Can someone please help me with these

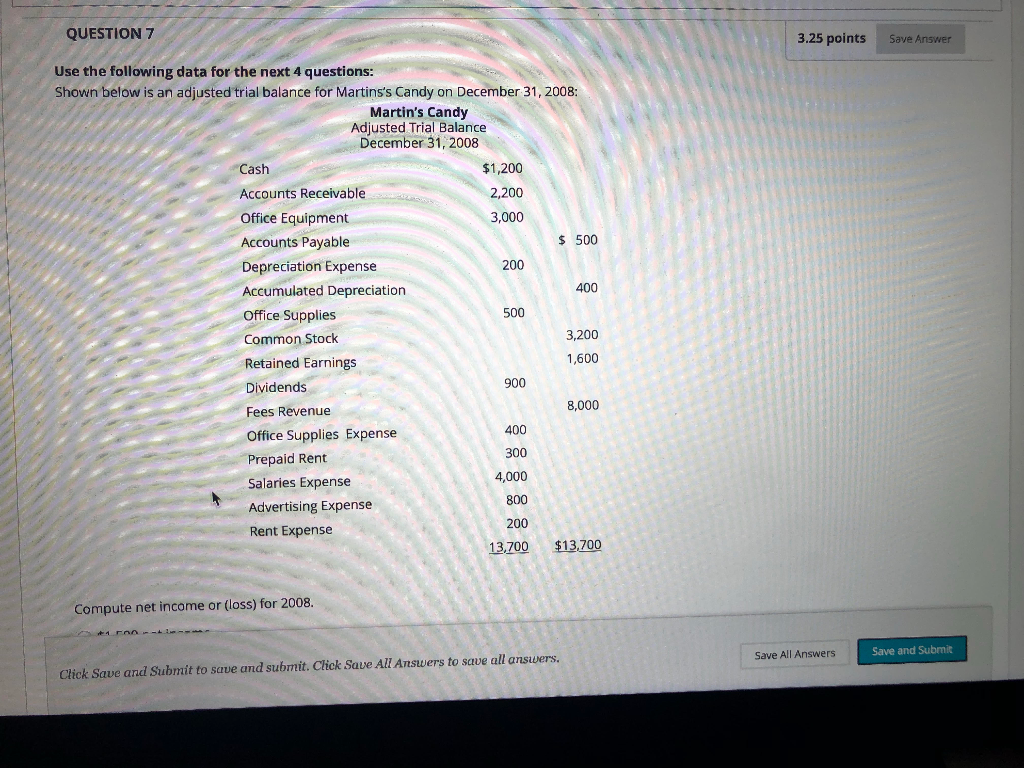

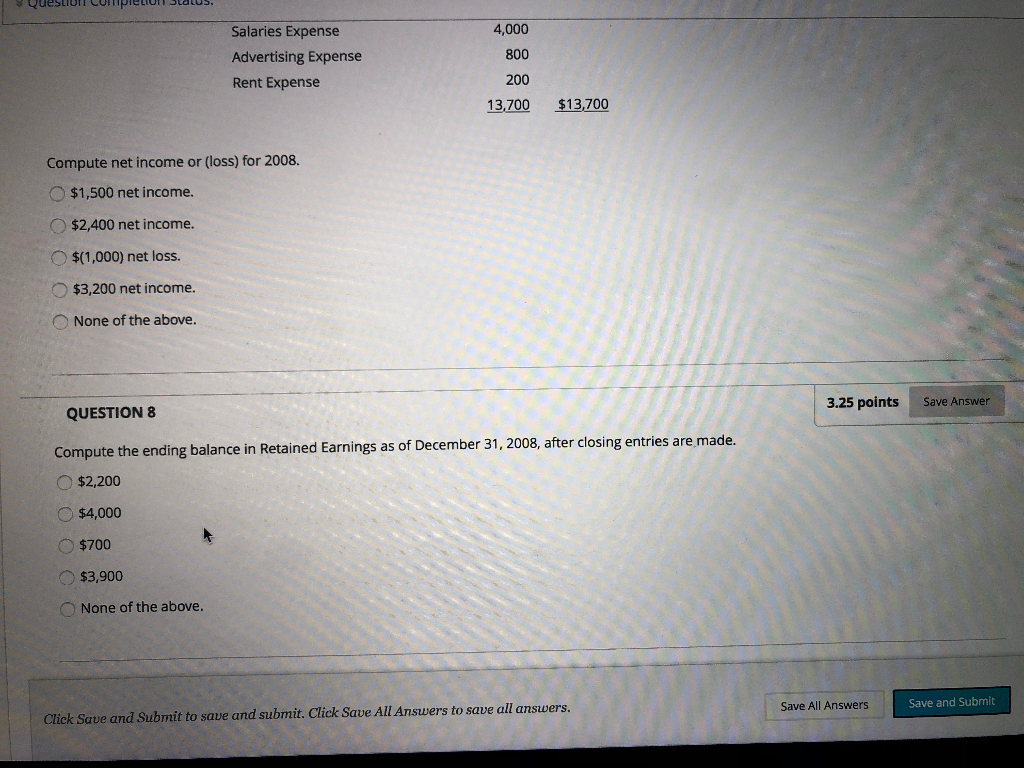

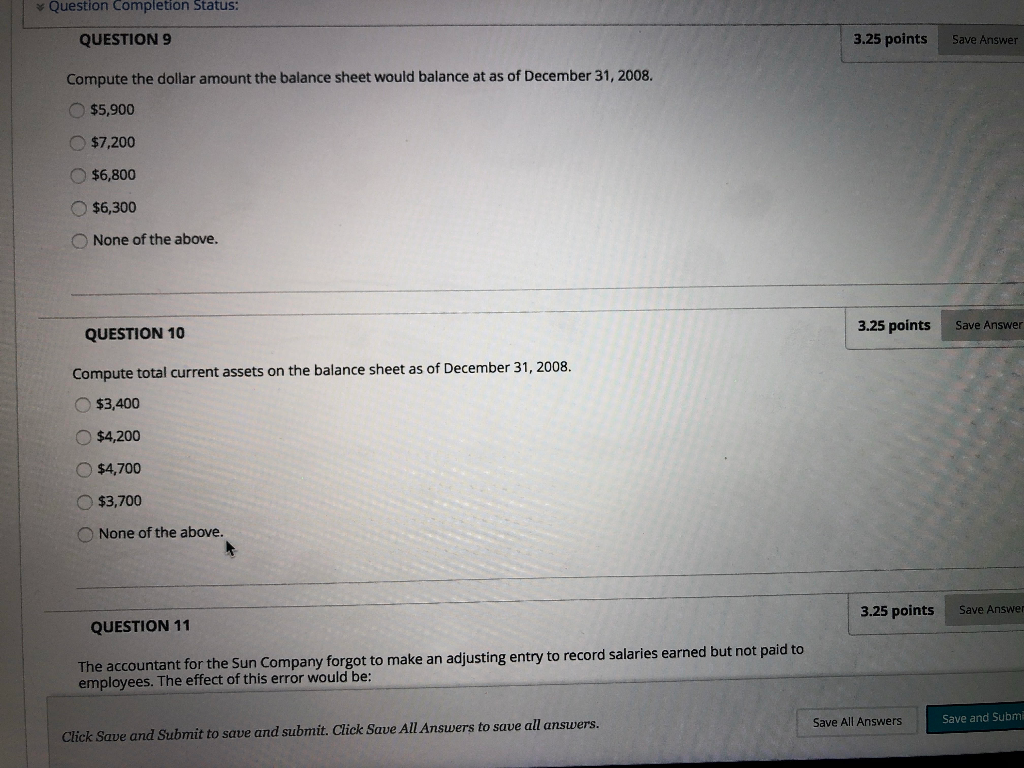

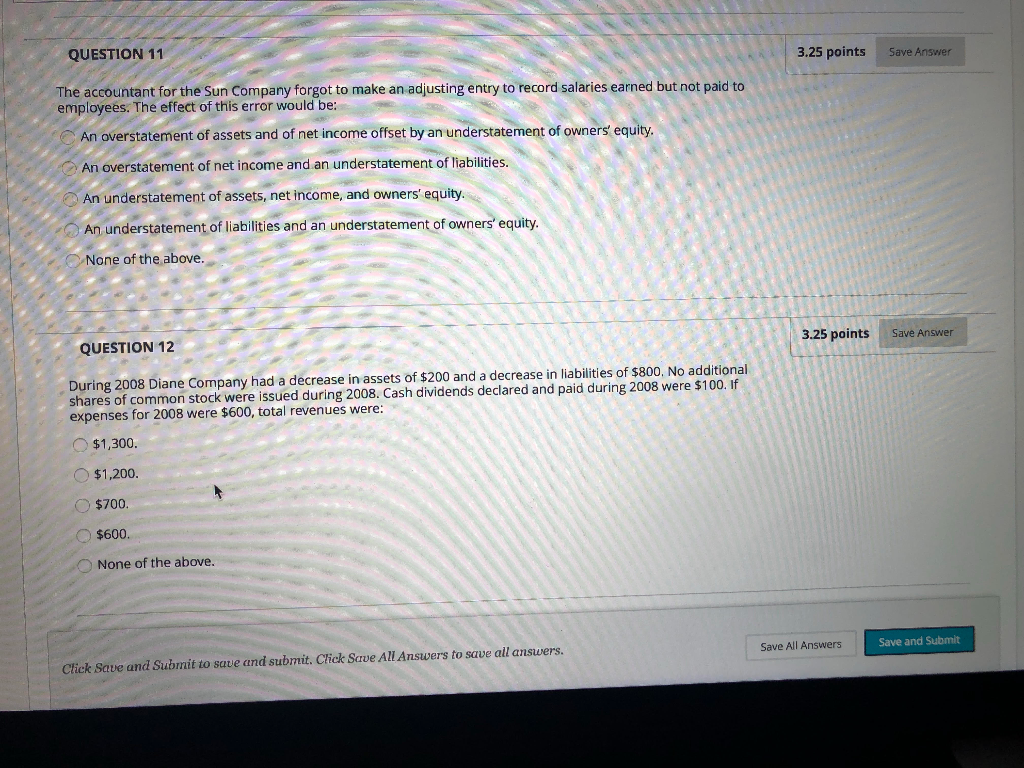

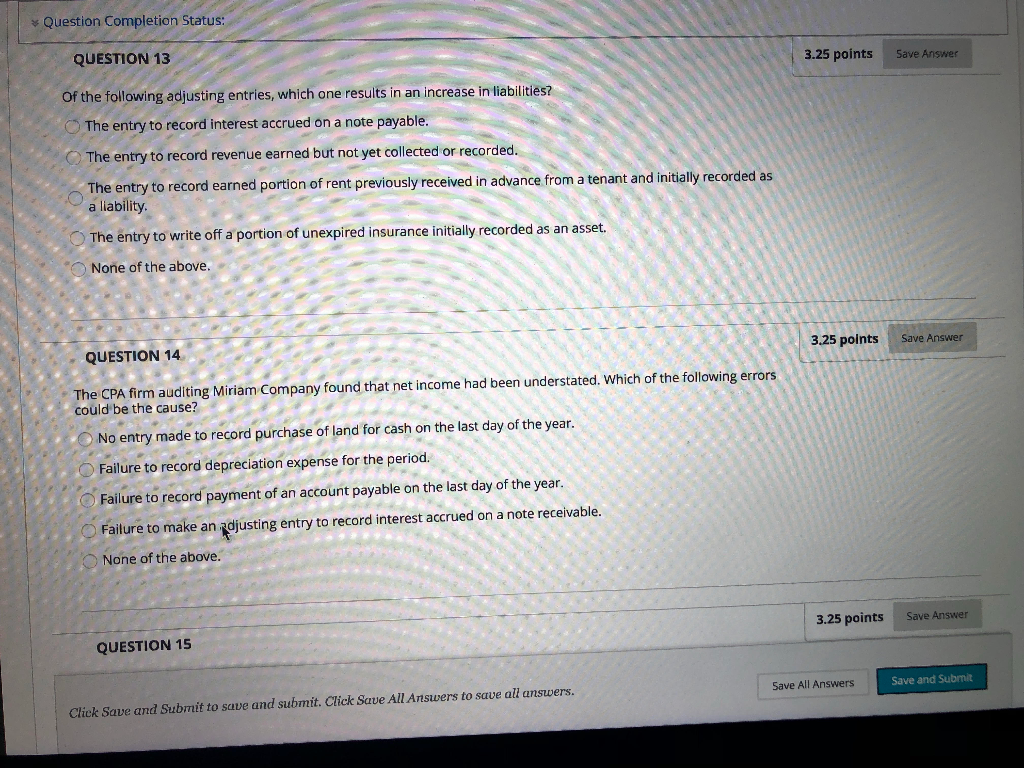

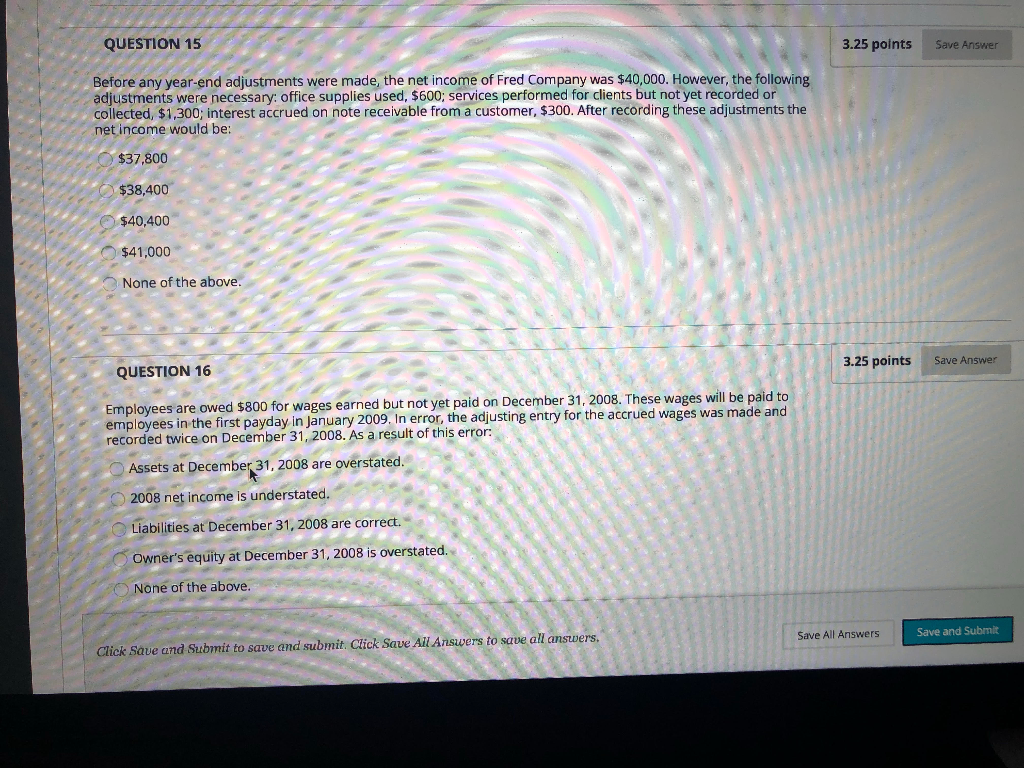

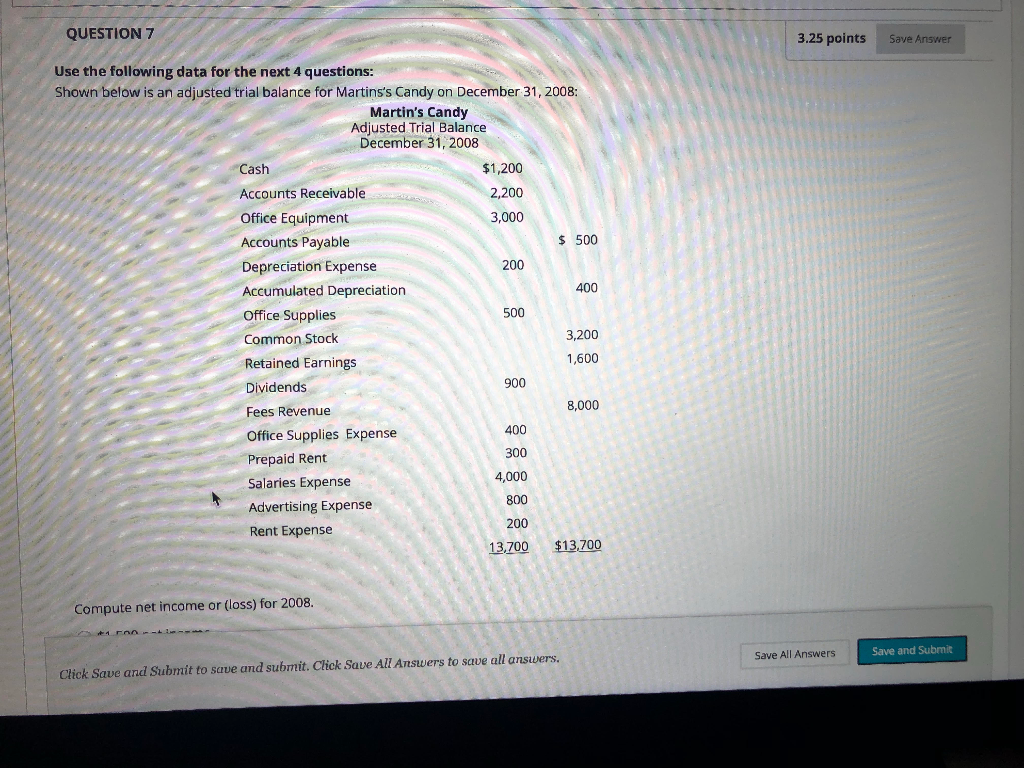

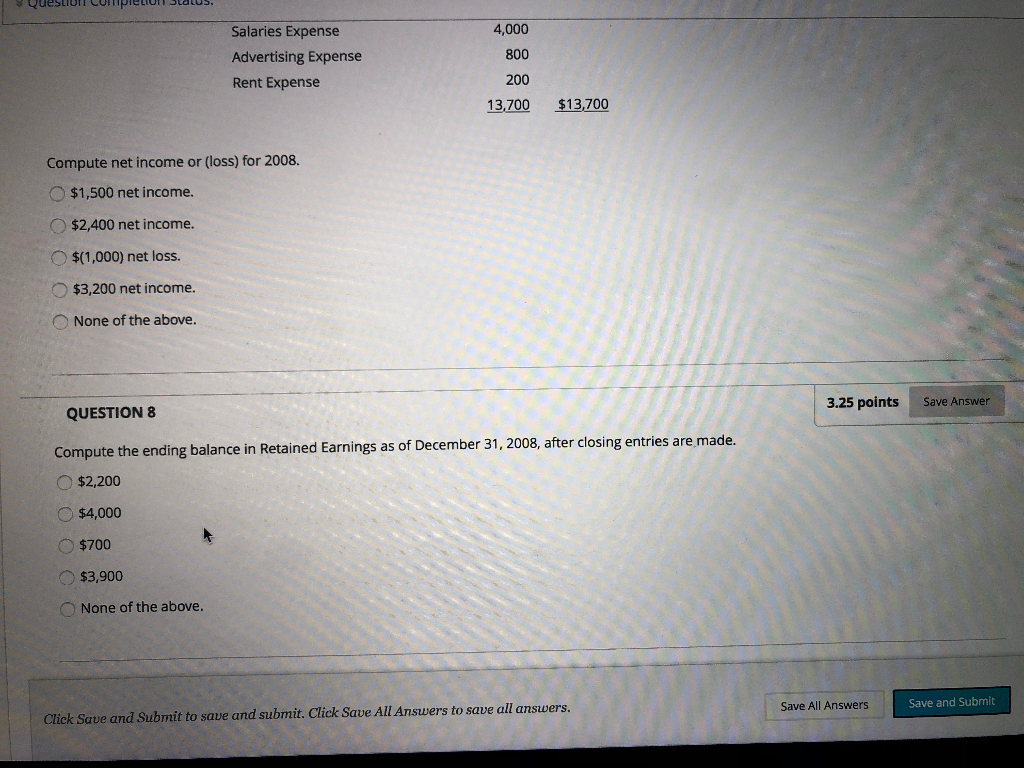

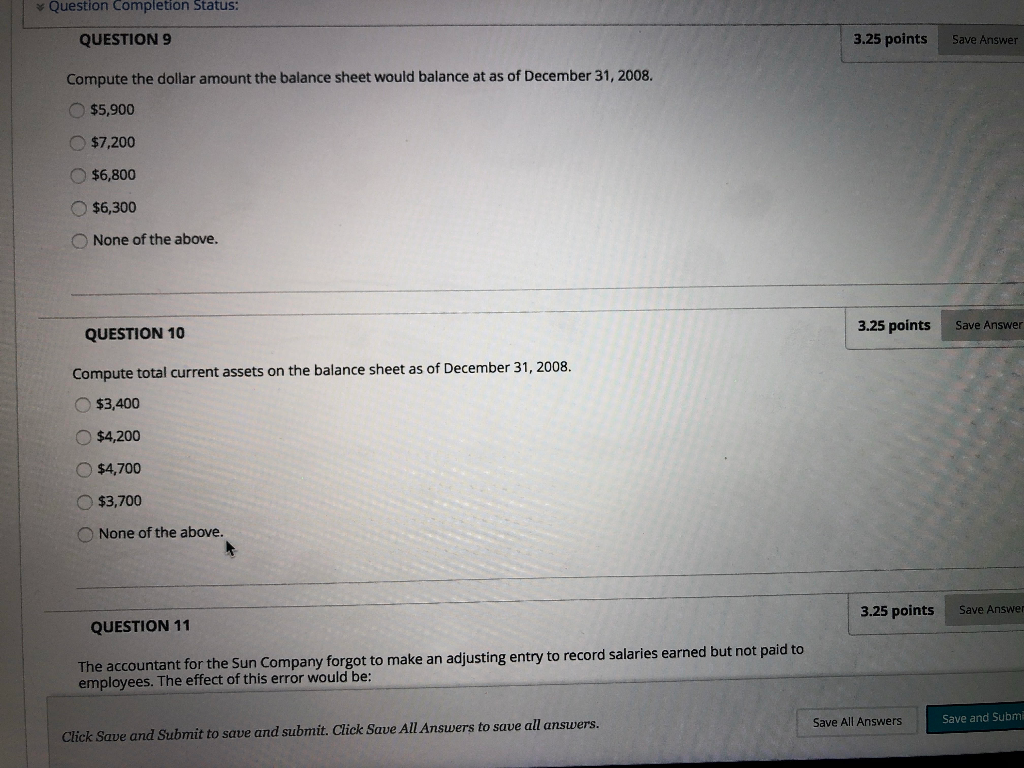

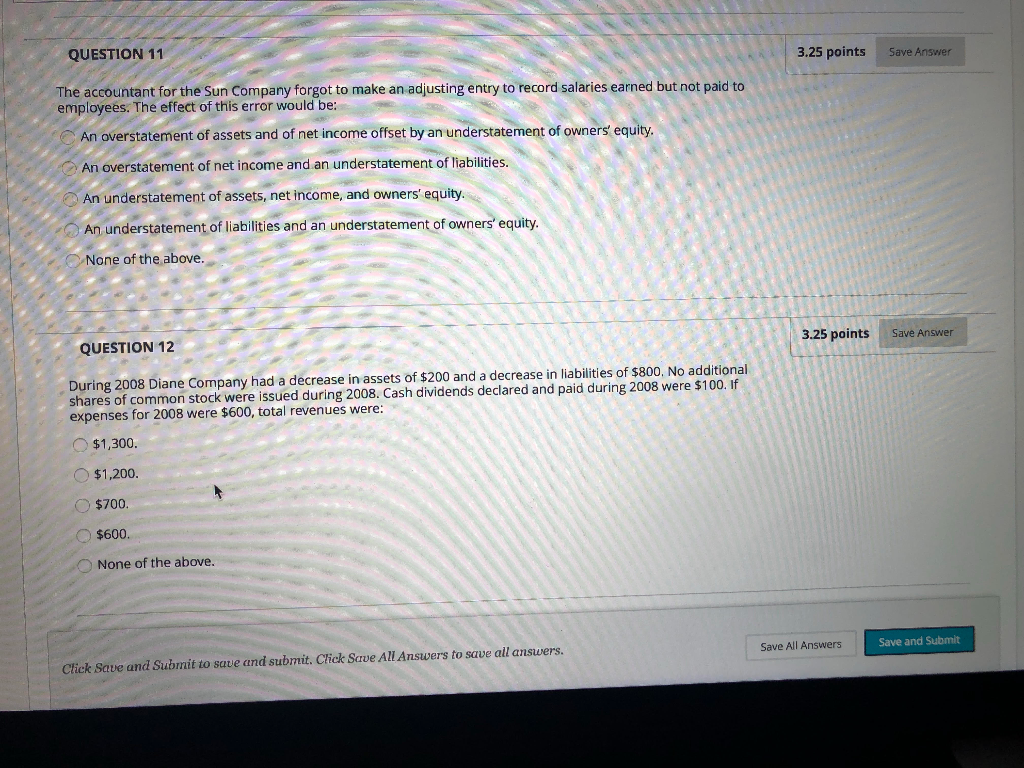

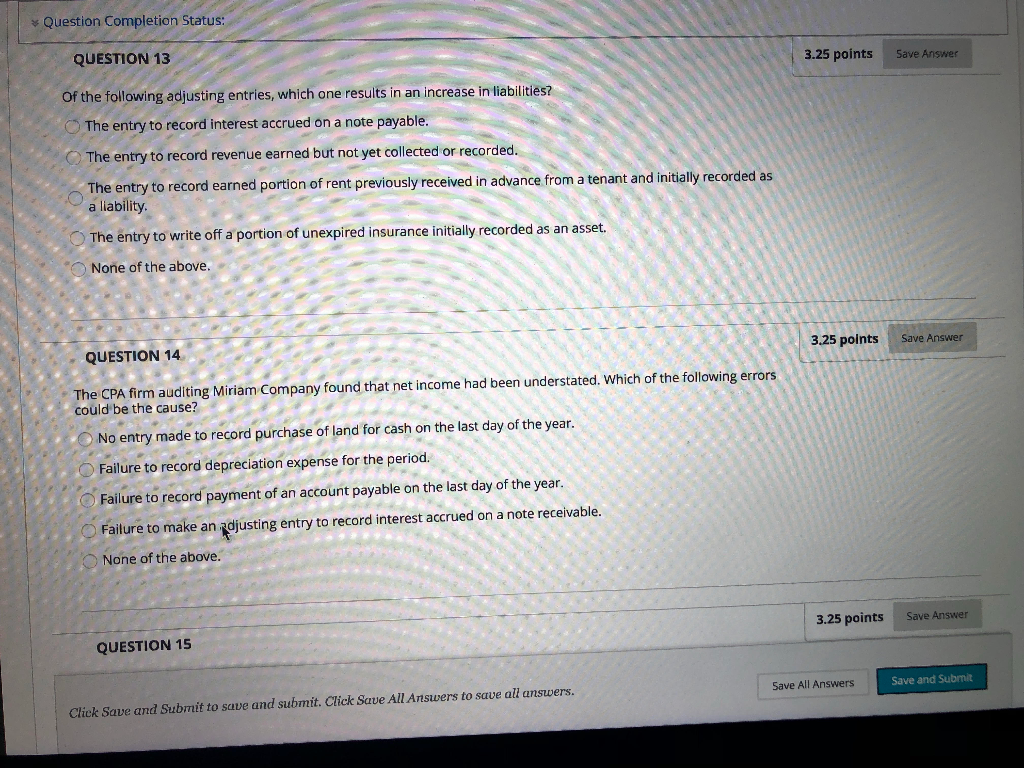

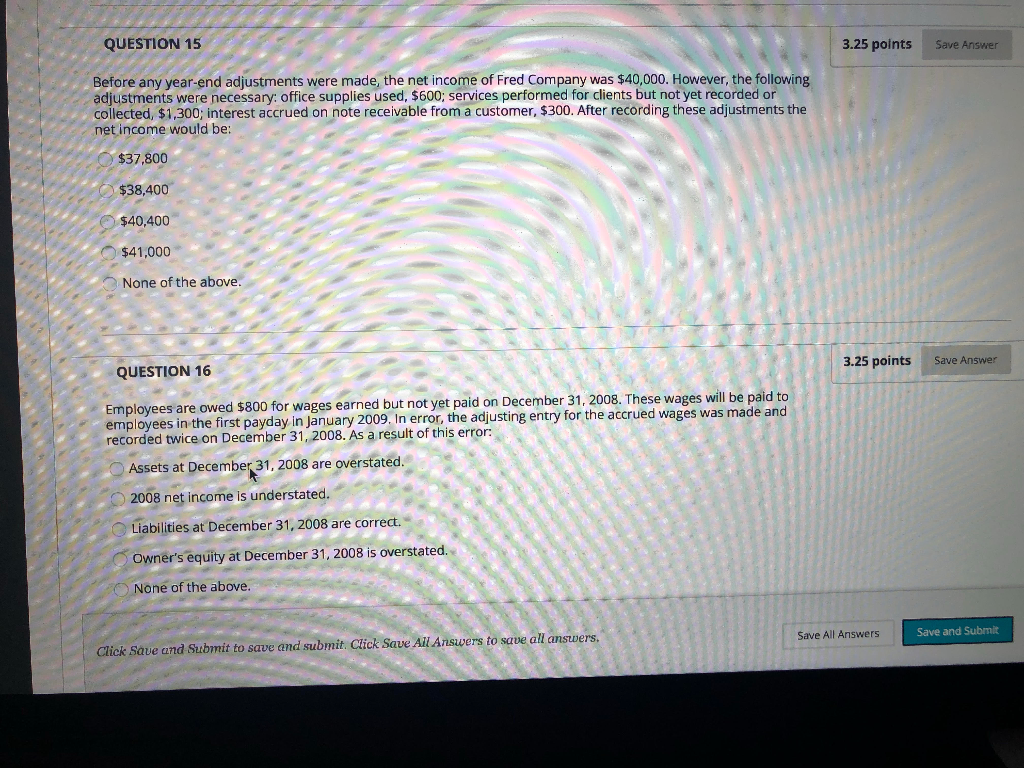

QUESTION 7 3.25 points Save Answer Use the following data for the next 4 questions: Shown below is an adjusted trial balance for Martins's Candy