can someone please help me with yhis problem. thank you

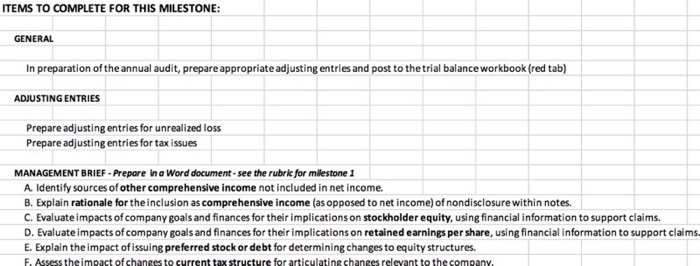

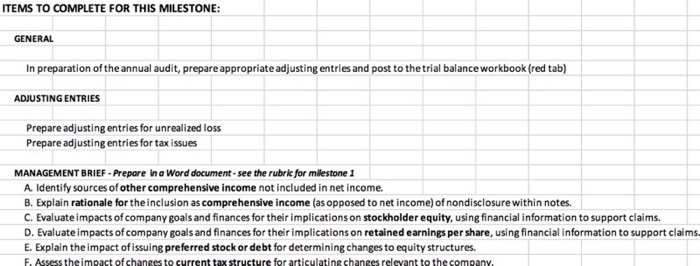

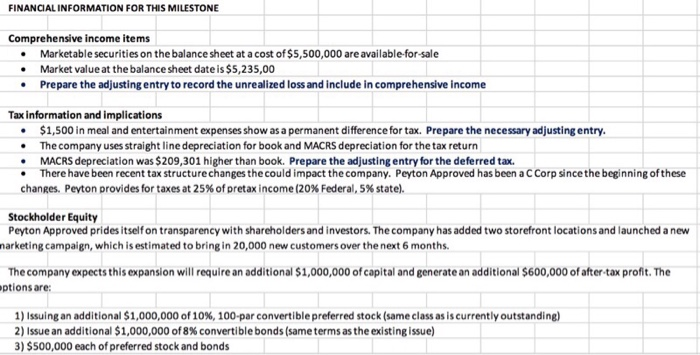

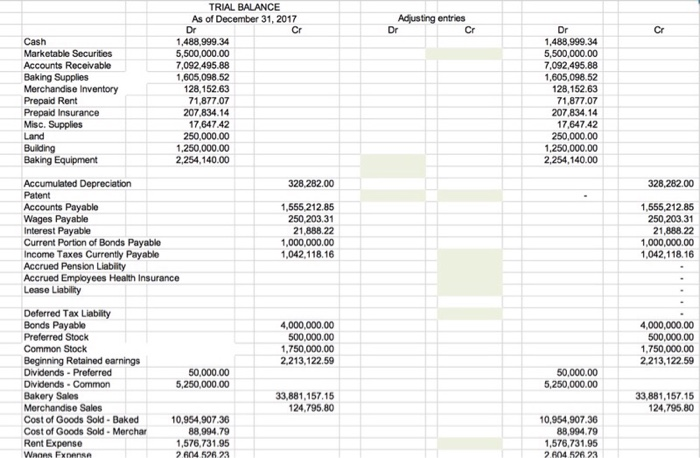

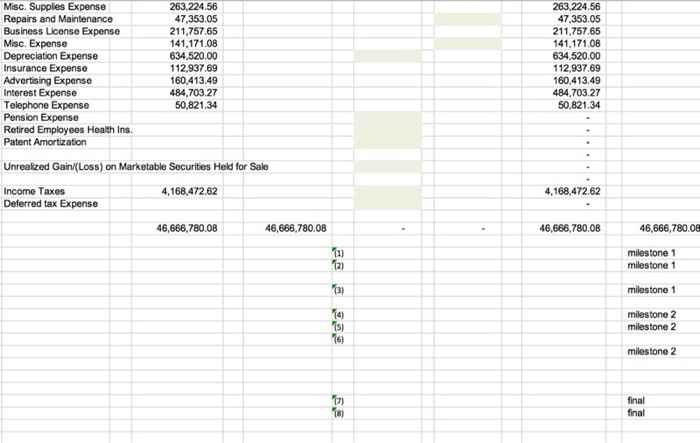

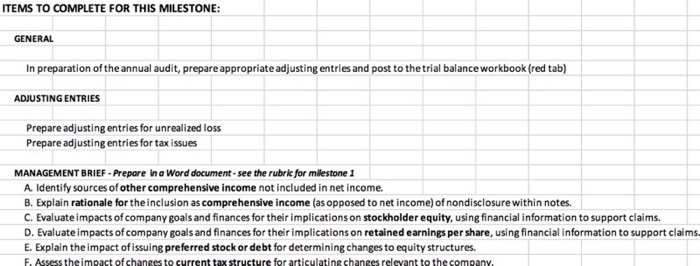

ITEMS TO COMPLETE FOR THIS MILESTONE: GENERAL In preparation of the annual audit, prepare appropriate adjusting entries and post to the trial balan ce workbook (red tab) ADJUSTING ENTRIES Prepare adjusting entries for unrealized loss Prepare adjusting entries for tax issues MANAGEMENT BRIEF-Prepare ina Word document-see the rubric for milestone 1 A Identify sources of other comprehensive income not included in net income. B. Explain rationale for the inclusion as comprehensive income (as opposed to net income) of nondisclosure within notes. C. Evaluate impacts of company goals and finances for their implications on stockholder equity, using financial information to support claims. D. Evaluate impacts of company goals and finances for their implications on retained earnings per share, using financial information to support claims. E. Explain the impact of issuing preferred stock or debt for determining changes to equity structures. F. Assess the impact ofshanses to current tax structure for articulating chanses relevant to the com pany FINANCIAL INFORMATION FOR THIS MILESTONE Comprehensive income items Marketable securities on the balance sheet at a cost of $5,500,000 are available- for-sale Market value at the balance sheet date is $5,235,00 Prepare the adjusting entry to record the unrealized loss and include in comprehensive income Tax information and implications $1,500 in meal and entertain ment expenses show as a permanent difference for tax. Prepare the necessary adjusting entry. The company uses straight line depreciation for book and MACRS depreciation for the tax return MACRS depreciation was $209,301 higher than book. Prepare the adjusting entry for the deferred tax. There have been recent tax structure changes the could impact the company. Peyton Approved has been a CCorp since the beginning of these changes. Pevton provides for taxes at 25% of pretax income (20 % Federal, 5 % state). Stockholder Equity Peyton Approved prides itself on transparency with shareholders and investors. The company has added two storefront locations and launched a new narketing campaign, which is estimated to bring in 20,000 new customers over the next 6 months. The company expects this expansion will require an additional $1,000,000 of capital and generate an additional $600,000 of after-tax profit. The ptions are: 1) Issuing an additional $1,000,000 of 10%, 100-par convertible preferred stock (same class as is currently outstanding) 2) Issue an additional $1,000,000 of 8% convertible bonds (same terms as the existing issue) 3) $500,000 each of preferred stock and bonds TRIAL BALANCE Adjusting entries Dr As of December 31, 2017 Dr 1,488,999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 r Cr Dr 1,488,999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 Cr Cash Marketable Securities Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Land Building Baking Equipment Accumulated Depreciation Patent 328,282.00 328,282.