Can someone please help me with this? My numbers are off and any help would be greatly appreciated!!! The journal entriues must be done first and then the numbers below are the numbers that I need to come up with.

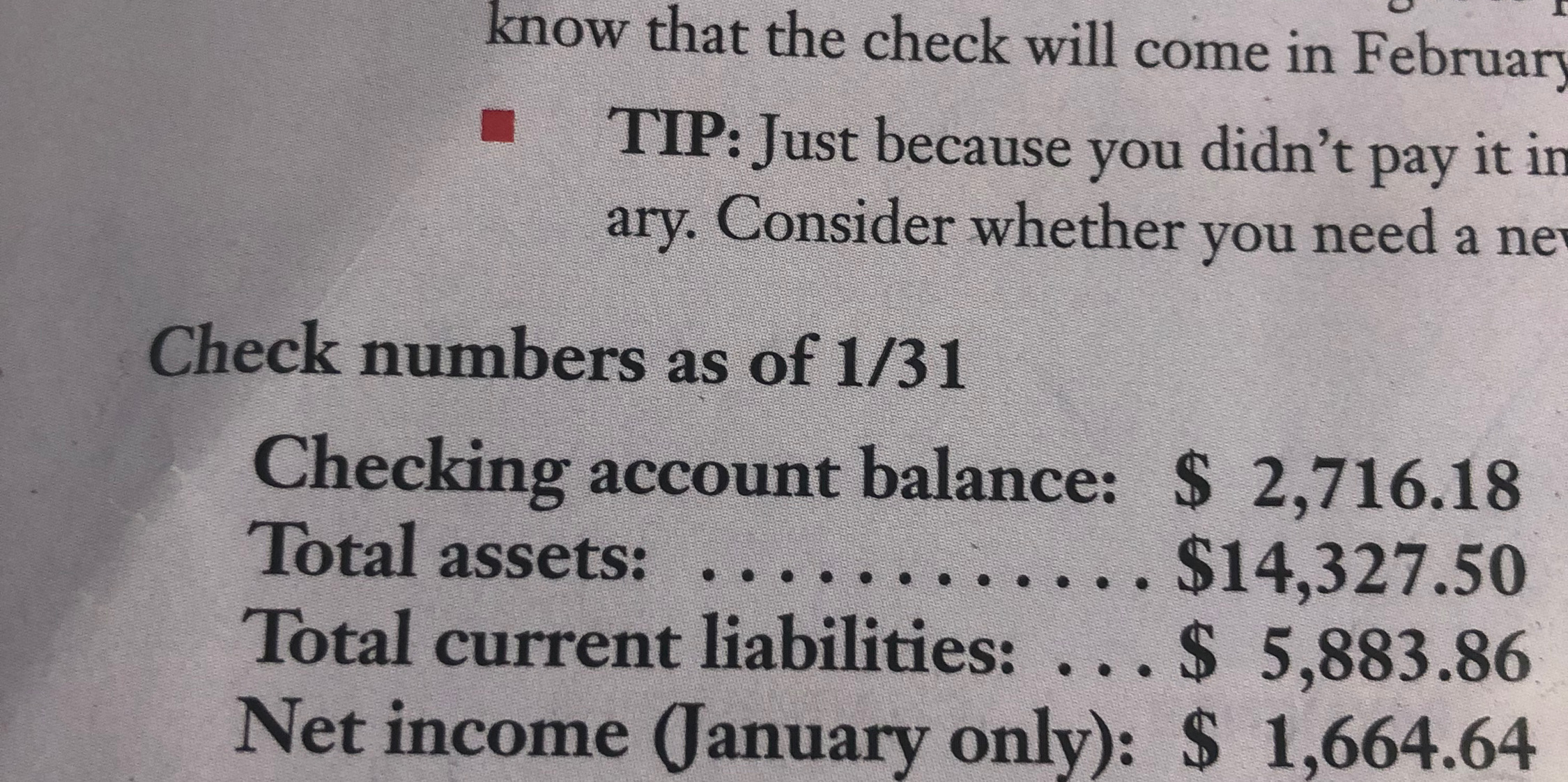

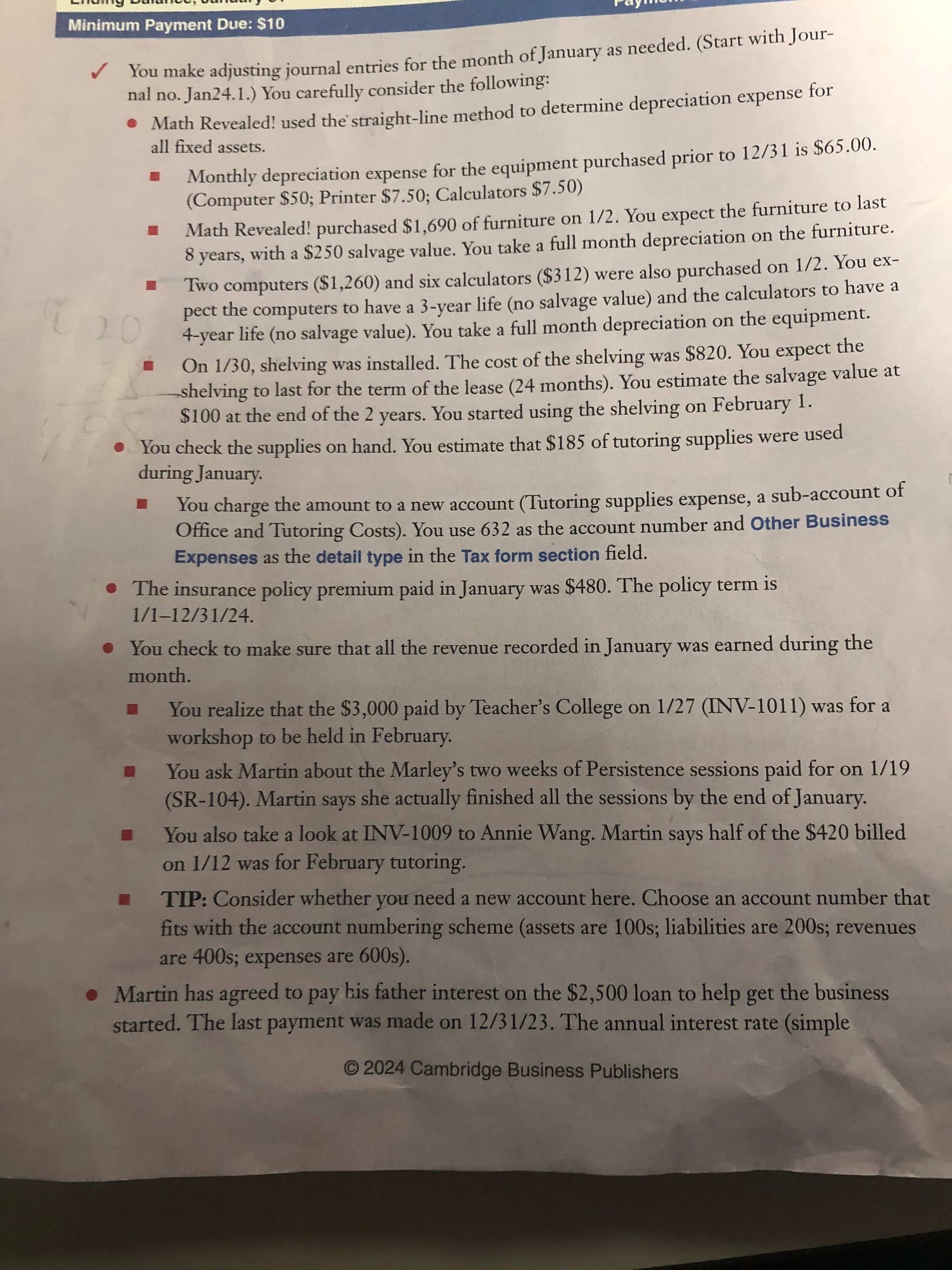

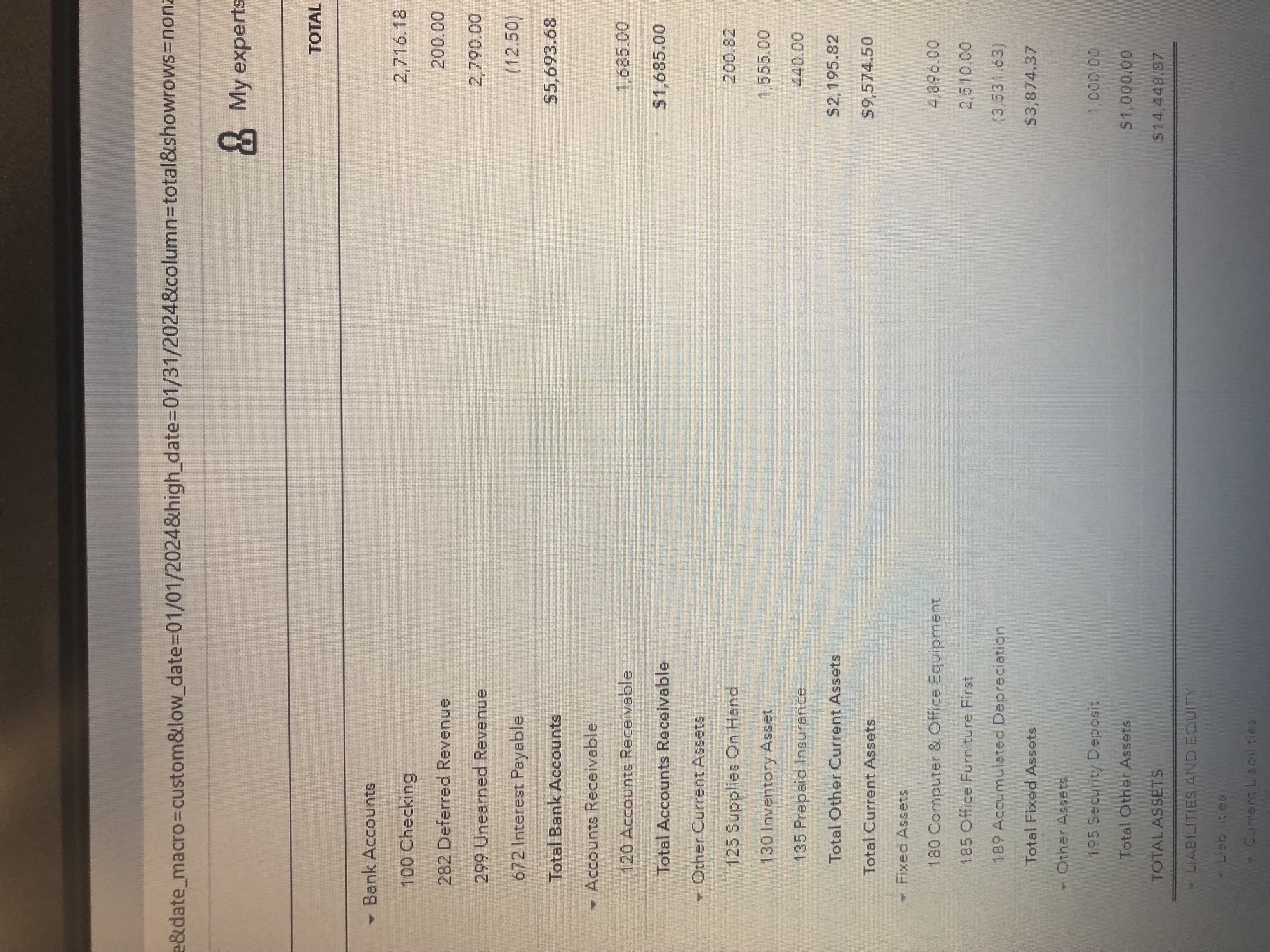

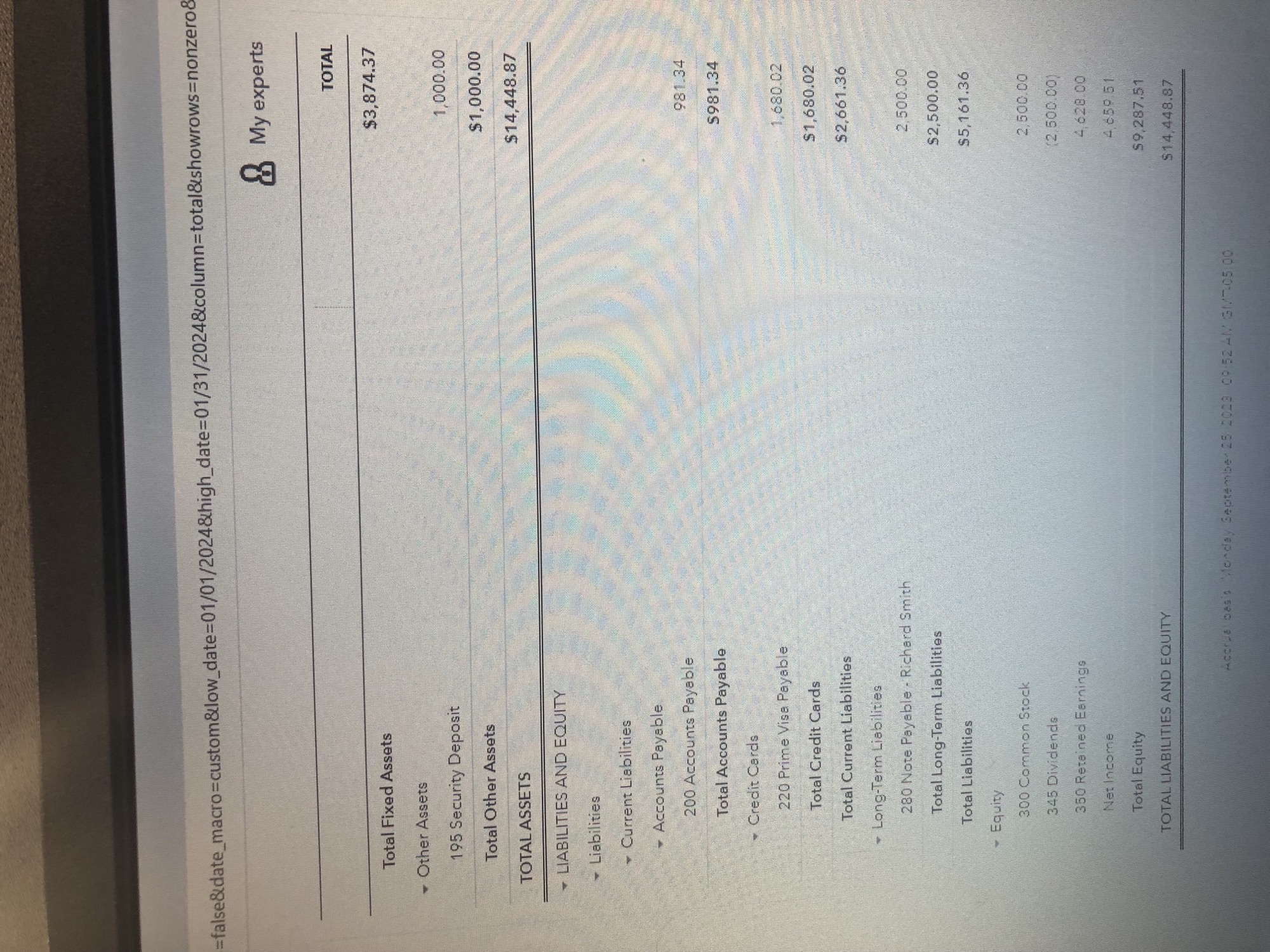

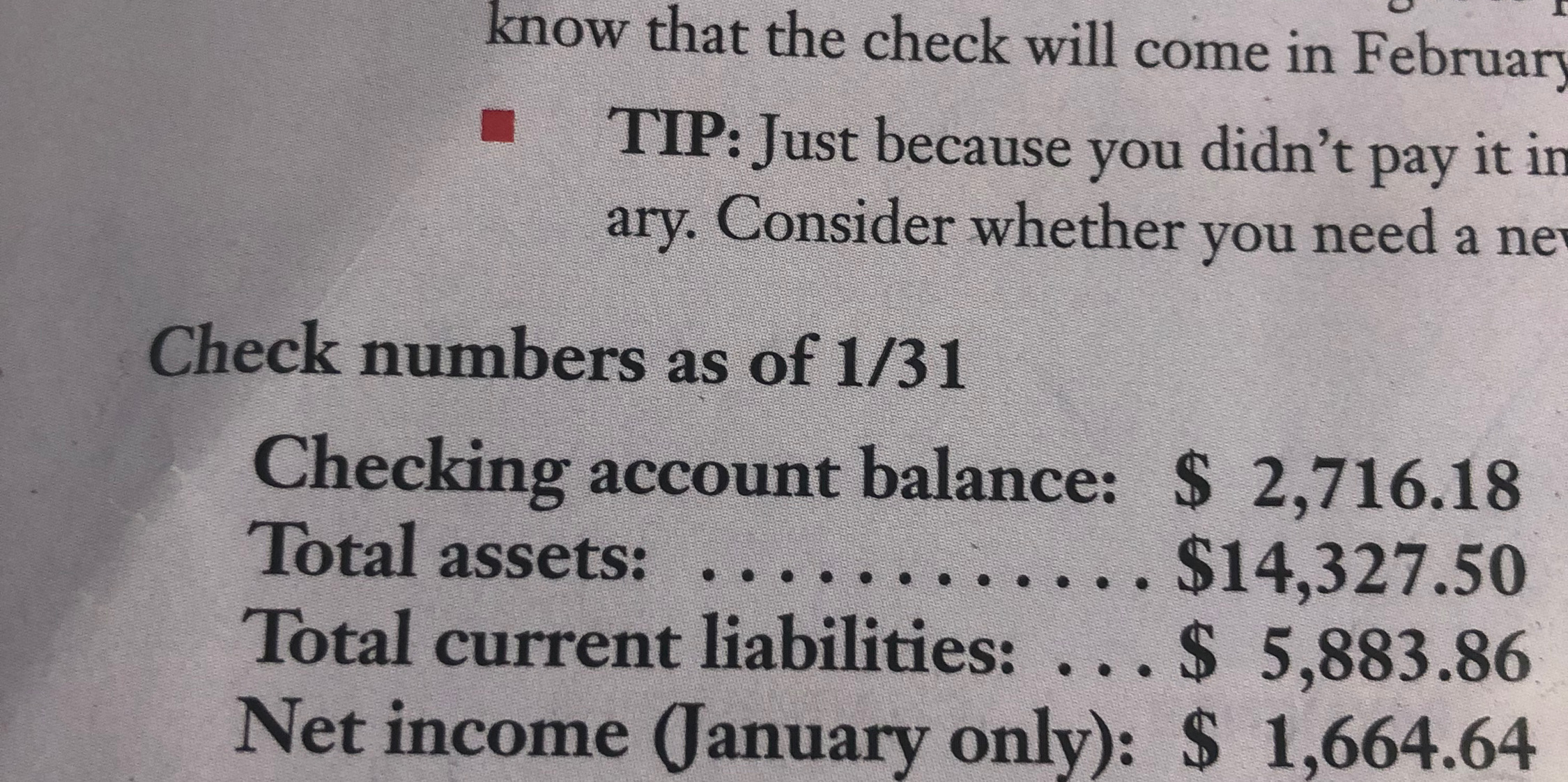

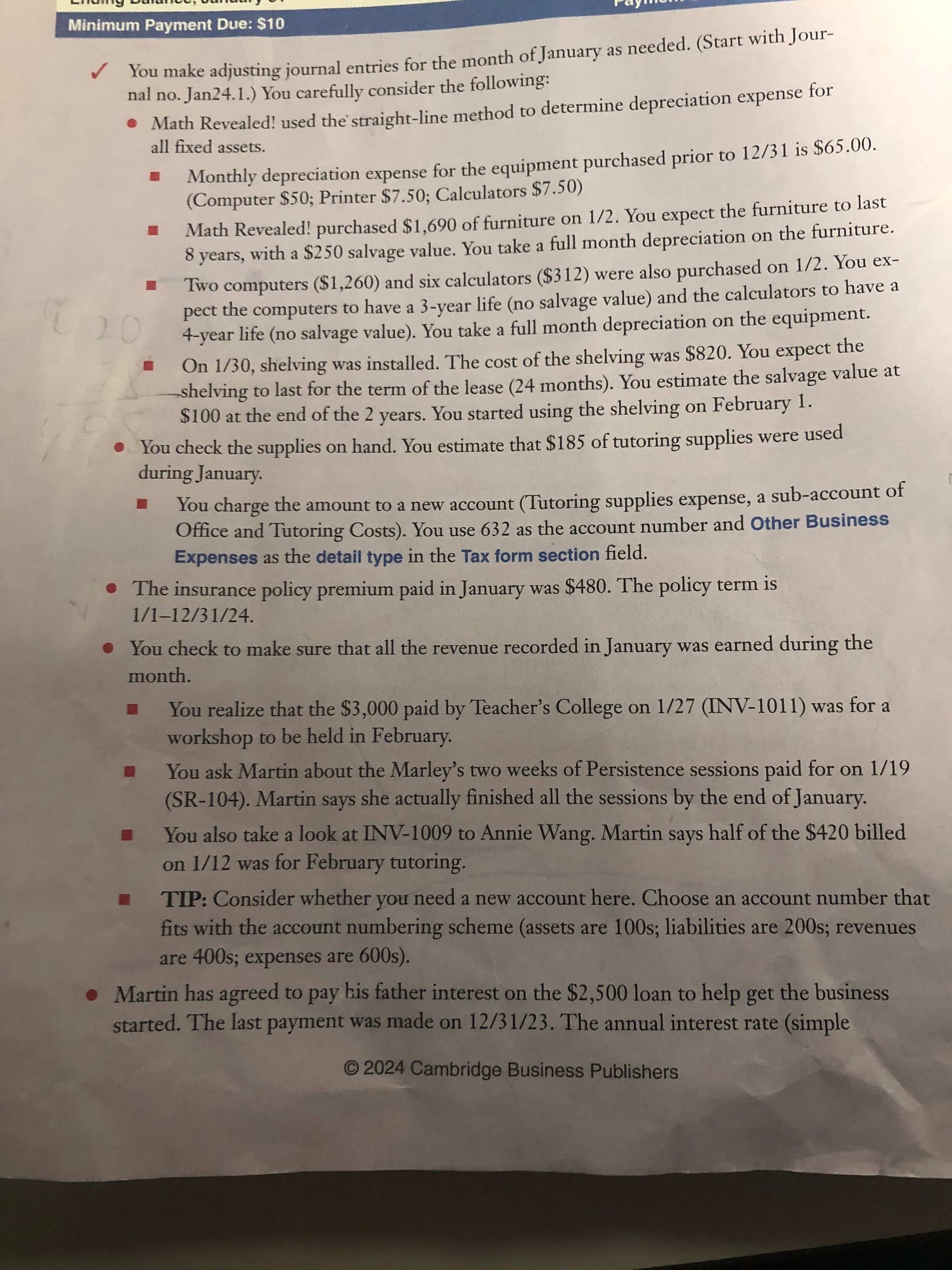

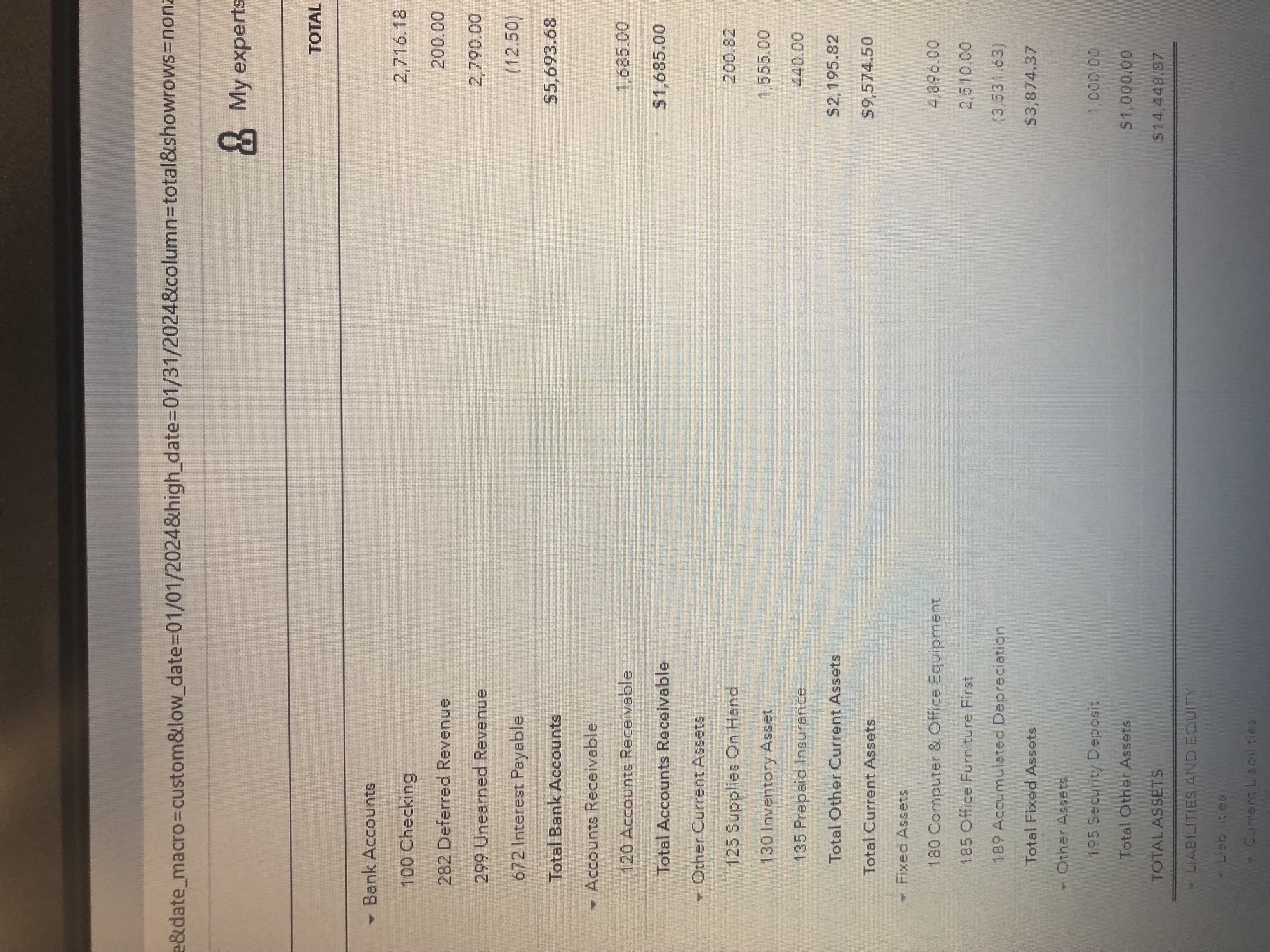

