can someone please show all the math/computations on how to get the answers?

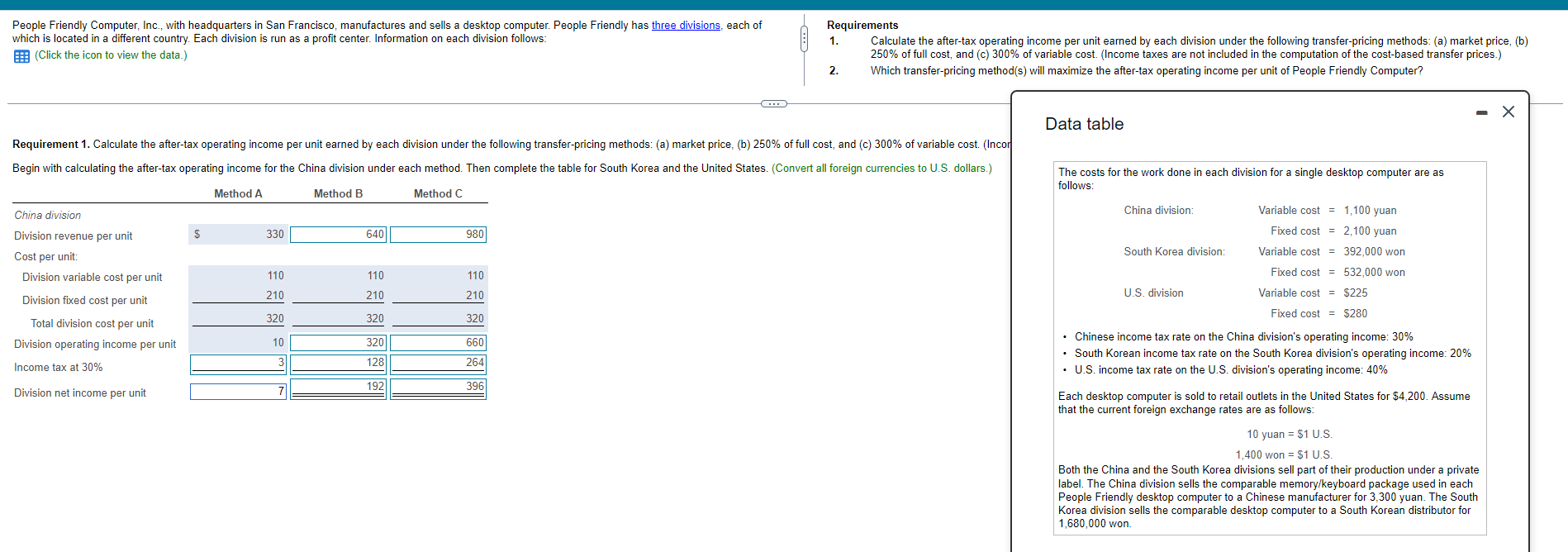

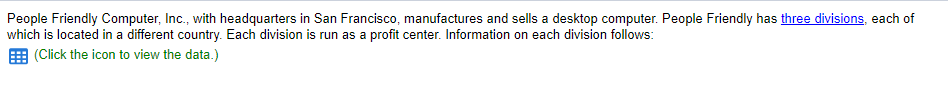

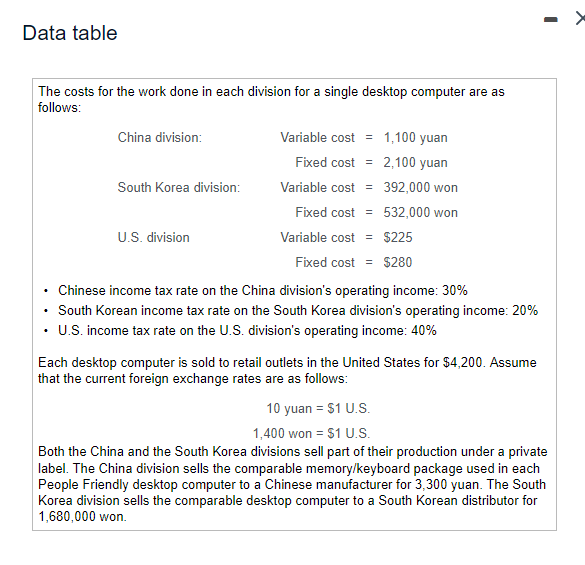

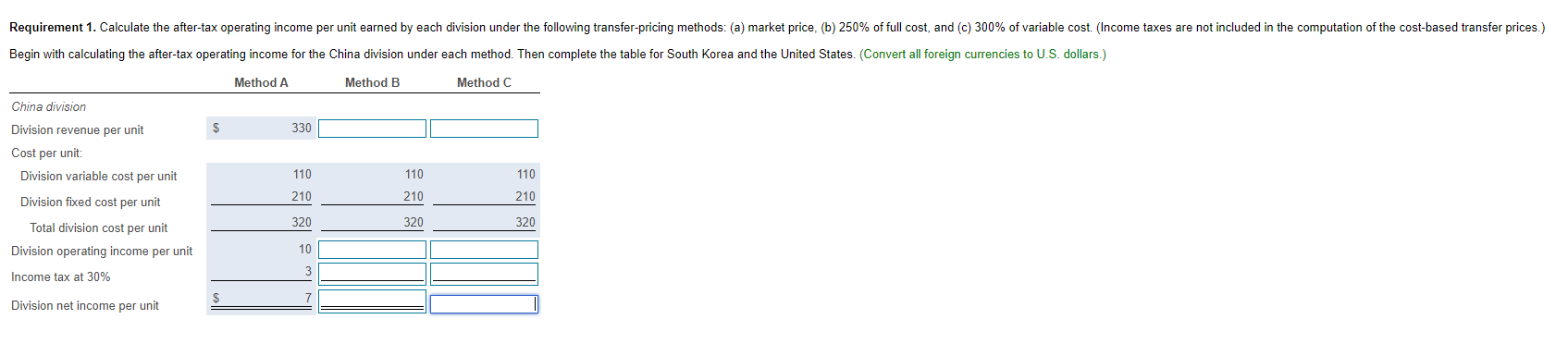

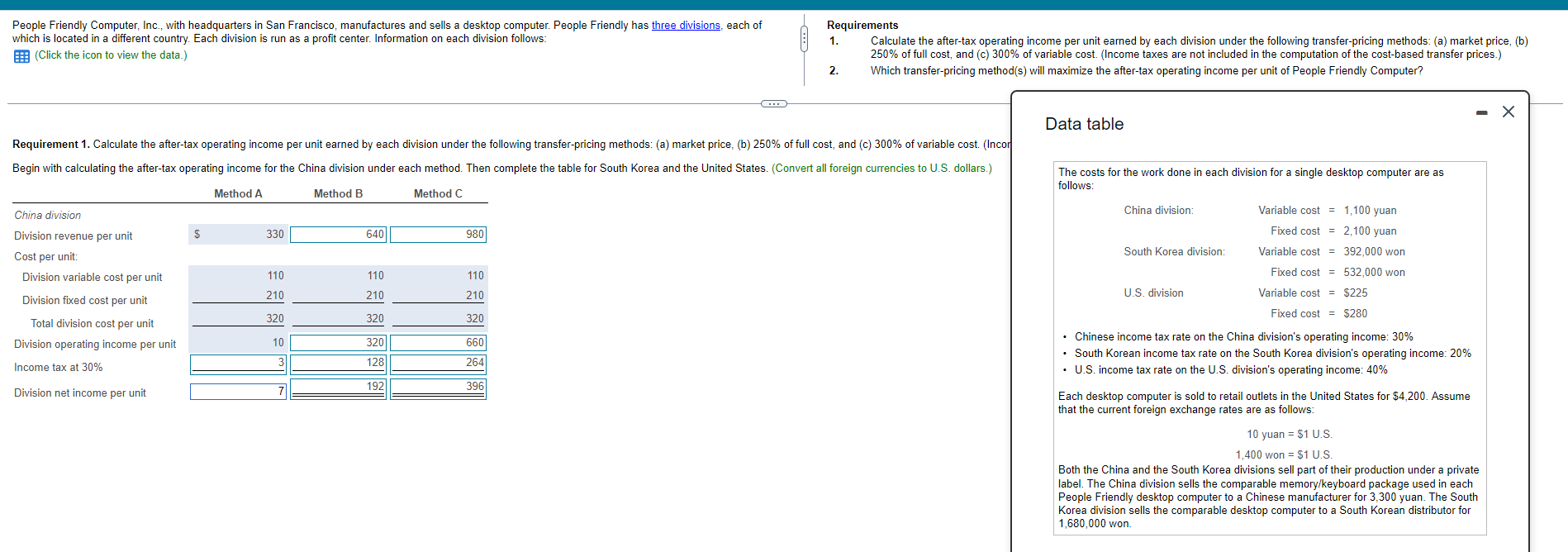

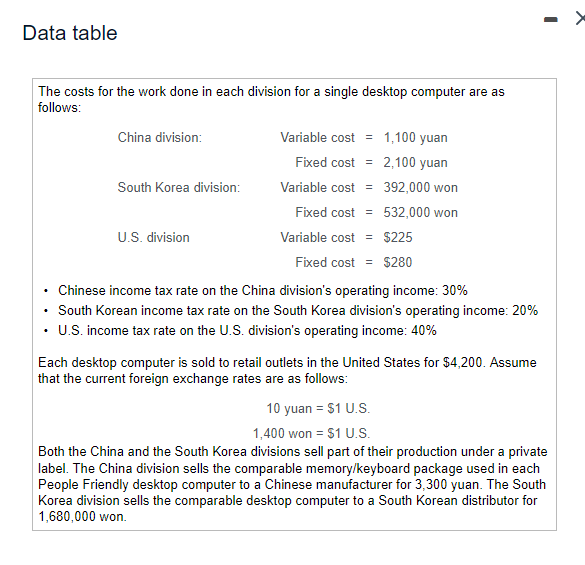

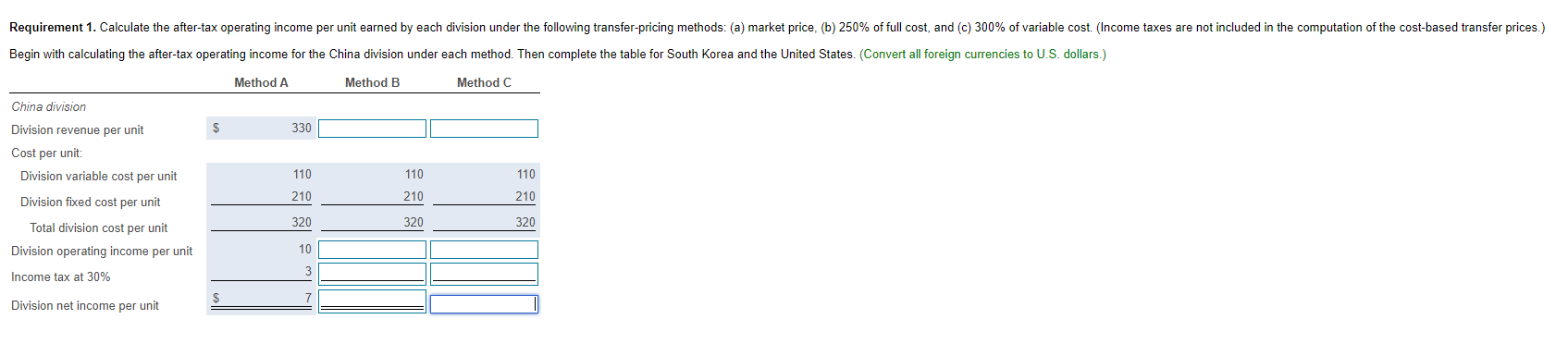

People Friendly Computer, Inc., with headquarters in San Francisco, manufactures and sells a desktop computer. People Friendly has three divisions, each of which is located in a different country. Each division is run as a profit center. Information on each division follows: (Click the icon to view the data.) Requirements 1. Calculate the after-tax operating income per unit earned by each division under the following transfer-pricing methods: (a) market price, (b) 250% of full cost, and (c) 300% of variable cost. (Income taxes are not included in the computation of the cost-based transfer prices.) 2. 2 Which transfer pricing method(s) will maximize the after-tax operating income per unit of People Friendly Computer? .. - X Data table Requirement 1. Calculate the after-tax operating income per unit earned by each division under the following transfer-pricing methods: (a) market price, (b) 250% of full cost, and (c) 300% of variable cost. (Incor Begin with calculating the after-tax operating income for the China division under each method. Then complete the table for South Korea and the United States. (Convert all foreign currencies to U.S. dollars.) The costs for the work done in each division for a single desktop computer are as follows: Method A Method B Method C China division China division: Division revenue per unit $ 330 640 980 South Korea division: Variable cost = 1,100 yuan Fixed cost = 2,100 yuan Variable cost = 392,000 won Fixed cost = 532,000 won Variable cost = $225 $ Fixed cost = $280 110 110 210 110 210 210 Cost per unit: Division variable cost per unit Division fixed cost per unit Total division cost per unit Division operating income per unit U.S. division 320 320 320 10 320 660 264 3 1281 Income tax at 30% 1921 