Answered step by step

Verified Expert Solution

Question

1 Approved Answer

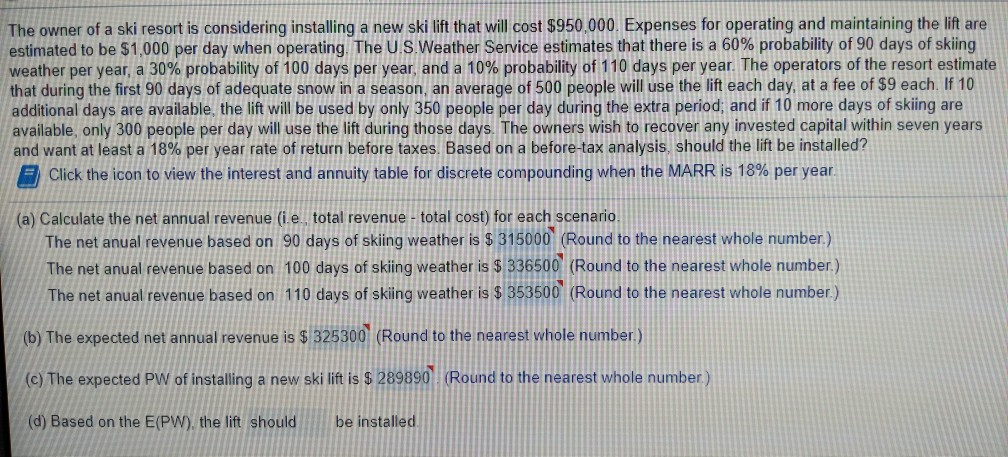

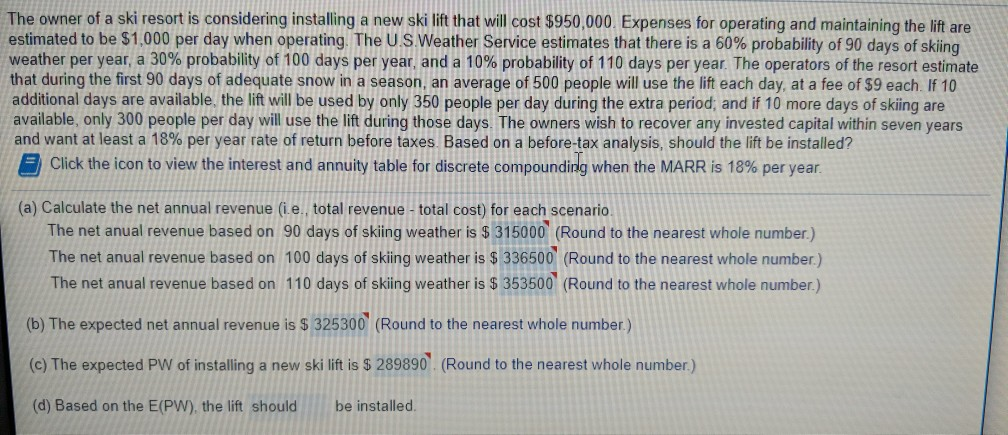

Can someone show me how they got these numbers, show all your work please, thank you. The correct answers are shown in the picture. Here's

Can someone show me how they got these numbers, show all your work please, thank you. The correct answers are shown in the picture.

Here's a clearer picture

The owner of a ski resort is considering installing a new ski lift that will cost $950,000. Expenses for operating and maintaining the lift are estimated to be $1,000 per day when operating. The US,Weather Service estimates that there is a 60% probability of 90 days of skiing weather peryear, a 30% probability of 100 days per year, and a 10% probability of 110 days per year The operators of the resort estimate that during the first 90 days of adequate snow in a season, an average of 500 people will use the lift each day, at a fee of $9 each. If 10 additional days are available, the lift will be used by only 350 people per day during the extra period, and if 10 more days of skiing are available, only 300 people per day will use the lift during those days. The owners wish to recover any invested capital within seven years and want at least a 18% per year rate of return before taxes. Based on a before-tax analysis, should the lift be installed? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 18% per year (a) Calculate the net annual revenue (i e., total revenue total cost) for leach scenario The net anual revenue based on 90 days of sking weather is $ 315000 (Round to the nearest whole number.) The net anual revenue based on 100 days of sking weather is $ 336500 (Round to the nearest whole number,) The net anual revenue based on 110 days of sking weather is $ 353500 (Round to the nearest whole number) (b) The expected net annual revenue is $325300 (Round to the nearest whole number) (c) The expected PW of installing a new ski lift is $ 289890 (Round to the nearest whole number) (d) Based on the E(PW). the lift should be installed The owner of a ski resort is considering installing a new ski lift that will cost $950,000. Expenses for operating and maintaining the lift are estimated to be $1,000 per day when operating The US Weather Service estimates that there is a 60% probability of 90 days of skiing weather per year, a 30% probability of 100 days per year, and a 10% probability of 110 days per year The operators of the resort estimate that during the first 90 days of adequate snow in a season, an average of 500 people will use the lift each day, at a fee of $9 each. If 10 additional days are available, the lift will be used by only 350 people per day during the extra period, and if 10 more days of skiing are available, only 300 people per day will use the lift during those days. The owners wish to recover any invested capital within seven years and want at least a 18% per year rate of return before taxes Based on a before tax analysis, should the lift be installed? Click the icon to view the interest and annuity table for discrete compoundidg when the MARR is 18% per year. (a) Calculate the net annual revenue (L.e., total revenue - total cost) for each scenario The net anual revenue based on 90 days of sking weather is S 315000 (Round to the nearest whole number.) The net anual revenue based on 100 days of sking weather is $ 336500 (Round to the nearest whole number) The net anual revenue based on 110 days of sking weather is $ 353500 (Round to the nearest whole number.) (b) The expected net annual revenue is $ 325300 (Round to the nearest whole number) (c) The expected PW of installing a new ski lift is $ 289890 (Round to the nearest whole number,) (d) Based on the E(PW), the lift should be installedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started