can someone please solve them all?

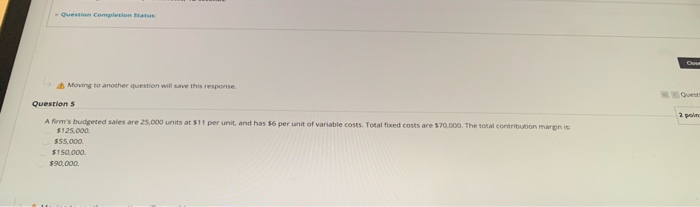

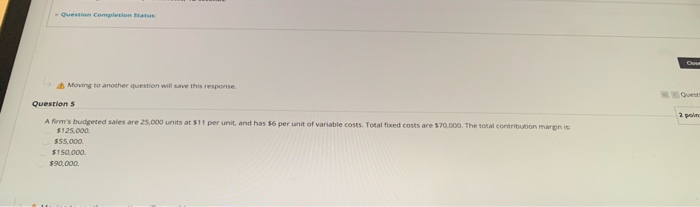

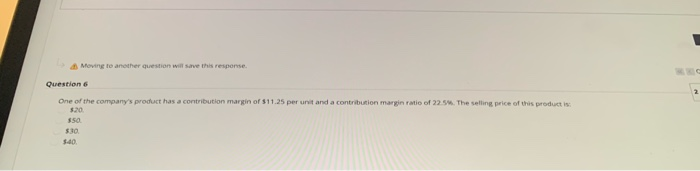

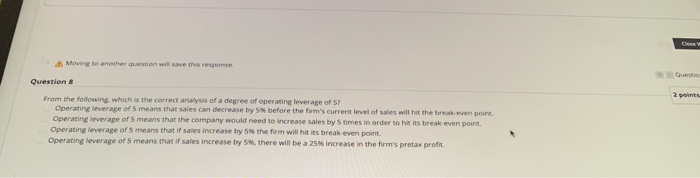

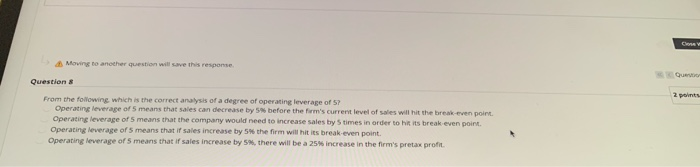

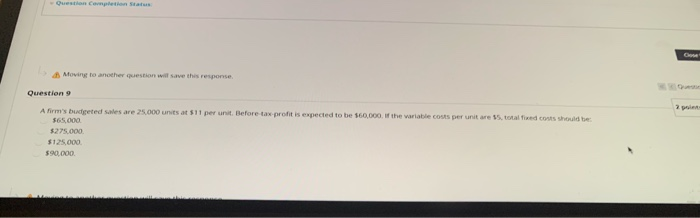

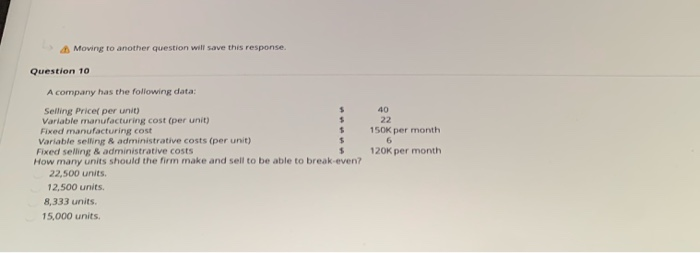

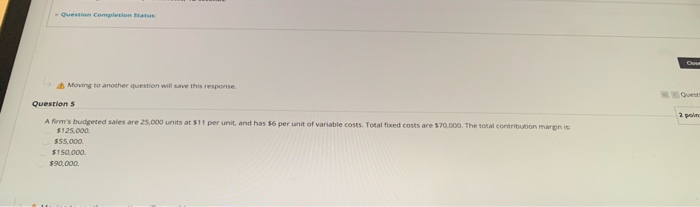

Question completion ratus Moving to another question will save this response Questions 2 poin A firm's budgeted sales are 25.000 units at $11 per unit and has 56 per unit of variable costs. Totalfixed costs are $70,000. The total contribution margin is: $125,000 $55.000 $150,000 $90,000 Moving to another question will save this response Question 6 One of the company's product has a contribution margin of $11.25 per unit and a contribution margin ratio of 22.5. The selling price of this product is: S10 $40. Moving to another question will save this response Question 8 2 points From the following which is the correct analysis of a degree of operating leverage of 5? Operating leverage of 5 means that sales can decrease by before the firm's current level of sales will hit the break even point. Operating leverage of 5 means that the company would need to increase sales by 5 times in order to hit its break even point. Operating leverage of 5 means that if sales increase by 5% the firm will hit its break-even point. Operating leverage of 5 means that if sales increase by SM, there will be a 25% increase in the firm's pretax profit Moving to another question will save this response Questions 2 points From the following which is the correct analysis of a degree of operating leverage of ? Operating leverage of 5 means that sales can decrease by before the firm's current level of sales will hit the break-even point. Operating leverage of 5 means that the company would need to increase sales by 5 times in order to hit its break even point Operating leverage of 5 means that if sales increase by 5% the firm will hit its break-even point. Operating leverage of 5 means that if sales increase by SM, there will be a 25% increase in the firm's pretax profit Moving to another question will save this response 2. Question 9 Afirm's budgeted sales are 25.000 units at 11 per unit. Before tax profit is expected to be $60,000. the variable couts per unit are 35. total fixed costs should be 565,000 $275.000 $125.000 $90,000 Moving to another question will save this response. Question 10 $ A company has the following data: Selling Price per unit) $ Variable manufacturing cost (per unit) Fixed manufacturing cost Variable selling & administrative costs (per unit) $ Fixed selling & administrative costs How many units should the firm make and sell to be able to break-even? 22,500 units 12,500 units. 8,333 units. 15,000 units 40 22 150K per month 6 120K per month