Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone show me how to calculate PV of annual lease payments and PV of bargain purchase option, please? I don't know where the 88,277.60

Can someone show me how to calculate PV of annual lease payments and PV of bargain purchase option, please? I don't know where the 88,277.60 and 2,722.33 came from.

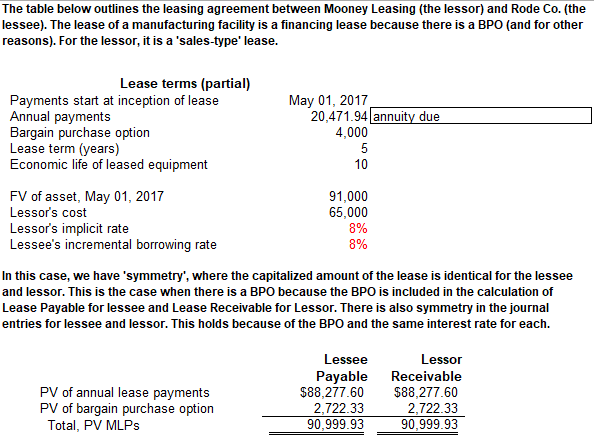

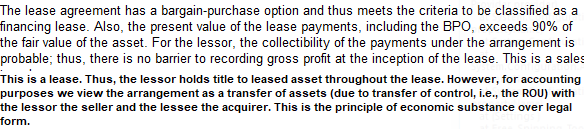

The table below outlines the leasing agreement between Mooney Leasing (the lessor) and Rode Co. (the lessee). The lease of a manufacturing facility is a financing lease because there is a BPO (and for other reasons). For the lessor, it is a 'sales-type' lease. Lease terms (partial) Payments start at inception of lease Annual payments Bargain purchase option Lease term (years) Economic life of leased equipment May 01, 2017 20,471.94 annuity due 4,000 FV of asset, May 01, 2017 Lessor's cost Lessor's implicit rate Lessee's incremental borrowing rate 91,000 65,000 8% 8% In this case, we have 'symmetry', where the capitalized amount of the lease is identical for the lessee and lessor. This is the case when there is a BPO because the BPO is included in the calculation of Lease Payable for lessee and Lease Receivable for Lessor. There is also symmetry in the journal entries for lessee and lessor. This holds because of the BPO and the same interest rate for each. PV of annual lease payments PV of bargain purchase option Total, PV MLPs Payable $88,277.60 2,722.33 90,999.93 Lessor Receivable $88,277.60 2 ,722.33 90,999.93 The lease agreement has a bargain-purchase option and thus meets the criteria to be classified as a financing lease. Also, the present value of the lease payments, including the BPO, exceeds 90% of the fair value of the asset. For the lessor, the collectibility of the payments under the arrangement is probable; thus, there is no barrier to recording gross profit at the inception of the lease. This is a sales This is a lease. Thus, the lessor holds title to leased asset throughout the lease. However, for accounting purposes we view the arrangement as a transfer of assets (due to transfer of control, i.e., the ROU) with the lessor the seller and the lessee the acquirer. This is the principle of economic substance over legal form. The table below outlines the leasing agreement between Mooney Leasing (the lessor) and Rode Co. (the lessee). The lease of a manufacturing facility is a financing lease because there is a BPO (and for other reasons). For the lessor, it is a 'sales-type' lease. Lease terms (partial) Payments start at inception of lease Annual payments Bargain purchase option Lease term (years) Economic life of leased equipment May 01, 2017 20,471.94 annuity due 4,000 FV of asset, May 01, 2017 Lessor's cost Lessor's implicit rate Lessee's incremental borrowing rate 91,000 65,000 8% 8% In this case, we have 'symmetry', where the capitalized amount of the lease is identical for the lessee and lessor. This is the case when there is a BPO because the BPO is included in the calculation of Lease Payable for lessee and Lease Receivable for Lessor. There is also symmetry in the journal entries for lessee and lessor. This holds because of the BPO and the same interest rate for each. PV of annual lease payments PV of bargain purchase option Total, PV MLPs Payable $88,277.60 2,722.33 90,999.93 Lessor Receivable $88,277.60 2 ,722.33 90,999.93 The lease agreement has a bargain-purchase option and thus meets the criteria to be classified as a financing lease. Also, the present value of the lease payments, including the BPO, exceeds 90% of the fair value of the asset. For the lessor, the collectibility of the payments under the arrangement is probable; thus, there is no barrier to recording gross profit at the inception of the lease. This is a sales This is a lease. Thus, the lessor holds title to leased asset throughout the lease. However, for accounting purposes we view the arrangement as a transfer of assets (due to transfer of control, i.e., the ROU) with the lessor the seller and the lessee the acquirer. This is the principle of economic substance over legal formStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started