can someone please help me with 1.1,1.4,1.5,1.6

can someone please help me with 1.1,1.4,1.5,1.6

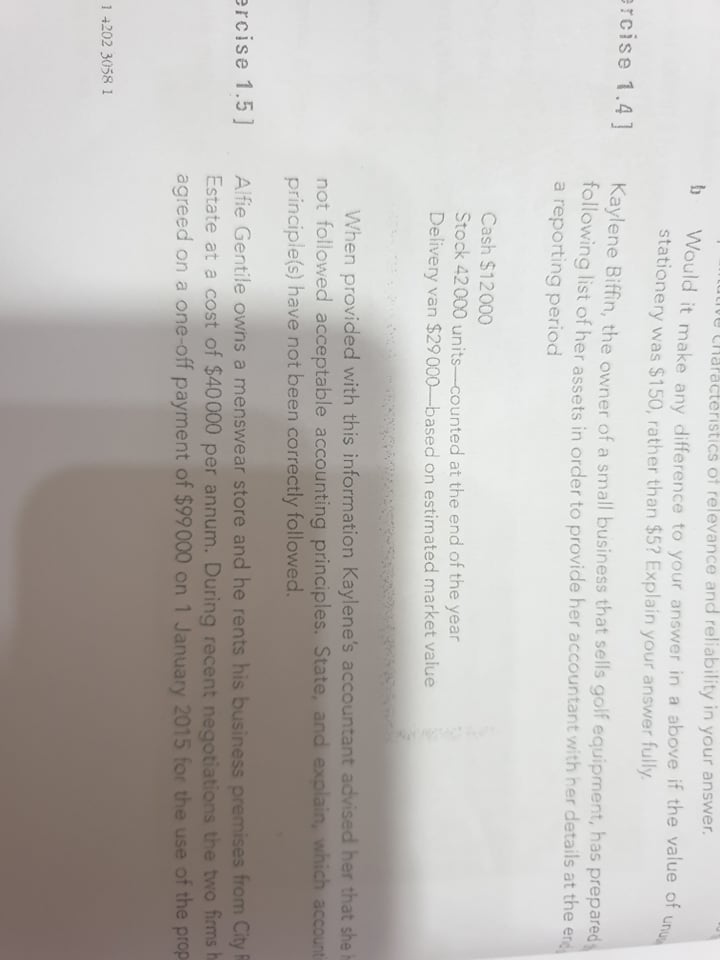

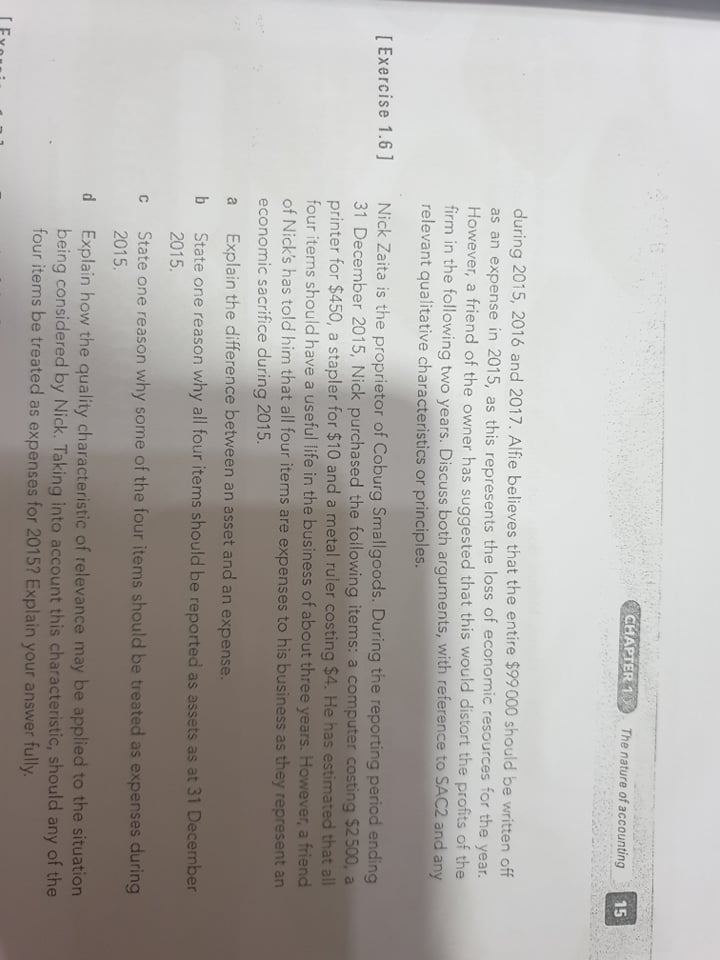

UNTING Units 3&4 tical exercises Melbourne Magazines publishes a range of magazines that are sold only to priv: subscribers. The business accepts prepaid subscriptions whereby customers can pay in advance for a one, two or three-year subscription. During 2015 the firm received a total o $180 000 for its three-year subscriptions covering the years 2016, 2017 and 2018. How should the $180 000 be reported in the general purpose reports of Melbourne Magazines for the year 2015? Your answer should discuss whether or not the amount in question should be treated as a revenue item or a liability item. You should also make reference to the definitions of the key elements of accounting from SAC2 to justif your answer. In order to keep track of her business transactions, the proprietor of Superior Appliance borrows a computer from her sister on a regular basis. The system cost $3000 two years ago and has recently been valued at $1800. a How should the computer be treated in the hooks of Sunri ve Characteristics of relevance and reliability in your answer. would it make any difference to your answer in a above if the value of unus stationery was $150, rather than $5? Explain your answer fully. ercise 1.4] Kaylene Biffin, the owner of a small business that sells golf equipment, has prepared following list of her assets in order to provide her accountant with her details at the end a reporting period Cash $12000 Stock 42000 units-counted at the end of the year Delivery van $29000-based on estimated market value When provided with this information Kaylene's accountant advised her that she not followed acceptable accounting principles. State, and explain which account principle(s) have not been correctly followed. ercise 1.5 ] Alfie Gentile owns a menswear store and he rents his business premises from City Estate at a cost of $40000 per annum. During recent negotiations the two fim agreed on a one-off payment of $99000 on 1 January 2015 for the use of the prop 1 +202 30581 CHAPTER 13. The nature of accounting 15 during 2015, 2016 and 2017. Alfie believes that the entire $99 000 should be written off as an expense in 2015, as this represents the loss of economic resources for the year. However, a friend of the owner has suggested that this would distort the profits of the firm in the following two years. Discuss both arguments, with reference to SAC2 and any relevant qualitative characteristics or principles. [ Exercise 1.6] Nick Zaita is the proprietor of Coburg Smallgoods. During the reporting period ending 31 December 2015, Nick purchased the following items: a computer costing $2500, a printer for $450, a stapler for $10 and a metal ruler costing $4. He has estimated that all four items should have a useful life in the business of about three years. However, a friend of Nick's has told him that all four items are expenses to his business as they represent an economic sacrifice during 2015. a Explain the difference between an asset and an expense. b State one reason why all four items should be reported as assets as at 31 December 2015. State one reason why some of the four items should be treated as expenses during 2015 d Explain how the quality characteristic of relevance may be applied to the situation being considered by Nick. Taking into account this characteristic, should any of the four items be treated as expenses for 2015? Explain your answer fully IFY 11

can someone please help me with 1.1,1.4,1.5,1.6

can someone please help me with 1.1,1.4,1.5,1.6