Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone show me how they did this? Need to compare my answer see is right. Please and thank you! Question #4 (18 marks) The

Can someone show me how they did this? Need to compare my answer see is right. Please and thank you!

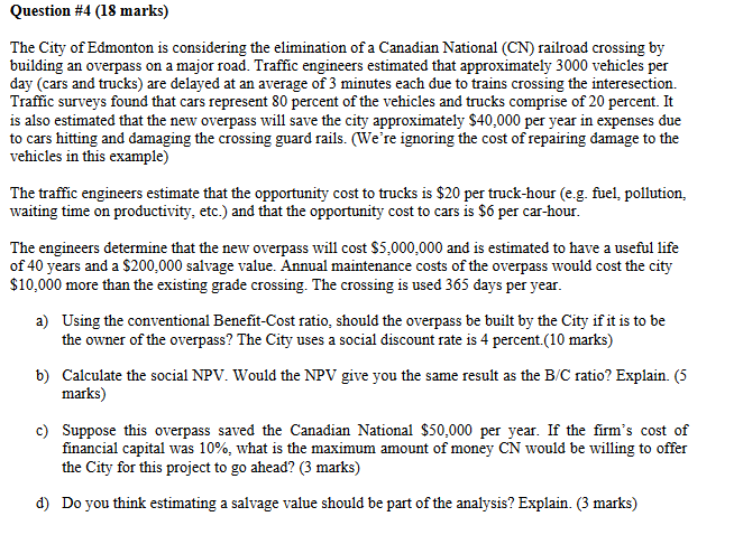

Question #4 (18 marks) The City of Edmonton is considering the elimination of a Canadian National (CN) railroad crossing by building an overpass on a major road. Traffic engineers estimated that approximately 3000 vehicles per day (cars and trucks) are delayed at an average of3 minutes each due to trains crossing the interesection. Traffic surveys found that cars represent 80 percent ofthe vehicles and trucks comprise of 20 percent. It is also estimated that the new overpass will save the city approximately $40,000 per year in expenses due to cars hitting and damaging the crossing guard rails. Twe're ignoring the cost of repairing damage to the vehicles in this example) The traffic engineers estimate that the opportunity cost to trucks is $20 per truck-hour (e.g. fuel, pollution, waiting time on productivity, etc.) and that the opportunity cost to cars is $6 per car-hour. The engineers determine that the new overpass will cost $5,000,000 and is estimated to have a useful life of 40 years and a $200,000 salvage value. Annual maintenance costs of the overpass would cost the city $10,000 more than the existing grade crossing. The crossing is used 365 days per year. a) Using the conventional Benefit-Cost ratio, should the overpass be built by the City if it is to be the owner of the overpass? The City uses a social discount rate is 4 percent.(10 marks) b) Calculate the social NPV. Would the NPV give you the same result as the B/Cratio? Explain. (5 marks c) Suppose this overpass saved the Canadian National $50,000 per year. If the firm's cost of financial capital was 10%, what is the maximum amount of money CN would be willing to offer the City for this project to go ahead? marks) Do youthink estimating a salvage value should be partofthe analysis? Explain. G marks d)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started