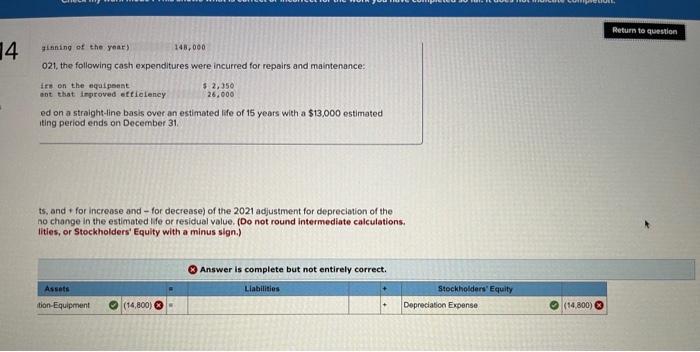

Can someone please help me with the values in red? TY!

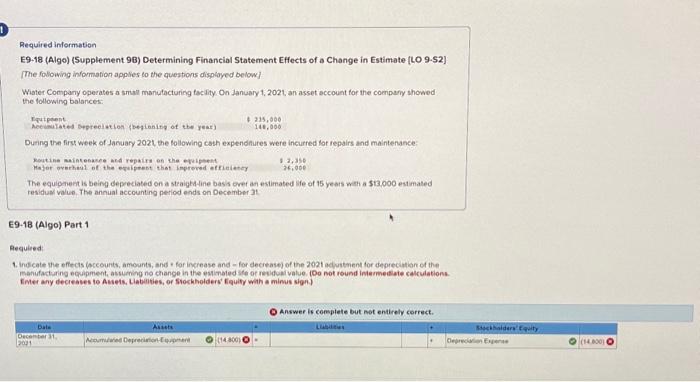

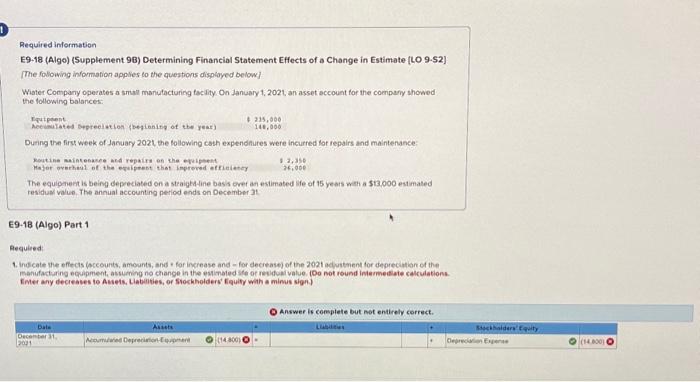

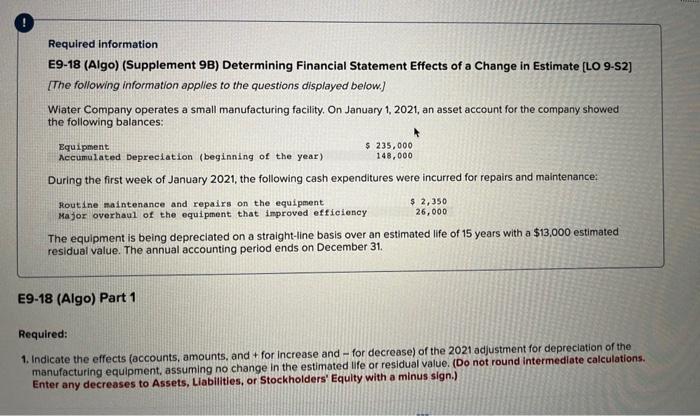

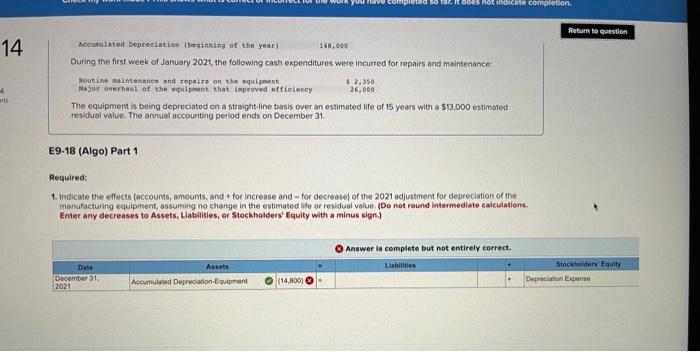

Required information E9-18 (Algo) (Supplement 98) Determining Financial Statement Effects of a Change in Estimate [LO 9-52] [The following information applies to the questions displaycd below] Wiater Company operates a small manutacturing factity. On January 1, 2021, an asset occount for the compery showed the following balances: reipipent 141,000214,000 During the firu week of January 202 t the following cash expendaures were incurred for fepairs and maintenance: 37,35 The equipment is being depreciated on a straightine basis oref an estimated ife of 15 years with a 513.000 estimated residual value. The annual accounting period ends on Dectember 3t E9-18 (Algo) Part 1 Pequieed: Emer any decreases to Absets, Liebilities, of Siockholders' Equify with a mimus sign) Required information E9-18 (Algo) (Supplement 9B) Determining Financial Statement Effects of a Change in Estimate [LO 9-S2] [The following information applies to the questions displayed below.] Wiater Company operates a small manufacturing facility. On January 1, 2021, an asset account for the company showed the following balances: Equipment Accumulated Depreciation (beginning of the year) $235,000 During the first week of January 2021, the following cash expenditures were incurred for repairs and maintenance: Routine maintenance and repairs on the equipment Major overhaul of the equipment that improved efficioncy $2,350 26,000 The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $13,000 estimated residual value. The annual accounting period ends on December 31. E9-18 (Algo) Part 1 Required: 1. Indicate the effects (accounts, amounts, and + for increase and - for decrease) of the 2021 adjustment for depreciation of the manufacturing equipment, assuming no change in the estimated ife or residual value. (Do not round intermediate calculations. Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.) Nocunalatod Depreciation (bezinning of the year) 146,000 Duning the first week of January 2021, the following cash expenditures were incurred for repairs and maintenance: goutine maintenance nod ropaire on the equipent major overhaul of the equipmest that inproved affioienoy 12,25026,000 The equipmem is being depreclated on a straight-line basis over an estimated life of 15 years with a 513,000 estimated residual value. The annual accounting perlod ends on December 31. E9-18 (Algo) Part 1 Required: 1. Indicate the effects faccounts, amounts, and + for increase and - for decrease) of the 2021 adjustment for depreciation of the monufacturing equipment, assuming no change in the estimated hite or residual value. (Do not round intermediate calculations. Enter any decreases to Assets, Labilities, or Stockholders' Equity with a minus sign-) gining of the; year) 148,090 021, the following cash expenditures were incurred for repairs and maintenance: Irt on the equipene at that inproved eftiolency 3. 2,350 26,000 ed on a straight-line basis over an estimated life of 15 years with a $13,000 estimated iting period ends on December 31 . ts, and + for increase and - for decrease) of the 2021 adjustment for depreciation of the no change in the estimated life or residual value. (Do not round intermediate calculations. lities, or Stockholders' Equity with a minus sign.) Q Answer is complete but not entirely correct