Answered step by step

Verified Expert Solution

Question

1 Approved Answer

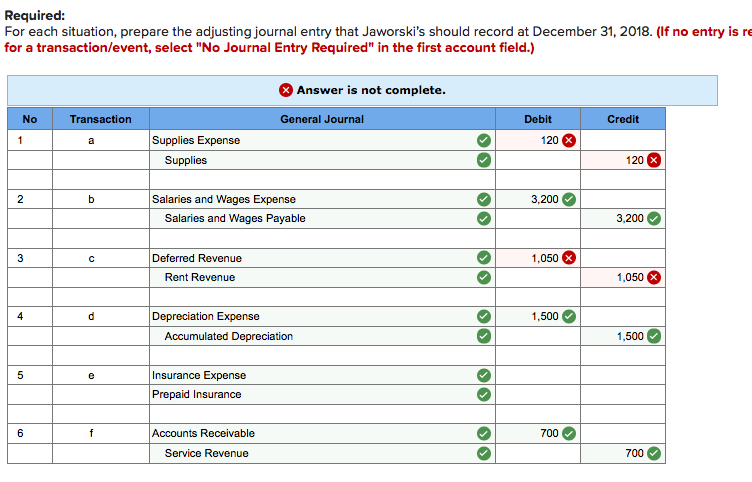

Can someone show me what I am doing wrong? Jaworskis Ski Store is completing the accounting process for its first year ended December 31, 2018.

Can someone show me what I am doing wrong?

Jaworskis Ski Store is completing the accounting process for its first year ended December 31, 2018. The transactions during 2018 have been journalized and posted. The following data are available to determine adjusting journal entries:

- The unadjusted balance in Supplies was $800 at December 31, 2018. The unadjusted balance in Supplies Expense was $0 at December 31, 2018. A year-end count showed $120 of supplies on hand.

- Wages earned by employees during December 2018, unpaid and unrecorded at December 31, 2018, amounted to $3,200. The last paychecks were issued December 28; the next payments will be made on January 6, 2019.

- A portion of the stores basement is now being rented for $1,050 per month to K. Frey. On November 1, 2018, the store collected six months rent in advance from Frey in the amount of $6,300. It was credited in full to Deferred Revenue when collected. The unadjusted balance in Rent Revenue was $0 at December 31, 2018.

- The store purchased delivery equipment at the beginning of the year. The estimated depreciation for 2018 is $1,500, although none has been recorded yet.

- On December 31, 2018, the unadjusted balance in Prepaid Insurance was $2,700. This was the amount paid in the middle of the year for a two-year insurance policy with coverage beginning on July 1, 2018.

- Jaworskis store did some ski repair work for Frey. At the end of December 31, 2018, Frey had not paid for work completed amounting to $700. This amount has not yet been recorded as Service Revenue. Collection is expected during January 2019.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started