obtained her CPA license, to supervise all accounting and financial reporting operations. Having worked two years for a CPA firm in a nearby town, Ms. Ramirez gained lim- ited experience auditing not-for-profit organizations, as well as compiling fi- nancial statements for small businesses. Although she has little knowledge of governmental accounting, she is confident that her foundation in business and not-for-profit accounting will enable her to handle the job. Using her experience with not-for-profit organizations, for the year ended December 31, 2020, Ms. Ramirez prepared the following unaudited financial statements for the Town of Fordville. Assaming the city wants to prepare fi- nancial statements in accordance with GASB standards, study the financial statements and answer the questions that follow TOWN OF FORDWILLE Oecember 31, 2020 S 1,740 18.555 7.468 Due tron other $344,100 5 3,892 299.893 $344 109 TOWN OF FORDVILLE Slatement of Activities Year Ended December 31, 2020 5121,290 Property x Charges for services Sewer fees nvestment income 6850 Totel revenues Expenses 15.958 7.227 Increase in net essets Net assets, January 1, 2020 Net assets, December 31, 2020 321 $328 274 Required a. What basis of accounting does it appear Ms. Ramirez has used? Explain how you arrived at your answer. would the town be required to prepare using GASB standards? which two financial statements prepared using GASB standards? Using the b. Given what you know about the town's activities, what financial statements c. The financial statements presented appear to be most comparable to 60 Part One State and Local Goeerent information from the Fiaancial Reporting Model section of the text and Illustrations A2-I and A2-2, explain what modifications would be needed to wemake the two financial statements conform to the format of the financial ni statements you have identified. 2-12. Evaluation of a City's Basic Financial Statements. (L02-3) Following is a description of the basic financial statements extracted from a city's manage- ment's discussion and analysis (MD&A). Review the description and respond to the requirements at the end of the case. Government-wide Financial Statements The basic financial statements include two government-wide financial state- ments: the statement of net position and the statement of activities. The govern- ment-wide financial statements report information about the city as a whole using accounting methods similar to those used by the private sector. The state- ment of net position and statement of activities divide the city into the following: Governmental activities-All of the city's basic services are considered to be governmental activities, including public safety, public works, health, parks, planning, cultural and economic development, and general adminis- tration. These activities are supported primarily with general city revenue such as sales taxes, property taxes, fines, and specific program revenue like permit fees and grants. Business-type activities-All the city's enterprise activities are included here. These operations derive revenues from charges for services that are 2-3. Describe how the reporting objectives for government-wide and governmenta fund financial statements are different. 2-4. Explain the modified accrual basis of accounting. Why is it used for govern 2-5. What are the three categories of funds prescribed by GASB standards an 2-6. What is the primary reason government entities use funds for financial repot 2-7. What is meant by the terms deferred outflows of resources and deferred inflows 2-8. How do expenses and expenditures differ? mental fund financial statements? which fund types are included in each? Which basis of accounting is used by each category? ing? How are funds established? of resources? When are these accounts used? of 2-9. Identify the governmental fund balance classifications and give an example what might be included in each classification identified. Identify the criteria for determining if a governmental or enterprise fund must be reported as a major fund. What other funds should or may be reported 2-10. as major funds? ments of statement of 2-11. Accounting and Reporting Principles. (LO2-3) The financial state the Town of Fordville consist of a statement of cash receipts and a cash disbursements prepared by the town treasurer for each of its three funds: the General Fund, the Road Tax Fund (special revenue fund), and the Sewer Fund (enterprise fund). As required by state law, the town submits its financial statements to the Office of the State Auditor; however, due to its small size, its financial statements have never had to be audited by an independent auditor. Because of its growing population (nearing 20,000) and increasing financial complexity, the town has hired Emily Ramirez, who recently obtained her CPA license, to supervise all accounting and financial reporting operations. Having worked two years for a CPA firm in a nearby town, Ms. Ramirez gained lim- ited experience auditing not-for-profit organizations, as well as compiling fi- nancial statements for small businesses. Although she has little knowledge of governmental accounting, she is confident that her foundation in business and not-for-profit accounting will enable her to handle the job. her experience with not-for-profit organizations, for the year ended December 31. 