Answered step by step

Verified Expert Solution

Question

1 Approved Answer

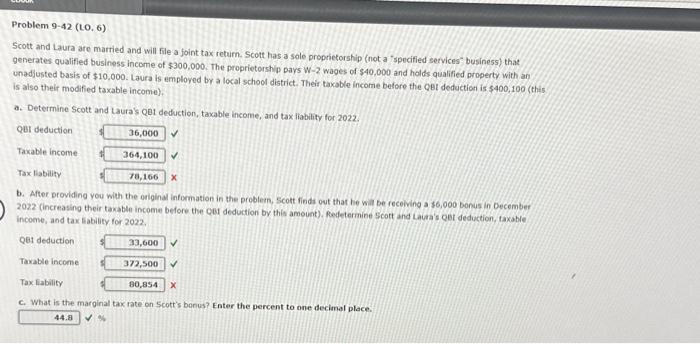

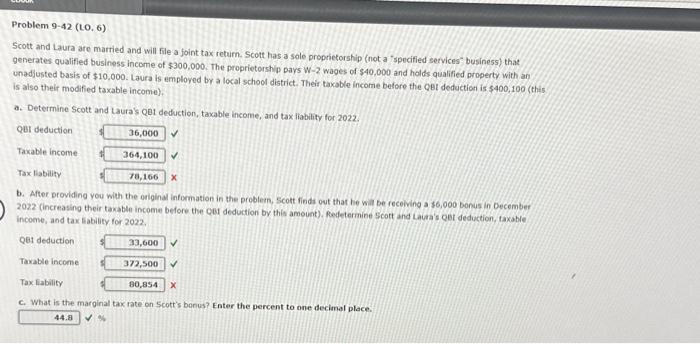

Can someone please help? thank you Problem 9-42 (LO, 6) Scott and Laura are martied and will file a foint tax return. Scott has a

Can someone please help? thank you

Problem 9-42 (LO, 6) Scott and Laura are martied and will file a foint tax return. Scott has a sole proprietorship (not a "specified services" business) that generates qualified business income of $300,000. The proprietorship pays W2 wages of $40,000 and holds qualified property with an unadjusted basis of $10,000. Laura is emploved by a local school district. Their taxable income belore the qet deduction is $400,100 (this is also their modified taxable income). a. Determine Scott and taura's Qet deduction, taxable income, and tax liability for 2022. b. After providing you with the original information in the problen, scott finds out that he will be receiving a $6,000 bonus in December 2022 (increasing their tamable income belore the cer deduction by this amount). Redetermine Scott and Lalma's oet deduction, taxable income, and tax 5ability for 2022. c. What is the marginal tax rate on 5 cott's bonus? Enter the percent to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started