on December 31, 2008: Martin's Candy Adjusted Trial Balance December 31, 2008 Cash $1,200 Accounts Receivable 2,200 Office Equipment 3,000 Accounts Payable $ 500 Depreciation Expense 200 Accumulated Depreciation 400 Office Supplies 500 Common Stock 3,200 Retained Earnings 1,600 Dividends 900 Fees Revenue Office Supplies Expense Prepaid Rent Salaries Expense 800 Advertising Expense Rent Expense 200 13,700 $13,700 400 300 4.000 . Compute net income or (loss) for 2008. Save All Answers Save and Submit Click Save and Submit to save and submit. Click Save All Answers to save all answers. Salaries Expense Advertising Expense Rent Expense 4,000 800 200 13,700 $13,700 Compute net income or loss) for 2008. $1,500 net income. $2,400 net income. $(1,000) net loss. $3,200 net income. None of the above. QUESTION 8 3.25 points Save Answer Compute the ending balance in Retained Earnings as of December 31, 2008, after closing entries are made. $2,200 $4,000 $700 $3,900 None of the above. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit Question Completion Status: QUESTION 9 3.25 points Save Answer Compute the dollar amount the balance sheet would balance at as of December 31, 2008. $5,900 $7,200 $6,800 $6,300 None of the above. Save Answer 3.25 points QUESTION 10 Compute total current assets on the balance sheet as of December 31, 2008. $3,400 $4,200 $4,700 $3,700 None of the above. 