Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone please help me work these problems? i think there might be an excel formula for them? preferrably if there is an excel formula

can someone please help me work these problems? i think there might be an excel formula for them? preferrably if there is an excel formula if there is one?

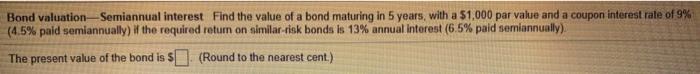

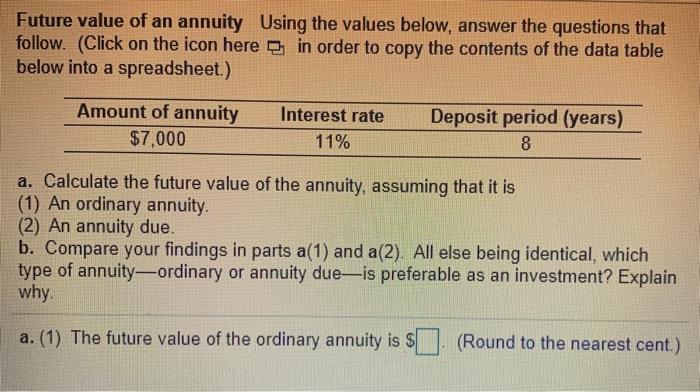

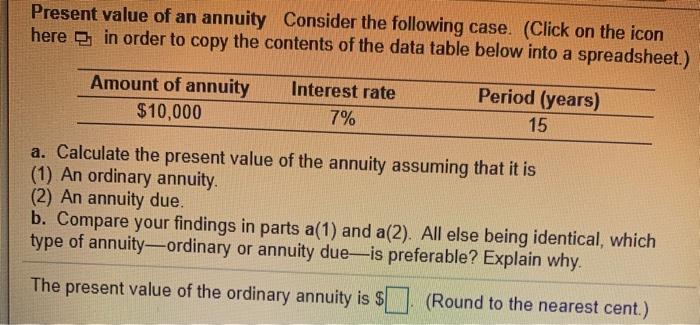

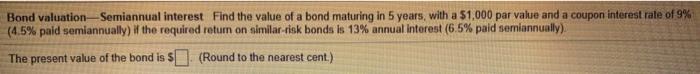

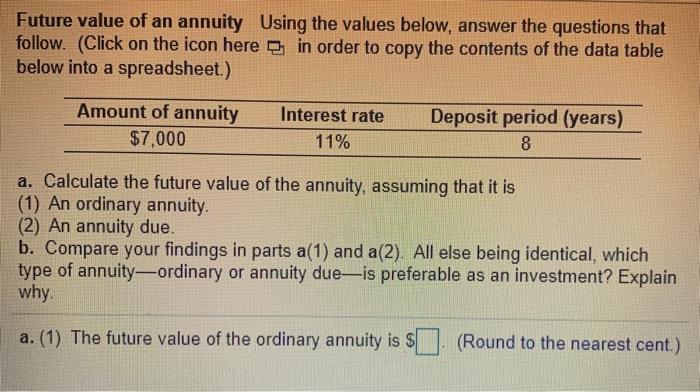

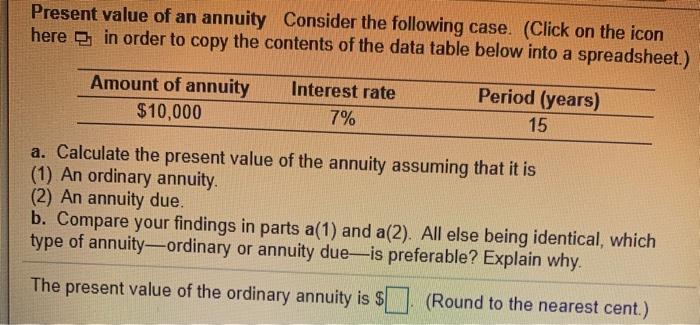

Bond valuation-Semiannual interest Find the value of a bond maturing in 5 years, with a $1,000 par value and a coupon interest rate of 9% (4.5% paid semiannually) if the required retum on similar-risk bonds is 13% annual interest (6.5% paid semiannually) The present value of the bond is 5 (Round to the nearest cent.) Future value of an annuity Using the values below, answer the questions that follow. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Amount of annuity $7,000 Interest rate 11% Deposit period (years) 8 a. Calculate the future value of the annuity, assuming that it is (1) An ordinary annuity. (2) An annuity due b. Compare your findings in parts a(1) and a(2). All else being identical, which type of annuity-ordinary or annuity dueis preferable as an investment? Explain why. a. (1) The future value of the ordinary annuity is $ (Round to the nearest cent.) Present value of an annuity Consider the following case. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Amount of annuity $10,000 Interest rate 7% Period (years) 15 a. Calculate the present value of the annuity assuming that it is (1) An ordinary annuity. (2) An annuity due. b. Compare your findings in parts a(1) and a(2). All else being identical, which type of annuity-ordinary or annuity dueis preferable? Explain why. The present value of the ordinary annuity is $. (Round to the nearest cent.) thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started