396 Division net income per unit 7 Chinese income tax rate on the China division's operating income: 30% South Korean income tax rate on the South Korea division's operating income: 20% U.S. income tax rate on the U.S. division's operating income: 40% Each desktop computer is sold to retail outlets in the United States for $4,200. Assume that the current foreign exchange rates are as follows: 10 yuan = $1 U.S. 1,400 won = $1 U.S. Both the China and the South Korea divisions sell part of their production under a private label. The China division sells the comparable memory/keyboard package used in each People Friendly desktop computer to a Chinese manufacturer for 3,300 yuan. The South Korea division sells the comparable desktop computer to a South Korean distributor for 1,680,000 won People Friendly Computer, Inc., with headquarters in San Francisco, manufactures and sells a desktop computer. People Friendly has three divisions, each of which is located in a different country. Each division is run as a profit center. Information on each division follows: (Click the icon to view the data.) Requirements 1. Calculate the after-tax operating income per unit earned by each division under the following transfer pricing methods: (a) market price, (b) 250% of full cost, and (c) 300% of variable cost. (Income taxes are not included in the computation of the cost-based transfer prices.) 2. Which transfer pricing method(s) will maximize the after-tax operating income per unit of People Friendly Computer? Data table The costs for the work done in each division for a single desktop computer are as follows: China division: Variable cost = 1,100 yuan Fixed cost = 2,100 yuan South Korea division Variable cost = 392,000 won Fixed cost = 532,000 won U.S. division Variable cost = $225 Fixed cost = $280 Chinese income tax rate on the China division's operating income: 30% South Korean income tax rate on the South Korea division's operating income: 20% U.S. income tax rate on the U.S. division's operating income: 40% Each desktop computer is sold to retail outlets in the United States for $4,200. Assume that the