Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone solve 3b. without using excel formulas? Thanks. 3. You are considering taking out a 20 year fixed rate mortgage on a $640,000 house.

Can someone solve 3b. without using excel formulas? Thanks.

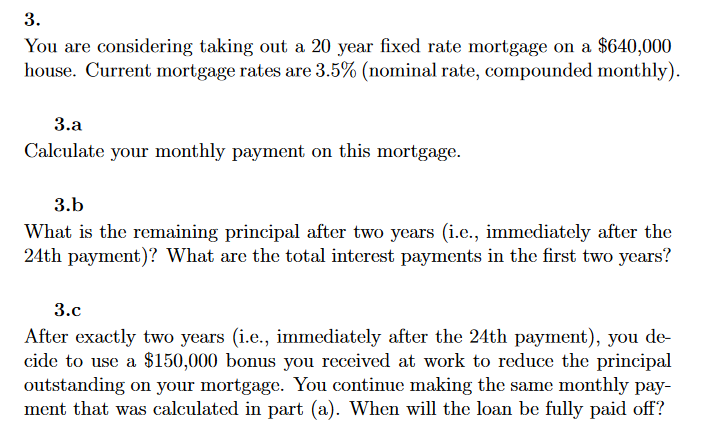

3. You are considering taking out a 20 year fixed rate mortgage on a $640,000 house. Current mortgage rates are 3.5\% (nominal rate, compounded monthly). 3.a Calculate your monthly payment on this mortgage. 3.b What is the remaining principal after two years (i.e., immediately after the 24th payment)? What are the total interest payments in the first two years? 3.c After exactly two years (i.e., immediately after the 24th payment), you decide to use a $150,000 bonus you received at work to reduce the principal outstanding on your mortgage. You continue making the same monthly payment that was calculated in part (a). When will the loan be fully paid offStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started