2020, Ms. Ramirez prepared the following unaudined financial statements for the Town of Fordville. Assuming the city wants to prepare fi nancial statements in accordance with GASB standards, study the financial statements and answer the questions that follow TOWN OF FORDVIALE Balance Sheet December 31, 2020 % 1,740 18.555 7.468 Tases seceib Due from other govermments Land, buildings, and equipment inet of accumuianed depreciation of $132.840 Total assets $344 109 Liabilinies and Net s 3892 Accounts payable Due to other govenments Total Sabilities Net assets-without donor restrictions 219.893 Net assees-with donor restrictions Total net assets 328274 Total labitsies and net assets TOWN OF FORDVILLE Year Ended December 31,2020 Revenues Property taxes Charges for services Sewer fees investment income $121.290 3,580 6.859 239 1968 Total revenues 115.958 Government services Sewer services Miscellaneous 7227 131.647 321 Total expenses 327953 328,274 Net assets, January 1, 2020 Net assets, December 31, 2020 Required a. What basis of accounting does it appear Ms. Ramirez has used? Explain how you arrived at your answer. would the town be required to prepare using GASB standards? which two financial statements prepared using GASB standards? Using the b. Given what you know about the town's activities, what financial statements c. The financial statements presented appear to be most comparable to Go Part One State and Local Gon information from the Financial Reporting Model section of the text and Illustrations A2-1 and A2-2, explain what modifications would be needed to make the two financial statements conform to the format of the financial statements you have identified. 2-12. Evaluation of a City's Basic Financial Statements. (1.O2-3) Following is a description of the basic financial statements extracted from a city's manage- ment's discussion and analysis (MD&A). Review the description and respond to the requirements at the end of the case. Government-wide Financial Statements The basic financial statements include two government-wide financial state- ments: the statement of net position and the statement of activities. The govern- ment-wide financial statements report information about the city as a whole using accounting methods similar to those used by the private sector. The state- ment of net position and statement of activities divide the city into the following: Governmental activities-All of the city's basic services are considered to be governmental activities, including public safety, public works, health, parks, planning, cultural and economic development, and general adminis- tration. These activities are supported primarily with general city revenue such as sales taxes, property taxes, fines, and specific program revenue like permit fees and grants Business-type activities-All the city's enterprise activities are included here. These operations derive revenues from charges for services that are intended to recoup the full cost of operations. Three of these operations re- quire subsidies from tax revenue (airport, transit, and recreation services). The city does not include any component units in its financial statements. Fund Financial Statements Another major section of the basic financial statements is the fund financial statements. The fund financial statements provide detailed information about each of the city's most significant funds, called "major funds." All "nonmajor" funds are summarized and presented in a single column. The city has three kinds of funds: Governmental funds-Most of the city's basic services are included in Statement of revenues expenditures, and Unassigned fund balance, 35 activities, 27 Codiflcation of Govermensal Accownting Governmental Accounting Standards Board Selected ReferenceGovemental Accounsting and Financial Reporting Standards as of Jume 30, 2017. Nowal Standards Board. Statement No. 85, "Fiduciary Activities." Norwalk, CT. 2017 Under GASB gu financial statements? Under what note disclosure should accompany an item that has been financial statements? idance, when should an item be recognized on the face of the conditions would the GASB indicate that a recognized on the 2-1. Questions Identify and briefly describe the three broad categories of service activities that Describe how the reporting objectives for govermment-wide and governmental 2-2. 2-3. 2-4. Explain the modifled accrual basis of accounting. Why is it used for 2-5. What are the three categories of funds prescribed by GASB standards and 2-6 What is the primary reason government entities use funds for financial report 2-7. What is meant by the terms deferred ougflows of resources and deferred inflows 2-8. How do expenses and expenditares differ? most general purpose governments perform. fund financial statements are different. mental fund financial statements? which fund types are included in each? Which basis of accounting is used by each category? ing? How are funds established? of resources? When are these accounts used? what might be included in each classification identified. major funds? 