can someone please help me with some accounting homework

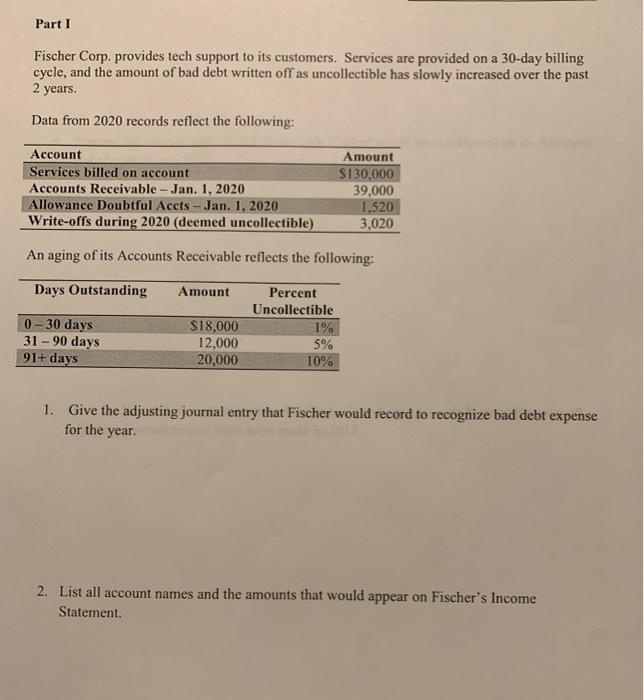

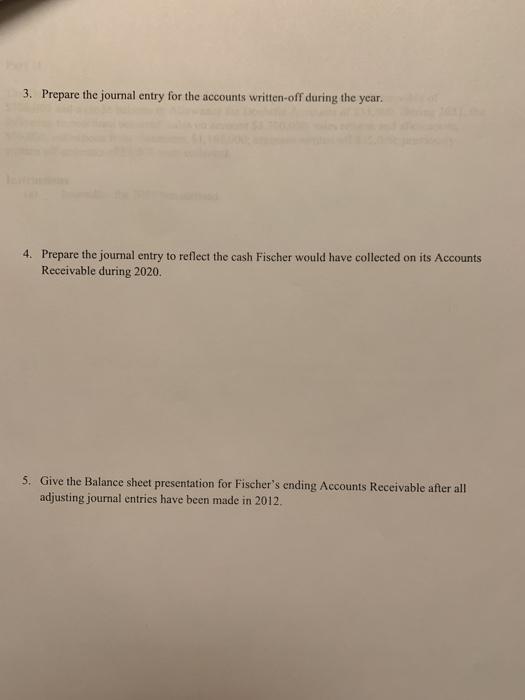

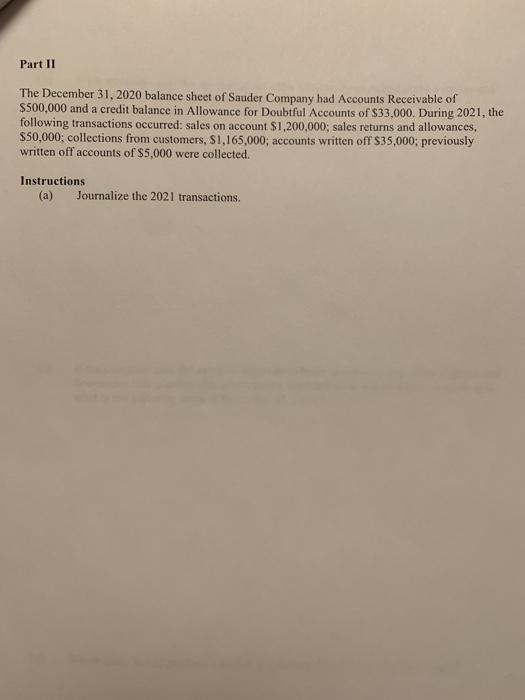

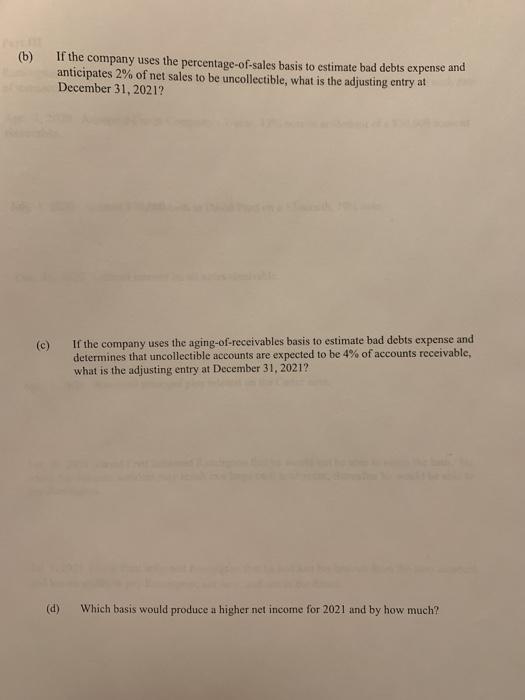

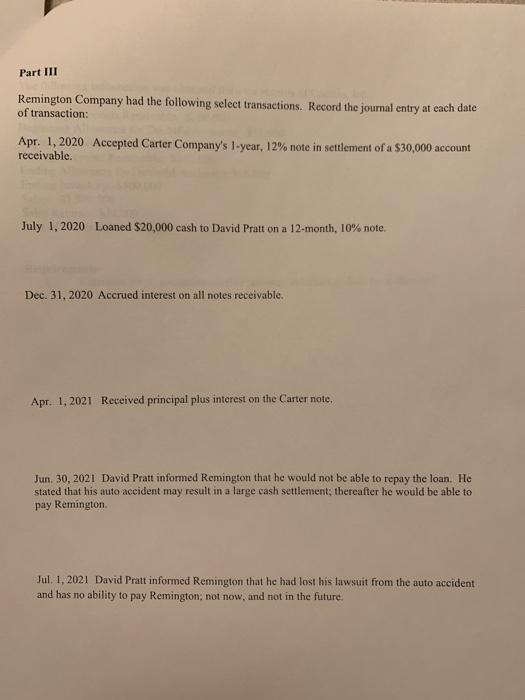

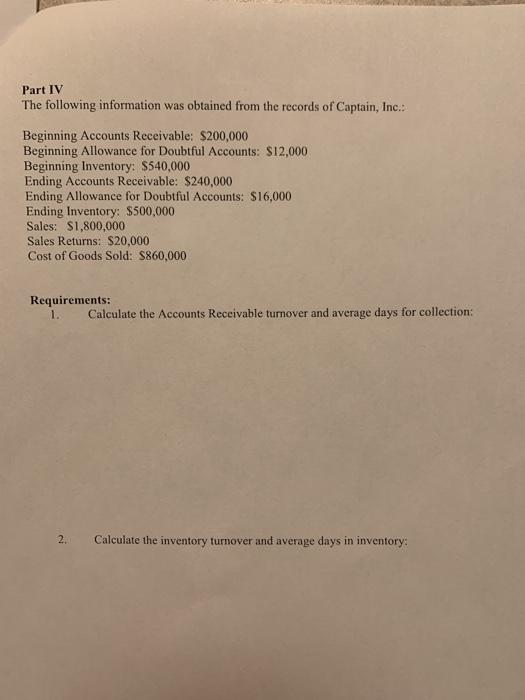

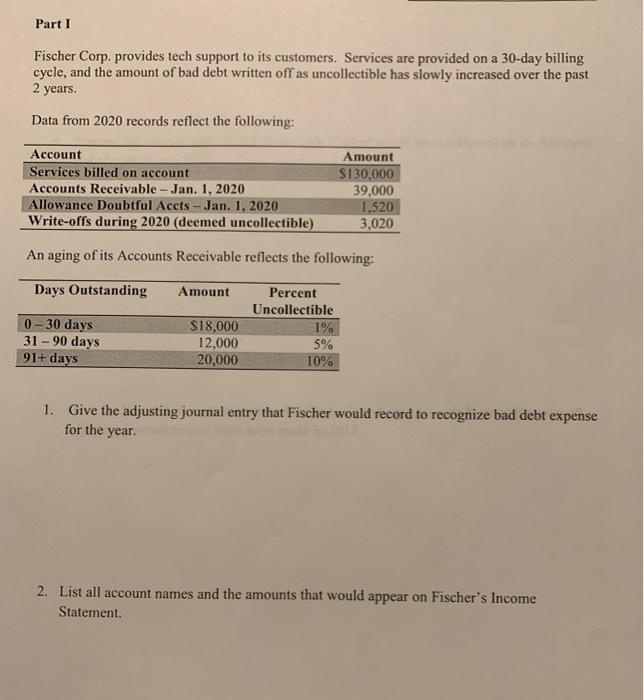

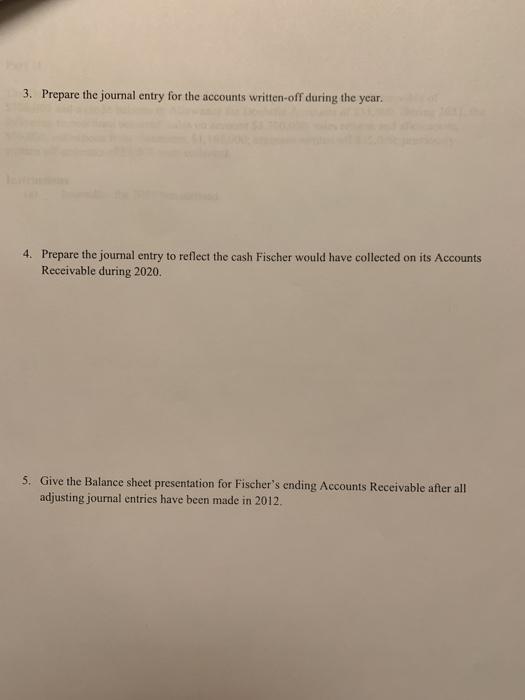

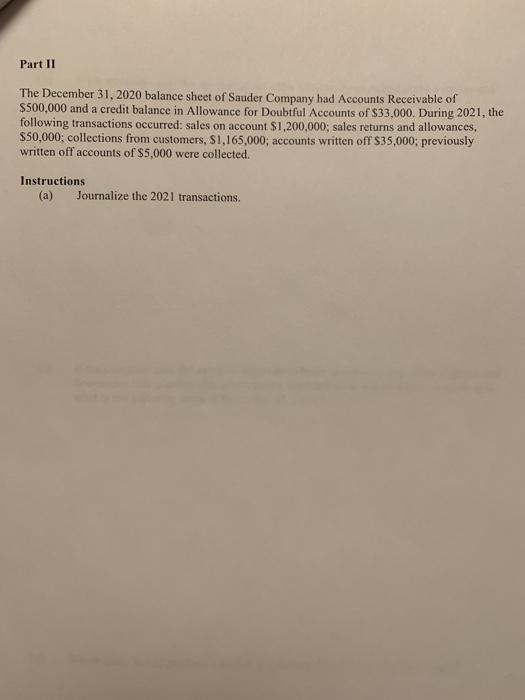

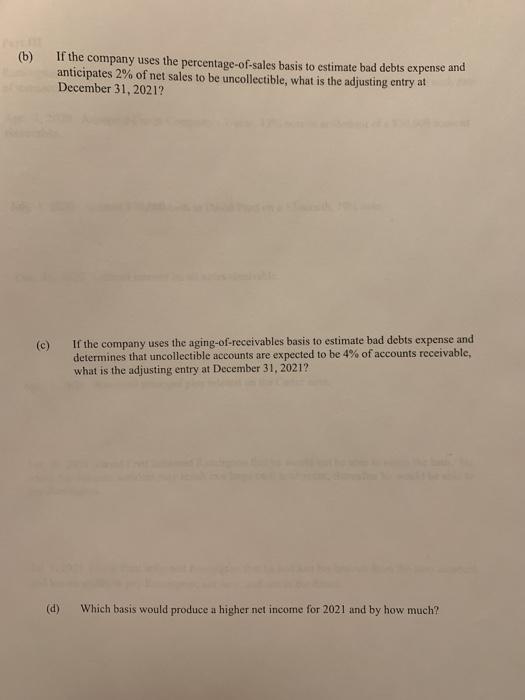

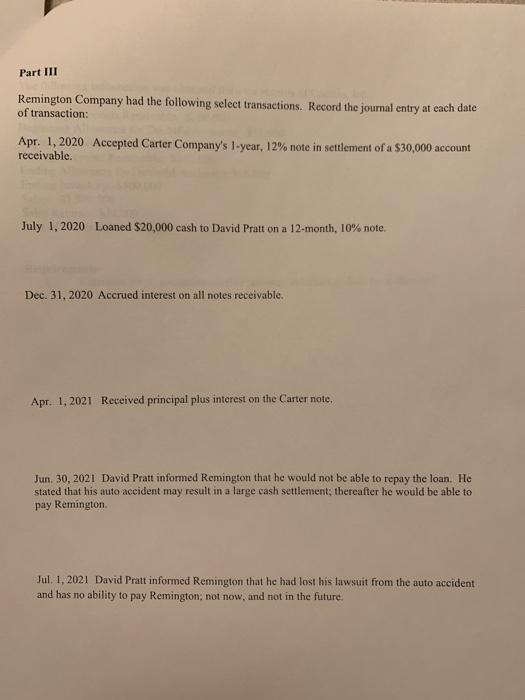

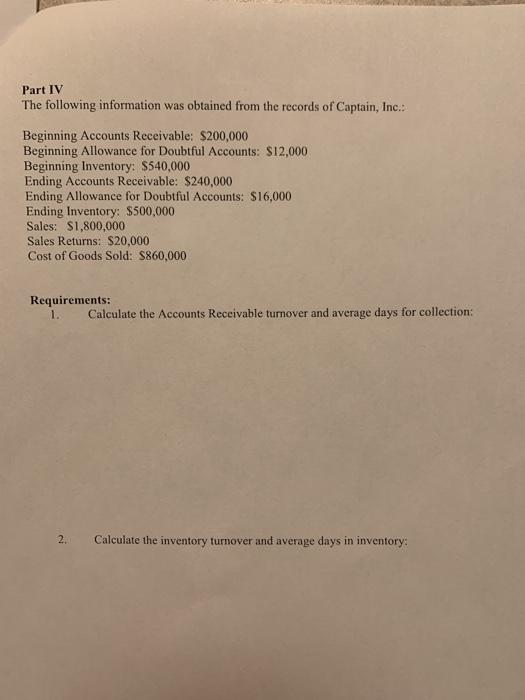

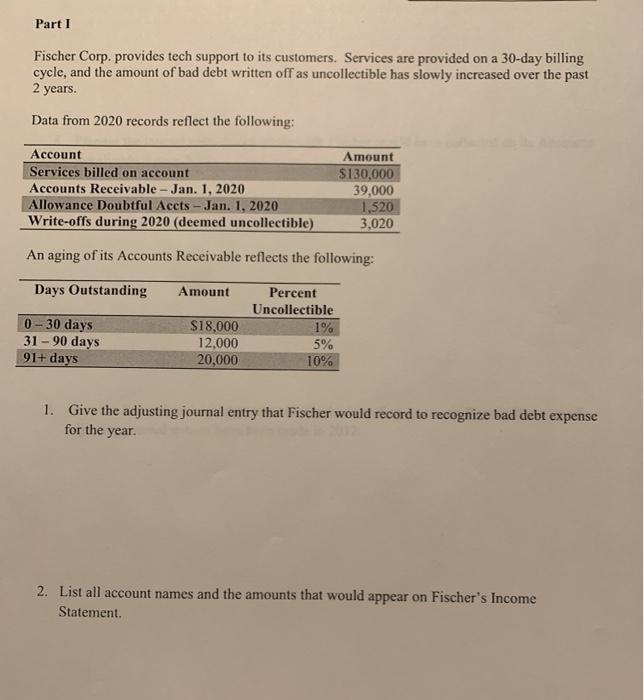

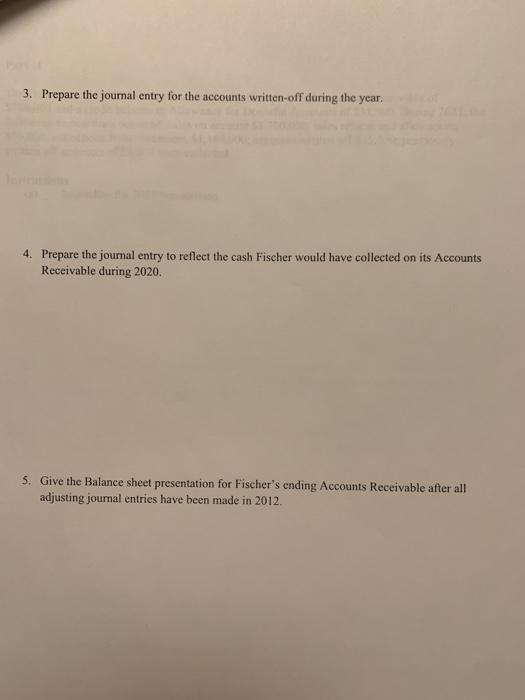

Part I Fischer Corp. provides tech support to its customers. Services are provided on a 30-day billing cycle, and the amount of bad debt written off as uncollectible has slowly increased over the past 2 years. Data from 2020 records reflect the following: Account Services billed on account Accounts Receivable - Jan. 1, 2020 Allowance Doubtful Accts - Jan. 1, 2020 Write-offs during 2020 (deemed