Answered step by step

Verified Expert Solution

Question

1 Approved Answer

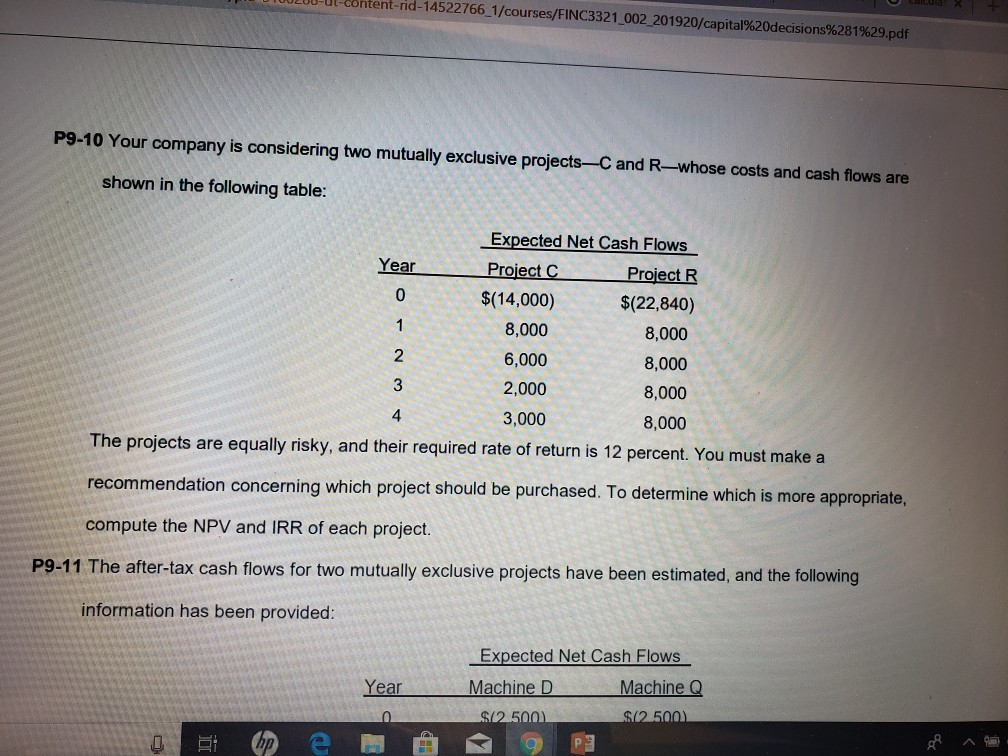

can someone please provide steps for calculating IRR on a TI Nspire CX? I can calculate npv already, but I do not know how to

can someone please provide steps for calculating IRR on a TI Nspire CX? I can calculate npv already, but I do not know how to use the irr function on ti nspire. the problem I am stuck on is number 10.

thank you

out-content-rid-14522766-1/courses/FINC3321-002-201 920/capital%20decisions%281 %29.pdf P9-10 Your company is considering two mutually exclusive projects-C and R-whose costs and cash flows are shown in the following table: Expected Net Cash Flows Year Project CF Project R $(14,000) 8,000 6,000 2,000 3,000 $(22,840) 8,000 8,000 8,000 8,000 2 4 The projects are equally risky, and their required rate of return is 12 percent. You must make a recommendation concerning which project should be purchased. To determine which is more ap compute the NPV and IRR of each project. propriate P9-11 The after-tax cash flows for two mutually exclusive projects have been estimated, and the following information has been provided Expected Net Cash Flows Machine Q Machine D 2 500 Year eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started