2-9, Identify the governmental fund balance classifications and give an example of Identify the criteria for determining if a governmental or enterprise fund must be reported as a major fund. What other funds should or may be reported as 2-10. Cases 2-11. Accounting and Reporting Principles. (L02-3) The financial statements of the Town of Fordville consist of a statement of cash receipts and a statement of cash disbursements prepared by the town treasurer for each of its three funds: the General Fund, the Road Tax Fund (special revenue fund), and the Sewer Fund (enterprise fund). As required by state law, the town submits its financial statements to the Office of the State Auditor; however, due to its small size, its financial statements have never had to be audited by an independent auditor. Because of its growing population (nearing 20,000) and increasing financial complexity, the town has hired Emily Ramirez, who recently obtained her CPA license, to supervise all accounting and financial reporting operations. Having worked two years for a CPA firm in a nearby town, Ms. Ramirez gained lim- ited experience auditing not-for-profit organizations, as well as compiling fi- nancial statements for small businesses. Although she has little knowledge of governmental accounting, she is confident that her foundation in business and not-for-profit accounting will enable her to handle the job. Using her experience with not-for-profit organizations, for the year ended December 31, 2020, Ms. Ramirez prepared the following unaudited financial statements for the Town of Fordville. Assaming the city wants to prepare fi- nancial statements in accordance with GASB standards, study the financial statements and answer the questions that follow TOWN OF FORDWILLE Oecember 31, 2020 S 1,740 18.555 7.468 Due tron other $344,100 5 3,892 299.893 $344 109 TOWN OF FORDVILLE Slatement of Activities Year Ended December 31, 2020 5121,290 Property x Charges for services Sewer fees nvestment income 6850 Totel revenues Expenses 15.958 7.227 Increase in net essets Net assets, January 1, 2020 Net assets, December 31, 2020 321 $328 274 Required a. What basis of accounting does it appear Ms. Ramirez has used? Explain how you arrived at your answer. would the town be required to prepare using GASB standards? which two financial statements prepared using GASB standards? Using the b. Given what you know about the town's activities, what financial statements c. The financial statements presented appear to be most comparable to 60 Part One State and Local Goeerent information from the Fiaancial Reporting Model section of the text and Illustrations A2-I and A2-2, explain what modifications would be needed to wemake the two financial statements conform to the format of the financial ni statements you have identified. 2-12. Evaluation of a City's Basic Financial Statements. (L02-3) Following is a description of the basic financial statements extracted from a city's manage- ment's discussion and analysis (MD&A). Review the description and respond to the requirements at the end of the case. Government-wide Financial Statements The basic financial statements include two government-wide financial state- ments: the statement of net position and the statement of activities. The govern- ment-wide financial statements report information about the city as a whole using accounting methods similar to those used by the private sector. The state- ment of net position and statement of activities divide the city into the following: Governmental activities-All of the city's basic services are considered to be governmental activities, including public safety, public works, health, parks, planning, cultural and economic development, and general adminis- tration. These activities are supported primarily with general city revenue such as sales taxes, property taxes, fines, and specific program revenue like permit fees and grants. Business-type activities-All the city's enterprise activities are included here. These operations derive revenues from charges for services that are 2-3. Describe how the reporting objectives for government-wide and governmenta fund financial statements are different. 