current foreign exchange rates are as follows: 10 yuan = 51 U.S. 1,400 won = $1 U.S. Both the China and the South Korea divisions sell part of their production under a private label. The China division sells the comparable memory/keyboard package used in each People Friendly desktop computer to a Chinese manufacturer for 3,300 yuan. The South Korea division sells the comparable desktop computer to a South Korean distributor for 1,680,000 won. Requirement 1. Calculate the after-tax operating income per unit earned by each division under the following transfer pricing methods: (a) market price, (b) 250% of full cost, and (c) 300% of variable cost. (Income taxes are not included in the computation of the cost-based transfer prices.) Begin with calculating the after-tax operating income for the China division under each method. Then complete the table for South Korea and the United States. (Convert all foreign currencies to U.S. dollars.) Method A Method B Method C China division Division revenue per unit $ 330 Cost per unit: Division variable cost per unit 110 110 110 Division fixed cost per unit 210 210 210 320 320 320 Total division cost per unit Division operating income per unit Income tax at 30% 10 3 7 Division net income per unit People Friendly Computer, Inc., with headquarters in San Francisco, manufactures and sells a desktop computer. People Friendly has three divisions, each of which is located in a different country. Each division is run as a profit center. Information on each division follows: (Click the icon to view the data.) Requirements 1. Calculate the after-tax operating income per unit earned by each division under the following transfer-pricing methods: (a) market price, (b) 250% of full cost, and (c) 300% of variable cost. (Income taxes are not included in the computation of the cost-based transfer prices.) 2. 