Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone please me with these questions can someone please help me with these questions Question 2 [40 Marks] The financial statements of AZ shoe

can someone please me with these questions

can someone please help me with these questions

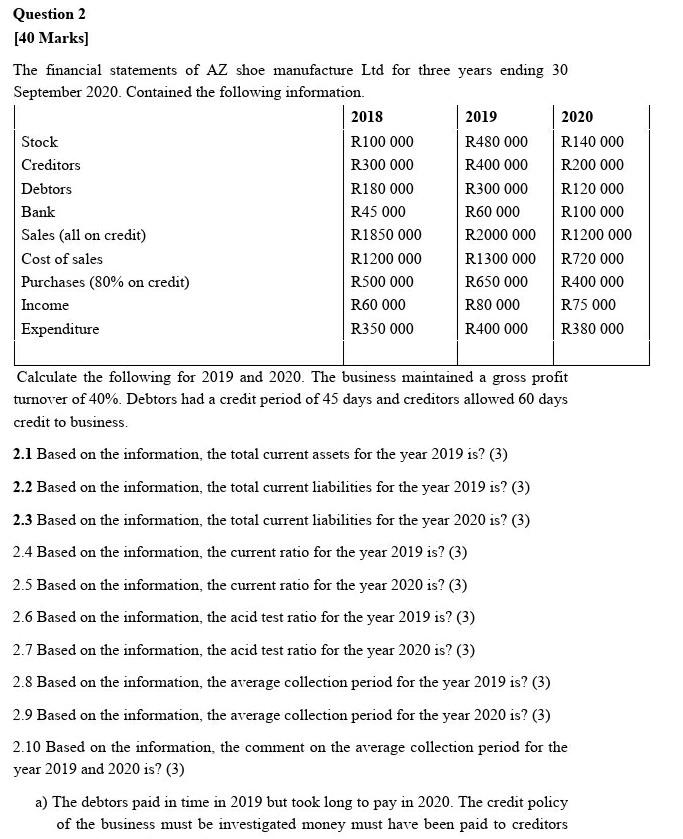

Question 2 [40 Marks] The financial statements of AZ shoe manufacture Ltd for three years ending 30 September 2020. Contained the following information. 2018 2019 2020 Stock R100 000 R480 000 R140 000 Creditors R300 000 R400 000 R200 000 Debtors R180 000 R300 000 R120 000 Bank R45 000 R60 000 R100 000 Sales (all on credit) R1850 000 R2000 000 R1200 000 Cost of sales R1200 000 R1300 000 R720 000 Purchases (80% on credit) R500 000 R650 000 R400 000 Income R60 000 R80 000 R75 000 Expenditure R350 000 R400 000 R380 000 Calculate the following for 2019 and 2020. The business maintained a gross profit turnover of 40%. Debtors had a credit period of 45 days and creditors allowed 60 days credit to business 2.1 Based on the information, the total current assets for the year 2019 is? (3) 2.2 Based on the information, the total current liabilities for the year 2019 is? (3) 2.3 Based on the information, the total current liabilities for the year 2020 is? (3) 2.4 Based on the information, the current ratio for the year 2019 is? (3) 2.5 Based on the information, the current ratio for the year 2020 is? (3) 2.6 Based on the information, the acid test ratio for the year 2019 is? (3) 2.7 Based on the information, the acid test ratio for the year 2020 is? (3) 2.8 Based on the information, the average collection period for the year 2019 is? (3) 2.9 Based on the information, the average collection period for the year 2020 is? (3) 2.10 Based on the information, the comment on the average collection period for the year 2019 and 2020 is? (3) a) The debtors paid in time in 2019 but took long to pay in 2020. The credit policy of the business must be investigated money must have been paid to creditorsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started