Question

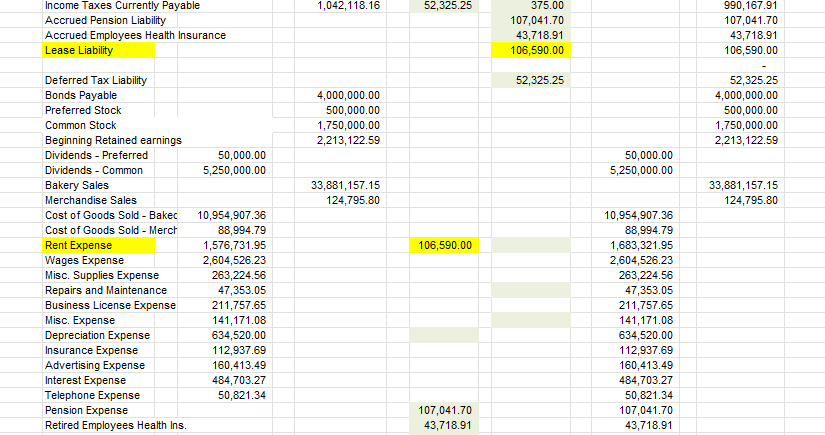

Can someone please tell me if my adjusting entries are correct for this specific adjustment? If not can you please provide the correct answer? I

Can someone please tell me if my adjusting entries are correct for this specific adjustment? If not can you please provide the correct answer? I think I am missing another adjustment for the rent expense incorrectly posted.

Prepare adjusting entries for capital lease obligations.

Scenario:

Leases: Six ovens were rented on December 31, with $20,000 charged to rent expense. The lease runs for 6 years with an implicit interest rate of 5%. At the end of the 6 years, Peyton will own them. Make any necessary adjusting entries.

Guidelines from Professor:

To record leased assets and liability: You must correct the rent expense incorrectly posted and then record the lease with the present value of the future obligation. The Rate is 5.3295.

1,042,118.16 52,325.25 Income Taxes Currently Payable Accrued Pension Liability Accrued Employees Health Insurance Lease Liability 375.00 107,041.70 43,718.91 106,590.00 990,167.91 107,041.70 43,718.91 106,590.00 52,325.25 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 52,325.25 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 50,000.00 5,250,000.00 50,000.00 5,250,000.00 33,881,157.15 124,795.80 33,881,157.15 124,795.80 106,590.00 Deferred Tax Liability Bonds Payable Preferred Stock Common Stock Beginning Retained earnings Dividends - Preferred Dividends - Common Bakery Sales Merchandise Sales Cost of Goods Sold - Bakec Cost of Goods Sold - Merch Rent Expense Wages Expense Misc. Supplies Expense Repairs and Maintenance Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Pension Expense Retired Employees Health Ins. 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 10,954,907.36 88,994.79 1,683,321.95 2,604,526.23 263,224.56 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 107,041.70 43,718.91 107,041.70 43,718.91

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started