2 Which transfer pricing method(s) will maximize the after-tax operating income per unit of People Friendly Computer? .. - X Data table Requirement 1. Calculate the after-tax operating income per unit earned by each division under the following transfer-pricing methods: (a) market price, (b) 250% of full cost, and (c) 300% of variable cost. (Incor Begin with calculating the after-tax operating income for the China division under each method. Then complete the table for South Korea and the United States. (Convert all foreign currencies to U.S. dollars.) The costs for the work done in each division for a single desktop computer are as follows: Method A Method B Method C China division China division: Division revenue per unit $ 330 640 980 South Korea division: Variable cost = 1,100 yuan Fixed cost = 2,100 yuan Variable cost = 392,000 won Fixed cost = 532,000 won Variable cost = $225 $ Fixed cost = $280 110 110 210 110 210 210 Cost per unit: Division variable cost per unit Division fixed cost per unit Total division cost per unit Division operating income per unit U.S. division 320 320 320 10 320 660 264 3 1281 Income tax at 30% 1921 396 Division net income per unit 7 Chinese income tax rate on the China division's operating income: 30% South Korean income tax rate on the South Korea division's operating income: 20% U.S. income tax rate on the U.S. division's operating income: 40% Each desktop computer is sold to retail outlets in the United States for $4,200. Assume that the current foreign exchange rates are as follows: 10 yuan = $1 U.S. 1,400 won = $1 U.S. Both the China and the South Korea divisions sell part of their production under a private label. The China division sells the comparable memory/keyboard package used in each People Friendly desktop computer to a Chinese manufacturer for 3,300 yuan. The South Korea division sells the comparable desktop computer to a South Korean distributor for 1,680,000 won People Friendly Computer, Inc., with headquarters in San Francisco, manufactures and sells a desktop computer. People Friendly has three divisions, each of which is located in a different country. Each division is run as a profit center. Information on each division follows: (Click the icon to view the data.) Requirements 1. Calculate the after-tax operating income per unit earned by each division under the following transfer pricing methods: (a) market price, (b) 250% of full cost, and (c) 300% of variable cost. (Income taxes are not included in the computation of the cost-based transfer prices.) 