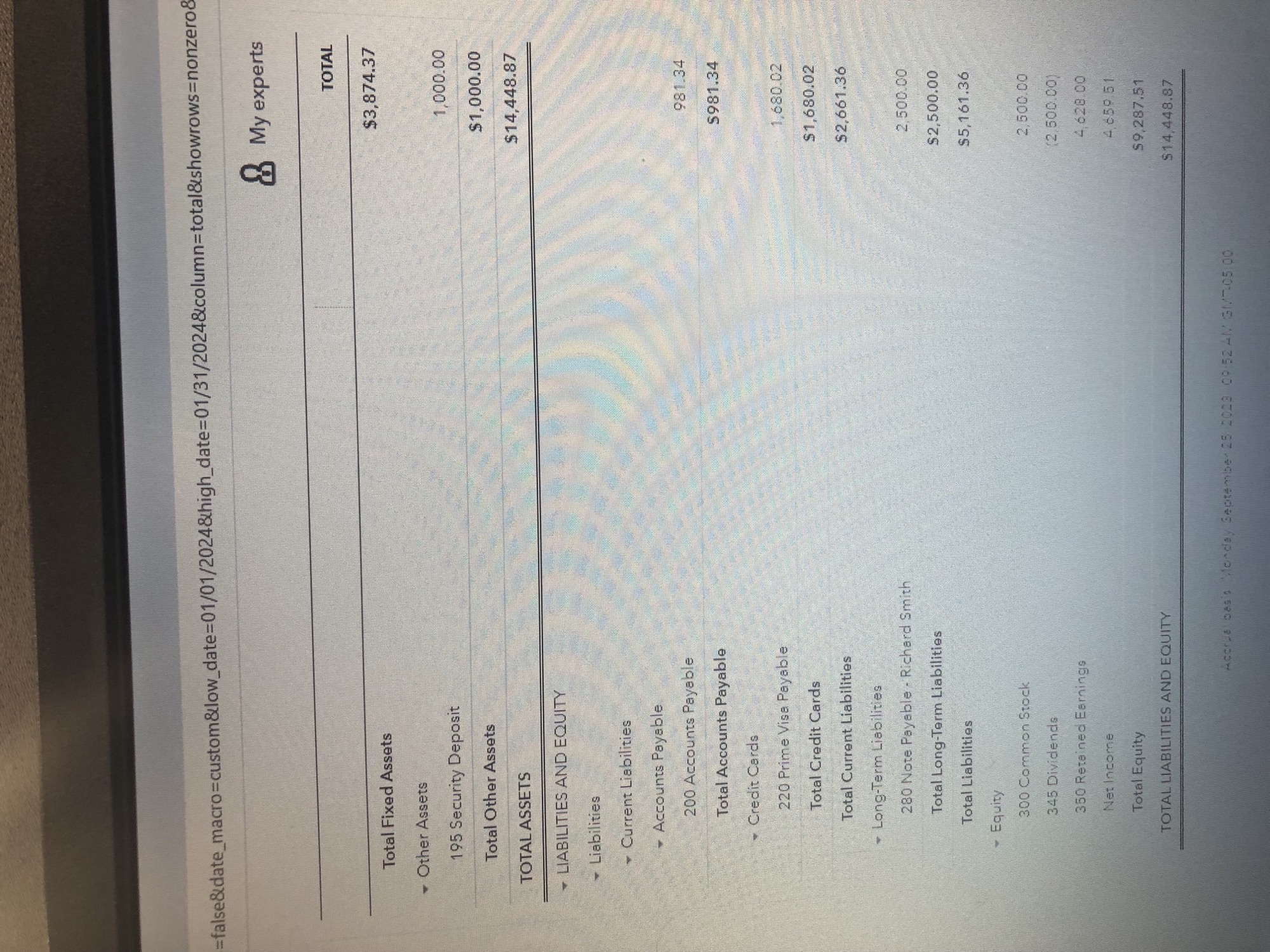

know that the check will come in Februar TIP: Just because you didn't pay it i ary. Consider whether you need a ne Check numbers as of 1/31 Checking account balance: $2,716.18 Total assets: $14,327.50 Total current liabilities: . . . \$ 5,883.86 Net income (January only): $1,664.64 You make adjusting journal entries for the month of January as needed. (Start with Journal no. Jan24.1.) You carefully consider the following: - Math Revealed! used the straight-line method to determine