uncollectible) Amount $130,000 39,000 1,520 3,020 An aging of its Accounts Receivable reflects the following: Days Outstanding Amount 0 - 30 days 31 - 90 days 91+ days $18,000 12,000 20,000 Percent Uncollectible 1% 5% 10% 1. Give the adjusting journal entry that Fischer would record to recognize bad debt expense for the year. 2. List all account names and the amounts that would appear on Fischer's Income Statement 3. Prepare the journal entry for the accounts written-off during the year. 4. Prepare the journal entry to reflect the cash Fischer would have collected on its Accounts Receivable during 2020. 5. Give the Balance sheet presentation for Fischer's ending Accounts Receivable after all adjusting journal entries have been made in 2012. Part II The December 31, 2020 balance sheet of Sauder Company had Accounts Receivable of $500,000 and a credit balance in Allowance for Doubtful Accounts of $33,000. During 2021, the following transactions occurred: sales on account $1,200,000; sales returns and allowances, $50,000; collections from customers, S1,165,000; accounts written off $35,000; previously written off accounts of $5,000 were collected. Instructions (a) Journalize the 2021 transactions. (b) If the company uses the percentage-of-sales basis to estimate bad debts expense and anticipates 2% of net sales to be uncollectible, what is the adjusting entry at December 31, 2021? (e) If the company uses the aging-of-receivables basis to estimate bad debts expense and determines that uncollectible accounts are expected to be 4% of accounts receivable, what is the adjusting entry at December 31, 2021? (d) Which basis would produce a higher net income for 2021 and by how much? Part III Remington Company had the following select transactions. Record the journal entry at each date of transaction: Apr. 1, 2020 Accepted Carter Company's 1-year, 12% note in settlement of a $30,000 account receivable. July 1, 2020 Loaned $20,000 cash to David Pratt on a 12-month, 10% note. Dec. 31, 2020 Accrued interest on all notes receivable. Apr. 1.2021 Received principal plus