Answered step by step

Verified Expert Solution

Question

1 Approved Answer

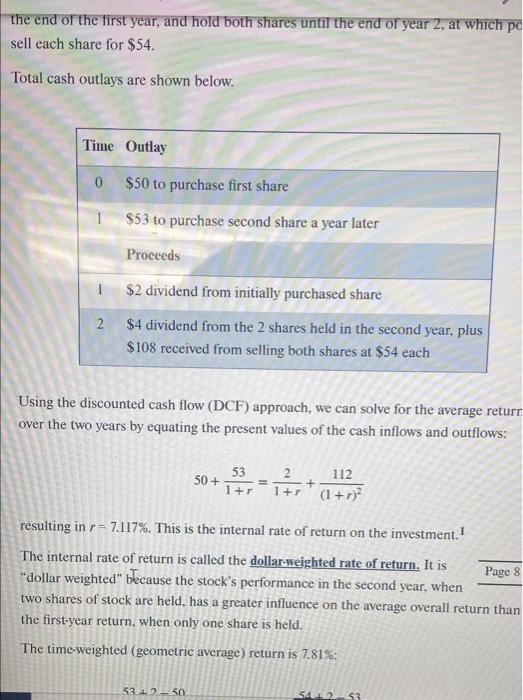

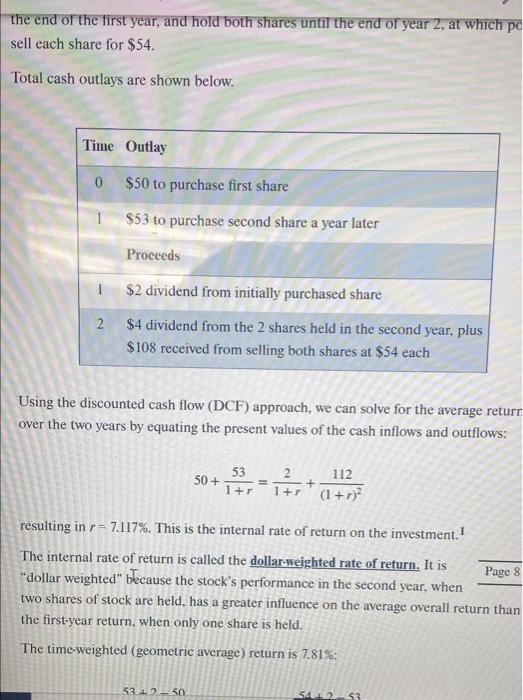

can someone show the steps on how they got 7.117% for the DCF the end of the first year, and hold both shares until the

can someone show the steps on how they got 7.117% for the DCF

the end of the first year, and hold both shares until the end of year 2, at which pa sell each share for $54. Total cash outlays are shown below. Time Outlay $50 to purchase first share $53 to purchase second share a year later 0 Proceeds 1 $2 dividend from initially purchased share 2 $4 dividend from the 2 shares held in the second year, plus $108 received from selling both shares at $54 each Using the discounted cash flow (DCF) approach, we can solve for the average return over the two years by equating the present values of the cash inflows and outflows: 50+ 53 1+1 = 2 112 1+(1+)2 resulting in r= 7.117%. This is the internal rate of return on the investment.! The internal rate of return is called the dollar-weighted rate of return. It is Page 8 -dollar weighted" because the stock's performance in the second year, when two shares of stock are held, has a greater influence on the average overall return than the first-year return, when only one share is held. The time-weighted (geometric average) return is 7.81% 53.50 KE253

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started