depreciation expense for all fixed assets. - Monthly depreciation expense for the equipment purchased prior to 12/31 is $65.00. (Computer \$50; Printer \$7.50; Calculators \$7.50) - Math Revealed! purchased \$1,690 of furniture on 1/2. You expect the furniture to last 8 years, with a $250 salvage value. You take a full month depreciation on the furniture. - Two computers ($1,260) and six calculators ($312) were also purchased on 1/2. You expect the computers to have a 3 -year life (no salvage value) and the calculators to have a 4-year life (no salvage value). You take a full month depreciation on the equipment. - On 1/30, shelving was installed. The cost of the shelving was $820. You expect the shelving to last for the term of the lease ( 24 months). You estimate the salvage value at $100 at the end of the 2 years. You started using the shelving on February 1. - You check the supplies on hand. You estimate that $185 of tutoring supplies were used during January. You charge the amount to a new account (Tutoring supplies expense, a sub-account of Office and Tutoring Costs). You use 632 as the account number and Other Business Expenses as the detail type in the Tax form section field. - The insurance policy premium paid in January was $480. The policy term is 1/112/31/24. - You check to make sure that all the revenue recorded in January was earned during the month. - You realize that the $3,000 paid by Teacher's College on 1/27 (INV-1011) was for a workshop to be held in February. You ask Martin about the Marley's two weeks of Persistence