2-4. Explain the modified accrual basis of accounting. Why is it used for govern 2-5. What are the three categories of funds prescribed by GASB standards an 2-6. What is the primary reason government entities use funds for financial repot 2-7. What is meant by the terms deferred outflows of resources and deferred inflows 2-8. How do expenses and expenditures differ? mental fund financial statements? which fund types are included in each? Which basis of accounting is used by each category? ing? How are funds established? of resources? When are these accounts used? of 2-9. Identify the governmental fund balance classifications and give an example what might be included in each classification identified. Identify the criteria for determining if a governmental or enterprise fund must be reported as a major fund. What other funds should or may be reported 2-10. as major funds? ments of statement of 2-11. Accounting and Reporting Principles. (LO2-3) The financial state the Town of Fordville consist of a statement of cash receipts and a cash disbursements prepared by the town treasurer for each of its three funds: the General Fund, the Road Tax Fund (special revenue fund), and the Sewer Fund (enterprise fund). As required by state law, the town submits its financial statements to the Office of the State Auditor; however, due to its small size, its financial statements have never had to be audited by an independent auditor. Because of its growing population (nearing 20,000) and increasing financial complexity, the town has hired Emily Ramirez, who recently obtained her CPA license, to supervise all accounting and financial reporting operations. Having worked two years for a CPA firm in a nearby town, Ms. Ramirez gained lim- ited experience auditing not-for-profit organizations, as well as compiling fi- nancial statements for small businesses. Although she has little knowledge of governmental accounting, she is confident that her foundation in business and not-for-profit accounting will enable her to handle the job. her experience with not-for-profit organizations, for the year ended December 31. 2020, Ms. Ramirez prepared the following unaudined financial statements for the Town of Fordville. Assuming the city wants to prepare fi nancial statements in accordance with GASB standards, study the financial statements and answer the questions that follow TOWN OF FORDVIALE Balance Sheet December 31, 2020 % 1,740 18.555 7.468 Tases seceib Due from other govermments Land, buildings, and equipment inet of accumuianed depreciation of $132.840 Total assets $344 109 Liabilinies and Net s 3892 Accounts payable Due to other govenments Total Sabilities Net assets-without donor restrictions 219.893 Net assees-with donor restrictions Total net assets 328274 Total labitsies and net assets TOWN OF FORDVILLE Year Ended December 31,2020 Revenues Property taxes Charges for services Sewer fees investment income $121.290 3,580 6.859 239 1968 Total revenues 115.958 Government services Sewer services Miscellaneous 7227 131.647 321 Total expenses 327953 328,274 Net assets, January 1, 2020 Net assets, December 31, 2020 Required a. What basis of accounting does it appear Ms. Ramirez has used? Explain how you arrived at your answer. would the town be required to prepare using GASB standards? which two financial statements prepared using GASB standards? Using the b. Given what you know about the town's activities, what financial statements c. The financial statements presented appear to be most comparable to Go Part One State and Local Gon information from the Financial Reporting Model section of the text and Illustrations A2-1 and A2-2, explain what modifications would be needed to make the two financial statements conform to the format of the financial statements you have identified. 2-12. Evaluation of a City's Basic Financial Statements. (1.O2-3) Following is a description of the basic financial statements extracted from a city's manage- ment's discussion and analysis (MD&A). Review the description and respond to the requirements at the end of the case. Government-wide Financial Statements The basic financial statements include two government-wide financial state- ments: the statement of net position and the statement of activities. The govern- ment-wide financial statements report information about the city as a whole using accounting methods similar to those used by the private sector. The state- ment of net position and statement of activities divide the city into the following: Governmental activities-All of the city's basic services are considered to be governmental activities, including public safety, public works, health, parks, planning, cultural and economic development, and general adminis- tration. These activities are supported primarily with general city revenue such as sales taxes, property taxes, fines, and specific program revenue like permit fees and grants Business-type activities-All the city's enterprise activities are included here. These operations derive revenues from charges for services that are intended to recoup the full cost of operations. Three of these operations re- quire subsidies from tax revenue (airport, transit, and recreation services). The city does not include any component units in its financial statements. Fund Financial Statements Another major section of the basic financial statements is the fund financial statements. The fund financial statements provide detailed information about each of the city's most significant funds, called "major funds." All "nonmajor" funds are summarized and presented in a single column. The city has three kinds of funds: Governmental funds-Most of the city's basic services are included in Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started