interest on the Carter note. Jun 30, 2021 David Pratt informed Remington that he would not be able to repay the loan. He stated that his auto accident may result in a large cash settlement; thereafter he would be able to pay Remington Jul 1, 2021 David Pratt informed Remington that he had lost his lawsuit from the auto accident and has no ability to pay Remington; not now, and not in the future. Part IV The following information was obtained from the records of Captain, Inc.: Beginning Accounts Receivable: $200,000 Beginning Allowance for Doubtful Accounts: $12,000 Beginning Inventory: $540,000 Ending Accounts Receivable: $240,000 Ending Allowance for Doubtful Accounts: $16,000 Ending Inventory: $500,000 Sales: $1,800,000 Sales Returns: $20,000 Cost of Goods Sold: $860,000 Requirements: 1. Calculate the Accounts Receivable turnover and average days for collection: 2. Calculate the inventory turnover and average days in inventory: Part I Fischer Corp. provides tech support to its customers. Services are provided on a 30-day billing cycle, and the amount of bad debt written off as uncollectible has slowly increased over the past 2 years. Data from 2020 records reflect the following: Account Services billed on account Accounts Receivable - Jan. 1, 2020 Allowance Doubtful Accts - Jan. 1, 2020 Write-offs during 2020 (deemed uncollectible) Amount $130,000 39,000 1,520 3,020 An aging of its Accounts Receivable reflects the following: Days Outstanding Amount 0 - 30 days 31 - 90 days 91+ days $18,000 12,000 20,000 Percent Uncollectible 1% 5% 10% 1. Give the adjusting journal entry that Fischer would record to recognize bad debt expense for the year. 2. List all account names and the amounts that would appear on Fischer's Income Statement 3. Prepare the journal entry for the accounts written-off during the year. 4. Prepare the journal entry to reflect the cash Fischer would have collected on its Accounts Receivable during 2020. 5. Give the Balance sheet presentation for Fischer's ending Accounts Receivable after all adjusting journal entries have been made in 2012