2. Which transfer pricing method(s) will maximize the after-tax operating income per unit of People Friendly Computer? Data table The costs for the work done in each division for a single desktop computer are as follows: China division: Variable cost = 1,100 yuan Fixed cost = 2,100 yuan South Korea division Variable cost = 392,000 won Fixed cost = 532,000 won U.S. division Variable cost = $225 Fixed cost = $280 Chinese income tax rate on the China division's operating income: 30% South Korean income tax rate on the South Korea division's operating income: 20% U.S. income tax rate on the U.S. division's operating income: 40% Each desktop computer is sold to retail outlets in the United States for $4,200. Assume that the current foreign exchange rates are as follows: 10 yuan = 51 U.S. 1,400 won = $1 U.S. Both the China and the South Korea divisions sell part of their production under a private label. The China division sells the comparable memory/keyboard package used in each People Friendly desktop computer to a Chinese manufacturer for 3,300 yuan. The South Korea division sells the comparable desktop computer to a South Korean distributor for 1,680,000 won. Requirement 1. Calculate the after-tax operating income per unit earned by each division under the following transfer pricing methods: (a) market price, (b) 250% of full cost, and (c) 300% of variable cost. (Income taxes are not included in the computation of the cost-based transfer prices.) Begin with calculating the after-tax operating income for the China division under each method. Then complete the table for South Korea and the United States. (Convert all foreign currencies to U.S. dollars.) Method A Method B Method C China division Division revenue per unit $ 330 Cost per unit: Division variable cost per unit 110 110 110 Division fixed cost per unit 210 210 210 320 320 320 Total division cost per unit Division operating income per unit Income tax at 30% 10 3 7 Division net income per unit