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,042,118.16 Accounts Payable Wages Payable Interest Payable Current Portion of Bonds Payable Income Taxes Currently Payable Accrued Pension Liabity Accrued Employees Health Insurance Lease Liability 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,042,118.16 Deferred Tax Liability Bonds Payable Preferred Stock Common Stock Beginning Retained earnings Dividends Preferred Dividends Common 4,000,000.00 500,000.00 1,750,000.00 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 2,213,122.59 50,000.00 5,250,000.00 50,000.00 5,250,000.00 Bakery Sales Merchandise Sales 33,881,157.15 124,795.80 33,881,157.15 124,795.80 10,954,907.36 Cost of Goods Sold - Baked 10,954,907.36 88,994.79 Cost of Goods Sold- Merchar 88,994.79 Misc. Supplies Expense Repairs and Maintenance Business License Expense Misc. Expense Depreciation Expense |Insurance Expense Advertising Expense Interest Expense Telephone Expense Pension Expense Retired Employees Health Ins. Patent Amortization 263,224.56 263,224.56 47,353.05 211,757.65 141,171.08 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 634,520.00 112.937.69 160,413.49 484,703.27 484,703.27 50,821.34 50,821.34 Unrealized Gain/(Loss) on Marketable Securities Held for Sale 4,168,472.62 Income Taxes 4,168,472.62 Deferred tax Expense 46,666,780.08 46,666,780.08 46,666,780.08 46,666,780.08 milestone 1 milestone 1 (2) 3) milestone 1 4) s) (6) milestone 2 milestone 2 milestone 2 final (8) final ITEMS TO COMPLETE FOR THIS MILESTONE: GENERAL In preparation of the annual audit, prepare appropriate adjusting entries and post to the trial balan ce workbook (red tab) ADJUSTING ENTRIES Prepare adjusting entries for unrealized loss Prepare adjusting entries for tax issues MANAGEMENT BRIEF-Prepare ina Word document-see the rubric for milestone 1 A Identify sources of other comprehensive income not included in net income. B. Explain rationale for the inclusion as comprehensive income (as opposed to net income) of nondisclosure within notes. C. Evaluate impacts of company goals and finances for their implications on stockholder equity, using financial information to support claims. D. Evaluate impacts of company goals and finances for their implications on retained earnings per share, using financial information to support claims. E. Explain the impact of issuing preferred stock or debt for determining changes to equity structures. F. Assess the impact ofshanses to current tax structure for articulating chanses relevant to the com pany FINANCIAL INFORMATION FOR THIS MILESTONE Comprehensive income items Marketable securities on the balance sheet at a cost of $5,500,000 are available- for-sale Market value at the balance sheet date is $5,235,00 Prepare the adjusting entry to record the unrealized loss and include in comprehensive income Tax information and implications $1,500 in meal and entertain ment expenses show as a permanent difference for tax. Prepare the necessary adjusting entry. The company uses straight line depreciation for book and MACRS depreciation for the tax return MACRS depreciation was $209,301 higher than book. Prepare the adjusting entry for the deferred tax. There have been recent tax structure changes the could impact the company. Peyton Approved has been a CCorp since the beginning of these changes. Pevton provides for taxes at 25% of pretax income (20 % Federal, 5 % state). Stockholder Equity Peyton Approved prides itself on transparency with shareholders and investors. The company has added two storefront locations and launched a new narketing campaign, which is estimated to bring in 20,000 new customers over the next 6 months. The company expects this expansion will require an additional $1,000,000 of capital and generate an additional $600,000 of after-tax profit. The ptions are: 1) Issuing an additional $1,000,000 of 10%, 100-par convertible preferred stock (same class as is currently outstanding) 2) Issue an additional $1,000,000 of 8% convertible bonds (same terms as the existing issue) 3) $500,000 each of preferred stock and bonds TRIAL BALANCE Adjusting entries Dr As of December 31, 2017 Dr 1,488,999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 r Cr Dr 1,488,999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 Cr Cash Marketable Securities Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Land Building Baking Equipment Accumulated Depreciation Patent 328,282.00 328,282.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,042,118.16 Accounts Payable Wages Payable Interest Payable Current Portion of Bonds Payable Income Taxes Currently Payable Accrued Pension Liabity Accrued Employees Health Insurance Lease Liability 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,042,118.16 Deferred Tax Liability Bonds Payable Preferred Stock Common Stock Beginning Retained earnings Dividends Preferred Dividends Common 4,000,000.00 500,000.00 1,750,000.00 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 2,213,122.59 50,000.00 5,250,000.00 50,000.00 5,250,000.00 Bakery Sales Merchandise Sales 33,881,157.15 124,795.80 33,881,157.15 124,795.80 10,954,907.36 Cost of Goods Sold - Baked 10,954,907.36 88,994.79 Cost of Goods Sold- Merchar 88,994.79 Misc. Supplies Expense Repairs and Maintenance Business License Expense Misc. Expense Depreciation Expense |Insurance Expense Advertising Expense Interest Expense Telephone Expense Pension Expense Retired Employees Health Ins. Patent Amortization 263,224.56 263,224.56 47,353.05 211,757.65 141,171.08 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 634,520.00 112.937.69 160,413.49 484,703.27 484,703.27 50,821.34 50,821.34 Unrealized Gain/(Loss) on Marketable Securities Held for Sale 4,168,472.62 Income Taxes 4,168,472.62 Deferred tax Expense 46,666,780.08 46,666,780.08 46,666,780.08 46,666,780.08 milestone 1 milestone 1 (2) 3) milestone 1 4) s) (6) milestone 2 milestone 2 milestone 2 final (8) final