Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please help with this question! Problem 1-3 On January 1, 2013, Photo Investments Inc. acquired 20,000 shares of the 100,000 outstanding common shares

Can someone please help with this question!

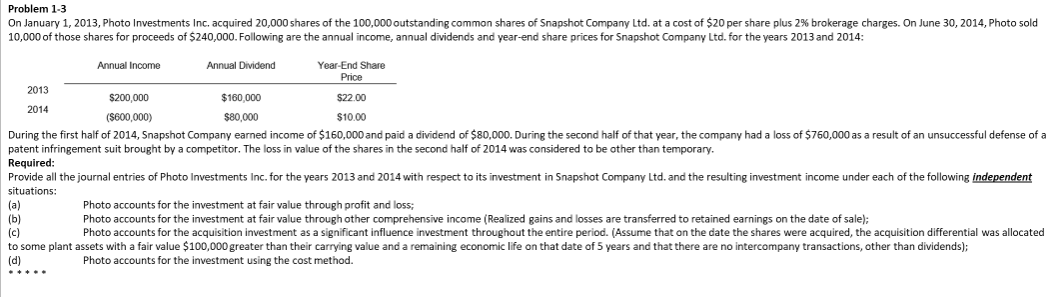

Problem 1-3 On January 1, 2013, Photo Investments Inc. acquired 20,000 shares of the 100,000 outstanding common shares Snapshot Company Ltd. at a cost of $20 per share plus 2% brokerage charges. On June 30, 2014, Photo sold 10,000 of those shares for proceeds of $240,000. Following are the annual income, annual dividends and year-end share prices for Snapshot Company Ltd. for the years 2013 and 2014: Annual Income Annual Dividend Year-End Share Price 2013 $200,000 $22.00 2014 $160,000 $80,000 ($600,000) $10.00 During the first half of 2014, Snapshot Company earned income of $160,000 and paid a dividend of $80,000. During the second half of that year, the company had a loss of $760,000 as a result of an unsuccessful defense of a patent infringement suit brought by a competitor. The loss in value of the shares in the second half of 2014 was considered to be other than temporary. Required: Provide all the journal entries of Photo Investments Inc. for the years 2013 and 2014 with respect to its investment Snapshot Company Ltd. and the resulting investment income under each of the following independent situations: (a) Photo accounts for the investment at fair value through profit and loss; Photo accounts for the investment at fair value through other comprehensive income (Realized gains and losses are transferred to retained earnings on the date of sale); (b) (c) Photo accounts for the acquisition investment as a significant influence investment throughout the entire period. (Assume that on the date the shares were acquired, the acquisition differential was allocated to some plant assets with a fair value $100,000 greater than their carrying value and a remaining economic life on that date of 5 years and that there are no intercompany transactions, other than dividends); (d) Photo accounts for the investment using the cost method. Problem 1-3 On January 1, 2013, Photo Investments Inc. acquired 20,000 shares of the 100,000 outstanding common shares Snapshot Company Ltd. at a cost of $20 per share plus 2% brokerage charges. On June 30, 2014, Photo sold 10,000 of those shares for proceeds of $240,000. Following are the annual income, annual dividends and year-end share prices for Snapshot Company Ltd. for the years 2013 and 2014: Annual Income Annual Dividend Year-End Share Price 2013 $200,000 $22.00 2014 $160,000 $80,000 ($600,000) $10.00 During the first half of 2014, Snapshot Company earned income of $160,000 and paid a dividend of $80,000. During the second half of that year, the company had a loss of $760,000 as a result of an unsuccessful defense of a patent infringement suit brought by a competitor. The loss in value of the shares in the second half of 2014 was considered to be other than temporary. Required: Provide all the journal entries of Photo Investments Inc. for the years 2013 and 2014 with respect to its investment Snapshot Company Ltd. and the resulting investment income under each of the following independent situations: (a) Photo accounts for the investment at fair value through profit and loss; Photo accounts for the investment at fair value through other comprehensive income (Realized gains and losses are transferred to retained earnings on the date of sale); (b) (c) Photo accounts for the acquisition investment as a significant influence investment throughout the entire period. (Assume that on the date the shares were acquired, the acquisition differential was allocated to some plant assets with a fair value $100,000 greater than their carrying value and a remaining economic life on that date of 5 years and that there are no intercompany transactions, other than dividends); (d) Photo accounts for the investment using the cost methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started