sessions paid for on 1/19 (SR-104). Martin says she actually finished all the sessions by the end of January. - You also take a look at INV-1009 to Annie Wang. Martin says half of the $420 billed on 1/12 was for February tutoring. - TIP: Consider whether you need a new account here. Choose an account number that fits with the account numbering scheme (assets are 100s; liabilities are 200s; revenues are 400 s; expenses are 600 s). - Martin has agreed to pay kis father interest on the $2,500 loan to help get the business started. The last payment was made on 12/31/23. The annual interest rate (simple C 2024 Cambridge Business Publishers \&\&date_macro = custom & low_date =01/01/2024& high_date =01/31/2024& column = total & showrows = non By experts TOTAL - Bank Accounts 100 Checking 282 Deferred Revenue 299 Unearned Revenue 672 Interest Payable Total Bank Accounts - Accounts Receivable 120 Accounts Receivable Total Accounts Receivable - Other Current Assets 125 Supplies On Hand 130 Inventory Asset 135 Prepaid Insurance Total Other Current Assets Total Current Assets Fixed Assets 180 Computer \& Office Equipment 185 Office Furniture First 189 Accumulated Depreciation Total Fixed Assets - Other Assets 195 Security Deposit Total Other Assets TOTALASSETS 2,716.18 200.00 2,790.00 (12.50) $5,693.68 1,685.00 $1,685.00 200.82 1.555 .00 440.00 $2,195.82 $9,574.50 4.896 .00 2,510.00 (3,531.63) $3,874.37 1.000 .00 $1,000.00 $14,448,87 false\&date_macro = custom\&low_date =01/01/2024& high_date =01/31/2024& column = total\&showrows = nonzerc B My experts