can someone please help me with the first 4 parts to this question with its excel sheet?

thank you

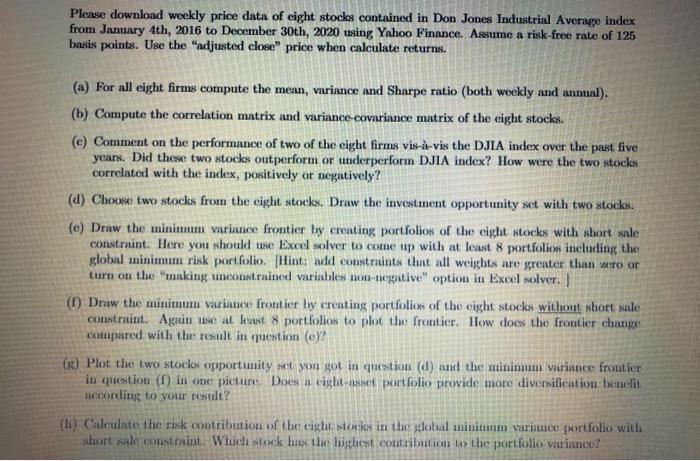

Please download weekly price data of eight stocks contained in Don Jones Industrial Average index from January 4th, 2016 to December 30th, 2020 using Yahoo Finance. Assume a risk-free rate of 125 basis points. Use the "adjusted close" price when calculate returns. (a) For all eight firms compute the mean, variance and Sharpe ratio (both weekly and annual). (b) Compute the correlation matrix and variance-Covariance matrix of the eight stocks. (c) Comment on the performance of two of the eight firms vis--vis the DJIA index over the past five years. Did these two stocks outperform or underperform DJIA index? How were the two stocks correlated with the index, positively or negatively? (d) Choose two stocks from the cight stocks. Draw the investment opportunity set with two stocks. (e) Draw the minimum variance frontier by creating portfolios of the cight stocks with short sale constraint. Here you should use Excel solver to come up with at least 8 portfolios including the global minimum risk portfolio. (Hint: add constraints that all weights are greater than were or turn on the making unconstrained variables non-negative" option in Excel solver. | () Draw the minimum variance frontier lvy creating portfolios of the eight stocks without short sale constraint. Again use at kast 8 portfolios to plot the frontier. How does the frontier change compared with the result in question (c)? (8) Plot the two stocks opportunity set you got in question (d) and the minimum variance frontier in question (1) in one picture Does a cight-asset portfolio prowide more diversification benefit wccording to your result? (1) Calculate the risk contribution of the eight stoken in the global minimum variance portfolio with short sale constraint. Which took us the highest contribution to the portfolio variance? Please download weekly price data of eight stocks contained in Don Jones Industrial Average index from January 4th, 2016 to December 30th, 2020 using Yahoo Finance. Assume a risk-free rate of 125 basis points. Use the "adjusted close" price when calculate returns. (a) For all eight firms compute the mean, variance and Sharpe ratio (both weekly and annual). (b) Compute the correlation matrix and variance-Covariance matrix of the eight stocks. (c) Comment on the performance of two of the eight firms vis--vis the DJIA index over the past five years. Did these two stocks outperform or underperform DJIA index? How were the two stocks correlated with the index, positively or negatively? (d) Choose two stocks from the cight stocks. Draw the investment opportunity set with two stocks. (e) Draw the minimum variance frontier by creating portfolios of the cight stocks with short sale constraint. Here you should use Excel solver to come up with at least 8 portfolios including the global minimum risk portfolio. (Hint: add constraints that all weights are greater than were or turn on the making unconstrained variables non-negative" option in Excel solver. | () Draw the minimum variance frontier lvy creating portfolios of the eight stocks without short sale constraint. Again use at kast 8 portfolios to plot the frontier. How does the frontier change compared with the result in question (c)? (8) Plot the two stocks opportunity set you got in question (d) and the minimum variance frontier in question (1) in one picture Does a cight-asset portfolio prowide more diversification benefit wccording to your result? (1) Calculate the risk contribution of the eight stoken in the global minimum variance portfolio with short sale constraint. Which took us the highest contribution to the portfolio variance