3.25 points Save Answer QUESTION 11 The accountant for the Sun Company forgot to make an adjusting entry to record salaries earned but not paid to employees. The effect of this error would be: Save All Answers Save and Submi Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 11 3.25 points Save Answer The accountant for the Sun Company forgot to make an adjusting entry to record salaries earned but not paid to employees. The effect of this error would be: An overstatement of assets and of net income offset by an understatement of owners' equity. An overstatement of net income and an understatement of liabilities. An understatement of assets, net income, and owners' equity. An understatement of liabilities and an understatement of owners' equity. None of the above. 3.25 points Save Answer QUESTION 12 During 2008 Diane Company had a decrease in assets of $200 and a decrease in liabilities of $800. No additional shares of common stock were issued during 2008. Cash dividends declared and paid during 2008 were $100. If expenses for 2008 were $600, total revenues were: $1,300. $1,200. $700. $600. None of the above. Save All Answers Save and Submit Click Save and Submit to save and submit. Click Save All Answers to save all answers. Question Completion Status: QUESTION 13 3.25 points Save Answer Of the following adjusting entries, which one results in an increase in liabilities? The entry to record interest accrued on a note payable. The entry to record revenue earned but not yet collected or recorded. The entry to record earned portion of rent previously received in advance from a tenant and initially recorded as a liability The entry to write off a portion of unexpired insurance initially recorded as an asset. None of the above. 3.25 points Save Answer QUESTION 14 The CPA firm auditing Miriam Company found that net income had been understated. Which of the following errors could be the cause? No entry made to record purchase of land for cash on the last day of the year. Failure to record depreciation expense for the period. Failure to record payment of an account payable on the last day of the year. Failure to make an adjusting entry to record interest accrued on a note receivable. None of the above. 3.25 points Save Answer QUESTION 15 Save All Answers Save and Submit Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 15 3.25 points Save Answer Before any year-end adjustments were made, the net income of Fred Company was $40,000. However, the following adjustments were necessary: office supplies used, $600; services performed for clients but not yet recorded or collected, $1,300; interest accrued on note receivable from a customer, $300. After recording these adjustments the net income would be: $37.800 $38,400 $40,400 $41,000 None of the above. QUESTION 16 3.25 points Save Answer Employees are owed $800 for wages earned but not yet paid on December 31, 2008. These wages will be paid to employees in the first payday in January 2009. In error, the adjusting entry for the accrued wages was made and recorded twice on December 31, 2008. As a result of this error: Assets at December 31, 2008 are overstated. 2008 net income is understated. Liabilities at December 31, 2008 are correct. Owner's equity at December 31, 2008 is overstated. None of the above. Save All Answers Save and Submit Click Save and Submit to save and submit. Click Save All Answers to save all answers